words - Nasdaq`s INTEL Solutions

... subsidiary of the Company acquired NBG EDV Handels- und Verlags GmbH ("NBG"), a privately held software distributor and publisher based in Burglengenfeld, Germany, and Target Software Vertriebs GmbH ("Target"), a small affiliated software retailer. The transaction was structured as a share for share ...

... subsidiary of the Company acquired NBG EDV Handels- und Verlags GmbH ("NBG"), a privately held software distributor and publisher based in Burglengenfeld, Germany, and Target Software Vertriebs GmbH ("Target"), a small affiliated software retailer. The transaction was structured as a share for share ...

Chicago Board of Trade (CBOT)

... • A Swap futures contract transforms its underlying reference swap rate into an index number that essentially looks and behaves like the price of a 6% coupon note. The mapping from the par swap rate to the contract price is standardized and one-to-one. So is the mapping from the par swap rate to key ...

... • A Swap futures contract transforms its underlying reference swap rate into an index number that essentially looks and behaves like the price of a 6% coupon note. The mapping from the par swap rate to the contract price is standardized and one-to-one. So is the mapping from the par swap rate to key ...

SEASONALITY IN STOCK MARKET LIQUIDITY AND ITS

... that have, usually concentrate on the U.S. market (Draper & Paudyal, 1997). 2.1.1. Month-of-the-year effect In their paper Hong and Yu (2009) study 51 stock exchanges around the globe and find that stock turnover in summer is considerably lower by approximately 7.9%. In addition, cost of trading (in ...

... that have, usually concentrate on the U.S. market (Draper & Paudyal, 1997). 2.1.1. Month-of-the-year effect In their paper Hong and Yu (2009) study 51 stock exchanges around the globe and find that stock turnover in summer is considerably lower by approximately 7.9%. In addition, cost of trading (in ...

Word - corporate

... the transfer of funds on the exercise of an Option (if the Cash Exercise method is used); ...

... the transfer of funds on the exercise of an Option (if the Cash Exercise method is used); ...

Staged Privatization: A Market Process with Multistage Lockups

... equilibrium speed of staged privatization, which is a key feature of our model. For example, if the economic environment experiences a downturn, the speed of privatization will automatically slow down, as each nontradable shareholder chooses to lock up their remaining shares for a longer period of t ...

... equilibrium speed of staged privatization, which is a key feature of our model. For example, if the economic environment experiences a downturn, the speed of privatization will automatically slow down, as each nontradable shareholder chooses to lock up their remaining shares for a longer period of t ...

Hereford-Funds-Semi-Annual-report-31.03.2014 1

... Additional Information for Investors in the Federal Republic of Germany With respect to the following compartment no notification has been filed with the German Federal Financial Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin). Units in the below-mentioned com ...

... Additional Information for Investors in the Federal Republic of Germany With respect to the following compartment no notification has been filed with the German Federal Financial Services Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht, BaFin). Units in the below-mentioned com ...

Liquidity and the Law of One Price: The Case of the Futures/Cash

... recorded before the open or after the closing time, and trades with special settlement conditions (because they might be subject to distinct liquidity considerations). A preliminary investigation reveals that auto-quotes (passive quotes by secondary market dealers) have been eliminated in the ISSM d ...

... recorded before the open or after the closing time, and trades with special settlement conditions (because they might be subject to distinct liquidity considerations). A preliminary investigation reveals that auto-quotes (passive quotes by secondary market dealers) have been eliminated in the ISSM d ...

NBER WORKING PAPER SERIES WHAT DOES FUTURES

... producers or consumers of commodities, tends to be pro-cyclical. For example, oil producers that anticipate higher demand could go short oil futures, while utilities that anticipate higher demand from manufacturing firms could go long oil futures. Importers that anticipate higher US demand could go s ...

... producers or consumers of commodities, tends to be pro-cyclical. For example, oil producers that anticipate higher demand could go short oil futures, while utilities that anticipate higher demand from manufacturing firms could go long oil futures. Importers that anticipate higher US demand could go s ...

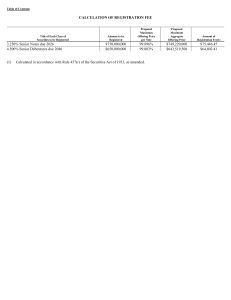

KELLOGG CO (Form: 424B5, Received: 02/26/2016 17:06:57)

... The notes will be our unsecured and unsubordinated obligations and will rank on a parity with all of our other unsecured and unsubordinated indebtedness from time to time outstanding. The notes will be effectively subordinated to all liabilities of our subsidiaries, including trade payables, and eff ...

... The notes will be our unsecured and unsubordinated obligations and will rank on a parity with all of our other unsecured and unsubordinated indebtedness from time to time outstanding. The notes will be effectively subordinated to all liabilities of our subsidiaries, including trade payables, and eff ...

CEO Turnover, Earnings Management, and Big Bath [PDF File

... scheme is (1 − s)R1 + sP , and N’s incentive scheme is (1 − w)R2 + wP , where R1 is period 1 earnings report, R2 is period 2 earnings report, P is stock price, s (w) is stock-based incentive weight measuring how much O’s (N’s) payoff depends on stock price (e.g. vesting of stock option), and 1 − s ( ...

... scheme is (1 − s)R1 + sP , and N’s incentive scheme is (1 − w)R2 + wP , where R1 is period 1 earnings report, R2 is period 2 earnings report, P is stock price, s (w) is stock-based incentive weight measuring how much O’s (N’s) payoff depends on stock price (e.g. vesting of stock option), and 1 − s ( ...

Automated Trading Desk and Price Prediction in High

... is only gradually becoming a focus).1 For example, Muniesa has examined the pathways via which markets have moved from face-to-face interaction to the algorithmic matching of supply and demand (Muniesa, 2005 and 2011), and Knorr Cetina and Preda have taught us how to conceptualize interaction in ele ...

