Cerberus Capital Management Acquires Chrysler Corporation

... leveraged buyout transactions initiate on the premise that private equity investors acquire and go private then regenerate or resurrect the ailing entity with for a future profit sale. To aide in its effort, Cerberus used the mortgage the entity assets so as to provide funding whatever acquisition p ...

... leveraged buyout transactions initiate on the premise that private equity investors acquire and go private then regenerate or resurrect the ailing entity with for a future profit sale. To aide in its effort, Cerberus used the mortgage the entity assets so as to provide funding whatever acquisition p ...

MBS Total Return Fund

... Investments in Mortgage-Backed Securities include additional risks that investors should be aware of such as credit risk, interest rate risk, prepayment risk, real estate market risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Fund may ...

... Investments in Mortgage-Backed Securities include additional risks that investors should be aware of such as credit risk, interest rate risk, prepayment risk, real estate market risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Fund may ...

Infrastructure - Debt and Equity Investments for UK Insurers

... Insurance and reinsurance undertakings may apply a matching adjustment […] where the following conditions are met: […] (c) the expected cash-flows of the assigned portfolio of assets replicate each of the expected cashflows of the portfolio of insurance or reinsurance obligations (h) the cash-flows ...

... Insurance and reinsurance undertakings may apply a matching adjustment […] where the following conditions are met: […] (c) the expected cash-flows of the assigned portfolio of assets replicate each of the expected cashflows of the portfolio of insurance or reinsurance obligations (h) the cash-flows ...

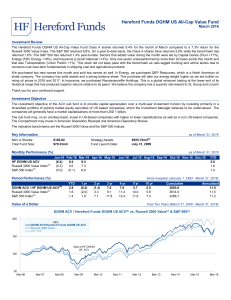

Click to download DGHM ACV December 2015

... their potential merger with Halliburton continues to be delayed by regulatory issues. Range Resources was sold due to a deteriorating natural gas oversupply situation. Cash averaged 3.0%. Thank you for your continued support. ...

... their potential merger with Halliburton continues to be delayed by regulatory issues. Range Resources was sold due to a deteriorating natural gas oversupply situation. Cash averaged 3.0%. Thank you for your continued support. ...

Do hedge funds hedge?

... salient personalities such as George Soros to the forefront. Long and short in any major market they often make leveraged bets in direction of certain macro variables such as interest or exchange rates after having identified mispriced valuations. In general these funds seem to rely more on the intu ...

... salient personalities such as George Soros to the forefront. Long and short in any major market they often make leveraged bets in direction of certain macro variables such as interest or exchange rates after having identified mispriced valuations. In general these funds seem to rely more on the intu ...

Transaction cost changes

... If you have any questions or would like further information, please: > speak with your ANZ Financial Planner > email us at [email protected] or [email protected] for ANZ OneAnswer > call Customer Services on 13 38 63 weekdays 8am to 8pm (Sydney time). This information is current as at Mar ...

... If you have any questions or would like further information, please: > speak with your ANZ Financial Planner > email us at [email protected] or [email protected] for ANZ OneAnswer > call Customer Services on 13 38 63 weekdays 8am to 8pm (Sydney time). This information is current as at Mar ...

Direct Leverage - Treasury.gov.au

... recovery of the debt must be quarantined, or ring fenced, to the specific asset acquired with the debt. The asset must be held in a special purpose trust as a further protection regarding recourse. No other assets of the fund can be used to secure the loan. The Benefits of Direct Leverage I submit t ...

... recovery of the debt must be quarantined, or ring fenced, to the specific asset acquired with the debt. The asset must be held in a special purpose trust as a further protection regarding recourse. No other assets of the fund can be used to secure the loan. The Benefits of Direct Leverage I submit t ...

FACTSHEET – 05.07.2017 Solactive Panthera World Market

... This info service is offered exclusively by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or imp ...

... This info service is offered exclusively by Solactive AG, Guiollettstr. 54, D-60325 Frankfurt am Main, E-Mail [email protected] | Disclaimer: The financial instrument is not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or imp ...

Vanguard High Dividend Yield Index Fund ETF Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard and Poor's. GICS is a service mark of MSCI and S&P and has been licensed for us ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard and Poor's. GICS is a service mark of MSCI and S&P and has been licensed for us ...

Document

... • Most, if not all, open-end mutual funds permit you to transfer all or any part of your investment from one fund to another fund within its family. This kind of transfer is commonly called "switching" ...

... • Most, if not all, open-end mutual funds permit you to transfer all or any part of your investment from one fund to another fund within its family. This kind of transfer is commonly called "switching" ...

UNIT IV

... business. No growth and expansion of business can take place without sufficient finance. It shows that no business activity is possible without finance. This is why; every business has to make plans regarding acquisition and utilization of funds. ...

... business. No growth and expansion of business can take place without sufficient finance. It shows that no business activity is possible without finance. This is why; every business has to make plans regarding acquisition and utilization of funds. ...

Review Questions

... from property provides a steady, dependable stream of income for investors. Some REITs either make or purchase mortgage loans on comm ercial property, and some do both. Individual REITs have different characteristics and may be highly specialized, depending on the investment strategy and management ...

... from property provides a steady, dependable stream of income for investors. Some REITs either make or purchase mortgage loans on comm ercial property, and some do both. Individual REITs have different characteristics and may be highly specialized, depending on the investment strategy and management ...

Note on the methodology for developing a more precise

... economic and political thinking. In a context of markets tending towards increased volatility, the various risks borne by financial assets will certainly not diminish and it is very important to know precisely how these risks are shared between the different sectors of the economy. It has often been ...

