Value Investing vs the Efficient Market Hypothesis

... Not all investors reach the same conclusion based on the same information at the same time. Not all investors are in a position to act on a given piece of information. Not all information is disseminated at the same speed to all investors, and most importantly not all information reaches the investo ...

... Not all investors reach the same conclusion based on the same information at the same time. Not all investors are in a position to act on a given piece of information. Not all information is disseminated at the same speed to all investors, and most importantly not all information reaches the investo ...

Press release- Bank Performance and Reporting Value

... banks across jurisdictions to allow for a comparison of accounting leverage (assets/equity) which in turn will enable a better understanding of risk signals. Kurt Schacht, CFA, Managing Director, CFA Institute, commented: “This study brings to the fore one of the most challenging issues facing banks ...

... banks across jurisdictions to allow for a comparison of accounting leverage (assets/equity) which in turn will enable a better understanding of risk signals. Kurt Schacht, CFA, Managing Director, CFA Institute, commented: “This study brings to the fore one of the most challenging issues facing banks ...

Lesotho: Launching of the Maseru Securities Market On the 22nd

... On the 22nd January 2016 the Central bank of Lesotho launched its maiden exchange - the Maseru Securities Market (MSM). This is in essence an exchange that will provide companies with an alternative source of capital upon listing with it and provide the public diversified investment opportunities to ...

... On the 22nd January 2016 the Central bank of Lesotho launched its maiden exchange - the Maseru Securities Market (MSM). This is in essence an exchange that will provide companies with an alternative source of capital upon listing with it and provide the public diversified investment opportunities to ...

RRF 320.2: Equity Securities Held Instruction Guide

... related bodies corporate (e.g. two or more money market corporations in the same group) on a Domestic Books basis. The Domestic books of the registered entity relates to the Australian books of the Australian entity and has the following scope: ¾ This form should be completed on a consolidated basis ...

... related bodies corporate (e.g. two or more money market corporations in the same group) on a Domestic Books basis. The Domestic books of the registered entity relates to the Australian books of the Australian entity and has the following scope: ¾ This form should be completed on a consolidated basis ...

$doc.title

... The geometric interpretation of the Mean Value Theorem for Integrals: for positive functions f , there is a number c s.t. the rectangle with base [a, b] and height f (c) has the same area as the region under the graph of f from a to b. ...

... The geometric interpretation of the Mean Value Theorem for Integrals: for positive functions f , there is a number c s.t. the rectangle with base [a, b] and height f (c) has the same area as the region under the graph of f from a to b. ...

4 daily review NO CHANGES

... offer to buy or sell, nor a solicitation to buy or sell, nor a solicitation to buy or sell the securities mentioned therein. This report is provided solely for the information of clients of CAL Brokers Limited (CBL) who are expected to make their own investment decisions without sole reliance on thi ...

... offer to buy or sell, nor a solicitation to buy or sell, nor a solicitation to buy or sell the securities mentioned therein. This report is provided solely for the information of clients of CAL Brokers Limited (CBL) who are expected to make their own investment decisions without sole reliance on thi ...

Venture capital, IPOs, and Seasoned Offerings

... Initial Public Offering (IPO) - First offering of stock to the general public. Underwriter - Firm that buys an issue of securities from a company and resells it to the public. Spread - Difference between public offer price and price paid by underwriter. ...

... Initial Public Offering (IPO) - First offering of stock to the general public. Underwriter - Firm that buys an issue of securities from a company and resells it to the public. Spread - Difference between public offer price and price paid by underwriter. ...

First Bankers` Banc Securities, Inc.

... Level 1 – Inputs that utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 – Inputs that include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or ...

... Level 1 – Inputs that utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 – Inputs that include quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or ...

Accounting for Financial Instruments Designated as Fair Value Option

... Canadian legislation governing FREs allow OSFI to specify accounting principles. OSFI’s ability to make specifications is addressed in International Standard on Auditing 210 and the equivalent Canadian Auditing Standard 210. Given that using the Fair Value Option is a choice, OSFI believes that the ...

... Canadian legislation governing FREs allow OSFI to specify accounting principles. OSFI’s ability to make specifications is addressed in International Standard on Auditing 210 and the equivalent Canadian Auditing Standard 210. Given that using the Fair Value Option is a choice, OSFI believes that the ...

An explanation of accounting jargon

... Money you owe to others. These can be current (payable within one year) or long-term. Net Current Assets This is a figure that appears in the Balance Sheet. It comprises the current assets less the current liabilities. It can be a very important figure. For example, you may have total assets of £1,0 ...

... Money you owe to others. These can be current (payable within one year) or long-term. Net Current Assets This is a figure that appears in the Balance Sheet. It comprises the current assets less the current liabilities. It can be a very important figure. For example, you may have total assets of £1,0 ...

INTERPRETATION AND METHODOLOGY Financial ratios Return

... 2. The ratios are calculated using the data from the last published Audited financial reports and last paid dividend. If the companies according to the requirements of Law, are preparing consolidated financial statements, for calculation of the ratios data from the consolidated statements will be us ...

