Returning Cash to the Owners: Dividend Policy

... Step 2: How much did the the company actually pay out during the period in question? Step 3: How much do I trust the management of this company with excess cash? • How well did they make investments during the period in question? • How well has my stock performed during the period in question? ...

... Step 2: How much did the the company actually pay out during the period in question? Step 3: How much do I trust the management of this company with excess cash? • How well did they make investments during the period in question? • How well has my stock performed during the period in question? ...

Franklin California Tax-Free Income Fund SAI

... proceeds of a special excise tax or other specific revenue source. Revenue bonds are issued to finance a wide variety of capital projects, including: electric, gas, water and sewer systems; highways, bridges and tunnels; port and airport facilities; colleges and universities; and hospitals. The prin ...

... proceeds of a special excise tax or other specific revenue source. Revenue bonds are issued to finance a wide variety of capital projects, including: electric, gas, water and sewer systems; highways, bridges and tunnels; port and airport facilities; colleges and universities; and hospitals. The prin ...

Did Stop Signs Stop Investor Trading?

... is not older than six months but not enough information to be considered current as well as firms “with financial reporting problems, economic distress, or in bankruptcy.” The no information tier, denoted NO, is for firms “that are not able or willing to provide disclosure to the public markets - ei ...

... is not older than six months but not enough information to be considered current as well as firms “with financial reporting problems, economic distress, or in bankruptcy.” The no information tier, denoted NO, is for firms “that are not able or willing to provide disclosure to the public markets - ei ...

Switching Bubbles: From Outside to Inside

... the future value of their capital. Moreover, only a fraction of capital can be collateralized. This type of constraint is obtained if there is, for example, limited enforcement. Section 2 presents the model and solves the steady-state equilibrium without bubbles. First, I solve the fundamental equil ...

... the future value of their capital. Moreover, only a fraction of capital can be collateralized. This type of constraint is obtained if there is, for example, limited enforcement. Section 2 presents the model and solves the steady-state equilibrium without bubbles. First, I solve the fundamental equil ...

gruppo de eccher 2013 gr u pp odeec ch er 2013

... simultaneous underwriting by another wholly owned special ...

... simultaneous underwriting by another wholly owned special ...

Cheap Talk, Fraud, and Adverse Selection in Financial Markets

... overoptimistic statements and bid too much for the asset. By purchasing the asset they significantly increase efficiency over the no-communication treatment, but they also transfer wealth to the sellers. What makes this result most surprising is that, in our experimental design, subjects alternate b ...

... overoptimistic statements and bid too much for the asset. By purchasing the asset they significantly increase efficiency over the no-communication treatment, but they also transfer wealth to the sellers. What makes this result most surprising is that, in our experimental design, subjects alternate b ...

tactical timing of low volatility equity strategies

... better meet their investment objectives. The appeal of this strategy is clear. Low volatility stocks have historically delivered higher returns with lower risk than the capitalization-weighted market. Moreover, the behavioral and market-structural forces that have been suggested as possible explanat ...

... better meet their investment objectives. The appeal of this strategy is clear. Low volatility stocks have historically delivered higher returns with lower risk than the capitalization-weighted market. Moreover, the behavioral and market-structural forces that have been suggested as possible explanat ...

Prospectus published on 20 September 2013

... or solicitation is unlawful or would impose any unfulfilled registration, qualification, publication or approval requirements on the Company or the Investment Manager. The offer and sale of Shares have not been and will not be registered under the applicable securities laws of the United States, Aus ...

... or solicitation is unlawful or would impose any unfulfilled registration, qualification, publication or approval requirements on the Company or the Investment Manager. The offer and sale of Shares have not been and will not be registered under the applicable securities laws of the United States, Aus ...

The information content of share repurchases

... More specifically, we compare the operating performance, capital expenditures, cash reserves, and equity risk of firms before and after actual share repurchases to try to distinguish between the information-signaling and free cash flow hypotheses. The former hypothesis argues that deliberate cash pa ...

... More specifically, we compare the operating performance, capital expenditures, cash reserves, and equity risk of firms before and after actual share repurchases to try to distinguish between the information-signaling and free cash flow hypotheses. The former hypothesis argues that deliberate cash pa ...

Form 8-K GENERAL ELECTRIC CAPITAL SERVICES INC/CT

... Real Estate is one of the world's leading providers of debt and equity capital to the global commercial real estate market. Real Estate provides funds for the acquisition, refinancing and renovation of real estate assets as well as making equity investments in real estate throughout the United State ...

... Real Estate is one of the world's leading providers of debt and equity capital to the global commercial real estate market. Real Estate provides funds for the acquisition, refinancing and renovation of real estate assets as well as making equity investments in real estate throughout the United State ...

Executive Summary - Baylor University

... net income of $46.6 and $203.4 million in 2003 and 2002 respectively. This loss can be attributed to high impairment and restructuring charges, as well as reduced sales margins. Newell did report an increase of 4% in sales from $7,453.9 million in 2002 to $7,750 million in 2003, however, its operati ...

... net income of $46.6 and $203.4 million in 2003 and 2002 respectively. This loss can be attributed to high impairment and restructuring charges, as well as reduced sales margins. Newell did report an increase of 4% in sales from $7,453.9 million in 2002 to $7,750 million in 2003, however, its operati ...

foresIght SolAr EiS

... Please note that applications may only be made, and will only be accepted, subject to the terms and conditions of this Information Memorandum. The attention of prospective investors is drawn to the fact that amounts invested in the Fund will be committed to investments which may be of a long term an ...

