Geographic Dispersion and Stock Returns

... report typically includes information on the evolution of the firm’s operations during that year, details on its organizational structure, executive compensation, competition, and regulatory issues. The 10 K statement also gives information on the firm’s properties, such as factories, warehouses, a ...

... report typically includes information on the evolution of the firm’s operations during that year, details on its organizational structure, executive compensation, competition, and regulatory issues. The 10 K statement also gives information on the firm’s properties, such as factories, warehouses, a ...

Extending the Resource-Based View to Explain Venture Capital

... finance literature. Positive relationships were hypothesized between the independent variables and the dependent variable. Data constraints limited the number of observations examined, and the selection of IPOs investigated displayed little variance. Thus, explaining additional abnormal performance ...

... finance literature. Positive relationships were hypothesized between the independent variables and the dependent variable. Data constraints limited the number of observations examined, and the selection of IPOs investigated displayed little variance. Thus, explaining additional abnormal performance ...

Predicting Mutual Fund Performance: The Win

... point of a holding report, and we estimate the Carhart (1997) four-factor alpha from this daily return series. 5 Next, we calculate the benchmark-adjusted return of each stock. Every month, Daniel, Grinblatt, Titman, and Wermers’ (1997) risk-adjusted return is calculated by subtracting size, book-to ...

... point of a holding report, and we estimate the Carhart (1997) four-factor alpha from this daily return series. 5 Next, we calculate the benchmark-adjusted return of each stock. Every month, Daniel, Grinblatt, Titman, and Wermers’ (1997) risk-adjusted return is calculated by subtracting size, book-to ...

HOW STOCKBROKERS COULD REDUCE THEIR

... House, hereafter called Broker 88. Delivery is made using the normal Settlement System by means of a Return Delivery Slip. The broker making the delivery inserts and is paid the current market price of the stock involved. The brokers nomrnl Settlement Statement will list all outstanding deliveries t ...

... House, hereafter called Broker 88. Delivery is made using the normal Settlement System by means of a Return Delivery Slip. The broker making the delivery inserts and is paid the current market price of the stock involved. The brokers nomrnl Settlement Statement will list all outstanding deliveries t ...

Speculation and Risk Sharing with New Financial Assets

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

... diversi…cation and the sharing of risks.1 However, this view does not take into account that new assets are often associated with much uncertainty, especially because they do not have a long track record. Belief disagreements come as a natural by-product of this uncertainty and change the implicatio ...

Dividends, Share Repurchases, and the Substitution Hypothesis

... we measure the repurchase activity only for common stocks, their measure uses the entire repurchase activity, which also includes preferred stocks. This difference, however, does not affect the results in this paper. We also compare our measure to the amount of repurchase activity reported by SDC ~a ...

... we measure the repurchase activity only for common stocks, their measure uses the entire repurchase activity, which also includes preferred stocks. This difference, however, does not affect the results in this paper. We also compare our measure to the amount of repurchase activity reported by SDC ~a ...

Standard Bank Group

... discharge the board’s regulatory responsibility of reviewing and approving the group’s material risk models, as well as models used in the calculation of regulatory capital. This committee is supported by the Personal & Business Banking (PBB) and Corporate & Investment Banking (CIB) model approval s ...

... discharge the board’s regulatory responsibility of reviewing and approving the group’s material risk models, as well as models used in the calculation of regulatory capital. This committee is supported by the Personal & Business Banking (PBB) and Corporate & Investment Banking (CIB) model approval s ...

Monte Carlo Simulation in Financial Valuation

... which the present value may be considered as the discounting of a future payout using a discount rate , or equivalently the future payout may be considered the result of exponential growth of the present value using as the growth rate. The choice of that makes the present value equal to the market-c ...

... which the present value may be considered as the discounting of a future payout using a discount rate , or equivalently the future payout may be considered the result of exponential growth of the present value using as the growth rate. The choice of that makes the present value equal to the market-c ...

Hedge Funds and Systemic Risk

... Hedge funds are investment pools open to high-net-worth investors and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general ...

