14-0187 Attachment - Settlement Agreement - Afam Elue

... and the Hearing Panel’s decision dated July 15, 2014, will be made available at www.iiroc.ca. Documents related to ongoing IIROC enforcement proceedings – including Reasons and Decisions of Hearing Panels – are posted on the IIROC website as they become available. Click here to search and access all ...

... and the Hearing Panel’s decision dated July 15, 2014, will be made available at www.iiroc.ca. Documents related to ongoing IIROC enforcement proceedings – including Reasons and Decisions of Hearing Panels – are posted on the IIROC website as they become available. Click here to search and access all ...

esma_priips_euronext_reply_form_jan_29

... not become a counterparty to the retail investor (or anyone for that matter) committing to any payouts. In reality, regulated markets have no relation at all with the end investor as trading in the products occurs between members of the regulated market, i.e. MiFID licensed investment firms. These f ...

... not become a counterparty to the retail investor (or anyone for that matter) committing to any payouts. In reality, regulated markets have no relation at all with the end investor as trading in the products occurs between members of the regulated market, i.e. MiFID licensed investment firms. These f ...

Medicine Hat-based financial advisor fined $70000 for

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while supporting healthy ...

... IIROC is the national self-regulatory organization which oversees all investment dealers and their trading activity in Canada’s debt and equity markets. IIROC sets high quality regulatory and investment industry standards, protects investors and strengthens market integrity while supporting healthy ...

Liquidity measures, liquidity drivers and expected returns on an

... shocks. By highlighting the role of consumption smoothing and wealth rebalancing we contribute to the discussion on the drivers of the liquidity risk premium. It has been shown that liquidity risk is priced, and recent findings provide for higher premiums on emerging markets than on developed market ...

... shocks. By highlighting the role of consumption smoothing and wealth rebalancing we contribute to the discussion on the drivers of the liquidity risk premium. It has been shown that liquidity risk is priced, and recent findings provide for higher premiums on emerging markets than on developed market ...

Low Volatility Strategies

... If, at the beginning of the year, the price-to-book ratio of the low market beta quintile is less than the price-to-book ratio of the high market beta quintile, the low price-to-book strategy invests in the low market beta quintile for that year. Otherwise, it invests in the high market beta quintil ...

... If, at the beginning of the year, the price-to-book ratio of the low market beta quintile is less than the price-to-book ratio of the high market beta quintile, the low price-to-book strategy invests in the low market beta quintile for that year. Otherwise, it invests in the high market beta quintil ...

Measuring and Modeling Execution Cost and Risk

... however, are disconnected from transaction costs faced in practice since they neglect any notion of risk. Specifically, a buy order could be filled by submitting a market order and paying a price near the ask. Alternatively, the order could be submitted as a limit order and either execute at a bette ...

... however, are disconnected from transaction costs faced in practice since they neglect any notion of risk. Specifically, a buy order could be filled by submitting a market order and paying a price near the ask. Alternatively, the order could be submitted as a limit order and either execute at a bette ...

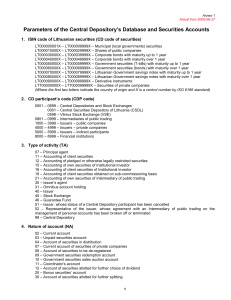

1. ISIN code of Lithuanian securities (CD code of securities)

... 015 – Stock exchange securities transactions with a postponed settlement day (T+x) 016 – Public sale of a block of state-owned shares 017 – Public sale of a block of non-state-owned shares 018 – Execution of a voluntary tender offer carrying settlement in cash 019 – Execution of a competitive tender ...

... 015 – Stock exchange securities transactions with a postponed settlement day (T+x) 016 – Public sale of a block of state-owned shares 017 – Public sale of a block of non-state-owned shares 018 – Execution of a voluntary tender offer carrying settlement in cash 019 – Execution of a competitive tender ...

An Examination of Herd Behavior: An Empirical Study on

... EMH gets violated, herding can be intentional. While it is spurious when EMH does not get violated (Hwang and Salmon [2001]). Since India is an open economy, it is sensitive to foreign market movements and actions of Foreign Institutional Investors (FII’s). Corporate governance has led to a greater ...

... EMH gets violated, herding can be intentional. While it is spurious when EMH does not get violated (Hwang and Salmon [2001]). Since India is an open economy, it is sensitive to foreign market movements and actions of Foreign Institutional Investors (FII’s). Corporate governance has led to a greater ...

