the fragile capital structure of hedge funds and the

... of asymmetrical information between investors placing their money with arbitrageurs and arbitrageurs managing investors’money. According to Shleifer and Vishny (1997), when investors do not understand or observe perfectly the trades and positions taken by arbitrageurs, they can react with their feet ...

... of asymmetrical information between investors placing their money with arbitrageurs and arbitrageurs managing investors’money. According to Shleifer and Vishny (1997), when investors do not understand or observe perfectly the trades and positions taken by arbitrageurs, they can react with their feet ...

The Round-the-Clock Market for US Treasury Securities

... expected to participate meaningfully at auction, make reasonably good markets in their trading relationships with the Federal Reserve Bank of New York’s trading desk, and supply market information to the Fed. Formerly, primary dealers were also required to transact a certain level of trading volume ...

... expected to participate meaningfully at auction, make reasonably good markets in their trading relationships with the Federal Reserve Bank of New York’s trading desk, and supply market information to the Fed. Formerly, primary dealers were also required to transact a certain level of trading volume ...

Short Selling Risk - Rady School of Management

... is the quantity of shares loaned out as a percentage of Loan Supply. Finally, Loan Fee, often referred to as specialness, is the cost of borrowing a share in basis points per annum. We use Loan Fee and Utilization to define two measures of short selling risk. The first measure, Fee Risk, is the nat ...

... is the quantity of shares loaned out as a percentage of Loan Supply. Finally, Loan Fee, often referred to as specialness, is the cost of borrowing a share in basis points per annum. We use Loan Fee and Utilization to define two measures of short selling risk. The first measure, Fee Risk, is the nat ...

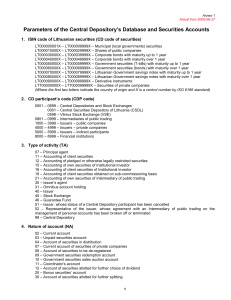

1. ISIN code of Lithuanian securities (CD code of securities)

... 112 – Premature Government securities redemption auction 113 – Premature final redemption of Government securities Other Stock events 001 – Stock events 091 – Change of the Central Depository participant’s code 110 – Closure of Government securities issue 150 – Debt securities coupon payment ...

... 112 – Premature Government securities redemption auction 113 – Premature final redemption of Government securities Other Stock events 001 – Stock events 091 – Change of the Central Depository participant’s code 110 – Closure of Government securities issue 150 – Debt securities coupon payment ...

Corporate Finance (Book 1)

... • Liquidity ratios refer to a firm’s ability to satisfy its short-term obligations when needed • The primary concern is the firm’s ability to pay its bills in the short term without undue stress • Efficiency or activity ratios measure how efficiently and intensively a firm uses its assets to generat ...

... • Liquidity ratios refer to a firm’s ability to satisfy its short-term obligations when needed • The primary concern is the firm’s ability to pay its bills in the short term without undue stress • Efficiency or activity ratios measure how efficiently and intensively a firm uses its assets to generat ...

Rules concerning Price Limits on Bids and Offers

... (2) The price limits on a foreign exchangeable corporate bond shall be those (a fraction less than tick sizes shall be rounded up) computed by multiplying the price limit which is obtained by applying [the price of a stock to be exchanged of such foreign exchangeable corporate bond that is computed ...

... (2) The price limits on a foreign exchangeable corporate bond shall be those (a fraction less than tick sizes shall be rounded up) computed by multiplying the price limit which is obtained by applying [the price of a stock to be exchanged of such foreign exchangeable corporate bond that is computed ...

Option traders use (very) sophisticated heuristics, never the Blackâ

... came up with a new option formula, but only an theoretical economic argument built on a new way of “deriving”, rather rederiving, an already existing – and well known – formula. The argument, we will see, is extremely fragile to assumptions. The foundations of option hedging and pricing were already ...

... came up with a new option formula, but only an theoretical economic argument built on a new way of “deriving”, rather rederiving, an already existing – and well known – formula. The argument, we will see, is extremely fragile to assumptions. The foundations of option hedging and pricing were already ...

Corporate Bond Trading on a Limit Order Book Exchange by

... investors were lower than today. They conclude that there are multiple possible equilibria in securities trading, and that the bond market in the US reached an inefficient equilibrium of OTC dominance: "Liquidity may not gravitate to the most efficient trading venue… even in the long term". The rea ...

... investors were lower than today. They conclude that there are multiple possible equilibria in securities trading, and that the bond market in the US reached an inefficient equilibrium of OTC dominance: "Liquidity may not gravitate to the most efficient trading venue… even in the long term". The rea ...

Risk Profiling

... that a long term investor does not meet their goals. Once investors understand what those risks are they are in a much better position to assess whether or not they are risks that they wish to take. So we begin by looking at what factors can get in the way of an investor meeting their goals. These w ...

... that a long term investor does not meet their goals. Once investors understand what those risks are they are in a much better position to assess whether or not they are risks that they wish to take. So we begin by looking at what factors can get in the way of an investor meeting their goals. These w ...

Disputation, August 4th, 2009, Ryan Riordan

... social uselessness) than high-frequency trading. The stock market is supposed to allocate capital to its most productive uses, for example by helping companies with good ideas raise money. But it's hard to see how traders who place their orders one-thirtieth of a second faster than anyone else do an ...

... social uselessness) than high-frequency trading. The stock market is supposed to allocate capital to its most productive uses, for example by helping companies with good ideas raise money. But it's hard to see how traders who place their orders one-thirtieth of a second faster than anyone else do an ...