Corporate Yield Spreads: Default Risk or Liquidity? New Evidence

... Given the independence assumption, we do not actually need to specify the risk-neutral dynamics of the riskless rate to solve for credit default swap premia and corporate bond prices. We require only that these dynamics be such that ...

... Given the independence assumption, we do not actually need to specify the risk-neutral dynamics of the riskless rate to solve for credit default swap premia and corporate bond prices. We require only that these dynamics be such that ...

R Failures in Risk Management

... next period. Table 2 shows estimates of serial correlaand fat-tailed. Or, one might assume a jump diffusion tion based on monthly return data for both large model, in which the returns usually behave as if stocks and long-term U.S. Treasuries over the period drawn from a normal distribution but are ...

... next period. Table 2 shows estimates of serial correlaand fat-tailed. Or, one might assume a jump diffusion tion based on monthly return data for both large model, in which the returns usually behave as if stocks and long-term U.S. Treasuries over the period drawn from a normal distribution but are ...

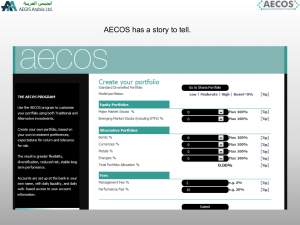

Portfolio Comparisons. - Artex Component System

... The AECOS program allows investors to test different portfolio strategies to determine the best mix of sectors, and the proper leverage to apply. Results for each sector are from the Aegis investment programs. Past results cannot predict future returns, but the AECOS program is designed primarily to ...

... The AECOS program allows investors to test different portfolio strategies to determine the best mix of sectors, and the proper leverage to apply. Results for each sector are from the Aegis investment programs. Past results cannot predict future returns, but the AECOS program is designed primarily to ...

What Difference Do Dividends Make?

... reduce the realized return. Once the sample was segmented by investment style, we formed four dividend yield portfolios within each style category: no dividend, low dividend, high dividend, and extreme dividend. We divided the dividend payers, roughly in half, into low- and high-dividend portfolios; ...

... reduce the realized return. Once the sample was segmented by investment style, we formed four dividend yield portfolios within each style category: no dividend, low dividend, high dividend, and extreme dividend. We divided the dividend payers, roughly in half, into low- and high-dividend portfolios; ...

sample - Test Bank College

... b. Financial risk c. Liquidity risk d. Exchange rate risk e. Unsystematic market risk ANS: E ...

... b. Financial risk c. Liquidity risk d. Exchange rate risk e. Unsystematic market risk ANS: E ...

Dividend Yield vs. Dividend Growth

... The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual ...

... The hypothetical backtested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy managed by OSAM. If actual ...

CME SPAN - CME Group

... specific set of market conditions from a set point in time to a specific point in time in the future. • Risk Arrays typically consist of 16 profit/loss scenarios for each contract. • Each Risk Array scenario is comprised of a different market simulation, ...

... specific set of market conditions from a set point in time to a specific point in time in the future. • Risk Arrays typically consist of 16 profit/loss scenarios for each contract. • Each Risk Array scenario is comprised of a different market simulation, ...

RAFI® Bonds US High Yield 1-10 Index

... registered trademarks and are the exclusive intellectual property of Research Affiliates, LLC. Any use of these trade names and logos without the prior written permission of Research Affiliates, LLC is expressly prohibited. Research Affiliates, LLC reserves the right to take any and all necessary ac ...

... registered trademarks and are the exclusive intellectual property of Research Affiliates, LLC. Any use of these trade names and logos without the prior written permission of Research Affiliates, LLC is expressly prohibited. Research Affiliates, LLC reserves the right to take any and all necessary ac ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... – FIs can diversify away some individual firm-specific credit risk, but not systematic credit risk • firm-specific credit risk is the risk of default for the borrowing firm associated with the specific types of project risk taken by that firm • systematic credit risk is the risk of default associate ...

... – FIs can diversify away some individual firm-specific credit risk, but not systematic credit risk • firm-specific credit risk is the risk of default for the borrowing firm associated with the specific types of project risk taken by that firm • systematic credit risk is the risk of default associate ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... – FIs can diversify away some individual firm-specific credit risk, but not systematic credit risk • firm-specific credit risk is the risk of default for the borrowing firm associated with the specific types of project risk taken by that firm • systematic credit risk is the risk of default associate ...

... – FIs can diversify away some individual firm-specific credit risk, but not systematic credit risk • firm-specific credit risk is the risk of default for the borrowing firm associated with the specific types of project risk taken by that firm • systematic credit risk is the risk of default associate ...

Time and Risk Diversification in Real Estate Investments: the Ex

... analysis correctly measures the features of the distribution of asset returns that are of importance. For instance, Hoevenaars et al. (2007) and Fugazza, Guidolin, and Nicodano (2007) argue that enlarging the asset menu, while accounting for predictable asset returns, may significantly increase ex a ...

... analysis correctly measures the features of the distribution of asset returns that are of importance. For instance, Hoevenaars et al. (2007) and Fugazza, Guidolin, and Nicodano (2007) argue that enlarging the asset menu, while accounting for predictable asset returns, may significantly increase ex a ...