... is only gradually becoming a focus).1 For example, Muniesa has examined the pathways via which markets have moved from face-to-face interaction to the algorithmic matching of supply and demand (Muniesa, 2005 and 2011), and Knorr Cetina and Preda have taught us how to conceptualize interaction in ele ...

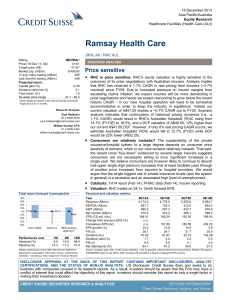

Ramsay Health Care 2013 12 18 - Price sensitive

... ■ RHC is price sensitive: RHC's equity valuation is highly sensitive to the outcomes of its price negotiations with Australian insurers. Analysis implies that RHC has received a 1.1% CAGR in real pricing from insurers (~3.7% nominal) since FY09. Due to increased pressure on insurer margins from esca ...

... ■ RHC is price sensitive: RHC's equity valuation is highly sensitive to the outcomes of its price negotiations with Australian insurers. Analysis implies that RHC has received a 1.1% CAGR in real pricing from insurers (~3.7% nominal) since FY09. Due to increased pressure on insurer margins from esca ...

Essilor (EI FP)-Buy: Bigger playing field becomes reality

... Essilor remains by far a “captain of industry” in the corrective lenses but also in the optical instruments market. The expansion in new markets (sun and online) supported by the global roll-out of direct-to-consumer marketing campaigns (a game changer in our view as it is targeting directly end con ...

... Essilor remains by far a “captain of industry” in the corrective lenses but also in the optical instruments market. The expansion in new markets (sun and online) supported by the global roll-out of direct-to-consumer marketing campaigns (a game changer in our view as it is targeting directly end con ...

DTE ENERGY CO (Form: DEF 14A, Received: 03/15

... registered public accounting firm for the year 2012; 3. Vote on an advisory proposal relating to a nonbinding vote on executive compensation; 4. Vote on a Management proposal to amend the DTE Energy Company 2006 Long-Term Incentive Plan; 5. Vote on a Shareholder proposal relating to political contri ...

... registered public accounting firm for the year 2012; 3. Vote on an advisory proposal relating to a nonbinding vote on executive compensation; 4. Vote on a Management proposal to amend the DTE Energy Company 2006 Long-Term Incentive Plan; 5. Vote on a Shareholder proposal relating to political contri ...

APPLE INC (Form: 424B2, Received: 11/04/2014 06:07:42)

... We are not, and the underwriters are not, making an offer of the notes in any jurisdiction where the offer or sale is not permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering or sale of the notes in some jurisdictions may be restricted by law. Th ...

... We are not, and the underwriters are not, making an offer of the notes in any jurisdiction where the offer or sale is not permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering or sale of the notes in some jurisdictions may be restricted by law. Th ...

Option traders use (very) sophisticated heuristics, never the Blackâ

... 2. The Black–Scholes–Merton “formula” was an argument Option traders call the formula they use the “Black–Scholes–Merton” formula without being aware that by some irony, of all the possible options formulas that have been produced in the past century, what is called the Black–Scholes–Merton “formula ...

... 2. The Black–Scholes–Merton “formula” was an argument Option traders call the formula they use the “Black–Scholes–Merton” formula without being aware that by some irony, of all the possible options formulas that have been produced in the past century, what is called the Black–Scholes–Merton “formula ...

prospectus

... Any investment involves risk, and there is no assurance that the Fund’s objective will be achieved. As you consider an investment in the Fund, you also should take into account your tolerance for the daily fluctuations of the financial markets and whether you can afford to leave your money in the Fu ...

... Any investment involves risk, and there is no assurance that the Fund’s objective will be achieved. As you consider an investment in the Fund, you also should take into account your tolerance for the daily fluctuations of the financial markets and whether you can afford to leave your money in the Fu ...

Costs of Eliminating Discretionary Broker Voting on Uncontested

... The portion of shares held by retail investors will significantly affect the cost of soliciting votes in an uncontested election of directors, as institutional investors are more likely to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for ...

... The portion of shares held by retail investors will significantly affect the cost of soliciting votes in an uncontested election of directors, as institutional investors are more likely to vote their shares than are retail shareholders.4 Investment advisers to closed-end funds and mutual funds, for ...

How to set up a securitisation vehicle

... Securitisation is a financial technique that consists in transferring the risks pertaining to certain underlying assets, such as receivables or other eligible assets, to a special purpose vehicle, which will finance the acquisition of the underlying assets by the issue of transferable securities to ...

... Securitisation is a financial technique that consists in transferring the risks pertaining to certain underlying assets, such as receivables or other eligible assets, to a special purpose vehicle, which will finance the acquisition of the underlying assets by the issue of transferable securities to ...

the role of international accounting standards in transitional

... In this paper we examine the usefulness of IAS standards using accounting and stock price data from the Peoples Republic of China (PRC). As discussed in section 2, the PRC provides an interesting setting for studying the relative value of international accounting standards. At the formation of a sto ...

... In this paper we examine the usefulness of IAS standards using accounting and stock price data from the Peoples Republic of China (PRC). As discussed in section 2, the PRC provides an interesting setting for studying the relative value of international accounting standards. At the formation of a sto ...

SunAmerica Dynamic Allocation Portfolio Summary

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

... and short-term investments (the “Overlay Component”). The Fund-of-Funds Component will allocate approximately 50% to 80% of its assets to Underlying Portfolios investing primarily in equity securities and 20% to 50% of its assets to Underlying Portfolios investing primarily in fixed income securitie ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.