TNI BLUE CHIP UAE FUND - The National Investor

... SUBSCRIPTION AND SALE: The Units have not been, and will not be registered under the Securities Act of 1933, as amended, and have not been registered or qualified under any state securities law of the U.S. and may not be offered or sold within the US except pursuant to an exemption from, or in a tra ...

... SUBSCRIPTION AND SALE: The Units have not been, and will not be registered under the Securities Act of 1933, as amended, and have not been registered or qualified under any state securities law of the U.S. and may not be offered or sold within the US except pursuant to an exemption from, or in a tra ...

1 September 2006 Page 1 of 52 The SPI Fund of Scottish Provident

... respect of a particular policy (or Specimen Policy, where the context admits). For some policy types this may be expressed as a pension or annuity rather than a cash sum. ...

... respect of a particular policy (or Specimen Policy, where the context admits). For some policy types this may be expressed as a pension or annuity rather than a cash sum. ...

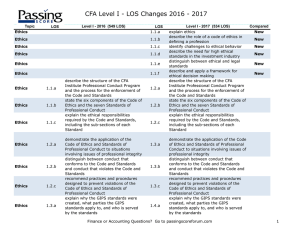

CFA Level I - LOS Changes 2016 - 2017

... describe the key features of the GIPS standards and the fundamentals of compliance describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for perfor ...

... describe the key features of the GIPS standards and the fundamentals of compliance describe the scope of the GIPS standards with respect to an investment firm’s definition and historical performance record explain how the GIPS standards are implemented in countries with existing standards for perfor ...

14. procedure for application and allotment

... All capital market operators with current SEC registration as at the date of this Prospectus are eligible to act as Receiving Agents to the Issue. A brokerage commission of 0.20% will be paid on the value of allotted Units in respect of applications bearing the Receiving Agent’s official stamp. The ...

... All capital market operators with current SEC registration as at the date of this Prospectus are eligible to act as Receiving Agents to the Issue. A brokerage commission of 0.20% will be paid on the value of allotted Units in respect of applications bearing the Receiving Agent’s official stamp. The ...

Active CDS Trading and Managers` Voluntary Disclosure

... of the CDS market – informed trading by lenders – results in a positive externality for capital markets by eliciting enhanced voluntary disclosures from CDS reference entities. Large financial institutions trade in the CDS market to satisfy their hedging and speculative needs. They also serve as dea ...

... of the CDS market – informed trading by lenders – results in a positive externality for capital markets by eliciting enhanced voluntary disclosures from CDS reference entities. Large financial institutions trade in the CDS market to satisfy their hedging and speculative needs. They also serve as dea ...

derivatives - Bombay Chartered Accountants` Society

... Transaction Cost Valuation at the year end Time of accrual of premium for writer Pradip Kapasi & Co. Chartered Accountants ...

... Transaction Cost Valuation at the year end Time of accrual of premium for writer Pradip Kapasi & Co. Chartered Accountants ...

Regulatory Capital Requirements under FTK and

... the chapter we will discuss the future perspective of the Financial Assessment Framework. In chapter 3, the Solvency II legislation will be introduced. The standard model which can be used in order to determine the Regulatory Capital Requirement under Solvency II will be explained in more detail. Th ...

... the chapter we will discuss the future perspective of the Financial Assessment Framework. In chapter 3, the Solvency II legislation will be introduced. The standard model which can be used in order to determine the Regulatory Capital Requirement under Solvency II will be explained in more detail. Th ...

FINANCIAL STATEMENTS AND NOTES TABLE OF CONTENTS

... presented updated business segment disclosures based on the previously announced transfer, effective January 1, 2012, of the substantial majority of its retail partner cards business (which Citi now refers to as ―Citi retail services‖) from Citi Holdings – Local Consumer Lending to Citicorp—North Am ...

... presented updated business segment disclosures based on the previously announced transfer, effective January 1, 2012, of the substantial majority of its retail partner cards business (which Citi now refers to as ―Citi retail services‖) from Citi Holdings – Local Consumer Lending to Citicorp—North Am ...

Scholar`s Edge Enrollment Kit

... upon how much is accumulated in a tax-advantaged account. The loan portion assumed in each column is calculated to include a fixed interest rate of 6.25% to be repaid over 180 months as defined by Sallie Mae (that’s like paying off a 15-year mortgage) following graduation with 54 monthly payments of ...

... upon how much is accumulated in a tax-advantaged account. The loan portion assumed in each column is calculated to include a fixed interest rate of 6.25% to be repaid over 180 months as defined by Sallie Mae (that’s like paying off a 15-year mortgage) following graduation with 54 monthly payments of ...

The required return on equity under a foundation model

... the computation of the allowed return on equity in the Australian regulatory setting. Specifically, we have been asked to: a. Review the AER’s concerns as to the use of dividend growth model (DGM) estimates to inform the MRP. b. Consider the criticism—that is made in the context of adjusting the Sha ...

... the computation of the allowed return on equity in the Australian regulatory setting. Specifically, we have been asked to: a. Review the AER’s concerns as to the use of dividend growth model (DGM) estimates to inform the MRP. b. Consider the criticism—that is made in the context of adjusting the Sha ...

