Governed Portfolio 8 - Royal London for advisers

... This is for financial adviser use only and shouldn’t be relied upon by any other person. Performance as at 28/02/17 ...

... This is for financial adviser use only and shouldn’t be relied upon by any other person. Performance as at 28/02/17 ...

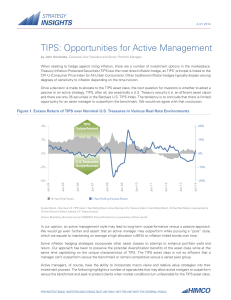

TIPS: Opportunities for Active Management

... which we equate to maintaining on average a high allocation (≥90%) to inflation-linked bonds over time. Some inflation hedging strategies incorporate other asset classes to attempt to enhance portfolio yield and return. Our approach has been to preserve the potential diversification benefits of the ...

... which we equate to maintaining on average a high allocation (≥90%) to inflation-linked bonds over time. Some inflation hedging strategies incorporate other asset classes to attempt to enhance portfolio yield and return. Our approach has been to preserve the potential diversification benefits of the ...

Exercises - lasse h. pedersen

... live in for about 5 years, and, given the mobile workforce in the region, you also expect future buyers of the property to move relatively frequently. You find a house and an apartment which are equally attractive and consider which one to buy. (The house and apartment are equally attractive in the ...

... live in for about 5 years, and, given the mobile workforce in the region, you also expect future buyers of the property to move relatively frequently. You find a house and an apartment which are equally attractive and consider which one to buy. (The house and apartment are equally attractive in the ...

Seasons Series Trust - Mid Cap Value Portfolio - Annuities

... Portfolio generally will not sell securities in its portfolio and buy different securities over the course of a year other than in conjunction with changes in its target index, even if there are adverse developments concerning a particular security, company or industry. As a result, you may suffer l ...

... Portfolio generally will not sell securities in its portfolio and buy different securities over the course of a year other than in conjunction with changes in its target index, even if there are adverse developments concerning a particular security, company or industry. As a result, you may suffer l ...

Document

... network environment that prevents downloading or reproducing the copyrighted material. Otherwise, no part of this work covered by the copyright hereon may be reproduced or used in any form or by any means—graphic, electronic, or mechanical, including, but not limited to, photocopying, recording, tap ...

... network environment that prevents downloading or reproducing the copyrighted material. Otherwise, no part of this work covered by the copyright hereon may be reproduced or used in any form or by any means—graphic, electronic, or mechanical, including, but not limited to, photocopying, recording, tap ...

Implied Excess Return

... Investors often start their analysis using screens that provide preliminary indicators of mispriced stocks. The forward PE ratio and the PEG ratio (PE ratio divided by short-term growth) are examples of widely used screens. These screens incorporate the common sense idea that “earnings ought to be b ...

... Investors often start their analysis using screens that provide preliminary indicators of mispriced stocks. The forward PE ratio and the PEG ratio (PE ratio divided by short-term growth) are examples of widely used screens. These screens incorporate the common sense idea that “earnings ought to be b ...

1606_CF Canlife Global High Yield Bond

... believes does not involve undue risk to income or principal. Normally, at least 80% of the Putnam Global High Yield Bond Fund’s assets will be invested in debt securities (such as (i) corporate and public utility debt securities (including treasury paper, commercial paper and convertible bonds), (ii ...

... believes does not involve undue risk to income or principal. Normally, at least 80% of the Putnam Global High Yield Bond Fund’s assets will be invested in debt securities (such as (i) corporate and public utility debt securities (including treasury paper, commercial paper and convertible bonds), (ii ...

An Introduction to Asset Pricing Models

... 4. All investors have the same one-period time horizon such as one-month, six months, or one year. – The model will be developed for a single hypothetical period, and its results could be affected by a different assumption. A difference in the time horizon would require investors to derive risk meas ...

... 4. All investors have the same one-period time horizon such as one-month, six months, or one year. – The model will be developed for a single hypothetical period, and its results could be affected by a different assumption. A difference in the time horizon would require investors to derive risk meas ...