Empirical Investigation of an Equity Pairs Trading Strategy

... our pairs trading strategy. The information delay explanation posits that when a firm and its peer deviate in stock prices, there is likely news related to the fundamentals of the pair; however, it takes time for the news to disseminate to the pair and this creates trading opportunity. This explana ...

... our pairs trading strategy. The information delay explanation posits that when a firm and its peer deviate in stock prices, there is likely news related to the fundamentals of the pair; however, it takes time for the news to disseminate to the pair and this creates trading opportunity. This explana ...

IQP-Computized trading stock - Worcester Polytechnic Institute

... can pick your favorite stock “guru” or “gurus” and get a list of stocks that scanned by each guru’s investment methodology. This powerful tool enables investors to pick their stocks the same way as gurus and many mutual fund managers do. But there are several drawbacks to this Guru Stock Screener. F ...

... can pick your favorite stock “guru” or “gurus” and get a list of stocks that scanned by each guru’s investment methodology. This powerful tool enables investors to pick their stocks the same way as gurus and many mutual fund managers do. But there are several drawbacks to this Guru Stock Screener. F ...

a century of stock market liquidity and trading

... Subrahmanyam (2001). The last paper examines variation in average NYSE bid-ask spreads since the mid-1980’s. Their goal is to predict changes in liquidity at short horizons. In contrast, the goal of this paper is to document systematic, cyclical changes in liquidity over a much longer time period at ...

... Subrahmanyam (2001). The last paper examines variation in average NYSE bid-ask spreads since the mid-1980’s. Their goal is to predict changes in liquidity at short horizons. In contrast, the goal of this paper is to document systematic, cyclical changes in liquidity over a much longer time period at ...

Issues in assessing trade execution costs

... November of 2000 the U.S. SEC issued Rule 11Ac1-5, which requires each U.S. market center to provide monthly reports detailing execution quality for its trades in common stocks.1 The ideal measure of trading costs may be the ‘‘implementation shortfall’’ described by Perold (1988). This measure invol ...

... November of 2000 the U.S. SEC issued Rule 11Ac1-5, which requires each U.S. market center to provide monthly reports detailing execution quality for its trades in common stocks.1 The ideal measure of trading costs may be the ‘‘implementation shortfall’’ described by Perold (1988). This measure invol ...

the long reach of Georgia-Pacific`s Harmon Associates is beginning

... provide the rapidly growing Chinese market with high-quality secondary fiber, assured supply, financial tools and logistical services, managed by a professional local sales team," he said when the joint venture announcement was made. "We will work closely with the paper industry leaders in China to ...

... provide the rapidly growing Chinese market with high-quality secondary fiber, assured supply, financial tools and logistical services, managed by a professional local sales team," he said when the joint venture announcement was made. "We will work closely with the paper industry leaders in China to ...

I 1) Which of the following is NOT an example of a

... a) An agreement to buy a car in the future at a specified price. b) An agreement to buy an airplane ticket at a future date for a certain price c) An agreement to buy a refrigerator today at the posted price. d) An agreement to subscribe to a newspaper at a specified price at a future date. 2) The m ...

... a) An agreement to buy a car in the future at a specified price. b) An agreement to buy an airplane ticket at a future date for a certain price c) An agreement to buy a refrigerator today at the posted price. d) An agreement to subscribe to a newspaper at a specified price at a future date. 2) The m ...

Maker-Taker Pricing Effects on Market Quotations

... by approximately 0.5¢/share. These changes in net spreads affect the incentives to take or make markets. In particular, holding constant the quoted spread, the access fees render taking liquidity less attractive, and the liquidity rebates render making markets more attractive. Following the adoption ...

... by approximately 0.5¢/share. These changes in net spreads affect the incentives to take or make markets. In particular, holding constant the quoted spread, the access fees render taking liquidity less attractive, and the liquidity rebates render making markets more attractive. Following the adoption ...

predicting currency markets behavior after scheduled

... is a more realistic one, as it deals with real world constraints and traders behavior. This method performs a simulated ruled based trading activity over real prices and values the final results. Our goal is to understand whether it is possible or not to capture reaction of prices after scheduled ne ...

... is a more realistic one, as it deals with real world constraints and traders behavior. This method performs a simulated ruled based trading activity over real prices and values the final results. Our goal is to understand whether it is possible or not to capture reaction of prices after scheduled ne ...

Regulatory Notice 14-47

... purposes, particularly since firms are reporting to OATS in milliseconds and will begin trade reporting in milliseconds in the near future.7 As the SEC has recognized, it is critical for regulators to have the capability to accurately determine the sequence in which all reportable events occur.8 Tim ...