Saudi Capital Market Overview

... Real Estate Investment Traded Funds (REITS): Real Estate Investment Traded Funds, or REITs, are financial instruments that allow all types of investors to obtain investment exposure to the Real Estate Market. This is achieved through collective ownership of constructed developed real estate qualifie ...

... Real Estate Investment Traded Funds (REITS): Real Estate Investment Traded Funds, or REITs, are financial instruments that allow all types of investors to obtain investment exposure to the Real Estate Market. This is achieved through collective ownership of constructed developed real estate qualifie ...

Scheme Information Document IDFC Dynamic Bond Fund

... To generate optimal returns with high liquidity by active management of the portfolio, by investing in high quality money market & debt instruments. However there is no assurance that the investment objective of the scheme will be realized. Units of the Scheme may be purchased or redeemed on all Bus ...

... To generate optimal returns with high liquidity by active management of the portfolio, by investing in high quality money market & debt instruments. However there is no assurance that the investment objective of the scheme will be realized. Units of the Scheme may be purchased or redeemed on all Bus ...

Implied Expected Returns and the Choice of a Mean–Variance

... the fundamentally weighted portfolio (Arnott et al. [2005]), the equally weighted portfolio (DeMiguel et al. [2009]), the inverse volatility weighted portfolio (Leote De Carvalho et al. [2012]), the equalrisk-contribution portfolio (Maillard et al. [2010]), the maximum diversification portfolio (Cho ...

... the fundamentally weighted portfolio (Arnott et al. [2005]), the equally weighted portfolio (DeMiguel et al. [2009]), the inverse volatility weighted portfolio (Leote De Carvalho et al. [2012]), the equalrisk-contribution portfolio (Maillard et al. [2010]), the maximum diversification portfolio (Cho ...

Public-Private Partnerships and Infrastructure Resilience

... The Importance of Infrastructure Resilience Infrastructure resilience refers to the potential for a given facility to “withstand an adverse event while continuing to function at acceptable levels or, if functioning is diminished, the speed by which an asset can return to the acceptable level of func ...

... The Importance of Infrastructure Resilience Infrastructure resilience refers to the potential for a given facility to “withstand an adverse event while continuing to function at acceptable levels or, if functioning is diminished, the speed by which an asset can return to the acceptable level of func ...

Transforming NGO MFIs: Critical Ownership Issues to Consider

... financial condition and trustworthiness. This may pose problems for NGOs that do not have “deep ...

... financial condition and trustworthiness. This may pose problems for NGOs that do not have “deep ...

The relation between equity incentives and misreporting_ The role

... effect of vega on misreporting is economically large and larger than many other determinants of misreporting. The theoretical and conceptual arguments for why equity incentives engender misreporting predict not only that managers with greater risk-taking incentives are more likely to misreport, but ...

... effect of vega on misreporting is economically large and larger than many other determinants of misreporting. The theoretical and conceptual arguments for why equity incentives engender misreporting predict not only that managers with greater risk-taking incentives are more likely to misreport, but ...

Factors that influence the decision of a firm to offer a - UvA-DARE

... influence the likelihood that businesses offer a DRIP. Data covering the period 2003-2012 is used to test various hypotheses regarding potential firm specific factors that could influence DRIP usage. Both univariate mean-difference analyses and multivariate linear probability models are used to test ...

... influence the likelihood that businesses offer a DRIP. Data covering the period 2003-2012 is used to test various hypotheses regarding potential firm specific factors that could influence DRIP usage. Both univariate mean-difference analyses and multivariate linear probability models are used to test ...

Financial Results - Insurance Gateway

... US economy grudgingly gaining traction, with China maintaining momentum. Medium term, things looking distinctly better in the US. Much improved home sales and falling unemployment (apart from Friday 5 April’s figure!). ...

... US economy grudgingly gaining traction, with China maintaining momentum. Medium term, things looking distinctly better in the US. Much improved home sales and falling unemployment (apart from Friday 5 April’s figure!). ...

2009 Annual Report: Employees` Retirement Program

... Denver Water established a 457 Deferred Compensation Plan pursuant to Section 457 of the Internal Revenue Code (IRC) in 1987. Assets from that plan were transferred to the Denver Water 457 Deferred Compensation Plan, when it was established on January 3, 2001. All regular or discretionary employees ...

... Denver Water established a 457 Deferred Compensation Plan pursuant to Section 457 of the Internal Revenue Code (IRC) in 1987. Assets from that plan were transferred to the Denver Water 457 Deferred Compensation Plan, when it was established on January 3, 2001. All regular or discretionary employees ...

Debt Refinancing and Equity Returns∗

... We then explore the role of debt refinancing for equity returns more rigorously in FamaMacBeth (FMB) regressions. Here, we show that equity returns are significantly related to firms’ debt refinancing intensities. In regressions of returns on leverage and refinancing intensities the coefficient est ...

... We then explore the role of debt refinancing for equity returns more rigorously in FamaMacBeth (FMB) regressions. Here, we show that equity returns are significantly related to firms’ debt refinancing intensities. In regressions of returns on leverage and refinancing intensities the coefficient est ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.