... economic and political thinking. In a context of markets tending towards increased volatility, the various risks borne by financial assets will certainly not diminish and it is very important to know precisely how these risks are shared between the different sectors of the economy. It has often been ...

Return on Capital Employed The ROCE Formula Calculating ROCE

... return on assets (ROA) and return on equity (ROE). Both represent management’s ability to generate profits; however, both give an incomplete picture of the capital base that management has at its disposal, since they consider only total assets (in the case of ROA) or total equity (in the case of ROE) ...

... return on assets (ROA) and return on equity (ROE). Both represent management’s ability to generate profits; however, both give an incomplete picture of the capital base that management has at its disposal, since they consider only total assets (in the case of ROA) or total equity (in the case of ROE) ...

Invisible Receipts Purpose Description Code . No. SERVICES

... Remittances made on account of dividends by companies, firms, and banks to foreign shareholders having direct investment (ownership of 10% or more) in the enterprises operating in Pakistan. ...

... Remittances made on account of dividends by companies, firms, and banks to foreign shareholders having direct investment (ownership of 10% or more) in the enterprises operating in Pakistan. ...

Click to download DGHM ACV March 2016

... shale company. The company has solid assets and a strong balance sheet. This purchase will take our energy weight higher as we are bullish on rising oil prices in 2016 and 2017. In Insurance, we purchased RenaissanceRe Holdings. This is a global reinsurer trading at the lower end of its historical r ...

... shale company. The company has solid assets and a strong balance sheet. This purchase will take our energy weight higher as we are bullish on rising oil prices in 2016 and 2017. In Insurance, we purchased RenaissanceRe Holdings. This is a global reinsurer trading at the lower end of its historical r ...

Chairman`s Letter 2005 - Plymouth Rock Assurance

... overall volume for the group went down for the first time in many years, and not because we were trimming away customers we didn’t want or turning away risks at insufficient prices. The other is that 2005 was among the most profitable years in the history of our industry, both nationally and in our ...

... overall volume for the group went down for the first time in many years, and not because we were trimming away customers we didn’t want or turning away risks at insufficient prices. The other is that 2005 was among the most profitable years in the history of our industry, both nationally and in our ...

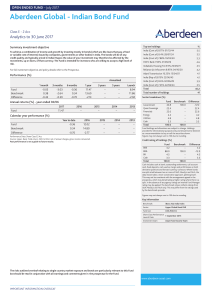

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

CHAPTER 12

... cost to acquire the investment exceeds the book value of the net assets acquired. Compare fair value of net assets acquired to their book value. If any of the difference is due to “undervaluation” of depreciable assets or inventory, then take additional depreciation over the life of the depreciable ...

... cost to acquire the investment exceeds the book value of the net assets acquired. Compare fair value of net assets acquired to their book value. If any of the difference is due to “undervaluation” of depreciable assets or inventory, then take additional depreciation over the life of the depreciable ...

Calculate Your Own Working Capital/Ratio

... debt servicing capacity / annual term principal and interest – A linking ratio (links the income statement and balance sheet) – A measure of long-term solvency used by lenders ...

... debt servicing capacity / annual term principal and interest – A linking ratio (links the income statement and balance sheet) – A measure of long-term solvency used by lenders ...

Fair Value: Fact or Opinion

... If life were simple, the value of an asset would be analyzed by looking at how an exactly identical asset - in terms of risk, growth and cash flows - is priced. Identical assets can be found with real assets or even with fixed income assets, but difficult to find with risky assets or businesses. In ...

... If life were simple, the value of an asset would be analyzed by looking at how an exactly identical asset - in terms of risk, growth and cash flows - is priced. Identical assets can be found with real assets or even with fixed income assets, but difficult to find with risky assets or businesses. In ...

Are investment certificates too complex?

... bonds are. However it is only if the issuer becomes bankrupt that the certificate holder suffers a total loss or receives only part of the invested capital back. There are now ways of hedging against this default risk. ...

... bonds are. However it is only if the issuer becomes bankrupt that the certificate holder suffers a total loss or receives only part of the invested capital back. There are now ways of hedging against this default risk. ...

Concentration and Diversification in Long

... is our Chief Compliance Officer, a job from which he derives great satisfaction. We have 10 employees in total. We manage the portfolios jointly. We don’t specialize as to industry. We want six eyes looking at each investment idea. TWST: What do you believe Heathbridge does particularly well in serv ...

... is our Chief Compliance Officer, a job from which he derives great satisfaction. We have 10 employees in total. We manage the portfolios jointly. We don’t specialize as to industry. We want six eyes looking at each investment idea. TWST: What do you believe Heathbridge does particularly well in serv ...

43% 15% 54% - Columbia Threadneedle Investments

... social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards than those generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Growth securities, at times, may not perform as well as value sec ...

... social and others within a particular country, as well as to currency instabilities and less stringent financial and accounting standards than those generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Growth securities, at times, may not perform as well as value sec ...

05 HF DGHM ACV MAY 2011

... The Hereford Funds DGHM US Allcap Value Fund returned Ͳ2.3% for the month of May compared to a -1.1% return for the Russell 3000 Value Index. For the year to date period, the fund was up 7.1% compared to a return of 8.0% for the Russell 3000 Value Index. Sectors that added value during the month wer ...

... The Hereford Funds DGHM US Allcap Value Fund returned Ͳ2.3% for the month of May compared to a -1.1% return for the Russell 3000 Value Index. For the year to date period, the fund was up 7.1% compared to a return of 8.0% for the Russell 3000 Value Index. Sectors that added value during the month wer ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.