Instructor`s Manual Chapter 11-7e

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

... ____11. "Extra" dividends are usually stock dividends paid out in an especially profitable year. ____12. The preferred dividend coverage ratio and the times interest earned ratio both express "margin of safety" relationships with respect to the firm's ability to cover fixed expenses. ____13. Financi ...

Capital Budgeting for Small Businesses

... the typical discounted cash flow models and to suggest a liquidity-sensitive capital budgeting technique that is theoretically correct and appropriate for small businesses. For a small business with a single product and source of revenue the use of debt financing also suggests an additional criterio ...

... the typical discounted cash flow models and to suggest a liquidity-sensitive capital budgeting technique that is theoretically correct and appropriate for small businesses. For a small business with a single product and source of revenue the use of debt financing also suggests an additional criterio ...

1494308082-Create a 10

... Create a 10- to 12-slide presentation that addresses each question within the Comparative Analysis Case, Comparative Analysis Case The Coca-Cola Company and PepsiCo, Inc. The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annu ...

... Create a 10- to 12-slide presentation that addresses each question within the Comparative Analysis Case, Comparative Analysis Case The Coca-Cola Company and PepsiCo, Inc. The financial statements of Coca-Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annu ...

Financing Infrastructure Through Capital Market

... Rule of law –fair and timely Decentralised authority and autonomy Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy ...

... Rule of law –fair and timely Decentralised authority and autonomy Creditworthy or credit enhanced borrowers Acceptance of cost recovery principles and/or appropriate subsidy where required Developed capital market – access - yield curves to price risk- tradability Risk/reward in balance Clear policy ...

Chapter 10

... Stock dividends and stock splits do not represent a payout to stockholders. These transactions have no effect on total stockholders’ equity. ...

... Stock dividends and stock splits do not represent a payout to stockholders. These transactions have no effect on total stockholders’ equity. ...

Engineering Economics - Inside Mines

... The financial cost of capital is based on the assumption that financing is unlimited and the company can always pay off loans or buy stock back, so the financial cost of capital rate of return is the average cost of debt after tax (remember interest is tax deductible) and the cost of equity (what th ...

... The financial cost of capital is based on the assumption that financing is unlimited and the company can always pay off loans or buy stock back, so the financial cost of capital rate of return is the average cost of debt after tax (remember interest is tax deductible) and the cost of equity (what th ...

Document

... Factors affecting the value of an option Black–Scholes options valuation model Payoffs on options Public (market) debt and private (bank) debt Continuum of financial instruments Credit ratings (long-term debt) Securitization cash flows Mezzanine and convertibles give return in two wa ...

... Factors affecting the value of an option Black–Scholes options valuation model Payoffs on options Public (market) debt and private (bank) debt Continuum of financial instruments Credit ratings (long-term debt) Securitization cash flows Mezzanine and convertibles give return in two wa ...

FACTORS DETERMINING THE FIRM`S COST OF CAPITAL

... of the firm’s securities (market conditions), operating and financing conditions within the company, and the amount of financing needed for new investments. Factor 1: General Economic Conditions General economic conditions determine the demand for and supply of capital within the economy, as well as ...

... of the firm’s securities (market conditions), operating and financing conditions within the company, and the amount of financing needed for new investments. Factor 1: General Economic Conditions General economic conditions determine the demand for and supply of capital within the economy, as well as ...

Cash flow is king: even profitable family

... Cash flow is king: even profitable family businesses must be cash flow savvy to succeed Cash flow management is often identified by family business owners as a source of concern, with many family businesses seeking advice on how to manage their cash flow effectively. Brendan Green, Head of Cashflow ...

... Cash flow is king: even profitable family businesses must be cash flow savvy to succeed Cash flow management is often identified by family business owners as a source of concern, with many family businesses seeking advice on how to manage their cash flow effectively. Brendan Green, Head of Cashflow ...

FIN550 final exam

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

Final February 9, 2002

... What is the model’s estimate of the present value of the stock? (4marks) If the model is right, what is the expected price of a share a year from now? (4marks) Suppose that the current price of a share is $50. By how much would you have to adjust each of the following model parameters to “justify” t ...

... What is the model’s estimate of the present value of the stock? (4marks) If the model is right, what is the expected price of a share a year from now? (4marks) Suppose that the current price of a share is $50. By how much would you have to adjust each of the following model parameters to “justify” t ...

Schroder USD Bond Fund

... and Bapepam & LK regulation number IV.D.1. It should not be considered as an offer to sell, or a solicitation of an offer to buy. All reasonable care has been taken to ensure that the information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospectiv ...

... and Bapepam & LK regulation number IV.D.1. It should not be considered as an offer to sell, or a solicitation of an offer to buy. All reasonable care has been taken to ensure that the information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospectiv ...

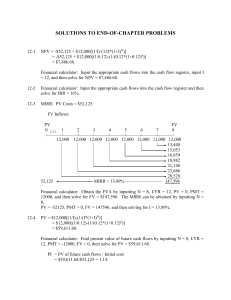

solutions to end-of

... d. The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the cost of capital, while use of the IRR method implies the opportunity to reinvest at the IRR. If the firm's cost of capital is constant at 10 percent, all projects with an NPV > 0 ...

... d. The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the cost of capital, while use of the IRR method implies the opportunity to reinvest at the IRR. If the firm's cost of capital is constant at 10 percent, all projects with an NPV > 0 ...

Common Errors in DCF Models

... investors are much better off considering alternative scenarios for the key operating value drivers (sales growth, margins, capital intensity). Sometimes asset mispricings do show up as high discount rates, as we saw in the high-yield bond market in late 2002. But even there, you could argue great i ...

... investors are much better off considering alternative scenarios for the key operating value drivers (sales growth, margins, capital intensity). Sometimes asset mispricings do show up as high discount rates, as we saw in the high-yield bond market in late 2002. But even there, you could argue great i ...

Cash Flow Statement for the year ended 31st March, 2016

... OF ARRANGEMENT CLOSING CASH AND CASH EQUIVALENTS ...

... OF ARRANGEMENT CLOSING CASH AND CASH EQUIVALENTS ...