chapter 14 - Tourism and Hotel Management

... 10. What are the two major noncash expenses? Depriciation expense and amortization expense are noncash expenses that never affect cash flows. They never require a cash outlay because this type of expense is derived from adjusting entries that merely allocate the historical cost of a long-lived asse ...

... 10. What are the two major noncash expenses? Depriciation expense and amortization expense are noncash expenses that never affect cash flows. They never require a cash outlay because this type of expense is derived from adjusting entries that merely allocate the historical cost of a long-lived asse ...

Solutions_ch2_ch3_2

... EM = 1 + D/E EM = 1 + 0.65 = 1.65 One formula to calculate return on equity is: ROE = (ROA)(EM) ROE = .085(1.65) = .1403 or 14.03% ...

... EM = 1 + D/E EM = 1 + 0.65 = 1.65 One formula to calculate return on equity is: ROE = (ROA)(EM) ROE = .085(1.65) = .1403 or 14.03% ...

Fund Facts

... Past performance is not an indication of future performance. Values of investments, and any income derived from them, may fall as well as rise and you may not get back the amount you invested. Exchange rate changes may have an adverse effect on the value, price or income of investments. The levels a ...

... Past performance is not an indication of future performance. Values of investments, and any income derived from them, may fall as well as rise and you may not get back the amount you invested. Exchange rate changes may have an adverse effect on the value, price or income of investments. The levels a ...

Inflation-Linked Bonds

... Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unau ...

... Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unau ...

Economist Insights Rate of Change

... unemployment rate. If the long-run, or neutral, unemployment rate is lower, then the current unemployment rate will have to drop even further before wages, and hence inflation, are likely to accelerate. If we take under-utilisation into account (those working part-time who would rather work more hou ...

... unemployment rate. If the long-run, or neutral, unemployment rate is lower, then the current unemployment rate will have to drop even further before wages, and hence inflation, are likely to accelerate. If we take under-utilisation into account (those working part-time who would rather work more hou ...

Meeting Financial Goals—Rate of Return

... 17. After each round, each group should record its rate of return (4 percent, 8 percent, or 12 percent) and then return the item to the bag. 18. Conduct Round 1—have each group draw an item and record its result. Repeat for the remaining 9 rounds. 19. Explain that these 10 rates represent the 10-yea ...

... 17. After each round, each group should record its rate of return (4 percent, 8 percent, or 12 percent) and then return the item to the bag. 18. Conduct Round 1—have each group draw an item and record its result. Repeat for the remaining 9 rounds. 19. Explain that these 10 rates represent the 10-yea ...

real interest rate

... APPLYING THE CONCEPTS #3: Why are there different types of interest rates in the economy? FIGURE 12.2 Interest Rates on Corporate and Government Investments, ...

... APPLYING THE CONCEPTS #3: Why are there different types of interest rates in the economy? FIGURE 12.2 Interest Rates on Corporate and Government Investments, ...

Risk, Cost of Capital, and Capital Budgeting

... For example, if a project is expected to last for one year, then the interest rate on Treasury bills may be a good proxy for the risk-free rate. If a firm is expected to last for 30 years, then using the yield-to-maturity (YTM) of a 30-year government bond may be more appropriate. ...

... For example, if a project is expected to last for one year, then the interest rate on Treasury bills may be a good proxy for the risk-free rate. If a firm is expected to last for 30 years, then using the yield-to-maturity (YTM) of a 30-year government bond may be more appropriate. ...

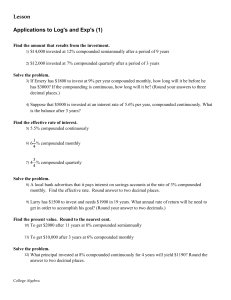

Lesson Applications to Log`s and Exp`s (1)

... 8) A local bank advertises that it pays interest on savings accounts at the rate of 3% compounded monthly. Find the effective rate. Round answer to two decimal places. ...

... 8) A local bank advertises that it pays interest on savings accounts at the rate of 3% compounded monthly. Find the effective rate. Round answer to two decimal places. ...

