a cash flow forecast

... Optimum cash holding levels can be calculated from formal models, such as the Baumol model and MillerOrr model. Cash management models attempt to minimizing the total costs associated with cash movements between a current account and short term investment – the ‘opportunity’ cost of lost interest pl ...

... Optimum cash holding levels can be calculated from formal models, such as the Baumol model and MillerOrr model. Cash management models attempt to minimizing the total costs associated with cash movements between a current account and short term investment – the ‘opportunity’ cost of lost interest pl ...

Truth in Savings - UVA Community Credit Union

... Accrual of Dividends: Dividends begin to accrue on the day that you deposit items, including non-cash items such as checks, to your account. Dividends will be calculated using the daily balance method, which is an application of a daily periodic rate to the full amount of principal in the account e ...

... Accrual of Dividends: Dividends begin to accrue on the day that you deposit items, including non-cash items such as checks, to your account. Dividends will be calculated using the daily balance method, which is an application of a daily periodic rate to the full amount of principal in the account e ...

Financial Management

... PV is the value on a given date of a future payment or series of future payments, discounted to reflect the time value of money and other factors such as investment risk. Present ...

... PV is the value on a given date of a future payment or series of future payments, discounted to reflect the time value of money and other factors such as investment risk. Present ...

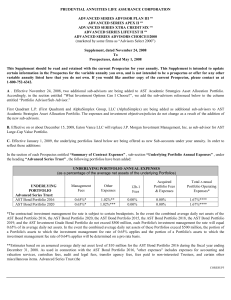

Investment Strategies and Alternative Investments in Insurance and

... Bank of America Merrill Lynch does not provide actuarial services or legal or tax advice. ...

... Bank of America Merrill Lynch does not provide actuarial services or legal or tax advice. ...

Expected Return

... diversifiable, and therefore is not a promising factor in terms of its impact on the firm’s cost of capital. ...

... diversifiable, and therefore is not a promising factor in terms of its impact on the firm’s cost of capital. ...

Statement of Cash Flows Statement of Cash Flows

... If cash is not involved in a significant change in the Land account (such as purchase of land for a long-term note payable), this information can be reported in an accompanying schedule or report or at the end of the statement of cash flows in a section called ‘Significant noncash transactions.’ ...

... If cash is not involved in a significant change in the Land account (such as purchase of land for a long-term note payable), this information can be reported in an accompanying schedule or report or at the end of the statement of cash flows in a section called ‘Significant noncash transactions.’ ...

bonds plus 400 fund - Insight Investment

... achieved and a capital loss may occur. Funds which have a higher performance aim generally take more risk to achieve this and so have a greater potential for the returns to be significantly different than expected. Past performance is not a guide to future performance. The value of investments and a ...

... achieved and a capital loss may occur. Funds which have a higher performance aim generally take more risk to achieve this and so have a greater potential for the returns to be significantly different than expected. Past performance is not a guide to future performance. The value of investments and a ...

Modeling Portfolios that Contain Risky Assets I: Risk and

... Statistical Approach. Return rates ri (d) for asset i can vary wildly from day to day as the share price si (d) rises and falls. Sometimes the reasons for such fluctuations are very clear because they directly relate to some news about the company, agency, or government that issued the asset. For e ...

... Statistical Approach. Return rates ri (d) for asset i can vary wildly from day to day as the share price si (d) rises and falls. Sometimes the reasons for such fluctuations are very clear because they directly relate to some news about the company, agency, or government that issued the asset. For e ...

Renewable Energy Financing and Climate Policy Effectiveness

... solar. Uncertainty about when a project will be able to produce and sell energy translates into uncertainty around cash flows available to repay investors. Resource risk is not unique to renewable energy, however, and the conventional energy industry has evolved mechanisms for managing or mitigating ...

... solar. Uncertainty about when a project will be able to produce and sell energy translates into uncertainty around cash flows available to repay investors. Resource risk is not unique to renewable energy, however, and the conventional energy industry has evolved mechanisms for managing or mitigating ...

Decision Criteria for New Technology Investment

... Return on investment has long been the central paradigm for business evaluation of capital investment projects as well as for many other decisions. In a basic sense, ROI analysis is used to measure the efficiency of an investment or to compare the efficiency of a number of different investments. To ...

... Return on investment has long been the central paradigm for business evaluation of capital investment projects as well as for many other decisions. In a basic sense, ROI analysis is used to measure the efficiency of an investment or to compare the efficiency of a number of different investments. To ...

