Answers to Before You Go On Questions

... the possible outcomes (FCFs) and the probabilities that those outcomes will be realized. ...

... the possible outcomes (FCFs) and the probabilities that those outcomes will be realized. ...

ITEM 9 Treasury Management Annual Report 2011_12

... inability of leaders to either agree on remedial policies or implement fiscal consolidation measures prompted frequent bouts of market volatility, as investors positioned themselves for potential government defaults or even the breakup of the Eurozone itself. Investor confidence in struggling Eurozo ...

... inability of leaders to either agree on remedial policies or implement fiscal consolidation measures prompted frequent bouts of market volatility, as investors positioned themselves for potential government defaults or even the breakup of the Eurozone itself. Investor confidence in struggling Eurozo ...

FinancialCalculations_001

... Taxable yield x (1 – your tax rate) For example: Cae D’Ann Drofsab is comparing a $1,000 corporate bond paying a 7.5% return with a municipal bond paying 6.2% return. If Miss Drofsab is in the 28% tax bracket, which investment is the best after tax choice? It would appear at first glance that the co ...

... Taxable yield x (1 – your tax rate) For example: Cae D’Ann Drofsab is comparing a $1,000 corporate bond paying a 7.5% return with a municipal bond paying 6.2% return. If Miss Drofsab is in the 28% tax bracket, which investment is the best after tax choice? It would appear at first glance that the co ...

Final Exam Comprehensive EDP III Sp09

... 4. You notice that all your neighbors seem to need various items (e.g., tree limbs, construction debris) hauled away. You are thinking of buying a dump truck for $35,000. You estimate you could generate $10,000 a year cash flow (end of year) after paying for all expenses including hiring someone to ...

... 4. You notice that all your neighbors seem to need various items (e.g., tree limbs, construction debris) hauled away. You are thinking of buying a dump truck for $35,000. You estimate you could generate $10,000 a year cash flow (end of year) after paying for all expenses including hiring someone to ...

Working Capital Management

... assets (e.g. increase in stocks) • Reduction in stock turnover and increase in average time taken by debtors to pay invoices • Only a small increase in owner’s capital – with most of the additional finance coming from higher trade creditors (borrowing from suppliers) and the bank • Signific ...

... assets (e.g. increase in stocks) • Reduction in stock turnover and increase in average time taken by debtors to pay invoices • Only a small increase in owner’s capital – with most of the additional finance coming from higher trade creditors (borrowing from suppliers) and the bank • Signific ...

PPT - NCCU SLIS

... “A library vendor will get into financial difficulty some time soon. Who knows where, who knows when, but it will happen again-it’s a certainty.” James Gray – CEO Coutts Information Services, LTD ...

... “A library vendor will get into financial difficulty some time soon. Who knows where, who knows when, but it will happen again-it’s a certainty.” James Gray – CEO Coutts Information Services, LTD ...

Economics and finance_ Discuss the potential impact of the recent

... were highly levered, suggesting they were at an optimal capital position. However, this was clearly not the case as both suffered during the crisis, with Northern Rock being nationalised after a bank-run, and Lehman Brothers filing for bankruptcy. So why does a potential optimal capital structure no ...

... were highly levered, suggesting they were at an optimal capital position. However, this was clearly not the case as both suffered during the crisis, with Northern Rock being nationalised after a bank-run, and Lehman Brothers filing for bankruptcy. So why does a potential optimal capital structure no ...

NOTEBOOK12.1 - Plymouth State College

... and the management of the firm. The term "financial analysis" has different shades of meaning, but in general, the analysis regards the financial health and value of the firm from various perspectives. For example liquidity, leverage and operational efficiency are all measures of financial health, a ...

... and the management of the firm. The term "financial analysis" has different shades of meaning, but in general, the analysis regards the financial health and value of the firm from various perspectives. For example liquidity, leverage and operational efficiency are all measures of financial health, a ...

Select this.

... because the promised yield to maturity will be less than the investor’s required rate of return ...

... because the promised yield to maturity will be less than the investor’s required rate of return ...