... Hedge funds are investment pools open to high-net-worth investors and institutions but not to the general public. In part because of this restriction, hedge funds have, until recently, been subject to reduced reporting and oversight regulations. They have also been reluctant to provide even general ...

sukuk structures

... ownership or financial certificates of assets or a pool of underlying assets. Sukuk can also provide holders the right to receive income generated from that business of the issuer. Sukuk adhere to and are consistent with Islamic law known as Shariah. Shariah originates from the Qur’an, the holy text ...

... ownership or financial certificates of assets or a pool of underlying assets. Sukuk can also provide holders the right to receive income generated from that business of the issuer. Sukuk adhere to and are consistent with Islamic law known as Shariah. Shariah originates from the Qur’an, the holy text ...

How Deep is the Annuity Market Participation Puzzle

... Why are annuities not voluntarily taken up by a larger number of retirees? In the individual consumption/savings-portfolio choice literature, a very important participation puzzle arises from the revealed preference of households not to voluntarily buy annuities at retirement, despite the strong the ...

... Why are annuities not voluntarily taken up by a larger number of retirees? In the individual consumption/savings-portfolio choice literature, a very important participation puzzle arises from the revealed preference of households not to voluntarily buy annuities at retirement, despite the strong the ...

Practical Methods for Assessing Private Climate Finance Flows

... Copenhagen and Cancun, developed country Parties are committed to “mobilising jointly USD 100 billion per year by 2020 to address the needs of developing countries...from a wide variety of sources, public and private, bilateral and multilateral, including alternative sources” (UNFCCC, 2009; UNFCCC, ...

... Copenhagen and Cancun, developed country Parties are committed to “mobilising jointly USD 100 billion per year by 2020 to address the needs of developing countries...from a wide variety of sources, public and private, bilateral and multilateral, including alternative sources” (UNFCCC, 2009; UNFCCC, ...

Historical cost measurement and the use of DuPont analysis by

... asset age is linked to a measurement bias, which lowers assets (and thus increases assetdenominated ratios), rather than a competitive advantage, which would be reflected in higher sales.4 We hypothesize that historical cost measurement of assets will lead to biases in the persistence of the asset ...

... asset age is linked to a measurement bias, which lowers assets (and thus increases assetdenominated ratios), rather than a competitive advantage, which would be reflected in higher sales.4 We hypothesize that historical cost measurement of assets will lead to biases in the persistence of the asset ...

What types of investors drive commonality in

... Many claim that the crisis was not caused by solvency issues in the first place (as it might initially seem), but rather by lack of liquidity resulting in painful liquidity spirals and significant decrease in market activity (e.g., Brunnermeier, 2009). Even though it has been long understood that li ...

... Many claim that the crisis was not caused by solvency issues in the first place (as it might initially seem), but rather by lack of liquidity resulting in painful liquidity spirals and significant decrease in market activity (e.g., Brunnermeier, 2009). Even though it has been long understood that li ...

Low volatility anomaly and mutual fund allocations - Aalto

... allocation decision across asset classes. Baker et al. (2010) discuss that private investors have preference for lottery-like payoffs, and relate the bias to positive skewness in stocks returns, where large positive payoffs are more likely than large negative payoffs. Also Kumar (2009) finds that so ...

... allocation decision across asset classes. Baker et al. (2010) discuss that private investors have preference for lottery-like payoffs, and relate the bias to positive skewness in stocks returns, where large positive payoffs are more likely than large negative payoffs. Also Kumar (2009) finds that so ...

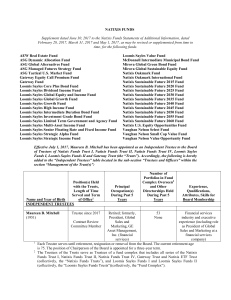

LOOMIS SAYLES VALUE FUND Supplement dated April 19, 2017 to

... Effective July 1, 2017, the section “How to Buy Shares” is hereby amended and restated as follows: How to Buy Shares The procedures for purchasing shares of a Fund are summarized in its Prospectus. All purchases made by check should be in U.S. dollars and made payable to Natixis Funds or the Funds’ ...