... 2. The ratios are calculated using the data from the last published Audited financial reports and last paid dividend. If the companies according to the requirements of Law, are preparing consolidated financial statements, for calculation of the ratios data from the consolidated statements will be us ...

Presentation on AS 1

... underline the preparation and presentation of financial statement: (a) Going Concern: The enterprises is normally viewed as going concern i.e. as continuing in operation for the foreseeable future. It is assumed that the enterprises has neither the intention nor the necessity of liquidation or of cu ...

... underline the preparation and presentation of financial statement: (a) Going Concern: The enterprises is normally viewed as going concern i.e. as continuing in operation for the foreseeable future. It is assumed that the enterprises has neither the intention nor the necessity of liquidation or of cu ...

General Principals of Accounting

... • Cost of Capital is the price the investor must pay for the cash needed to make an investment • The Cash flow is the revenue an entity receives from its investments in buildings, equipment, or programs • Historical costs of Investment • Replacement cost of Investment • Current Market Value of Inves ...

... • Cost of Capital is the price the investor must pay for the cash needed to make an investment • The Cash flow is the revenue an entity receives from its investments in buildings, equipment, or programs • Historical costs of Investment • Replacement cost of Investment • Current Market Value of Inves ...

NSE DGs pronouncement today may determine market direction

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

... In the wake of improved market activity on the floor of the Nigerian Stock Exchange (NSE) which led to a recorded four percent gain in just one week, Ndi Okereke-Onyiuke, director-general of the Nigerian Stock Exchange, will today appraise the Exchange’s 2009 performance and review activities of the ...

Certain U.S. accounting standards have been, and will be, amended

... In 2007, the CFA Institute Centre for Financial Market Integrity proposed a new financial model to replace the traditional earnings number. Which of the following characteristics does the proposed statement of changes in net assets available to stockholders exclude? It recognizes all transactions an ...

... In 2007, the CFA Institute Centre for Financial Market Integrity proposed a new financial model to replace the traditional earnings number. Which of the following characteristics does the proposed statement of changes in net assets available to stockholders exclude? It recognizes all transactions an ...

Traded loans (borderline between securities and other financial

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

... maintained: that is, the loan should be reclassified as a security only if there is evidence of a market and there are quotations in the market. This change of category of financial instrument is achieved via a change in classification entry in the other changes in the volume of assets account and n ...

Lower of Cost or Market

... Lower of Cost or Market Accounting "conservatism" requires inventory to be recorded at the lower of cost or market. As a result, firms are required to "write-down" their inventory when the market value of their inventory substantially declines. • Obsolescence • Deterioration In order to make this de ...

... Lower of Cost or Market Accounting "conservatism" requires inventory to be recorded at the lower of cost or market. As a result, firms are required to "write-down" their inventory when the market value of their inventory substantially declines. • Obsolescence • Deterioration In order to make this de ...

Written exam 2008 spring

... value from their capacity to generate cash flows in the future. It does make your job easier, if the company has a history that can be used in estimating future cash flows. It works best for investors who either – have a long time horizon, allowing the market time to correct its valuation mistakes a ...

... value from their capacity to generate cash flows in the future. It does make your job easier, if the company has a history that can be used in estimating future cash flows. It works best for investors who either – have a long time horizon, allowing the market time to correct its valuation mistakes a ...

A particularly active market in 2007

... Despite the subprime crisis in the United States in 2007 and its effects on the credit supply around the world, the commercial property market reached new records in France in 2007, as in most of the European markets. No less than €28.5 Bn of investments were transacted on this segment, representing ...

... Despite the subprime crisis in the United States in 2007 and its effects on the credit supply around the world, the commercial property market reached new records in France in 2007, as in most of the European markets. No less than €28.5 Bn of investments were transacted on this segment, representing ...

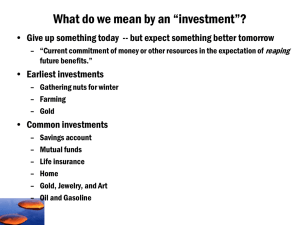

Investors and Markets

... “futures”. This led to dealing in “puts” and “calls” as well as buying and selling on margins. … There was an era of sudden wealth, wild extravagance and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzling visions of immediate wealth. “(the Panic of 1720 was) …due ...

... “futures”. This led to dealing in “puts” and “calls” as well as buying and selling on margins. … There was an era of sudden wealth, wild extravagance and inflated prices. … Good faith had been swamped by the delusion conjured up by dazzling visions of immediate wealth. “(the Panic of 1720 was) …due ...

Valley Publishing Company

... checked these number with the trial balances and last years audit. I also check that the account were being used for the items in the investment accounts. It is my opinion that there was a misstatement in the Investment account (see AJE #9) because the land that was set up as investment to put a bui ...

... checked these number with the trial balances and last years audit. I also check that the account were being used for the items in the investment accounts. It is my opinion that there was a misstatement in the Investment account (see AJE #9) because the land that was set up as investment to put a bui ...