Summary Report on OECD-China Events on Intellectual Property

... Some readers have interpreted this to mean the activity is valued as “sum of costs” ie non-market This is loose wording in the SNA. Own account exploration would be valued at the sum of costs (including return to assets used) but when exploration is carried out under contract, the whole value includ ...

... Some readers have interpreted this to mean the activity is valued as “sum of costs” ie non-market This is loose wording in the SNA. Own account exploration would be valued at the sum of costs (including return to assets used) but when exploration is carried out under contract, the whole value includ ...

CREF Money Market

... Active Management: The investment is actively managed and subject to the risk that the advisor’s usage of investment techniques and risk analyses to make investment decisions fails to perform as expected, which may cause the portfolio to lose value or underperform investments with similar objectives ...

... Active Management: The investment is actively managed and subject to the risk that the advisor’s usage of investment techniques and risk analyses to make investment decisions fails to perform as expected, which may cause the portfolio to lose value or underperform investments with similar objectives ...

chapter 32

... shareholders of Dietech who would realize the additional value. The shareholders of Enbonpoint would be paying market value for the real estate as part of the higher price of acquiring Dietech and thus would not realize any gain from the acquisition. ...

... shareholders of Dietech who would realize the additional value. The shareholders of Enbonpoint would be paying market value for the real estate as part of the higher price of acquiring Dietech and thus would not realize any gain from the acquisition. ...

ch_1_intro_to_accoun..

... States that when a transaction is recorded, the transaction price (cost) establishes the accounting value ...

... States that when a transaction is recorded, the transaction price (cost) establishes the accounting value ...

2. MLS Agents Are Excited About Your Home

... Do Agents Control The ‘Market Value’ Price of Homes? No - Agents Just Report Value To Sellers The job of an agent is to report to sellers what home buyers are willing to pay for a home at a specific point in time. Who Then Controls Price? Generally speaking, it is the overall economic condition of ...

... Do Agents Control The ‘Market Value’ Price of Homes? No - Agents Just Report Value To Sellers The job of an agent is to report to sellers what home buyers are willing to pay for a home at a specific point in time. Who Then Controls Price? Generally speaking, it is the overall economic condition of ...

property, plant and equipment (ppe) structure

... Identifying useful lives within approved ranges for all types of PPE Deciding useful lives of asset components (e.g. plumbing and heating system of a building) Identifying situations of control over shared assets Determining if further classes are needed for disclosure and respective lives ...

... Identifying useful lives within approved ranges for all types of PPE Deciding useful lives of asset components (e.g. plumbing and heating system of a building) Identifying situations of control over shared assets Determining if further classes are needed for disclosure and respective lives ...

Global Accounting Standards Report

... The views expressed in this presentation are my own and do not represent positions of the Financial Accounting Standards Board. Positions of the FASB are arrived at only after extensive due process and deliberations. ...

... The views expressed in this presentation are my own and do not represent positions of the Financial Accounting Standards Board. Positions of the FASB are arrived at only after extensive due process and deliberations. ...

Chapter 6: The Measurement Perspective on Decision Usefulness

... Derivative Instruments Derivative instruments are contracts such as options and interest rate caps and floors. Their value depends on an underlying variable such as price, interest rate, exchange rate, etc. Derivatives are difficult to deal with as they are characterized by low initial investment. T ...

... Derivative Instruments Derivative instruments are contracts such as options and interest rate caps and floors. Their value depends on an underlying variable such as price, interest rate, exchange rate, etc. Derivatives are difficult to deal with as they are characterized by low initial investment. T ...

General Disclosures based on PFRS 7

... (k) Information about compound financial instruments with multiple embedded derivatives; 8 and (l) Breaches of terms of loans agreements. 9 Statement of Comprehensive Income 1. Items of income, expense, gains, and losses, with separate disclosure of gains and losses From: 10 (a) Financial assets mea ...

... (k) Information about compound financial instruments with multiple embedded derivatives; 8 and (l) Breaches of terms of loans agreements. 9 Statement of Comprehensive Income 1. Items of income, expense, gains, and losses, with separate disclosure of gains and losses From: 10 (a) Financial assets mea ...