... Effective July 1, 2017, the section “How to Buy Shares” is hereby amended and restated as follows: How to Buy Shares The procedures for purchasing shares of a Fund are summarized in its Prospectus. All purchases made by check should be in U.S. dollars and made payable to Natixis Funds or the Funds’ ...

measuring and rewarding performance: theory and evidence

... We begin by reviewing the structure of executive pay arrangements in the UK and the regulatory system in which CEO pay is governed. Section 3 reviews key theoretical insights concerning pay structures, including the demand for performance-based compensation in a traditional principal-agent setting, ...

... We begin by reviewing the structure of executive pay arrangements in the UK and the regulatory system in which CEO pay is governed. Section 3 reviews key theoretical insights concerning pay structures, including the demand for performance-based compensation in a traditional principal-agent setting, ...

2014 Annual Report

... and to be responsive to a 2013 stockholder proposal that received 32% support. Stock ownership requirements have been six times annual salary for the CEO and three times annual salary for other senior executives. Before reaching these goals, senior management must retain 75% of the net proceeds from ...

... and to be responsive to a 2013 stockholder proposal that received 32% support. Stock ownership requirements have been six times annual salary for the CEO and three times annual salary for other senior executives. Before reaching these goals, senior management must retain 75% of the net proceeds from ...

Do Dividend Initiations Signal Firm Prosperity?

... price reaction to earnings announcements is smaller in the post dividend-initiation period, regardless of whether earnings precede or follow dividend announcements. He also finds that the volatility of shareholder returns is lower in the post dividend-initiation period, primarily due to decrease in ...

... price reaction to earnings announcements is smaller in the post dividend-initiation period, regardless of whether earnings precede or follow dividend announcements. He also finds that the volatility of shareholder returns is lower in the post dividend-initiation period, primarily due to decrease in ...

5.45% Series J Cumulative Preferred Stock

... The Gabelli Equity Trust Inc. (the “Fund,” “we,” “us” or “our”) is offering 3,200,000 shares of 5.45% Series J Cumulative Preferred Stock, par value $0.001 per share (the “Series J Preferred Shares”). The Series J Preferred Shares will constitute a separate series of the Fund’s preferred stock. Inve ...

... The Gabelli Equity Trust Inc. (the “Fund,” “we,” “us” or “our”) is offering 3,200,000 shares of 5.45% Series J Cumulative Preferred Stock, par value $0.001 per share (the “Series J Preferred Shares”). The Series J Preferred Shares will constitute a separate series of the Fund’s preferred stock. Inve ...

Dissecting Anomalies

... July 1963 through December 2005 for sorts of microcaps, small stocks, and big stocks on each anomaly variable. For all variables except momentum, the sorts are done once a year at the end of June, and monthly returns are calculated from July through June of the following year. The monthly return on ...

... July 1963 through December 2005 for sorts of microcaps, small stocks, and big stocks on each anomaly variable. For all variables except momentum, the sorts are done once a year at the end of June, and monthly returns are calculated from July through June of the following year. The monthly return on ...

Main Street Capital CORP (Form: 10-K, Received: 02

... Our Middle Market portfolio investments primarily consist of direct investments in or secondary purchases of interest bearing debt securities in privately held companies that are generally larger in size than the companies included in our LMM portfolio. Our Middle Market portfolio debt investments a ...

... Our Middle Market portfolio investments primarily consist of direct investments in or secondary purchases of interest bearing debt securities in privately held companies that are generally larger in size than the companies included in our LMM portfolio. Our Middle Market portfolio debt investments a ...

Skybridge Multi-Adviser Hedge Fund Portfolios LLC

... The transaction is expected to close in the second quarter of 2017. There can be no assurance that the transaction will be consummated as contemplated. In the event the transaction closes before the Company shareholder vote, in order for the portfolio team to provide uninterrupted services to the C ...

... The transaction is expected to close in the second quarter of 2017. There can be no assurance that the transaction will be consummated as contemplated. In the event the transaction closes before the Company shareholder vote, in order for the portfolio team to provide uninterrupted services to the C ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.