The cost of capital of levered equity is equal to the cost of capital of

... Because the cash flows of levered equity are smaller than ...

... Because the cash flows of levered equity are smaller than ...

Valuation Risk chapter 02

... geometric mean reduces the likelihood of nonsense answers • Assume a $100 investment falls by 50 percent in period 1 and rises by 50 percent in period 2 • The investor has $75 at the end of period 2 – Arithmetic mean = [(0.50) + (–0.50)]/2 = 0% – Geometric mean = (0.50 × 1.50)1/2 – 1 = –13.40% ...

... geometric mean reduces the likelihood of nonsense answers • Assume a $100 investment falls by 50 percent in period 1 and rises by 50 percent in period 2 • The investor has $75 at the end of period 2 – Arithmetic mean = [(0.50) + (–0.50)]/2 = 0% – Geometric mean = (0.50 × 1.50)1/2 – 1 = –13.40% ...

StrongPCMP4e-ch02

... Risky Alternatives (cont’d) Example (cont’d) Solution (cont’d): Choice A is like buying shares of a utility stock. Choice B is like purchasing a stock option. Choice C is like a convertible bond. Choice D is like writing out-of-the-money call ...

... Risky Alternatives (cont’d) Example (cont’d) Solution (cont’d): Choice A is like buying shares of a utility stock. Choice B is like purchasing a stock option. Choice C is like a convertible bond. Choice D is like writing out-of-the-money call ...

Citibank Online Premium Account

... By investing in a Citibank Premium Account, you are allowing the bank to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. A Premium Account is ...

... By investing in a Citibank Premium Account, you are allowing the bank to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time. A Premium Account is ...

Opportunistic Deep-Value Investing: A Multi-Asset Class

... We expect deep-value investments to exhibit higher absolute volatility than broad market indices because of concentration, added business risks, and potentially greater economic sensitivity. How to manage the potentially high volatility of deep-value investments is a question that must be addressed ...

... We expect deep-value investments to exhibit higher absolute volatility than broad market indices because of concentration, added business risks, and potentially greater economic sensitivity. How to manage the potentially high volatility of deep-value investments is a question that must be addressed ...

Examples of Level II exam item set questions

... the program has dramatically improved the team’s portfolio management knowledge and their ability to achieve better performance results.” Sherman has earned a reputation for consistently outperforming the market. Over the long run, his mutual funds have outperformed their respective market benchmark ...

... the program has dramatically improved the team’s portfolio management knowledge and their ability to achieve better performance results.” Sherman has earned a reputation for consistently outperforming the market. Over the long run, his mutual funds have outperformed their respective market benchmark ...

Chapter 10 - personal.kent.edu

... 20. The arithmetic average return is the sum of the known returns divided by the number of returns, so: Arithmetic average return = (.29 + .14 + .23 –.08 + .09 –.14) / 6 Arithmetic average return = .0883 or 8.83% Using the equation for the geometric return, we find: Geometric average return = [(1 + ...

... 20. The arithmetic average return is the sum of the known returns divided by the number of returns, so: Arithmetic average return = (.29 + .14 + .23 –.08 + .09 –.14) / 6 Arithmetic average return = .0883 or 8.83% Using the equation for the geometric return, we find: Geometric average return = [(1 + ...

DOES FINANCIAL LEVERAGE INFLUENCE INVESTMENT

... using leverage because they have enough cash flows to mitigate the risk arises from the use of leverage for availing investment opportunity. On the contrary, low growth firms’ face major difficulties to use leverage for availing any investment opportunity. The reason for this is that these firms hav ...

... using leverage because they have enough cash flows to mitigate the risk arises from the use of leverage for availing investment opportunity. On the contrary, low growth firms’ face major difficulties to use leverage for availing any investment opportunity. The reason for this is that these firms hav ...

real options and the evaluation of research and developement

... five types of operational uncertainty: 1) the generated cashflow from the market, 2) the budget required, 3) the performance in the research and the development process, 4) the market requirement and 5) the schedule or time scales. They also discuss how each of them affect the value of a project and ...

... five types of operational uncertainty: 1) the generated cashflow from the market, 2) the budget required, 3) the performance in the research and the development process, 4) the market requirement and 5) the schedule or time scales. They also discuss how each of them affect the value of a project and ...