(vcm) in the derivatives market

... 7. Determination of the VCM Reference Price The reference price of the VCM is the price of the last trade 5 minutes ago (excluding prices of combo vs. combo trades, tailor-made combination trades and block trades), and this being a dynamic price, captures both the magnitude and speed of price change ...

... 7. Determination of the VCM Reference Price The reference price of the VCM is the price of the last trade 5 minutes ago (excluding prices of combo vs. combo trades, tailor-made combination trades and block trades), and this being a dynamic price, captures both the magnitude and speed of price change ...

Annexure – 1

... client orders. Brokers should maintain all activities/ alerts log with audit trail facility. The DMA Server should have internally generated unique numbering for all such client order/trades. A systems audit of the DMA systems and software shall be periodically carried out by the broker as may be sp ...

... client orders. Brokers should maintain all activities/ alerts log with audit trail facility. The DMA Server should have internally generated unique numbering for all such client order/trades. A systems audit of the DMA systems and software shall be periodically carried out by the broker as may be sp ...

Download paper (PDF)

... Hanson (2002), Hahn and Tetlock (2005), Sunstein (2006), and Cowgill, Wolfers, and Zitzewitz (2007)). In principle, the range of applications is virtually limitless—from helping businesses make better investment decisions to helping governments make better fiscal and monetary policy decisions. For e ...

... Hanson (2002), Hahn and Tetlock (2005), Sunstein (2006), and Cowgill, Wolfers, and Zitzewitz (2007)). In principle, the range of applications is virtually limitless—from helping businesses make better investment decisions to helping governments make better fiscal and monetary policy decisions. For e ...

NBER Reporter Summary of My Commodity Research

... In my joint work with Michael Sockin, we develop a theoretical framework to highlight an informational feedback channel for trading in commodity markets to affect commodity demand.10 This framework integrates commodity market trading under asymmetric information with an international macro setting. ...

... In my joint work with Michael Sockin, we develop a theoretical framework to highlight an informational feedback channel for trading in commodity markets to affect commodity demand.10 This framework integrates commodity market trading under asymmetric information with an international macro setting. ...

An Empirical Analysis of the Profitability of Technical Analysis

... rules to determine when to buy or sell. A large survey conducted in 2010, found that technical analysis is widely applied by hedge fund managers around the world (Menkhoff, 2010). Together with fundamental analysis, which aims to determine the intrinsic (or fundamental) value of an asset based on fi ...

... rules to determine when to buy or sell. A large survey conducted in 2010, found that technical analysis is widely applied by hedge fund managers around the world (Menkhoff, 2010). Together with fundamental analysis, which aims to determine the intrinsic (or fundamental) value of an asset based on fi ...

The impact of dark trading and visible fragmentation on market quality

... universe of trading platforms, provides stronger identification of fragmentation and allows for improved liquidity metrics. Our main finding is that the effect of visible fragmentation on global liquidity is generally positive, while the effect of dark trading is negative. An increase in dark tradin ...

... universe of trading platforms, provides stronger identification of fragmentation and allows for improved liquidity metrics. Our main finding is that the effect of visible fragmentation on global liquidity is generally positive, while the effect of dark trading is negative. An increase in dark tradin ...

Pairs Trading in the UK Equity Market Risk and Return

... transaction costs compared to the FTSE All-Share Index average annual total return of 10.9%. The average annual standard deviation for the pairs trading portfolios (between 4.4% and 5.8%) is considerably lower than the market index (16.1%). When the sample is separated into two sub sample periods, b ...

... transaction costs compared to the FTSE All-Share Index average annual total return of 10.9%. The average annual standard deviation for the pairs trading portfolios (between 4.4% and 5.8%) is considerably lower than the market index (16.1%). When the sample is separated into two sub sample periods, b ...

IIIS Discussion Paper No. 304

... Researchers have shown that culture can affect economics. One of the earliest works can be traced back to Weber (1905), where the author associated Protestantism with the development of capitalism. Later literature relates culture to more specific areas. King et al. (1994) indicated that the dynami ...

... Researchers have shown that culture can affect economics. One of the earliest works can be traced back to Weber (1905), where the author associated Protestantism with the development of capitalism. Later literature relates culture to more specific areas. King et al. (1994) indicated that the dynami ...

