integrative problem

... 6) Suppose the current yield on U.S. Treasury securities is 6.25%, the expected market return is 10.50%, and the beta for Dobb's Brothers stock is 1.38. The stock has just paid a dividend of $4.36 per share and the dividend is expected to grow at a rate of 4.20% in the future. How much would you be ...

... 6) Suppose the current yield on U.S. Treasury securities is 6.25%, the expected market return is 10.50%, and the beta for Dobb's Brothers stock is 1.38. The stock has just paid a dividend of $4.36 per share and the dividend is expected to grow at a rate of 4.20% in the future. How much would you be ...

Credit Constraints and Growth in a Global Economy St´ephane Guibaud (LSE)

... investment rates across countries. Together, these facts pose a challenge to existing open-economy macroeconomic models, which must explain not only why savings can outpace investment in a fast-growing economy, but also why the global equilibrium features asymmetric responses of saving rate, leadin ...

... investment rates across countries. Together, these facts pose a challenge to existing open-economy macroeconomic models, which must explain not only why savings can outpace investment in a fast-growing economy, but also why the global equilibrium features asymmetric responses of saving rate, leadin ...

3.01 part 2

... All cash payments are recorded in the cash payments journal A special journal used to record only cash payment transactions is called a cash payments journal Checks are the source documents for most cash payments The cash payments journal contains columns for general journal transactions, accou ...

... All cash payments are recorded in the cash payments journal A special journal used to record only cash payment transactions is called a cash payments journal Checks are the source documents for most cash payments The cash payments journal contains columns for general journal transactions, accou ...

Interest Rate Risk Management using Duration Gap

... model, we consider necessary to present the working hypothesis: n ...

... model, we consider necessary to present the working hypothesis: n ...

I_Ch05

... – Examine risk/return tradeoff (capital allocation line (資本配置線) and Sharpe ratio) – Demonstrate how different degrees of risk aversion will affect allocations between the risky and risk free assets ...

... – Examine risk/return tradeoff (capital allocation line (資本配置線) and Sharpe ratio) – Demonstrate how different degrees of risk aversion will affect allocations between the risky and risk free assets ...

Finance 419

... In A, the firm can distribute a total of $600 to stakeholders. In B, the firm can distribute $100+$540=$640 to stakeholders. The tax shield from debt gives the firm $40 more to distribute. This tax shield lowers the effective interest payment on debt to $60=$100(1-0.4) or 6% coupon rate. ...

... In A, the firm can distribute a total of $600 to stakeholders. In B, the firm can distribute $100+$540=$640 to stakeholders. The tax shield from debt gives the firm $40 more to distribute. This tax shield lowers the effective interest payment on debt to $60=$100(1-0.4) or 6% coupon rate. ...

Operating Activities

... 1. The item must be readily convertible to cash. 2. It must be so near to its maturity that there is insignificant risk of change in value due to changes in interest rate. ...

... 1. The item must be readily convertible to cash. 2. It must be so near to its maturity that there is insignificant risk of change in value due to changes in interest rate. ...

Mankiw 6e PowerPoints

... depreciation cost is measured using current price of capital, and the CIT would not affect investment But, the legal definition uses the historical price of capital. If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if ...

... depreciation cost is measured using current price of capital, and the CIT would not affect investment But, the legal definition uses the historical price of capital. If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if ...

Mankiw 6e PowerPoints

... If future profits expected to be high, investment might be worthwhile. But if firm faces financing constraints and current profits are low, firm might be unable to obtain funds. CHAPTER 17 ...

... If future profits expected to be high, investment might be worthwhile. But if firm faces financing constraints and current profits are low, firm might be unable to obtain funds. CHAPTER 17 ...

Chapter 9

... fees and/or earns the spread between fixed and floating rates paid at the pricing dates of the swap. 16. Interest rate swaps may be more attractive than futures because they can have longer maturities and do not require marking to market. Swaps may be less attractive if the secondary market is not a ...

... fees and/or earns the spread between fixed and floating rates paid at the pricing dates of the swap. 16. Interest rate swaps may be more attractive than futures because they can have longer maturities and do not require marking to market. Swaps may be less attractive if the secondary market is not a ...

Royce Total Return Fund

... This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. The Fund invests primarily in small-cap stocks, which may involve considerably more risk than investing in larger-cap stock ...

... This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. The Fund invests primarily in small-cap stocks, which may involve considerably more risk than investing in larger-cap stock ...

FM11 Ch 09 Instructors Manual

... component costs of capital—-debt, preferred stock, and common equity. Each weighting factor is the proportion of that type of capital in the optimal, or target, capital structure. The after-tax cost of debt, rd(1 - T), is the relevant cost to the firm of new debt financing. Since interest is deducti ...

