Reporting Standard ARS 720.4 ABS/RBA Debt Securities Held

... Examples included under ‘Include’ and ‘Exclude’ are examples and should not be taken as an exhaustive list of items to be included or excluded. 1. Total short-term debt securities held Item 1 collects information on the value of short-term debt securities held by the ADI or RFC by the counterparty o ...

... Examples included under ‘Include’ and ‘Exclude’ are examples and should not be taken as an exhaustive list of items to be included or excluded. 1. Total short-term debt securities held Item 1 collects information on the value of short-term debt securities held by the ADI or RFC by the counterparty o ...

cm advisors small cap value fund cm advisors fixed income fund

... to greater maturity risk to extent it is invested in fixed income securities with longer maturities. This risk may be heightened given the current historically low interest rate environment and the likelihood of increases in those rates in the near future. • Liquidity Risk – Liquidity risk is the r ...

... to greater maturity risk to extent it is invested in fixed income securities with longer maturities. This risk may be heightened given the current historically low interest rate environment and the likelihood of increases in those rates in the near future. • Liquidity Risk – Liquidity risk is the r ...

prospectus - Cullen Funds

... At times, these reactions have created scenarios where investors and traders have redeemed their investments/holdings en masse thereby creating additional and often significant downward price pressure than might be experienced in less volatile periods. In the future, market participants’ views on th ...

... At times, these reactions have created scenarios where investors and traders have redeemed their investments/holdings en masse thereby creating additional and often significant downward price pressure than might be experienced in less volatile periods. In the future, market participants’ views on th ...

words

... identified in this prospectus, are selling up to 1,344,086 of our ordinary shares. Go2Net is also selling a warrant and 1,136,000 ordinary shares which may be acquired upon exercise of the warrant. These securities may be offered from time to time by the Selling Securityholders through public or pri ...

... identified in this prospectus, are selling up to 1,344,086 of our ordinary shares. Go2Net is also selling a warrant and 1,136,000 ordinary shares which may be acquired upon exercise of the warrant. These securities may be offered from time to time by the Selling Securityholders through public or pri ...

there is no exception to this rule

... HomeBridge is providing information on TRID rules and HomeBridge requirements. Sellers are responsible to ensure all loans submitted for purchase to HomeBridge are in compliance with TRID and HomeBridge guidelines. Additionally, Sellers are responsible to ensure all applicable disclosures required u ...

... HomeBridge is providing information on TRID rules and HomeBridge requirements. Sellers are responsible to ensure all loans submitted for purchase to HomeBridge are in compliance with TRID and HomeBridge guidelines. Additionally, Sellers are responsible to ensure all applicable disclosures required u ...

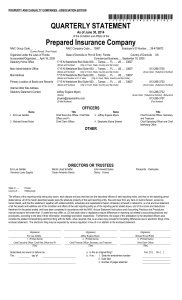

quarterly statement - Prepared Insurance

... and short-term investments ($.....374,328).................................................................................. ...............20,877,569 ................................... ...............20,877,569 ...............12,384,281 ...

... and short-term investments ($.....374,328).................................................................................. ...............20,877,569 ................................... ...............20,877,569 ...............12,384,281 ...

2016 Proxy Statement - Investor Relations

... be held at 10:00 a.m. PDT on Thursday, August 4, 2016 at our headquarters located at 345 Encinal Street, Santa Cruz, California 95060. Our Board of Directors ("Board") is soliciting proxies for the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding ...

... be held at 10:00 a.m. PDT on Thursday, August 4, 2016 at our headquarters located at 345 Encinal Street, Santa Cruz, California 95060. Our Board of Directors ("Board") is soliciting proxies for the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding ...

DIME COMMUNITY BANCSHARES INC

... This Proxy Statement and accompanying proxy card are being furnished to the shareholders of Dime Community Bancshares, Inc. (the "Company") in connection with the solicitation of proxies by the Company's Board of Directors from holders of the shares of the Company's issued and outstanding common sto ...

... This Proxy Statement and accompanying proxy card are being furnished to the shareholders of Dime Community Bancshares, Inc. (the "Company") in connection with the solicitation of proxies by the Company's Board of Directors from holders of the shares of the Company's issued and outstanding common sto ...

Good news-Bad news: Information revelation

... regime will not be realized. The final dividend is realized at the end of period three. In the ambiguity treatment, the probability of occurrence of the two different dividend regimes is left unknown. Specifically, we tell subjects that a given regime of dividends will be selected at the end of the ...

... regime will not be realized. The final dividend is realized at the end of period three. In the ambiguity treatment, the probability of occurrence of the two different dividend regimes is left unknown. Specifically, we tell subjects that a given regime of dividends will be selected at the end of the ...