The Trading Behavior of Institutions and Individuals in Chinese

... investors in Chinese equity markets allows us to perform a comprehensive and thorough analysis of the trading patterns of individual investors. Our panel of data also increases our power to detect any systematic trading patterns of stocks by individual investors. We recognize that there might be ma ...

... investors in Chinese equity markets allows us to perform a comprehensive and thorough analysis of the trading patterns of individual investors. Our panel of data also increases our power to detect any systematic trading patterns of stocks by individual investors. We recognize that there might be ma ...

MiFID II Implementation

... Exemption will be retained but request for details on which rules need to be amended to ensure “analogous” treatment This will have quite a significant impact in the domestic nonMiFID investment community In the same category there is a new exemption for firms which provide hedging for clients ...

... Exemption will be retained but request for details on which rules need to be amended to ensure “analogous” treatment This will have quite a significant impact in the domestic nonMiFID investment community In the same category there is a new exemption for firms which provide hedging for clients ...

Predatory or Sunshine Trading? Evidence from Crude Oil ETF Rolls

... Our empirical analysis reveals several findings. First, the oil futures market is indeed resilient. Using CME order book data, we implement a geometric lag regression of price changes on lagged order imbalances to estimate (a) the permanent and temporary component of trading costs and (b) a resilien ...

... Our empirical analysis reveals several findings. First, the oil futures market is indeed resilient. Using CME order book data, we implement a geometric lag regression of price changes on lagged order imbalances to estimate (a) the permanent and temporary component of trading costs and (b) a resilien ...

PDF

... To correct for the non-constant error variance in this final regression, maximum likelihood estimates of sigma from the appropriate monthly regressions were scaled to sum to the number of observations and used in a weighted least squares procedure. The scaling has the effect of leaving the overall e ...

... To correct for the non-constant error variance in this final regression, maximum likelihood estimates of sigma from the appropriate monthly regressions were scaled to sum to the number of observations and used in a weighted least squares procedure. The scaling has the effect of leaving the overall e ...

Financial Intermediation Chains in a Search Market

... last a few decades makes it possible for investors to exploit many high frequency opportunities that used to be prohibitive. Numerous trading platforms were set up to compete with main exchanges; hedge funds and especially high-frequency traders directly compete with traditional market makers. The i ...

... last a few decades makes it possible for investors to exploit many high frequency opportunities that used to be prohibitive. Numerous trading platforms were set up to compete with main exchanges; hedge funds and especially high-frequency traders directly compete with traditional market makers. The i ...

Statutory Regulation of Insider Trading in Impersonal Markets

... These goals are not all feasible, or even appropriate, in all circumstances. For example, the goal of rapid public disclosure of material information is irrelevant when the corporation has a legitimate business purpose for secrecy. Nor is compensation an appropriate regulatory goal under such circum ...

... These goals are not all feasible, or even appropriate, in all circumstances. For example, the goal of rapid public disclosure of material information is irrelevant when the corporation has a legitimate business purpose for secrecy. Nor is compensation an appropriate regulatory goal under such circum ...

Emerging Market Repo

... The information and opinions in this report were prepared by Morgan Stanley & Co. Incorporated ("Morgan Stanley Dean Witter"). Morgan Stanley Dean Witter does not undertake to advise you of changes in its opinion or information. Morgan Stanley Dean Witter and others associated with it may make mark ...

... The information and opinions in this report were prepared by Morgan Stanley & Co. Incorporated ("Morgan Stanley Dean Witter"). Morgan Stanley Dean Witter does not undertake to advise you of changes in its opinion or information. Morgan Stanley Dean Witter and others associated with it may make mark ...

Understanding Managed Futures

... long periods of time. This observation is supported by academic evidence, starting with the Nobel-prize winning work of behavioral economists Daniel Kahneman and Amos Tversky in the 1970s. Their work and subsequent economic studies show that trends in financial markets have often occurred because of ...

... long periods of time. This observation is supported by academic evidence, starting with the Nobel-prize winning work of behavioral economists Daniel Kahneman and Amos Tversky in the 1970s. Their work and subsequent economic studies show that trends in financial markets have often occurred because of ...

Derivatives and Volatility on Indian Stock Markets

... (namely Dax index) on which derivative products are not introduced. This study shows that unlike the findings by Antoniou and Holmes (1995) for the London Stock Exchange (LSE), the introduction of index future, per se, has actually reduced the stock price volatility. Bologna and Covalla also found t ...