... purposes, particularly since firms are reporting to OATS in milliseconds and will begin trade reporting in milliseconds in the near future.7 As the SEC has recognized, it is critical for regulators to have the capability to accurately determine the sequence in which all reportable events occur.8 Tim ...

learning and evolution of trading strategies in limit order markets

... strategically. Yet, if it is profitable for informed traders to time their trades, then it must be profitable for uninformed traders to do so as well.” She further highlights the importance of learning, “Another open question is what traders can learn from other pieces of market data, such as prices ...

... strategically. Yet, if it is profitable for informed traders to time their trades, then it must be profitable for uninformed traders to do so as well.” She further highlights the importance of learning, “Another open question is what traders can learn from other pieces of market data, such as prices ...

Debunking myths about ETF liquidity

... Immediately before the trade, JPGE traded at a bid of $51.10 for 1,000 shares, with an ask of $51.14 for 1,000 shares. The buyer of the 94,304 shares was initially concerned about JPGE’s liquidity and whether the buyer would be able to execute the trade at a reasonable price, because the trade was a ...

... Immediately before the trade, JPGE traded at a bid of $51.10 for 1,000 shares, with an ask of $51.14 for 1,000 shares. The buyer of the 94,304 shares was initially concerned about JPGE’s liquidity and whether the buyer would be able to execute the trade at a reasonable price, because the trade was a ...

Debunking myths about ETF liquidity

... Immediately before the trade, JPGE traded at a bid of $51.10 for 1,000 shares, with an ask of $51.14 for 1,000 shares. The buyer of the 94,304 shares was initially concerned about JPGE’s liquidity and whether the buyer would be able to execute the trade at a reasonable price, because the trade was a ...

... Immediately before the trade, JPGE traded at a bid of $51.10 for 1,000 shares, with an ask of $51.14 for 1,000 shares. The buyer of the 94,304 shares was initially concerned about JPGE’s liquidity and whether the buyer would be able to execute the trade at a reasonable price, because the trade was a ...

Financial Market Infrastructure Ordinance

... Securities suitable for mass standardised trading encompass certificated and uncertificated securities, derivatives, and intermediated securities which are publicly offered for sale in the same structure and denomination or are placed with more than 20 clients, insofar as they have not been created ...

... Securities suitable for mass standardised trading encompass certificated and uncertificated securities, derivatives, and intermediated securities which are publicly offered for sale in the same structure and denomination or are placed with more than 20 clients, insofar as they have not been created ...

2.07 Clearing Rules Cash Market

... XETRA® is under the obligation to take part in the clearing system in accordance with these Rules and the respective applicable Business Terms of CCP.A. Participation in clearing and settlement is possible directly as a clearing member (direct clearing member or general clearing member) or indirectl ...

... XETRA® is under the obligation to take part in the clearing system in accordance with these Rules and the respective applicable Business Terms of CCP.A. Participation in clearing and settlement is possible directly as a clearing member (direct clearing member or general clearing member) or indirectl ...

The Stock Trader

... would never want to be a stockbroker. But at the time, I thought it was the most prestigious job in the world. Why? Because I thought that a stockbroker was the closest person to the stock market. I had no idea back then that a stockbroker was really a salesmen - or that technology would afford me t ...

... would never want to be a stockbroker. But at the time, I thought it was the most prestigious job in the world. Why? Because I thought that a stockbroker was the closest person to the stock market. I had no idea back then that a stockbroker was really a salesmen - or that technology would afford me t ...

Price Discovery in Iran Gold Coin Market

... found that futures became the primary source of price discovery for the Major Market Index . High levels of price discovery by futures were coincident with high relative volume in the futures market, especially in the months preceding the 1987 crash. However, they found that the futures market does ...

... found that futures became the primary source of price discovery for the Major Market Index . High levels of price discovery by futures were coincident with high relative volume in the futures market, especially in the months preceding the 1987 crash. However, they found that the futures market does ...

Word - corporate

... Decimalization and Regulation NMS—sought to increase competition and efficiencies among markets in order to improve execution quality and lower trading costs. As the markets decentralized and became more electronic, stock trading dispersed across tens of public and private markets. Greater transpare ...

... Decimalization and Regulation NMS—sought to increase competition and efficiencies among markets in order to improve execution quality and lower trading costs. As the markets decentralized and became more electronic, stock trading dispersed across tens of public and private markets. Greater transpare ...