Basics of Investment

... 1. Set up Investment Policy - Return & Risk goes hand in hand Avoid “get-rich-quick-and-no-risk” schemes 2. Regular Review of Investment Policy At least once a year ...

... 1. Set up Investment Policy - Return & Risk goes hand in hand Avoid “get-rich-quick-and-no-risk” schemes 2. Regular Review of Investment Policy At least once a year ...

Economics 302

... country boarders is a result of differences in the equilibrium real interest rate and the world real interest rate. In order for the level of investment spending in an open economy to exceed that of a closed economy, the world interest rate must be lower than the equilibrium real interest rate that ...

... country boarders is a result of differences in the equilibrium real interest rate and the world real interest rate. In order for the level of investment spending in an open economy to exceed that of a closed economy, the world interest rate must be lower than the equilibrium real interest rate that ...

File

... The exchange rate is allowed to fluctuate within a band. The center of the band is a fixed rate, either in terms of one currency or of a basket of currencies. The width of the band varies. Some band systems are the result of cooperative arrangements, other are unilateral Example: (The Vietnam govern ...

... The exchange rate is allowed to fluctuate within a band. The center of the band is a fixed rate, either in terms of one currency or of a basket of currencies. The width of the band varies. Some band systems are the result of cooperative arrangements, other are unilateral Example: (The Vietnam govern ...

Forward Rate Contract - Western Australian Treasury Corporation

... = the continuously compounded foreign interest rate (dependent on the method of quotation) . This is equal to ln(1 + 0.083) or 0.079735 ...

... = the continuously compounded foreign interest rate (dependent on the method of quotation) . This is equal to ln(1 + 0.083) or 0.079735 ...

VALUE STOCKS At the cusp of re-rating

... The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. This document is based on data sources that are publicly av ...

... The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. This document is based on data sources that are publicly av ...

The Solow Growth Model (part two)

... • We want steady state “c” so we f(k*),δk* substitute steady state values for both output (f(k*)) and investment which equals depreciation in steady state (δk*) ...

... • We want steady state “c” so we f(k*),δk* substitute steady state values for both output (f(k*)) and investment which equals depreciation in steady state (δk*) ...

Cash Flow for Manufacturing and Wholesale Companies

... believe that generating more sales is the way to fix cash flow problems. However, increased sales may not increase cash flow. Other costs associated with sales, such as selling expenses or variable costs may even require more cash. Understanding the cash cycle of your company may assist you in makin ...

... believe that generating more sales is the way to fix cash flow problems. However, increased sales may not increase cash flow. Other costs associated with sales, such as selling expenses or variable costs may even require more cash. Understanding the cash cycle of your company may assist you in makin ...

5vcforum - Attica Ventures

... Numerous laws and ministerial decrees Unclear which apply and which have been repealed It is possible to interpret that pension funds can invest in PE based on Article 13 of Law 1902/1990: ΄΄.....Likewise they are permitted to purchase and sell all types of shares with a prior joint decision of the ...

... Numerous laws and ministerial decrees Unclear which apply and which have been repealed It is possible to interpret that pension funds can invest in PE based on Article 13 of Law 1902/1990: ΄΄.....Likewise they are permitted to purchase and sell all types of shares with a prior joint decision of the ...

High Quality High Yield Select UMA Seix Advisors

... subject to any other limitations stated in this profile. From January 1, 2016, performance consists of the performance of all FS accounts (as described in the previous sentence) as well as the performance of all single style Select UMA accounts managed by the investment manager in this strategy, sub ...

... subject to any other limitations stated in this profile. From January 1, 2016, performance consists of the performance of all FS accounts (as described in the previous sentence) as well as the performance of all single style Select UMA accounts managed by the investment manager in this strategy, sub ...

Presentation

... The Book Value of a stock is the value of the assets the company possesses. Historically, it was fairly close to the price of the stock. Today, it is rarely close to the price of the stock. ...

... The Book Value of a stock is the value of the assets the company possesses. Historically, it was fairly close to the price of the stock. Today, it is rarely close to the price of the stock. ...