... component costs of capital—-debt, preferred stock, and common equity. Each weighting factor is the proportion of that type of capital in the optimal, or target, capital structure. The after-tax cost of debt, rd(1 - T), is the relevant cost to the firm of new debt financing. Since interest is deducti ...

LECTURE 4 Consider a consumer with a two

... one. Given k0 what pins down c0? Solvency constraint is another one. • Paths above the saddle path intersect the vertical axis in finite time. At that point there is no capital to uninstall and c = f (0) = 0 → c jumps down violating differentiability (Euler equation). • Below the saddle path eventua ...

... one. Given k0 what pins down c0? Solvency constraint is another one. • Paths above the saddle path intersect the vertical axis in finite time. At that point there is no capital to uninstall and c = f (0) = 0 → c jumps down violating differentiability (Euler equation). • Below the saddle path eventua ...

How to reduce negative side effects of ECB policy

... costs. Benefits come from better economic conditions due to the ECB’s policy leading to lower non-performing loans (NPLs). With the excess liquidity ever increasing and the economy picking up, the balance between costs and benefits is changing for the worse and a tiered deposit rate can ensure the b ...

... costs. Benefits come from better economic conditions due to the ECB’s policy leading to lower non-performing loans (NPLs). With the excess liquidity ever increasing and the economy picking up, the balance between costs and benefits is changing for the worse and a tiered deposit rate can ensure the b ...

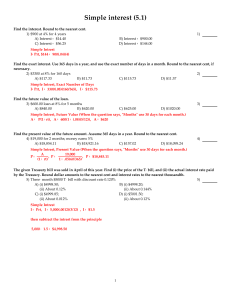

Simple interest (5.1)

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

... Find the payment made by the ordinary annuity with the given present value. 20) $50,000 monthly payments for 45 years; interest rate is 4.6% compounded monthly. A) $2,063,010.45 B) $14,695,906.14 C) $11,391,050.38 D) $3,792,673.35 Present Value Annunity (One knows it is an annunity, not an annunity ...

PSSap Investment options and risk IBR

... Keeping track of your investments Once you have made your choice of investment options, you also need to keep an eye on your investments, particularly if you have created your own portfolio combining different investment options. Market movements may take your individual asset class proportions away ...

... Keeping track of your investments Once you have made your choice of investment options, you also need to keep an eye on your investments, particularly if you have created your own portfolio combining different investment options. Market movements may take your individual asset class proportions away ...

Affinity Investment Advisors, LLC

... Equity Account (Gross): Affinity’s gross results do not reflect a deduction of the investment advisory fees charged by The investment manager may use the same or substantially similar investment strategies, and may hold similar Affinity, or program fees, if any, but are net of commissions charged on ...

... Equity Account (Gross): Affinity’s gross results do not reflect a deduction of the investment advisory fees charged by The investment manager may use the same or substantially similar investment strategies, and may hold similar Affinity, or program fees, if any, but are net of commissions charged on ...

Ch 24 Perf measurement 2/e

... example, consider a scenario where the rate of return each period consistently increases over several time periods. If the amount invested also increases each period, and then all of the proceeds are withdrawn at the end of several periods, the IRR is greater than either the geometric or the arithme ...

... example, consider a scenario where the rate of return each period consistently increases over several time periods. If the amount invested also increases each period, and then all of the proceeds are withdrawn at the end of several periods, the IRR is greater than either the geometric or the arithme ...

Large Cap Growth Fund FAQ - Westfield Capital Management

... Mutual fund investing involves risk, including possible loss of principal. There can be no assurance that the fund will achieve its stated objectives. The Westfield Capital Large Cap Growth Fund is distributed by SEI Investments Distribution Co., which is not affiliated with Westfield Capital or any ...

... Mutual fund investing involves risk, including possible loss of principal. There can be no assurance that the fund will achieve its stated objectives. The Westfield Capital Large Cap Growth Fund is distributed by SEI Investments Distribution Co., which is not affiliated with Westfield Capital or any ...

TIPS Index Fund - Get Retirement Right

... are to report the lower rating; if three or more organizations/ agencies have rated a security, fund companies are to report the median rating, and in cases where there are more than two organization/agency ratings and a median rating does not exist, fund companies are to use the lower of the two mi ...

... are to report the lower rating; if three or more organizations/ agencies have rated a security, fund companies are to report the median rating, and in cases where there are more than two organization/agency ratings and a median rating does not exist, fund companies are to use the lower of the two mi ...