a century of stock market liquidity and trading

... Since the proportional commission depends only on the share price, it is possible to estimate the weighted average commission rate during the fixed commission regime by looking only at the cross-sectional distribution of share prices and the total volume of trade. Other than ignoring odd lot transac ...

... Since the proportional commission depends only on the share price, it is possible to estimate the weighted average commission rate during the fixed commission regime by looking only at the cross-sectional distribution of share prices and the total volume of trade. Other than ignoring odd lot transac ...

Behind the Crash: Analysis of the Roles of Macroeconomic

... the stock market has continued to slide down. The Nigerian market crash came even before the rest of the world joined in what has now come to be accepted as a global economic recession. While the crash in the price of quoted shares on the Nigerian Stock Exchange started in March, those of the United ...

... the stock market has continued to slide down. The Nigerian market crash came even before the rest of the world joined in what has now come to be accepted as a global economic recession. While the crash in the price of quoted shares on the Nigerian Stock Exchange started in March, those of the United ...

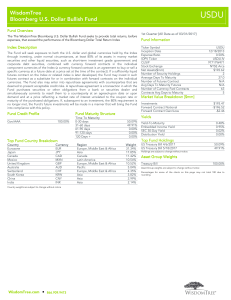

WisdomTree Bloomberg U.S. Dollar Bullish Fund

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

... through investing, under normal circumstances, at least 80% of its assets in money market securities and other liquid securities, such as short-term investment grade government and corporate debt securities, combined with currency forward contracts in the individual component currencies of the Index ...

Crowdfunding - North American Securities Administrators Association

... Remember: It is your business, so ask questions to ensure that the broker or funding portal is thoroughly familiar with the act and is motivated to see that your business properly and legally get off the ground. ...

... Remember: It is your business, so ask questions to ensure that the broker or funding portal is thoroughly familiar with the act and is motivated to see that your business properly and legally get off the ground. ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... offering of voting common stock or non-voting common stock but is one in which no one transferee (or group of associated transferees) acquires the rights to receive 2% or more of any class of the voting securities of the Company then outstanding (including pursuant to a related series of transfers); ...

... offering of voting common stock or non-voting common stock but is one in which no one transferee (or group of associated transferees) acquires the rights to receive 2% or more of any class of the voting securities of the Company then outstanding (including pursuant to a related series of transfers); ...

An Indirect Impact of the Price to Book Value to the Stock Returns

... JURNAL AKUNTANSI DAN KEUANGAN, VOL. 17, NO. 2, NOVEMBER 2015: 91-96 ...

... JURNAL AKUNTANSI DAN KEUANGAN, VOL. 17, NO. 2, NOVEMBER 2015: 91-96 ...

Portable_Presentation

... Returns are negative for the first quintile, and then grow positive. 4th quintile performed well with low volatility Equal weighted portfolio is more consistent through time Suggests that 1st quintile can be used as a short strategy, and a blend of the 4th and 5th quintiles can be used for a long st ...

... Returns are negative for the first quintile, and then grow positive. 4th quintile performed well with low volatility Equal weighted portfolio is more consistent through time Suggests that 1st quintile can be used as a short strategy, and a blend of the 4th and 5th quintiles can be used for a long st ...

Settlement model

... The fact that final securities transfers precede final funds transfers in this model clearly has the potential to expose sellers of securities to substantial principal risk To provide strong assurances that sellers will receive payment for delivered securities : creation of an assured payment system ...

... The fact that final securities transfers precede final funds transfers in this model clearly has the potential to expose sellers of securities to substantial principal risk To provide strong assurances that sellers will receive payment for delivered securities : creation of an assured payment system ...

Why variable inventory costs intensify retail competition, and a case

... sunk or remain variable has a signi…cant a¤ect on retail market outcomes if realistically retailers do not observe rivals’inventory before choosing prices (while, as supported by the currently held view discussed below, it has no e¤ect if instead retailers observe inventory choices). Second, we show ...

... sunk or remain variable has a signi…cant a¤ect on retail market outcomes if realistically retailers do not observe rivals’inventory before choosing prices (while, as supported by the currently held view discussed below, it has no e¤ect if instead retailers observe inventory choices). Second, we show ...

Statutory Accounting Principles Working Group

... indices, but possibly to achieve a specified investment objective using an active investment strategy. Regardless if following an active investment strategy, even if a reporting entity was to own all of the creation units of an ETF, the reporting entity is not perceived to have “control” of the unde ...