Statement of Capital Adequacy (Form PDR III) Quarter ended

... (a) Tier I Capital funds (after deductions) Rs. (b) Tier II Capital funds eligible ...

... (a) Tier I Capital funds (after deductions) Rs. (b) Tier II Capital funds eligible ...

BlueBay Asset Management LLP Ireland Corporate Credit Internship

... financing solutions providing senior, unitranche and subordinated loans to the SME sector in Ireland. This is in response to the financing gap created by the retrenchment and deleveraging of traditional bank lenders, who have been reducing their corporate loan books (in particular loans to small and ...

... financing solutions providing senior, unitranche and subordinated loans to the SME sector in Ireland. This is in response to the financing gap created by the retrenchment and deleveraging of traditional bank lenders, who have been reducing their corporate loan books (in particular loans to small and ...

Joseph B. McCarthy MBA, CPA - National Association of Corporate

... Reduced bank fees by $2MM (15%), by standardizing rates within merged banks, eliminating non-electronic services, and volume discounts across the organization. Reduced annual bank transaction costs by $500K annually by optimizing banking structure, replacing bank accounts with pool accounts, and ...

... Reduced bank fees by $2MM (15%), by standardizing rates within merged banks, eliminating non-electronic services, and volume discounts across the organization. Reduced annual bank transaction costs by $500K annually by optimizing banking structure, replacing bank accounts with pool accounts, and ...

Acct 2220 Zeigler - GQ #3 (Chp 10)

... 23. IF the machine was fully depreciated and then sold for $10,000 at the end of year 10: a. The after-tax NPV would be higher. b. The pre-tax NPV would be lower. c. The pre-tax NPV would not change. d. The after-tax NPV would not change. NPV would be higher if any additional benefit was to be recei ...

... 23. IF the machine was fully depreciated and then sold for $10,000 at the end of year 10: a. The after-tax NPV would be higher. b. The pre-tax NPV would be lower. c. The pre-tax NPV would not change. d. The after-tax NPV would not change. NPV would be higher if any additional benefit was to be recei ...

Thailand 10 years after the crisis: Beyond finance, the exhaustion of

... which are far more efficient and competitive. • As a consequence, Asian countries will be even more exposed to the whim of financial markets. • The project in fact is to operate a shift from a bank-based system to a market based system in Asia that better suit global finance. ...

... which are far more efficient and competitive. • As a consequence, Asian countries will be even more exposed to the whim of financial markets. • The project in fact is to operate a shift from a bank-based system to a market based system in Asia that better suit global finance. ...

Chapter 10: Input Demand: The Capital Market and the Investment

... interest means that there is an opportunity cost associated with every investment project. • The evaluation process thus involves not only estimating future benefits, but also comparing the possible alternative uses of the funds required to undertake the project. • At a minimum, those funds earn int ...

... interest means that there is an opportunity cost associated with every investment project. • The evaluation process thus involves not only estimating future benefits, but also comparing the possible alternative uses of the funds required to undertake the project. • At a minimum, those funds earn int ...

India's Experience with Capital Flow Management

... End use restrictions and minimum maturity. NRI deposits - interest rate ceiling linked to LIBOR/SWAP In sum, gradual and calibrated liberalization - sequencing 13 ...

... End use restrictions and minimum maturity. NRI deposits - interest rate ceiling linked to LIBOR/SWAP In sum, gradual and calibrated liberalization - sequencing 13 ...

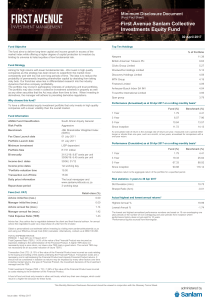

First Avenue Sanlam Collective Investments Equity Fund

... a capital gain for the shareholder. Similarly, negative sentiment about the company will result in the share price falling. Shares/equities are usually considered to have the potential for the highest return of all the investment classes, but with a higher level of risk i.e. share investments have t ...

... a capital gain for the shareholder. Similarly, negative sentiment about the company will result in the share price falling. Shares/equities are usually considered to have the potential for the highest return of all the investment classes, but with a higher level of risk i.e. share investments have t ...