... Please note that applications may only be made, and will only be accepted, subject to the terms and conditions of this Information Memorandum. The attention of prospective investors is drawn to the fact that amounts invested in the Fund will be committed to investments which may be of a long term an ...

Does Corporate Governance Predict Firms` Market

... (KCGI, 0~100) for 515 Korean companies based on a 2001 Korea Stock Exchange survey. In OLS, a worst-to-best change in KCGI predicts a 0.47 increase in Tobin’s q (about a 160% increase in share price). This effect is statistically strong (t = 6.12) and robust to choice of market value variable (Tobin ...

... (KCGI, 0~100) for 515 Korean companies based on a 2001 Korea Stock Exchange survey. In OLS, a worst-to-best change in KCGI predicts a 0.47 increase in Tobin’s q (about a 160% increase in share price). This effect is statistically strong (t = 6.12) and robust to choice of market value variable (Tobin ...

SEASONALITY IN STOCK MARKET LIQUIDITY AND ITS

... component of the modern financial system, which has received ample amount of attention by researchers. However, it has been noticed and documented that the level of liquidity in the market is not constant over time; rather it follows some seasonal pattern, which raises various questions. What causes ...

... component of the modern financial system, which has received ample amount of attention by researchers. However, it has been noticed and documented that the level of liquidity in the market is not constant over time; rather it follows some seasonal pattern, which raises various questions. What causes ...

Analyst Recommendations, Mutual Fund Herding, and

... “herding” (simultaneous buying or selling) in growth stocks, small stocks, and extreme ...

... “herding” (simultaneous buying or selling) in growth stocks, small stocks, and extreme ...

THIS FILE GENERATED BY THE FUND LIBRARY. (c) The Fund

... the Global Guide to Investing. In his 27 years as a money manager, Cundill has had only two down years. What's his secret? If you boil it down, there are five ingredients to Cundill's investing success.Balance Sheet Security BlanketFirst and foremost, the balance sheet is Peter Cundill's best frien ...

... the Global Guide to Investing. In his 27 years as a money manager, Cundill has had only two down years. What's his secret? If you boil it down, there are five ingredients to Cundill's investing success.Balance Sheet Security BlanketFirst and foremost, the balance sheet is Peter Cundill's best frien ...

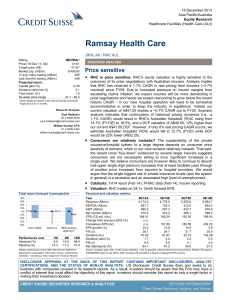

Ramsay Health Care 2013 12 18 - Price sensitive

... Price sensitive RHC's equity valuation is highly sensitive to the outcomes of its price negotiations with Australian insurers (Figure 2). Using a bottom-up analysis of key variables we estimate that only a 0.1% change in the 10-year CAGR of the real pricing RHC receives from insurers equates to a 3. ...

... Price sensitive RHC's equity valuation is highly sensitive to the outcomes of its price negotiations with Australian insurers (Figure 2). Using a bottom-up analysis of key variables we estimate that only a 0.1% change in the 10-year CAGR of the real pricing RHC receives from insurers equates to a 3. ...

Retirement Date Fund

... Retirement Date Funds (also known as target date funds) make investing for your retirement simple. All you have to do is choose the fund that most closely matches the year you expect to retire from the Florida Retirement System (FRS) Investment Plan. Diversification, asset allocation, and account re ...

... Retirement Date Funds (also known as target date funds) make investing for your retirement simple. All you have to do is choose the fund that most closely matches the year you expect to retire from the Florida Retirement System (FRS) Investment Plan. Diversification, asset allocation, and account re ...

Leverage and Capital Structure

... Earnings available for common stockholders Earnings per share (EPS) ...

... Earnings available for common stockholders Earnings per share (EPS) ...

Market Implied Costs of Bankruptcy

... costs. This can be achieved in principle by backing out bankruptcy costs implicit in observable prices or accoun ng data of non-bankrupt firms. Such an insight has first been u lized by Glover (2016). Intui vely, Glover’s paper es mates the level of bankruptcy costs which induces a firm to choose the o ...

... costs. This can be achieved in principle by backing out bankruptcy costs implicit in observable prices or accoun ng data of non-bankrupt firms. Such an insight has first been u lized by Glover (2016). Intui vely, Glover’s paper es mates the level of bankruptcy costs which induces a firm to choose the o ...

Dynamic Allocation Strategies using Minimum Volatility

... • Without limi ng any of the foregoing and to the maximum extent permi ed by applicable law, in no event shall any Informa on Provider have any liability regarding any of the Informa on for any direct, indirect, special, puni ve, consequen al (including lost profits) or any other damages even if no ...

... • Without limi ng any of the foregoing and to the maximum extent permi ed by applicable law, in no event shall any Informa on Provider have any liability regarding any of the Informa on for any direct, indirect, special, puni ve, consequen al (including lost profits) or any other damages even if no ...

Are banks still special when there is a secondary market for loans?

... It is commonly argued that banks play a special role in the financial system because they resolve important information asymmetries. Theoretical models (e.g., Diamond (1984), Ramakrishnan and Thakor (1984), Fama (1985)) highlight the unique monitoring functions of banks, and show that banks have a ...

... It is commonly argued that banks play a special role in the financial system because they resolve important information asymmetries. Theoretical models (e.g., Diamond (1984), Ramakrishnan and Thakor (1984), Fama (1985)) highlight the unique monitoring functions of banks, and show that banks have a ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.