Risk Management Objectives

... Leverage – Magnifies the damage if liquidity is lost Innovation – Creates complex, vulnerable products ...

... Leverage – Magnifies the damage if liquidity is lost Innovation – Creates complex, vulnerable products ...

Concept of Accounting And Review Of Balance Sheet

... business to out side parties ( called creditors ). This includes amount owed to suppliers for goods or services purchased amount borrowed from banks or other lenders, salaries and taxes due but not paid. Net worth : the term net worth, proprietorship, owner’s investment, or capital– all have the sam ...

... business to out side parties ( called creditors ). This includes amount owed to suppliers for goods or services purchased amount borrowed from banks or other lenders, salaries and taxes due but not paid. Net worth : the term net worth, proprietorship, owner’s investment, or capital– all have the sam ...

Economics 434 Financial Markets - SHANTI Pages

... Capital Asset Pricing Model • Makes all the same assumptions as Tobin model • But Tobin’s model is about “one person” • CAPM puts Tobin’s model in equilibrium, by assuming that everyone faces the same portfolio choice problem as in Tobin’s problem • Only difference between people in CAPM is that ea ...

... Capital Asset Pricing Model • Makes all the same assumptions as Tobin model • But Tobin’s model is about “one person” • CAPM puts Tobin’s model in equilibrium, by assuming that everyone faces the same portfolio choice problem as in Tobin’s problem • Only difference between people in CAPM is that ea ...

How can Hedge Funds take advantage of inefficiencies and

... Real Estate Markets are cyclical by nature; neither regular nor predictable. Your Real Estate Portfolio doesn’t have to be. ...

... Real Estate Markets are cyclical by nature; neither regular nor predictable. Your Real Estate Portfolio doesn’t have to be. ...

Main Market – key eligibility criteria

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

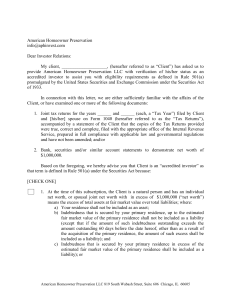

American Homeowner Preservation Dear

... Service, prepared in full compliance with applicable law and governmental regulations and have not been amended; and/or 2. Bank, securities and/or similar account statements to demonstrate net worth of ...

... Service, prepared in full compliance with applicable law and governmental regulations and have not been amended; and/or 2. Bank, securities and/or similar account statements to demonstrate net worth of ...

Transaction Analysis

... the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies determine these guidelines: ...

... the accounting profession recognizes as a general guide for financial reporting purposes. Standard-setting bodies determine these guidelines: ...

Downlaod File

... market is a financial market which securities that have been previously issued can be resold. So it’s less important because it’s not provide funds for the firms to increase their activities but secondary markets also important because it serve two function first they make it easier and quicker to s ...

... market is a financial market which securities that have been previously issued can be resold. So it’s less important because it’s not provide funds for the firms to increase their activities but secondary markets also important because it serve two function first they make it easier and quicker to s ...

Perkins Mid Cap Value Fund (Class S)

... not actual returns. Adjusted historical returns can only provide an approximation of what the performance of a new share class might have been had it existed for the periods shown. Mid-capitalization companies are generally less established and their stocks may be more volatile and less liquid than ...

... not actual returns. Adjusted historical returns can only provide an approximation of what the performance of a new share class might have been had it existed for the periods shown. Mid-capitalization companies are generally less established and their stocks may be more volatile and less liquid than ...

Liquidity ratios

... You start this module by learning the use of financial statement ratios for long- and short-term trend identification. As long-term objectives involve assessing strategic advantage, this module looks at how to assess strategic advantages. Treasury risk management and mergers and acquisitions are tou ...

... You start this module by learning the use of financial statement ratios for long- and short-term trend identification. As long-term objectives involve assessing strategic advantage, this module looks at how to assess strategic advantages. Treasury risk management and mergers and acquisitions are tou ...