11 Ratios Every Credit Union Professional Should

... seasonal loan/share lows and a contingency plan when liquidity approaches inadequate levels. ...

... seasonal loan/share lows and a contingency plan when liquidity approaches inadequate levels. ...

Document

... – There are elements that cannot be modelled this way • Evolutionary change in the system • Non-systemic events—such as for example, people being persuaded by the failure of the system that the system must be changed – There is a limit to modelling—institutions and evolution and human agency must al ...

... – There are elements that cannot be modelled this way • Evolutionary change in the system • Non-systemic events—such as for example, people being persuaded by the failure of the system that the system must be changed – There is a limit to modelling—institutions and evolution and human agency must al ...

Greenfield Seitz Capital Management, LLC

... Firm Information: Greenfield Seitz Capital Management LLC ("GSCM") is a registered investment advisor based in Dallas, Texas. GSCM is a 4-person entity controlled by Stuart Greenfield and Yancey Seitz. GSCM specializes in managing separate investment accounts for high net-worth individuals, with a f ...

... Firm Information: Greenfield Seitz Capital Management LLC ("GSCM") is a registered investment advisor based in Dallas, Texas. GSCM is a 4-person entity controlled by Stuart Greenfield and Yancey Seitz. GSCM specializes in managing separate investment accounts for high net-worth individuals, with a f ...

Dissecting the `MAC` Universe Multi-Asset Credit

... Unconstrained Fixed Income, Multi-Sector Total Return Bonds, Strategic Income Bond and Multi-Asset Credit are suggestive of a particular strategy but may be at odds with what a manager is actually doing in practice. There has been some disappointment in these products from investors who did not unde ...

... Unconstrained Fixed Income, Multi-Sector Total Return Bonds, Strategic Income Bond and Multi-Asset Credit are suggestive of a particular strategy but may be at odds with what a manager is actually doing in practice. There has been some disappointment in these products from investors who did not unde ...

How to Estimate the Long-Term Growth Rate in the Discounted

... Some valuation analysts consider the subject company’s LTG rate only in terms of historical growth, near-term projected growth, projected or historical inflation, or another similar measurable financial metric. Those factors are all considerations in the selection of the LTG rate. However, when sele ...

... Some valuation analysts consider the subject company’s LTG rate only in terms of historical growth, near-term projected growth, projected or historical inflation, or another similar measurable financial metric. Those factors are all considerations in the selection of the LTG rate. However, when sele ...

Chapter 23: Short-Term Financial Management

... and deposited in another of the firm’s bank accounts. An automated clearinghouse debit transfer is a preauthorized electronic withdrawal from the payer’s account and is generally known as an electronic depository transfer. A wire transfer is an electronic communication that removes funds from the pa ...

... and deposited in another of the firm’s bank accounts. An automated clearinghouse debit transfer is a preauthorized electronic withdrawal from the payer’s account and is generally known as an electronic depository transfer. A wire transfer is an electronic communication that removes funds from the pa ...

SOCIAL INVESTMENT - A comparison of the principal

... *Note: An "accredited social impact contractor" is a company limited by shares that is accredited under the Income Taxes Act 2007 as a social impact contractor. This note makes no further ...

... *Note: An "accredited social impact contractor" is a company limited by shares that is accredited under the Income Taxes Act 2007 as a social impact contractor. This note makes no further ...

Chapter 2

... • We will look at how cash is generated from utilizing assets and how it is paid to those that finance the purchase of the assets • A primary reason that accounting income differs from cash flow is that the income statement contains non-cash items (depreciation and deferred taxes are non-cash items, ...

... • We will look at how cash is generated from utilizing assets and how it is paid to those that finance the purchase of the assets • A primary reason that accounting income differs from cash flow is that the income statement contains non-cash items (depreciation and deferred taxes are non-cash items, ...

