Full Text - Digital Access to Scholarship at Harvard

... write-offs under SFAS 142 in circumstances where they have agency-based motives to do so, despite market indications that such write-offs are due. The unverifiable nature of fair-value estimates of goodwill makes such behavior predictable under agency theory (Watts, 2003; Ramanna, 2008). The evidenc ...

... write-offs under SFAS 142 in circumstances where they have agency-based motives to do so, despite market indications that such write-offs are due. The unverifiable nature of fair-value estimates of goodwill makes such behavior predictable under agency theory (Watts, 2003; Ramanna, 2008). The evidenc ...

conditions generales de vente version : 18-06-2008

... In case of refusal of the buyer, IPO Technologie reserves the right to terminate the contract. RETENTION OF TITLE Act of May 12, 1980 The transfer of ownership of the merchandise sold is subject to full payment on the agreed date. Checks, bills of exchange and sale of receivables, are not considered ...

... In case of refusal of the buyer, IPO Technologie reserves the right to terminate the contract. RETENTION OF TITLE Act of May 12, 1980 The transfer of ownership of the merchandise sold is subject to full payment on the agreed date. Checks, bills of exchange and sale of receivables, are not considered ...

Valuing IPOs

... group; the discounted cash #ow (DCF) approach; and the asset-based approach. Each of these methods has its advantages and disadvantages. For example, the comparable "rms approach works best when a highly comparable group is available. While it can reduce the probability of misvaluing a "rm relative ...

... group; the discounted cash #ow (DCF) approach; and the asset-based approach. Each of these methods has its advantages and disadvantages. For example, the comparable "rms approach works best when a highly comparable group is available. While it can reduce the probability of misvaluing a "rm relative ...

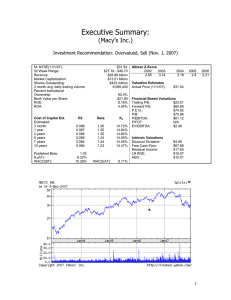

Macy's Inc. - Mark E. Moore

... We found that Macy’s liquidity, when compared to their competitors, is disappointing. Macy’s liquidity ratios such as: current ratio, quick asset ratio, and working capital turnover were either below the industrial average or in decline. However, after computing Macy’s profitability ratios, we disco ...

... We found that Macy’s liquidity, when compared to their competitors, is disappointing. Macy’s liquidity ratios such as: current ratio, quick asset ratio, and working capital turnover were either below the industrial average or in decline. However, after computing Macy’s profitability ratios, we disco ...

1. Which of the following statements best describes the IFRS

... A. To provide users with easy comparison with the industry. B. To provide users with a perspective on the economy. C. Because making comparisons using accounting information can be difficult and misleading. D. Because making comparisons significantly contributes to the interpretation of accounting i ...

... A. To provide users with easy comparison with the industry. B. To provide users with a perspective on the economy. C. Because making comparisons using accounting information can be difficult and misleading. D. Because making comparisons significantly contributes to the interpretation of accounting i ...

Journal of Marketing Development and Competitiveness

... In this study we aim to explore internal marketing applications in Egypt. There is no evidence about the extent of internal marketing understanding and its applications. Thus, we explore it by presenting some case studies and conducting some in-depth interviews. This paper is based on a combination ...

... In this study we aim to explore internal marketing applications in Egypt. There is no evidence about the extent of internal marketing understanding and its applications. Thus, we explore it by presenting some case studies and conducting some in-depth interviews. This paper is based on a combination ...

Revenue recognition: determinants of the accounts receivable and

... (2005) to control for changes of other accruals and its components. Finally I include a dummy variable for opportunistic behavior in my model to see how opportunistic behavior is influencing the change in accounts receivable and deferred revenue and a control variable or the opportunistic behavior ...

... (2005) to control for changes of other accruals and its components. Finally I include a dummy variable for opportunistic behavior in my model to see how opportunistic behavior is influencing the change in accounts receivable and deferred revenue and a control variable or the opportunistic behavior ...

tides two rivers fund

... On January 7, 2011, Tides Foundation repaid this $1,500,000 amount in full to the Calvert Foundation and cancelled the 2006 promissory note to TTRF. TTRF then entered into a new credit agreement with the Tides Foundation for $1,500,000. The term of the promissory note, with a maximum amount of $1,50 ...