Factors Affecting Dividend Payout

... theory suggests that dividends are subject to a higher tax cut than capital gains. This theory further argues that dividends are taxed directly, while capital gains tax is not realized until a stock is sold. Therefore, for tax-related reasons, investors prefer the retention of a firm’s profit over t ...

... theory suggests that dividends are subject to a higher tax cut than capital gains. This theory further argues that dividends are taxed directly, while capital gains tax is not realized until a stock is sold. Therefore, for tax-related reasons, investors prefer the retention of a firm’s profit over t ...

The Impact of Market Sentiment Index on Stock

... stocks and also returns of portfolios that belong to small investors. The portfolio was sorted based on size, and the data covers the period from 1991 to 1996. The results showed that investor sentiment is able to forecast stock returns in the cross-section and in the aggregate. Furthermore, they do ...

... stocks and also returns of portfolios that belong to small investors. The portfolio was sorted based on size, and the data covers the period from 1991 to 1996. The results showed that investor sentiment is able to forecast stock returns in the cross-section and in the aggregate. Furthermore, they do ...

The Return Volatility Effect of Stock Splits

... to be just a cosmetic accounting decision that has no direct cost or benefit attached to them (Grinblatt et al., 1984, p. 1). This is because a stock split is merely the division of outstanding shares and has no effect on the total value of the shares (Baker and Powell, 1993, p.20). For example, a s ...

... to be just a cosmetic accounting decision that has no direct cost or benefit attached to them (Grinblatt et al., 1984, p. 1). This is because a stock split is merely the division of outstanding shares and has no effect on the total value of the shares (Baker and Powell, 1993, p.20). For example, a s ...

EUROPEAN COMMISSION Brussels, 14.7.2016 C(2016) 4390 final

... instrument. Requiring investment firms to make public those transactions would cause significant operational challenges and costs without improving the price formation process. Therefore, post-trade transparency obligations in respect of transactions executed outside a trading venue should only app ...

... instrument. Requiring investment firms to make public those transactions would cause significant operational challenges and costs without improving the price formation process. Therefore, post-trade transparency obligations in respect of transactions executed outside a trading venue should only app ...

UK Equities for income and total return

... the fund’s total assets are invested. Holdings in different securities issued by the same company are listed separately and any exposure achieved by derivatives is not shown. This means that the data may not always represent the total exposure of the portfolio to any given company. A full list of ho ...

... the fund’s total assets are invested. Holdings in different securities issued by the same company are listed separately and any exposure achieved by derivatives is not shown. This means that the data may not always represent the total exposure of the portfolio to any given company. A full list of ho ...

Raising Capital- Get the Money You Need To Grow Your Business

... each have your own ideas as to how these factors should be weighted and balanced, as shown in Figure 1-1. Once a meeting of the minds takes place on these key elements, you’ll be able to do the deal. Risk. The venture investors want to mitigate their risk, which you can do with a strong management t ...

... each have your own ideas as to how these factors should be weighted and balanced, as shown in Figure 1-1. Once a meeting of the minds takes place on these key elements, you’ll be able to do the deal. Risk. The venture investors want to mitigate their risk, which you can do with a strong management t ...

Rights and Duties of Warrant Issuer and Warrant Holder

... units multiplies the exercise ratio. If there is a fraction of share derived from the calculation of adjustment to the exercise price and/or the exercise ratio, the company will discard such fraction and return to warrant holders the payment left from such exercise by check crossing "A/C payee only" ...

... units multiplies the exercise ratio. If there is a fraction of share derived from the calculation of adjustment to the exercise price and/or the exercise ratio, the company will discard such fraction and return to warrant holders the payment left from such exercise by check crossing "A/C payee only" ...

Rethinking the Role of Recourse in the Sale of Financial Assets

... than a loan. Yet, sale characterization has important consequences. If the transfer of the future payment stream from the originator [seller] to the third party [purchaser] fails to constitute a true sale under § 541 of the Bankruptcy Code, the transfer would be deemed an advance of funds by the thi ...

... than a loan. Yet, sale characterization has important consequences. If the transfer of the future payment stream from the originator [seller] to the third party [purchaser] fails to constitute a true sale under § 541 of the Bankruptcy Code, the transfer would be deemed an advance of funds by the thi ...

XX June 2010 - Providence Resources

... The Circular will be posted today to Shareholders and a copy will be available free of charge on the Company's website: www.providenceresources.com. The distribution of the Circular and the making of the Open Offer to persons located or resident in, or who are citizens of, or who have a registered ...

... The Circular will be posted today to Shareholders and a copy will be available free of charge on the Company's website: www.providenceresources.com. The distribution of the Circular and the making of the Open Offer to persons located or resident in, or who are citizens of, or who have a registered ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.