11: Corporate Finance: Corporate Investing and Financing Decisions

... b: Define and calculate the component cost of: 1) debt 2) preferred stock 3) retained earnings (3 different methods) and 4) newly issued stock or external equity. ...

... b: Define and calculate the component cost of: 1) debt 2) preferred stock 3) retained earnings (3 different methods) and 4) newly issued stock or external equity. ...

Understanding the Term Structure of Interest Rates

... the Fed’s rate increases were foreseen some months in advance. Based on the July 2004 federal funds futures contract, in late 2003 the market anticipated a funds rate of 1.25 percent or above, but then the expected rate for July fell to nearly 1 percent (i) as the FOMC maintained its 1 percent targe ...

... the Fed’s rate increases were foreseen some months in advance. Based on the July 2004 federal funds futures contract, in late 2003 the market anticipated a funds rate of 1.25 percent or above, but then the expected rate for July fell to nearly 1 percent (i) as the FOMC maintained its 1 percent targe ...

Atlassian Case Study Answers and Discussion

... The switch to on-demand is even harder to assess because we need more information on the average number of years customers stay subscribed, the churn rate (the percentage that cancel each year), and the “breakeven point” at which new customers become profitable. Broadly speaking, switching to subsc ...

... The switch to on-demand is even harder to assess because we need more information on the average number of years customers stay subscribed, the churn rate (the percentage that cancel each year), and the “breakeven point” at which new customers become profitable. Broadly speaking, switching to subsc ...

foundation market-based investment funds

... 5.1% and the MSCI Emerging Markets Index decreased 1.6%. Value stocks held up better than growth names with the Russell 1000 Value Index returned 12.3%, while the Russell 1000 Growth Index returned 9.5%. Fixed Income markets posted small gains or slight losses during the first quarter as interest ra ...

... 5.1% and the MSCI Emerging Markets Index decreased 1.6%. Value stocks held up better than growth names with the Russell 1000 Value Index returned 12.3%, while the Russell 1000 Growth Index returned 9.5%. Fixed Income markets posted small gains or slight losses during the first quarter as interest ra ...

Returns and Risk

... outcome can be assigned a probability. Return Expected value of return on a firm is the weighted average of all possible return outcomes where each outcome is weighted by its respective probability of occurrence. ...

... outcome can be assigned a probability. Return Expected value of return on a firm is the weighted average of all possible return outcomes where each outcome is weighted by its respective probability of occurrence. ...

Standard Life Global Absolute Return Strategies Fund

... markets are going down, as well as when they are going up. It also means GARS can help your money to grow smoothly as it aims to iron out short term fluctuations in markets. It has a target return of cash* +5% per annum (gross of ...

... markets are going down, as well as when they are going up. It also means GARS can help your money to grow smoothly as it aims to iron out short term fluctuations in markets. It has a target return of cash* +5% per annum (gross of ...

SAVINGS, INVESTMENT AND CAPITAL FLOWS: AN EMPIRICAL

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

... by productive activities transformed effectively from the increased domestic resources and the mobilized international resources in the forms of foreign capital inflow and foreign direct investment. The increase in investment enhanced aggregate output and national income, which in turn induce furthe ...

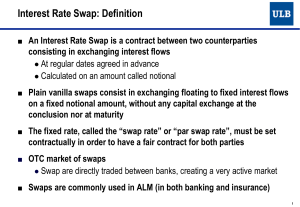

Interest Rate Swap

... ● In general this is only the case at issuance ● In this case, there is a bijection between maturity and yield to maturity ● We have seen that this is the equivalent of par swap rates Different types of rates: ● Par swap rate for a given maturity ● Zero-coupon rate for a given maturity ● Coupon ra ...

... ● In general this is only the case at issuance ● In this case, there is a bijection between maturity and yield to maturity ● We have seen that this is the equivalent of par swap rates Different types of rates: ● Par swap rate for a given maturity ● Zero-coupon rate for a given maturity ● Coupon ra ...