... (namely Dax index) on which derivative products are not introduced. This study shows that unlike the findings by Antoniou and Holmes (1995) for the London Stock Exchange (LSE), the introduction of index future, per se, has actually reduced the stock price volatility. Bologna and Covalla also found t ...

Low Risk- Hight Propabilities Trading Strategies 1

... large part of my trading strategy is based on my ability to do this. By watching for big block option orders, dubbed ‘unusual options activity,’ I try to determine the positions of Paper. ‘Paper’ is term originating from the trading floor, when order were actually written on paper and run to traders ...

... large part of my trading strategy is based on my ability to do this. By watching for big block option orders, dubbed ‘unusual options activity,’ I try to determine the positions of Paper. ‘Paper’ is term originating from the trading floor, when order were actually written on paper and run to traders ...

Market force, ecology and evolution

... have temporally correlated or clustered volatility (Mandelbrot, 1963, 1997; Engle, 1982) and fat tails.2 These facts are difficult to reconcile with rational expectations equilibrium. This paper develops a simple nonequilibrium theory of price formation that naturally explains the internal dynamics ...

... have temporally correlated or clustered volatility (Mandelbrot, 1963, 1997; Engle, 1982) and fat tails.2 These facts are difficult to reconcile with rational expectations equilibrium. This paper develops a simple nonequilibrium theory of price formation that naturally explains the internal dynamics ...

The Implications Of IEX`s 350 Microsecond Delay For Investors

... Stale Prices: Broker-dealers must send orders to IEX if it displays the best price, even if it is stale. This leads to uncertainty about both the size and price of displayed liquidity, meaning less efficient markets and higher costs for investors. ...

... Stale Prices: Broker-dealers must send orders to IEX if it displays the best price, even if it is stale. This leads to uncertainty about both the size and price of displayed liquidity, meaning less efficient markets and higher costs for investors. ...

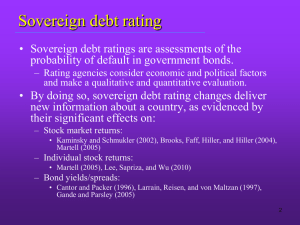

Sovereign Debt Rating and Stock Liquidity around the World

... liquidity. Our paper fills in that gap. – We study the impact of changes in sovereign credit ratings on daily stock liquidity for 40 developed and emerging markets from January 1990 to December 2009. – Stock-level analysis: Cross-sectional variation of impact – Cross-country analysis: differences in ...

... liquidity. Our paper fills in that gap. – We study the impact of changes in sovereign credit ratings on daily stock liquidity for 40 developed and emerging markets from January 1990 to December 2009. – Stock-level analysis: Cross-sectional variation of impact – Cross-country analysis: differences in ...

Option Trading: Information or Differences of

... questionable if this type of demand would explain the large volume of trading. Besides, Lakonsihok, Lee, Pearson and Poteshman (2006) found that the most popular option-trading strategy is covered call writing, followed by purchasing calls and writing puts, none of which appears to be a logical hedg ...

... questionable if this type of demand would explain the large volume of trading. Besides, Lakonsihok, Lee, Pearson and Poteshman (2006) found that the most popular option-trading strategy is covered call writing, followed by purchasing calls and writing puts, none of which appears to be a logical hedg ...

How Do Canadian Banks That Deal in Foreign Exchange Hedge

... Naik and Yadav’s analysis is extended in this paper. The affect on hedging is considered explicitly from two perspectives: the informational advantage of dealing banks who have access to order flow, and their ability to bear risk given their advantageous position in the market. While private payoff- ...

... Naik and Yadav’s analysis is extended in this paper. The affect on hedging is considered explicitly from two perspectives: the informational advantage of dealing banks who have access to order flow, and their ability to bear risk given their advantageous position in the market. While private payoff- ...

Information Trading

... hoping to benefit from the drift. The evidence indicates that across all stocks, the potential for excess returns from buying after earnings announcements is very small. You can concentrate only on earnings announcements made by smaller, less liquid companies where the drift is more pronounced. In a ...

... hoping to benefit from the drift. The evidence indicates that across all stocks, the potential for excess returns from buying after earnings announcements is very small. You can concentrate only on earnings announcements made by smaller, less liquid companies where the drift is more pronounced. In a ...