Anatomy of a Bond Futures Contract Delivery Squeeze

... the term structure which underlies the calculation of conversion factors does not become dramatically different from the prevailing term structure. Third, regulatory reporting should require flagging of trades like forward term repos that provide control of key deliverable issues against the futures ...

... the term structure which underlies the calculation of conversion factors does not become dramatically different from the prevailing term structure. Third, regulatory reporting should require flagging of trades like forward term repos that provide control of key deliverable issues against the futures ...

chapter xii international bond markets

... hand over 25% of the principal. The remaining 75% will be paid in 12 months. The GBP bond raised GBP 300 million and was aimed at overseas investors attracted by the relatively high yield on offer in the UK but concerned about the unusually strong GBP. ¶ ...

... hand over 25% of the principal. The remaining 75% will be paid in 12 months. The GBP bond raised GBP 300 million and was aimed at overseas investors attracted by the relatively high yield on offer in the UK but concerned about the unusually strong GBP. ¶ ...

Inflation-Indexed Bonds and the Expectations

... This article conducts an empirical exploration of the magnitude and time variation of risk premia in inflation-indexed and nominal government bonds, using data on US Treasury bonds and UK gilts. Understanding bond risk premia is fundamental in thinking about the term structure of interest rates. It ...

... This article conducts an empirical exploration of the magnitude and time variation of risk premia in inflation-indexed and nominal government bonds, using data on US Treasury bonds and UK gilts. Understanding bond risk premia is fundamental in thinking about the term structure of interest rates. It ...

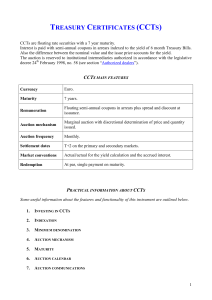

TREASURY CERTIFICATES (CCTS)

... adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, with a 7 year maturity. Like other Government bonds, CCTs are traded regularly on the electronic Govern ...

... adjust coupons to market rates and therefore guarantee, in case of a negotiation before maturity, a capital amount very similar to that initially invested. CCTs have been issued, since March 1991, with a 7 year maturity. Like other Government bonds, CCTs are traded regularly on the electronic Govern ...

Risk Management - Governance

... • We will focus on CRO organization structure, its job responsibility, and its relationship with other department (management and collaboration) • Keep in mind, no matter where you are in the organizational chart, the bottom line is to create value of the organization under a certain limits (e.g., r ...

... • We will focus on CRO organization structure, its job responsibility, and its relationship with other department (management and collaboration) • Keep in mind, no matter where you are in the organizational chart, the bottom line is to create value of the organization under a certain limits (e.g., r ...

CAPITAL MARKETS PRODUCT RISK BOOK

... (disadvantages) and risks of the financial instruments covered therein (the “Capital Markets Products”) so as to enable them to make investment decisions on an informed basis. Part A of this Product Risk Book contains the basic principles related to the Capital Markets Products (cash and derivative ...

... (disadvantages) and risks of the financial instruments covered therein (the “Capital Markets Products”) so as to enable them to make investment decisions on an informed basis. Part A of this Product Risk Book contains the basic principles related to the Capital Markets Products (cash and derivative ...

Bond Positions, Expectations, And The Yield Curve∗

... statistical model of yields into their three sources of time variation. We find that subjective risk premia are small and vary only at low frequencies. This is because both measured bond positions, and the hedging demand for long bonds under investors’ subjective belief move slowly over time. In co ...

... statistical model of yields into their three sources of time variation. We find that subjective risk premia are small and vary only at low frequencies. This is because both measured bond positions, and the hedging demand for long bonds under investors’ subjective belief move slowly over time. In co ...

Three Essays on The Term Structure of Interest Rates

... the information available to the investors. In order to examine how these effects work in equilibrium, consider the term structure of interest rates where some shocks to short term interest rates are not transmitted to long term interest rates and the risk premium of long term bonds is only affected ...

... the information available to the investors. In order to examine how these effects work in equilibrium, consider the term structure of interest rates where some shocks to short term interest rates are not transmitted to long term interest rates and the risk premium of long term bonds is only affected ...

FREE Sample Here - We can offer most test bank and

... 2. An investment is the current commitment of dollars over time to derive future payments to compensate the investor for the time funds are committed, the expected rate of inflation and the uncertainty of future payments. ANS: T ...

... 2. An investment is the current commitment of dollars over time to derive future payments to compensate the investor for the time funds are committed, the expected rate of inflation and the uncertainty of future payments. ANS: T ...

Factors Determining the Price of Butter

... particularly in light of the small share of the nation's butter traded on the Exchanges. Efforts to rig the price . have been reported only once or twice in history, for only a few hours and usually at heavy financial loss to the attempted rigger. Other traders correct the price quickly, and he must ...

... particularly in light of the small share of the nation's butter traded on the Exchanges. Efforts to rig the price . have been reported only once or twice in history, for only a few hours and usually at heavy financial loss to the attempted rigger. Other traders correct the price quickly, and he must ...

Rising Rates-What You Need to Know

... Different Factors Influence Short- and Long-Term Rates In general, interest rates typically rise in a thriving economy, and in a sluggish economy, they tend to drop. But it’s important to note that short-term and long-term rates don’t necessarily move in tandem. The Federal Reserve (Fed) controls th ...

... Different Factors Influence Short- and Long-Term Rates In general, interest rates typically rise in a thriving economy, and in a sluggish economy, they tend to drop. But it’s important to note that short-term and long-term rates don’t necessarily move in tandem. The Federal Reserve (Fed) controls th ...

Economics of Money, Banking, and Financial Markets, 8e

... A) A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk ...

... A) A liquid asset is one that can be quickly and cheaply converted into cash. B) The demand for a bond declines when it becomes less liquid, decreasing the interest rate spread between it and relatively more liquid bonds. C) The differences in bond interest rates reflect differences in default risk ...

An Empirical Analysis of the Canadian Term Structure of Zero

... the number of basis functions used, the more accurate the fit that is realized. For our purposes, we use nine basis functions (that is, N = 9). We find that, for values of N higher than nine, there is not a substantial improvement in the residual error. Given the above theoretical form for the disco ...

... the number of basis functions used, the more accurate the fit that is realized. For our purposes, we use nine basis functions (that is, N = 9). We find that, for values of N higher than nine, there is not a substantial improvement in the residual error. Given the above theoretical form for the disco ...

NBER WORKING PAPER SERIES OF BELIEFS. Pierre Collin-Dufresne

... cal findings question this doubly-stochastic assumption. For example, Das et al. (2006, 2007) report that the observed clustering of defaults in actual data are inconsistent with this assumption. Duffie et al (2009) use a fragility-based model similar to ours to identify a hidden state variable consis ...

... cal findings question this doubly-stochastic assumption. For example, Das et al. (2006, 2007) report that the observed clustering of defaults in actual data are inconsistent with this assumption. Duffie et al (2009) use a fragility-based model similar to ours to identify a hidden state variable consis ...