Global Fixed Income Portfolio

... (yield to maturity) is, the lower the value of the bond will be, all other factors being equal. A bond’s price and YTM are inversely related. An increase in YTM decreases the price and vice versa. Prices are more sensitive to changes in YTM for bonds with lower coupon rates and longer maturities, an ...

... (yield to maturity) is, the lower the value of the bond will be, all other factors being equal. A bond’s price and YTM are inversely related. An increase in YTM decreases the price and vice versa. Prices are more sensitive to changes in YTM for bonds with lower coupon rates and longer maturities, an ...

Desirable Properties of an Ideal Risk Measure in

... maximizing an expected state dependent utility function (see Castagnoli and LiCalzi (1996,1999))). Thus, the benchmark approach is a generalization of the classic von Neumann–Morgenstern approach. In addition, the same investor could have multiple objectives and hence multiple benchmarks. Thus, risk ...

... maximizing an expected state dependent utility function (see Castagnoli and LiCalzi (1996,1999))). Thus, the benchmark approach is a generalization of the classic von Neumann–Morgenstern approach. In addition, the same investor could have multiple objectives and hence multiple benchmarks. Thus, risk ...

ANZ Australian dollar `fair value` model

... This document is issued on the basis that it is only for the information of the particular person to whom it is provided. This document may not be reproduced, distributed or published by any recipient for any purpose. This document does not take into account your personal needs and financial circums ...

... This document is issued on the basis that it is only for the information of the particular person to whom it is provided. This document may not be reproduced, distributed or published by any recipient for any purpose. This document does not take into account your personal needs and financial circums ...

Expected and unexpected bond excess returns

... excess returns. The computation of the PIN-measure is based on the concept that order flow is a medium how information are incorporated into prices. Second, the price process of bonds matters for excess returns. Macroeconomic news lead to strong price shifts, so-called jumps (Lahaye et al. (2011)). ...

... excess returns. The computation of the PIN-measure is based on the concept that order flow is a medium how information are incorporated into prices. Second, the price process of bonds matters for excess returns. Macroeconomic news lead to strong price shifts, so-called jumps (Lahaye et al. (2011)). ...

Mean Semi-absolute Deviation Model for Uncertain Portfolio

... In this section, we present a numerical example about uncertain portfolio optimization problem to demonstrate the new modeling idea of this paper. For this purpose, we consider the problem that an investor plans to invest his fund among twenty securities. It is worth pointing out that the experiment ...

... In this section, we present a numerical example about uncertain portfolio optimization problem to demonstrate the new modeling idea of this paper. For this purpose, we consider the problem that an investor plans to invest his fund among twenty securities. It is worth pointing out that the experiment ...

SA BlackRock VCP Global Multi Asset Portfolio Summary

... The Portfolio incorporates a volatility control process that seeks to reduce risk when the portfolio’s volatility is expected to exceed an annual level of 10%. Volatility is a statistical measure of the magnitude of changes in the Portfolio’s returns over time without regard to the direction of thos ...

... The Portfolio incorporates a volatility control process that seeks to reduce risk when the portfolio’s volatility is expected to exceed an annual level of 10%. Volatility is a statistical measure of the magnitude of changes in the Portfolio’s returns over time without regard to the direction of thos ...

The Relationship between Portfolio Return Volatility and Stock

... pursuit algorithm in uncovering the hidden periodic components. M. Gallegati investigated the relationship between stock market returns and economic activity, applying the maximum overlap discrete wavelet transform to the Dow Jones Industrial Average and the USA industrial production indices. The ap ...

... pursuit algorithm in uncovering the hidden periodic components. M. Gallegati investigated the relationship between stock market returns and economic activity, applying the maximum overlap discrete wavelet transform to the Dow Jones Industrial Average and the USA industrial production indices. The ap ...

The Role of Positions and Activities In Derivative Pricing A

... price impacts across the whole surface/curve. Options market makers update the whole implied volatility surface in response to order flows from any one particular contract. ...

... price impacts across the whole surface/curve. Options market makers update the whole implied volatility surface in response to order flows from any one particular contract. ...

CHAPTER 11

... macro factors. Sometimes, however, rather than using a market proxy, it is more useful to focus directly on the ultimate sources of risk. This can be useful in risk assessment, for example, when measuring one’s exposures to particular sources of uncertainty. ...

... macro factors. Sometimes, however, rather than using a market proxy, it is more useful to focus directly on the ultimate sources of risk. This can be useful in risk assessment, for example, when measuring one’s exposures to particular sources of uncertainty. ...

Optimal Multiperiod Portfolio Policies Author(s): Jan Mossin Source

... In this way it is possible to consider Nor could it generally be optimal to the next-to-last decision as a simple onesimply make a first-perioddecision that period problem, grantedthat the objecwould maximize expected utility of tive is appropriatelydefined in terms of wealth at the end of that peri ...

... In this way it is possible to consider Nor could it generally be optimal to the next-to-last decision as a simple onesimply make a first-perioddecision that period problem, grantedthat the objecwould maximize expected utility of tive is appropriatelydefined in terms of wealth at the end of that peri ...