Perspectives on the negative repo rate

... historically very low levels around zero per cent, for the same reasons as Sweden’s (see Figure 2:1). If the Swedish policy rate were to deviate too much from those of other countries, the Swedish krona would, all else being equal, appreciate significantly, which in turn would subdue both econo ...

... historically very low levels around zero per cent, for the same reasons as Sweden’s (see Figure 2:1). If the Swedish policy rate were to deviate too much from those of other countries, the Swedish krona would, all else being equal, appreciate significantly, which in turn would subdue both econo ...

Test Presentation Line 2

... “Investment will be made in companies (that) will normally (but not exclusively) pursue long term sustainable growth strategies in the wider interests of all parties including owners, lenders, employees, suppliers, customers/clients and the local and wider community.” ...

... “Investment will be made in companies (that) will normally (but not exclusively) pursue long term sustainable growth strategies in the wider interests of all parties including owners, lenders, employees, suppliers, customers/clients and the local and wider community.” ...

CMAA Investment Policy - Construction Management Association of

... Investment Policy are to (1) provide liquidity; (2) protect assets; (3) preserve principal; and (4) maximize returns. Given that these funds are primarily of an operational nature, conservative investment will be practiced at all times (see section VII). II. ...

... Investment Policy are to (1) provide liquidity; (2) protect assets; (3) preserve principal; and (4) maximize returns. Given that these funds are primarily of an operational nature, conservative investment will be practiced at all times (see section VII). II. ...

Financial Maths Solutions

... depreciates by 20% p.a. The value of the motorbike after 4 years is: A $9216 B $11 520 C $13 500 D $18 000 ...

... depreciates by 20% p.a. The value of the motorbike after 4 years is: A $9216 B $11 520 C $13 500 D $18 000 ...

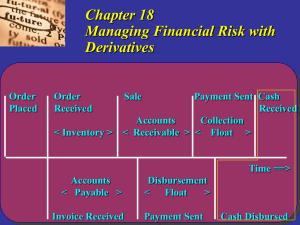

Chapter 17: Managing Interest Rate Risk

... opportunities in the various fixed- and floating-rate capital markets. Arbitrage opportunities exist because some markets react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to mark ...

... opportunities in the various fixed- and floating-rate capital markets. Arbitrage opportunities exist because some markets react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to mark ...

7_CashFlowStatement

... consistently from period to period Taxation Cash Flows Cash flows arising from taxes on income are normally classified as operating, unless they can be specifically identified with financing or investing activities ...

... consistently from period to period Taxation Cash Flows Cash flows arising from taxes on income are normally classified as operating, unless they can be specifically identified with financing or investing activities ...

class10 - Duke People

... An unlevered firm has 10 million shares outstanding, each with a market price of $20 and a beta of 1.0. The firm is considering issuing $50 million of 10% debt and using the proceeds to pay a dividend to shareholders. What effect will this capital structure change have on the value of the firm, the ...

... An unlevered firm has 10 million shares outstanding, each with a market price of $20 and a beta of 1.0. The firm is considering issuing $50 million of 10% debt and using the proceeds to pay a dividend to shareholders. What effect will this capital structure change have on the value of the firm, the ...

P 0 - Faculty Pages

... Recommend QuickBrush or SmileWhite stock for purchase by comparing each company’s intrinsic value with its current market price. Describe one strength of the two-stage DDM in comparison with the constant growth DDM. Describe one weakness inherent in all DDMs. ...

... Recommend QuickBrush or SmileWhite stock for purchase by comparing each company’s intrinsic value with its current market price. Describe one strength of the two-stage DDM in comparison with the constant growth DDM. Describe one weakness inherent in all DDMs. ...

No Slide Title

... interest rates are poised to rise, thereby eliminating P/E ratios as the major driver of total equity returns as was the case over the 1980-2000 period.”* ...

... interest rates are poised to rise, thereby eliminating P/E ratios as the major driver of total equity returns as was the case over the 1980-2000 period.”* ...

Objective

... A generator company installs generators over a number of days. The company is trying to use the equation y = -10X + 750 to help them figure out when do they need to re-order generators to have a full stock. What is the rate of change in this situation? What is the y intercept? What is the x interce ...

... A generator company installs generators over a number of days. The company is trying to use the equation y = -10X + 750 to help them figure out when do they need to re-order generators to have a full stock. What is the rate of change in this situation? What is the y intercept? What is the x interce ...

MIM700 - Prof Dimond

... Solving for g gives students more issues • V0 = CF0*(1+g)/(r-g) :. g = (r*V0 - CF0)/(CF0+V0) • This implies the growth of all cash flows after CF0, including the upcoming CF1. ...

... Solving for g gives students more issues • V0 = CF0*(1+g)/(r-g) :. g = (r*V0 - CF0)/(CF0+V0) • This implies the growth of all cash flows after CF0, including the upcoming CF1. ...

A lower neutral rate: causes and consequences

... remains far below where it was in the past. Of course, that conclusion could change. But not likely overnight. It would probably take several ...

... remains far below where it was in the past. Of course, that conclusion could change. But not likely overnight. It would probably take several ...

The Costs of Anticipated Inflation

... the economy is not liquidity constrained the way households are. Business investment therefore responds primarily to changes in real after-tax interest rates, rather than to changes in nominal interest rates. The decl ine in real after-tax interest rates associated with the five-percentage point inc ...

... the economy is not liquidity constrained the way households are. Business investment therefore responds primarily to changes in real after-tax interest rates, rather than to changes in nominal interest rates. The decl ine in real after-tax interest rates associated with the five-percentage point inc ...

Understanding the Correlation between Cap Rates and

... Understanding the Correlation between Cap Rates and Treasury Yields As we have noted in previous Insights from Inside the Vault articles, capitalization rates are an investor’s way of converting expected cash flows from real estate into an estimate of today’s value. They can be thought of as an inve ...

... Understanding the Correlation between Cap Rates and Treasury Yields As we have noted in previous Insights from Inside the Vault articles, capitalization rates are an investor’s way of converting expected cash flows from real estate into an estimate of today’s value. They can be thought of as an inve ...

Question and Problem Answers Chapter 5

... The SML shows us how much investors require in compensation for the systematic risk they bear. Investors require some return for postponing consumption. This return is the intercept of the SML and represents investments with no systematic risk. In other words, all investments must earn at least this ...

... The SML shows us how much investors require in compensation for the systematic risk they bear. Investors require some return for postponing consumption. This return is the intercept of the SML and represents investments with no systematic risk. In other words, all investments must earn at least this ...

Diversification – Too Much of a Good Thing is a Bad Thing

... is a legal requirement that assets be appropriately diversified by the investment professional). In the academic training for Chartered Financial Analysts and Certified Financial Planners, the content is rich and broad on the topic. The diversification mantra suggests that assets should be invested ...

... is a legal requirement that assets be appropriately diversified by the investment professional). In the academic training for Chartered Financial Analysts and Certified Financial Planners, the content is rich and broad on the topic. The diversification mantra suggests that assets should be invested ...

Ch10

... Bid-ask spread. High spreads signal an illiquid market. Investors like liquid markets so that they can buy and sell securities quickly and at a fair price. ...

... Bid-ask spread. High spreads signal an illiquid market. Investors like liquid markets so that they can buy and sell securities quickly and at a fair price. ...

The Need for High Quality Data on Direct Investment in

... • Many countries rely on banking transactions data to develop statistics on direct investment so are unaccustomed to conducting surveys and do not have BRs ...

... • Many countries rely on banking transactions data to develop statistics on direct investment so are unaccustomed to conducting surveys and do not have BRs ...