... indices, but possibly to achieve a specified investment objective using an active investment strategy. Regardless if following an active investment strategy, even if a reporting entity was to own all of the creation units of an ETF, the reporting entity is not perceived to have “control” of the unde ...

economics - SchoolRack

... the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in producer surplus (area BCFD) occurs in part because existing producers now receive more(area BCED) and in ...

... the triangle ABC. When the price rises from P1 to P2, as in panel (b), the quantity supplied rises from Q1 to Q2, and the producer surplus rises to the area of the triangle ADF. The increase in producer surplus (area BCFD) occurs in part because existing producers now receive more(area BCED) and in ...

FREE Sample Here

... Full file at http://testbanksite.eu/Investments-8th-Canadian-Edition-Test-Bank ...

... Full file at http://testbanksite.eu/Investments-8th-Canadian-Edition-Test-Bank ...

Does Gender and Age Affect Investor Performance and the

... The paper provides detailed analysis of the account size, risk level and trading intensity of different age groups, concentrating on gender differences in an emerging market setup. There is currently no empirical work for a young emerging market in western cultural environment that can have clear im ...

... The paper provides detailed analysis of the account size, risk level and trading intensity of different age groups, concentrating on gender differences in an emerging market setup. There is currently no empirical work for a young emerging market in western cultural environment that can have clear im ...

download

... been accompanied by, a number of new trends, one of which is the growth in earnings manipulation, ranging from fairly innocuous earnings "smoothing" to outright accounting fraud. This is reflected, for example, in the enormous growth in earnings restatements during the 1990s. While there were only s ...

... been accompanied by, a number of new trends, one of which is the growth in earnings manipulation, ranging from fairly innocuous earnings "smoothing" to outright accounting fraud. This is reflected, for example, in the enormous growth in earnings restatements during the 1990s. While there were only s ...

Proving Loss Causation and Damages under SEC Rule 10b-5

... The private right of action under § 10(b) of the 1934 Act is a product of judicial implication.' 7 The federal courts first implied this private cause of action in 1946 during an era where every wrong was deemed to have a remedy.' 8 It therefore comes as no surprise that courts have struggled to fin ...

... The private right of action under § 10(b) of the 1934 Act is a product of judicial implication.' 7 The federal courts first implied this private cause of action in 1946 during an era where every wrong was deemed to have a remedy.' 8 It therefore comes as no surprise that courts have struggled to fin ...

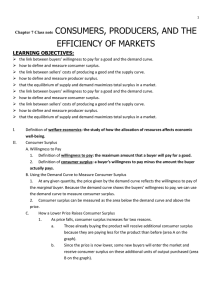

Chapter 7 Class note CONSUMERS, PRODUCERS, AND THE

... At the market equilibrium price: a. Buyers who value the product more than the equilibrium price will purchase the product; those who do not will not purchase the product. In other words, the free market allocates the supply of a good to the buyers who value it most highly, as measured by their will ...

... At the market equilibrium price: a. Buyers who value the product more than the equilibrium price will purchase the product; those who do not will not purchase the product. In other words, the free market allocates the supply of a good to the buyers who value it most highly, as measured by their will ...

risks associated with financial instruments (glossary)

... instruments require collateral (typically cash) from investors and contain several additional risks. A decrease in value of the investment can trigger margin calls. Investors can either cover the call by sending additional cash or by selling part or the entire investment. One needs to be aware that, ...

... instruments require collateral (typically cash) from investors and contain several additional risks. A decrease in value of the investment can trigger margin calls. Investors can either cover the call by sending additional cash or by selling part or the entire investment. One needs to be aware that, ...

Financial Accounting: Assets Question 1 (30 marks) Multiple choice

... C. Two years ago, Consolidated purchased 54% of the outstanding voting shares of Gas Distributors Inc. (Gas), a private foreign company in the natural gas distribution business. The purchase was made at a translated price of €24 per share. Consolidated has five seats on the eight-person Board of Di ...

... C. Two years ago, Consolidated purchased 54% of the outstanding voting shares of Gas Distributors Inc. (Gas), a private foreign company in the natural gas distribution business. The purchase was made at a translated price of €24 per share. Consolidated has five seats on the eight-person Board of Di ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.