Answers to the Problems – Chapter 6

... is created. However, it also gives the artists a monopoly over their creation and a monopoly creates a deadweight loss. In particular, the new technology insures that the price of music will be positive, but once the music is created, efficiency requires that the price be zero because the marginal s ...

... is created. However, it also gives the artists a monopoly over their creation and a monopoly creates a deadweight loss. In particular, the new technology insures that the price of music will be positive, but once the music is created, efficiency requires that the price be zero because the marginal s ...

competitive market

... • In a market with free entry and exit, profits are driven to zero in the long run and all firms produce at the efficient scale. • Changes in demand have different effects over different time horizons. • In the long run, the number of firms adjusts to drive the market back to the zero-profit ...

... • In a market with free entry and exit, profits are driven to zero in the long run and all firms produce at the efficient scale. • Changes in demand have different effects over different time horizons. • In the long run, the number of firms adjusts to drive the market back to the zero-profit ...

THE RELATIONSHIP BETWEEN CREDIT

... S&P AAA categories are not subdivided. Ratings below Baa3 (Moody’s) and BBB– (S&P) are referred to as “below investment grade”. Analysts and commentators often use ratings as descriptors of the creditworthiness of bond issuers rather than descriptors of the quality of the bonds themselves. This is ...

... S&P AAA categories are not subdivided. Ratings below Baa3 (Moody’s) and BBB– (S&P) are referred to as “below investment grade”. Analysts and commentators often use ratings as descriptors of the creditworthiness of bond issuers rather than descriptors of the quality of the bonds themselves. This is ...

The Microfinance Collateralized Debt Obligation: a Modern Robin

... “Although the General Motors episode [of 2005] might not repeat itself, it should nonetheless be a lesson for the future; whether or not the credit environment becomes riskier over the next couple of years, similar sudden changes in CDS spreads most likely will strike the CDS index market from time ...

... “Although the General Motors episode [of 2005] might not repeat itself, it should nonetheless be a lesson for the future; whether or not the credit environment becomes riskier over the next couple of years, similar sudden changes in CDS spreads most likely will strike the CDS index market from time ...

Chapter 10 - personal.kent.edu

... 20. The arithmetic average return is the sum of the known returns divided by the number of returns, so: Arithmetic average return = (.29 + .14 + .23 –.08 + .09 –.14) / 6 Arithmetic average return = .0883 or 8.83% Using the equation for the geometric return, we find: Geometric average return = [(1 + ...

... 20. The arithmetic average return is the sum of the known returns divided by the number of returns, so: Arithmetic average return = (.29 + .14 + .23 –.08 + .09 –.14) / 6 Arithmetic average return = .0883 or 8.83% Using the equation for the geometric return, we find: Geometric average return = [(1 + ...

The Process of Portfolio Management

... to maintain the relative weighting of the asset classes within the portfolio as their prices change • Requires the purchase of securities that have performed poorly and the sale of securities that have performed the best ...

... to maintain the relative weighting of the asset classes within the portfolio as their prices change • Requires the purchase of securities that have performed poorly and the sale of securities that have performed the best ...

Real Estate's Contribution to Portfolio Risk and Return in the New World Financial (Dis)Order

... April 2006 to March 2008 October 2006 to September 2008 April 2007 to March 2009 October 2007 to September 2009 April 2008 to March 2010 ...

... April 2006 to March 2008 October 2006 to September 2008 April 2007 to March 2009 October 2007 to September 2009 April 2008 to March 2010 ...

3 Java Program - Computing Science and Mathematics

... a portfolio. A portfolio of different kinds of investments will set a lower risk and yield higher returns than any individual investment which can be found within the portfolio .Diversification still works when correlations are near zero or somewhat positive, and it relies on the lack of a tight pos ...

... a portfolio. A portfolio of different kinds of investments will set a lower risk and yield higher returns than any individual investment which can be found within the portfolio .Diversification still works when correlations are near zero or somewhat positive, and it relies on the lack of a tight pos ...

