Private Placements and Managerial Entrenchment

... stock returns, but also the pricing of the placements, events at the firms following the placements, and the role the purchasers of the placements play in firm affairs. Like previous researchers, we find that the initial stock-price reaction to private placements is positive, but the long-run stock ...

... stock returns, but also the pricing of the placements, events at the firms following the placements, and the role the purchasers of the placements play in firm affairs. Like previous researchers, we find that the initial stock-price reaction to private placements is positive, but the long-run stock ...

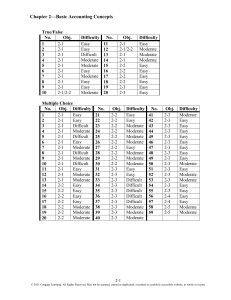

Corporate-Finance-4th-Edition-Ross-Test-Bank

... A. reduces both the net fixed assets and the costs of a firm. B. decreases net fixed assets, net income, and operating cash flows. C. is a non-cash expense that decreases the selling, general, and administrative expenses. D. is a non-cash expense that reduces the pretax income. E. increases the net ...

... A. reduces both the net fixed assets and the costs of a firm. B. decreases net fixed assets, net income, and operating cash flows. C. is a non-cash expense that decreases the selling, general, and administrative expenses. D. is a non-cash expense that reduces the pretax income. E. increases the net ...

Vanguard Natural Resources LLC

... Committee of its Board of Directors concluded that the contemporaneous formal documentation it had prepared to support its initial hedge designations and subsequent assessments for ineffectiveness in connection with the Company’s natural gas and oil hedging program in 2008 did not meet the technical ...

... Committee of its Board of Directors concluded that the contemporaneous formal documentation it had prepared to support its initial hedge designations and subsequent assessments for ineffectiveness in connection with the Company’s natural gas and oil hedging program in 2008 did not meet the technical ...

Experience Financial Accounting

... Completing the Accounting Cycle In the previous chapter, we examined how companies use the double-entry accounting system to record business activities that occur during the accounting period. However, accountants also make numerous adjustments at the end of accounting periods for business activitie ...

... Completing the Accounting Cycle In the previous chapter, we examined how companies use the double-entry accounting system to record business activities that occur during the accounting period. However, accountants also make numerous adjustments at the end of accounting periods for business activitie ...

Session 06 Production Costs

... 5.2: Short-Run Cost Curves and the Long-Run Planning Curve The appropriate size or scale for the new plant depends on how much the firm wants to produce. For example, if q is the desired rate of output in the long run, the average cost per unit is lowest with a small plant. If the desired output ra ...

... 5.2: Short-Run Cost Curves and the Long-Run Planning Curve The appropriate size or scale for the new plant depends on how much the firm wants to produce. For example, if q is the desired rate of output in the long run, the average cost per unit is lowest with a small plant. If the desired output ra ...

Preview Sample 1

... 15. The statement of cash flows is integrated with the balance sheet because a. the cash at the beginning of the period plus or minus the cash flows from operating, investing, and financing activities equals the end of period cash reported on the balance sheet. b. the cash at the beginning of the pe ...

... 15. The statement of cash flows is integrated with the balance sheet because a. the cash at the beginning of the period plus or minus the cash flows from operating, investing, and financing activities equals the end of period cash reported on the balance sheet. b. the cash at the beginning of the pe ...

Download attachment

... Paragraph 37 of Concepts Statement 1 states that: Financial reporting should provide information to help present and potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the ...

... Paragraph 37 of Concepts Statement 1 states that: Financial reporting should provide information to help present and potential investors and creditors and other users in assessing the amounts, timing, and uncertainty of prospective cash receipts from dividends or interest and the proceeds from the ...

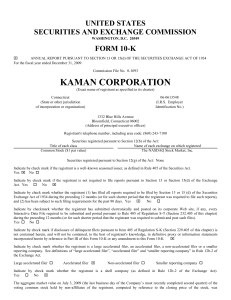

FORM 10-K - corporate

... performed on a fixed-price basis and the balance was performed on a cost-reimbursement basis. Under a fixed-price contract, the price paid to the contractor is negotiated at the outset of the contract and is not generally subject to adjustment to reflect the actual costs incurred by the contractor i ...