... On January 7, 2011, Tides Foundation repaid this $1,500,000 amount in full to the Calvert Foundation and cancelled the 2006 promissory note to TTRF. TTRF then entered into a new credit agreement with the Tides Foundation for $1,500,000. The term of the promissory note, with a maximum amount of $1,50 ...

Debits and Credits: Analyzing and Recording Business Transactions

... A transaction that involves more than one debit or more than one credit is called a compound entry. This first transaction of Mia Wong’s law firm is a compound entry; it involves a debit of $6,000 to Cash and a debit of $200 to Office Equipment (as well as a credit of $6,200 to Mia Wong, Capital). T ...

... A transaction that involves more than one debit or more than one credit is called a compound entry. This first transaction of Mia Wong’s law firm is a compound entry; it involves a debit of $6,000 to Cash and a debit of $200 to Office Equipment (as well as a credit of $6,200 to Mia Wong, Capital). T ...

Free Sample

... A) Assets - Liabilities = Shareholders' equity B) Assets = Liabilities + Shareholders' equity C) Assets - Current liabilities = Long-term liabilities D) Assets - Current liabilities = Long-term liabilities + Shareholders' equity ...

... A) Assets - Liabilities = Shareholders' equity B) Assets = Liabilities + Shareholders' equity C) Assets - Current liabilities = Long-term liabilities D) Assets - Current liabilities = Long-term liabilities + Shareholders' equity ...

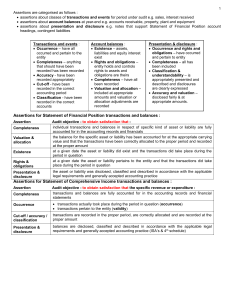

Aue2602 Summary

... Accuracy = minimising errors to ensure that data and transactions are correctly captured, processed and allocated Completeness – ensuring data and transactions are not omitted or incomplete Terms relating to the stage at which controls are implemented to achieve the objectives explained above : pr ...

... Accuracy = minimising errors to ensure that data and transactions are correctly captured, processed and allocated Completeness – ensuring data and transactions are not omitted or incomplete Terms relating to the stage at which controls are implemented to achieve the objectives explained above : pr ...

Limited partnership

... - limited joint-stock partnership Share in profits and participation in losses of limited joint stock partnership As a rule, a general partner and a shareholder participate in the profits of the partnership in proportion to their contributions made to the partnership, unless the statutes provide oth ...

... - limited joint-stock partnership Share in profits and participation in losses of limited joint stock partnership As a rule, a general partner and a shareholder participate in the profits of the partnership in proportion to their contributions made to the partnership, unless the statutes provide oth ...

Quality of Earnings Case Study Collection

... provide guidance and education to ensure that our members, and others in the financial reporting community report high quality earnings and the necessary disclosures to enable the investing public to make better informed decisions. One way to do this is through the creation of a robust performance m ...

... provide guidance and education to ensure that our members, and others in the financial reporting community report high quality earnings and the necessary disclosures to enable the investing public to make better informed decisions. One way to do this is through the creation of a robust performance m ...

introduction - Financial Accounting Standards Research Initiative

... can be assured that the statements appropriately communicate the results of their actions to generate value for investors. Finally, while not directly involving issues of accounting for individual line items, financial statement design feeds back to accounting issues (as we will see). The paper broa ...

... can be assured that the statements appropriately communicate the results of their actions to generate value for investors. Finally, while not directly involving issues of accounting for individual line items, financial statement design feeds back to accounting issues (as we will see). The paper broa ...

VT Transaction user guide

... If you want the opening balances for each customer and supplier to be broken down by invoice, you should post each outstanding invoice separately using the sales and purchase invoice input methods instead of the journal method. Each outstanding invoice should be given its original date. The total of ...

... If you want the opening balances for each customer and supplier to be broken down by invoice, you should post each outstanding invoice separately using the sales and purchase invoice input methods instead of the journal method. Each outstanding invoice should be given its original date. The total of ...

Annual Report 2016

... in a different direction. The acquisitions of 2016 have been conducive to achieving the strategic goal of making us the market-leader for complete sensing systems in our selected target markets, and to moving away from being solely a supplier of individual sensor ICs. In this context, the ability to ...

... in a different direction. The acquisitions of 2016 have been conducive to achieving the strategic goal of making us the market-leader for complete sensing systems in our selected target markets, and to moving away from being solely a supplier of individual sensor ICs. In this context, the ability to ...