The Myths and Fallacies about Diversified Portfolios

... all appear to agree that the most diversified portfolio – for a given level of return or risk – is the one that lies on the efficient frontier. Claimants to the Holy Grail of diversification summarily dismiss the extension of this theory to Figure 2 and the conclusion that the most-efficient portfol ...

... all appear to agree that the most diversified portfolio – for a given level of return or risk – is the one that lies on the efficient frontier. Claimants to the Holy Grail of diversification summarily dismiss the extension of this theory to Figure 2 and the conclusion that the most-efficient portfol ...

overhead - 23 Portfolio, Risk Stationarity

... Portfolio and Bid Analysis Models • Many business decisions can be couched in a portfolio analysis framework • A portfolio analysis refers to comparing investment alternatives • A portfolio can represent any set of risky alternatives the decision maker considers • For example an insurance purchase ...

... Portfolio and Bid Analysis Models • Many business decisions can be couched in a portfolio analysis framework • A portfolio analysis refers to comparing investment alternatives • A portfolio can represent any set of risky alternatives the decision maker considers • For example an insurance purchase ...

What is the effect of monetary policy on market behavior?

... constant had a negative sign, but it was not statistically significant, so the long term mean is equal to zero which is what we expect as we have previously induced stationarity. The lag variable of the High Yield Spread was statistically significant and had a negative magnitude of -0.41. This means ...

... constant had a negative sign, but it was not statistically significant, so the long term mean is equal to zero which is what we expect as we have previously induced stationarity. The lag variable of the High Yield Spread was statistically significant and had a negative magnitude of -0.41. This means ...

The Problem of Estimating the Volatility of Zero Coupon

... But the other difference is that we want to estimate the volatility of zero coupon bond yields not the volatility of a forward rate. And σ(t, Ti. Ti+1) is the volatility of a forward rate f(t, Ti. Ti+1). The main problem concerning zero coupon bond yields is that they are not observable variables ( ...

... But the other difference is that we want to estimate the volatility of zero coupon bond yields not the volatility of a forward rate. And σ(t, Ti. Ti+1) is the volatility of a forward rate f(t, Ti. Ti+1). The main problem concerning zero coupon bond yields is that they are not observable variables ( ...

Risk and Return: The CAPM - Dr. Gholamreza Zandi Website

... • Total risk is the combination of a security’s nondiversifiable risk and diversifiable risk. • Diversifiable risk is the portion of an asset’s risk that is attributable to firm-specific, random causes; can be eliminated through diversification. Also called unsystematic risk. • Nondiversifiable risk ...

... • Total risk is the combination of a security’s nondiversifiable risk and diversifiable risk. • Diversifiable risk is the portion of an asset’s risk that is attributable to firm-specific, random causes; can be eliminated through diversification. Also called unsystematic risk. • Nondiversifiable risk ...

ETP Econ Lecture Note 14 Fall 2014

... minimized, suggesting that its MC (Marginal Cost) equals its AVC (Average Variable Cost). If you were the consultant hired by the firm, would you suggest the firm manager to change the production level in the short run? Explain why? ...

... minimized, suggesting that its MC (Marginal Cost) equals its AVC (Average Variable Cost). If you were the consultant hired by the firm, would you suggest the firm manager to change the production level in the short run? Explain why? ...

Markowitz and the Expanding Definition of Risk: Applications of Multi

... Capital Asset Pricing Model (CAPM) held that investors are compensated for bearing not only total risk, but also rather market risk, or systematic risk, as measured by a stock’s beta. Investors are not compensated for bearing stock-specific risk, which can be diversified away in a portfolio context. ...

... Capital Asset Pricing Model (CAPM) held that investors are compensated for bearing not only total risk, but also rather market risk, or systematic risk, as measured by a stock’s beta. Investors are not compensated for bearing stock-specific risk, which can be diversified away in a portfolio context. ...