... performed on a fixed-price basis and the balance was performed on a cost-reimbursement basis. Under a fixed-price contract, the price paid to the contractor is negotiated at the outset of the contract and is not generally subject to adjustment to reflect the actual costs incurred by the contractor i ...

Stoc Mar et Information and REIT Earnings Management

... decisions, such as investment and financing activities, earnings management decisions are not publicly announced. Thus, to discover earnings management, stock investors need to have substantial knowledge about accounting standards, tax rules, and the company’s underlying business activities. Moreover ...

... decisions, such as investment and financing activities, earnings management decisions are not publicly announced. Thus, to discover earnings management, stock investors need to have substantial knowledge about accounting standards, tax rules, and the company’s underlying business activities. Moreover ...

PRIMERO MINING CORP

... The following information is of significant importance to shareholders of the Company who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as s ...

... The following information is of significant importance to shareholders of the Company who do not hold Common Shares in their own name. Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by registered shareholders or as s ...

Arcada Oasis Entrepreneurship Hub – Guide for Novice

... entrepreneurship hub located at Arcada University of Applied Sciences in Helsinki, Finland. Arcada Oasis is an “out of class” meeting place for students, entrepreneurs, teachers and mentors and a platform for innovation-based entrepreneurship. This guide will be particularly useful for potential ent ...

... entrepreneurship hub located at Arcada University of Applied Sciences in Helsinki, Finland. Arcada Oasis is an “out of class” meeting place for students, entrepreneurs, teachers and mentors and a platform for innovation-based entrepreneurship. This guide will be particularly useful for potential ent ...

Wild Chapter 9

... Potential Legal Claims – A potential claim is recorded if the amount can be reasonably estimated and payment for damages is probable. ...

... Potential Legal Claims – A potential claim is recorded if the amount can be reasonably estimated and payment for damages is probable. ...

CJAR Fundamentalist Perspective on Accounting Jiang

... We hasten to state that the focus on the equity analyst (and the equity investor) is not the only relevant perspective; there are other users of financial statements, and indeed the Boards see their task as accounting for all investors. Indeed, the Boards take an “entity perspective” in their conce ...

... We hasten to state that the focus on the equity analyst (and the equity investor) is not the only relevant perspective; there are other users of financial statements, and indeed the Boards see their task as accounting for all investors. Indeed, the Boards take an “entity perspective” in their conce ...

Giggles N` Hugs, Inc. (Form: 8-K, Received: 06/05

... Indemnify and hold harmless WestPark and any of its directors, officers, employees, consultants or agents (each individually an “Indemnified Person”) from and against any losses, claims, damages or liabilities to which such Indemnified Person may become subject arising out of our in connection with ...

... Indemnify and hold harmless WestPark and any of its directors, officers, employees, consultants or agents (each individually an “Indemnified Person”) from and against any losses, claims, damages or liabilities to which such Indemnified Person may become subject arising out of our in connection with ...

The FRAUD TREE:

... Overstating assets and revenues falsely reflects a financially stronger company by inclusion of fictitious asset costs or artificial revenues. Understated liabilities and expenses are shown through exclusion of costs or financial obligations. Both methods result in increased equity and net worth for ...

... Overstating assets and revenues falsely reflects a financially stronger company by inclusion of fictitious asset costs or artificial revenues. Understated liabilities and expenses are shown through exclusion of costs or financial obligations. Both methods result in increased equity and net worth for ...

Hewlett Packard Enterprise Co (Form: 8-K, Received: 03

... NOW, THEREFORE, BE IT RESOLVED, that, pursuant to Article IV of the Charter (which authorizes 300,000,000 shares of Preferred Stock, par value $0.01 per share (the “ Preferred Stock ”)) and the authority conferred on the Board of Directors, the Board of Directors hereby fixes the designation, power ...

... NOW, THEREFORE, BE IT RESOLVED, that, pursuant to Article IV of the Charter (which authorizes 300,000,000 shares of Preferred Stock, par value $0.01 per share (the “ Preferred Stock ”)) and the authority conferred on the Board of Directors, the Board of Directors hereby fixes the designation, power ...

ANNEX Section 1. Cost accounting and accounting

... gather accounting separation information in respect of non-SMP markets only insofar as an NRA can justify that the provision of such information is necessary for the NRA to carry out its responsibilities under other provisions of the framework. Accounting separation requirements could be developed s ...