Tangible Capital Assets - Waterloo Public Library

... physical damage; significant technological developments; a change in the demand for the services provided through use of the tangible capital asset; a change in the law or environment affecting the period of time over which the tangible capital asset can be used. Impairment of Assets (Write- ...

... physical damage; significant technological developments; a change in the demand for the services provided through use of the tangible capital asset; a change in the law or environment affecting the period of time over which the tangible capital asset can be used. Impairment of Assets (Write- ...

Balance Sheet

... that do not affect cash are reported in either a separate schedule at the bottom of the statement of cash flows or in the notes. Examples include: Issuance of common stock to purchase assets. Conversion of bonds into common stock. Issuance of debt to purchase assets. Exchanges on long-lived assets. ...

... that do not affect cash are reported in either a separate schedule at the bottom of the statement of cash flows or in the notes. Examples include: Issuance of common stock to purchase assets. Conversion of bonds into common stock. Issuance of debt to purchase assets. Exchanges on long-lived assets. ...

2016 Annual Report - Modern Times Group

... most markets. Linear TV viewing again declined in Scandinavia in 2016 as consumers watched more video online, on mobile and on demand, but was stable in the international markets. TV advertising prices were up in all markets as demand remained high for large scale, high quality and easily measured T ...

... most markets. Linear TV viewing again declined in Scandinavia in 2016 as consumers watched more video online, on mobile and on demand, but was stable in the international markets. TV advertising prices were up in all markets as demand remained high for large scale, high quality and easily measured T ...

APPTICATION OF THE AUDIT PROCESS TO OTHER CYCTES

... transactions for the acquisition and payment cycle receive a considerable amount of attention, especially when the client has effective internal controls. Tests of controls and substantive tests of transactions for the acquisition and payment cycle are divided into two broad areas: 1. Tests of acqui ...

... transactions for the acquisition and payment cycle receive a considerable amount of attention, especially when the client has effective internal controls. Tests of controls and substantive tests of transactions for the acquisition and payment cycle are divided into two broad areas: 1. Tests of acqui ...

The Separation of Ownership and Control and Corporate Tax

... market pressure place greater weight on financial than taxable income when divesting operating units, relative to public firms subject to less capital market pressure.10 That is, public firms subject to greater capital market pressure are willing to trade-off higher tax costs for the benefit of high ...

... market pressure place greater weight on financial than taxable income when divesting operating units, relative to public firms subject to less capital market pressure.10 That is, public firms subject to greater capital market pressure are willing to trade-off higher tax costs for the benefit of high ...

Pricing Agricultural Products and Services

... margins in the short run, but it generally enables the company to become more financially secure in the long run because more products are sold and more customers are secured. This strategy, referred to as giving a discount, is often a short-term one. A discount is a deduction from the regular price ...

... margins in the short run, but it generally enables the company to become more financially secure in the long run because more products are sold and more customers are secured. This strategy, referred to as giving a discount, is often a short-term one. A discount is a deduction from the regular price ...

The Interpretation of Marketing Actions and Communications by the

... How are these investments and strategic directions communicated to the financial markets? These questions are managerially relevant because executives need to (a) understand how the marketplace will view real strategic investments and (b) effectively communicate how other marketing actions will infl ...

... How are these investments and strategic directions communicated to the financial markets? These questions are managerially relevant because executives need to (a) understand how the marketplace will view real strategic investments and (b) effectively communicate how other marketing actions will infl ...

Construction Rules for Morningstar® US Dividend

... If an index constituent acquires or merges with another company in the index, the original entities are replaced by the security of the successor entity. The weight of the new entity is equal to the market value sum of the original index constituents. A divisor adjustment is not necessary because th ...

... If an index constituent acquires or merges with another company in the index, the original entities are replaced by the security of the successor entity. The weight of the new entity is equal to the market value sum of the original index constituents. A divisor adjustment is not necessary because th ...

Download attachment

... be noted here, however, that there is a study on manufacturing flexibility (one element of internal process) that indicated that there is a positive relationship between perceived environmental uncertainty and manufacturing flexibility (Swamidass & Newell, 1987). Further, besides looking at the indi ...

... be noted here, however, that there is a study on manufacturing flexibility (one element of internal process) that indicated that there is a positive relationship between perceived environmental uncertainty and manufacturing flexibility (Swamidass & Newell, 1987). Further, besides looking at the indi ...