... gather accounting separation information in respect of non-SMP markets only insofar as an NRA can justify that the provision of such information is necessary for the NRA to carry out its responsibilities under other provisions of the framework. Accounting separation requirements could be developed s ...

Guide for Equity - Cayman Islands Stock Exchange

... CSX is able to offer a fast track listing to specialist companies such as mineral companies, start-ups and companies with a sophisticated investor base. In 2013 the CSX launched a new equity market ‘XCAY’ which operates on Deutsche Boerse’s XETRA® trading platform with connectivity to up to 400 bank ...

... CSX is able to offer a fast track listing to specialist companies such as mineral companies, start-ups and companies with a sophisticated investor base. In 2013 the CSX launched a new equity market ‘XCAY’ which operates on Deutsche Boerse’s XETRA® trading platform with connectivity to up to 400 bank ...

Wahlen_1e_IM_Ch16 (new window)

... b. Stock dividends or splits can change the shares outstanding i. Retroactive recognition for all comparative income statements presented 5. Why it matters a. Price/earnings ratio measures the market’s assessment of the future earnings potential of the company i. Higher ratios are generally interpre ...

... b. Stock dividends or splits can change the shares outstanding i. Retroactive recognition for all comparative income statements presented 5. Why it matters a. Price/earnings ratio measures the market’s assessment of the future earnings potential of the company i. Higher ratios are generally interpre ...

Initial Accounting of Inventory

... 5. Investments held through an Investment Company (i.e. JD Edwards): Attach the most recent statement, or call the Investment Company for the following information: a. The name of the investment company where the investments are held. b. The total value held in the investment company. c. Summary of ...

... 5. Investments held through an Investment Company (i.e. JD Edwards): Attach the most recent statement, or call the Investment Company for the following information: a. The name of the investment company where the investments are held. b. The total value held in the investment company. c. Summary of ...

Free Sample

... B. The ownership right of the stockholder(s) of the entity. C. Probable future sacrifices of economic benefits. D. All of the above. E. None of the above. 10. Accumulated depreciation on a balance sheet: ...

... B. The ownership right of the stockholder(s) of the entity. C. Probable future sacrifices of economic benefits. D. All of the above. E. None of the above. 10. Accumulated depreciation on a balance sheet: ...

The effect of foreign ownership on the financial

... This study examined the effect of foreign ownership on the financial and market performance of firms in the South African economy. To review this relationship 18 foreign owned firms listed on the Johannesburg Stock Exchange All Share Index in 2010 were identified and paired with a locally owned firm ...

... This study examined the effect of foreign ownership on the financial and market performance of firms in the South African economy. To review this relationship 18 foreign owned firms listed on the Johannesburg Stock Exchange All Share Index in 2010 were identified and paired with a locally owned firm ...

Page 1 of 1 REPL::Annual Reports and Related Documents:: 7/5

... Where the consideration paid by the Company for the purchase or acquisition of Shares is made out of profits, the amount available for the distribution of cash dividends by the Company will be correspondingly reduced. Where the consideration paid by the Company for the purchase or acquisition of Sha ...

... Where the consideration paid by the Company for the purchase or acquisition of Shares is made out of profits, the amount available for the distribution of cash dividends by the Company will be correspondingly reduced. Where the consideration paid by the Company for the purchase or acquisition of Sha ...

ALMOST FAMILY INC (Form: 10-K, Received: 03

... services we provide to our patients and customers. Reimbursement under these programs, primarily Medicare and Medicaid, is subject to frequent changes as policy makers balance constituents’ needs for health care services within the constraints of the specific government’s fiscal budgets. Medicare an ...

... services we provide to our patients and customers. Reimbursement under these programs, primarily Medicare and Medicaid, is subject to frequent changes as policy makers balance constituents’ needs for health care services within the constraints of the specific government’s fiscal budgets. Medicare an ...

Director Penalties and Incentives to Restate: Evidence from Stock

... restatement. We gain insight into whether director penalties are levied in this manner by separately examining the penalties for the underlying misstatement and the restatement in two ways. First, we examine stock option data to identify firms that likely backdated but did not issue a restatement. P ...

... restatement. We gain insight into whether director penalties are levied in this manner by separately examining the penalties for the underlying misstatement and the restatement in two ways. First, we examine stock option data to identify firms that likely backdated but did not issue a restatement. P ...