2050 Retirement Strategy Fund

... The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic instability and political developments. The portfolios also invest some of their assets in small and midsize companies. Such investments increase the ris ...

... The Retirement Strategy Funds’ underlying investments include international companies, which involve such risks as currency fluctuations, economic instability and political developments. The portfolios also invest some of their assets in small and midsize companies. Such investments increase the ris ...

Alternative Investment Funds

... Investor diversification conditions should incorporate a look-through approach SEBI registered Foreign Venture Capital Investors and Foreign Portfolio Investors should automatically qualify as an eligible investment fund Determination of fund corpus should be tested 24 months from the date of its la ...

... Investor diversification conditions should incorporate a look-through approach SEBI registered Foreign Venture Capital Investors and Foreign Portfolio Investors should automatically qualify as an eligible investment fund Determination of fund corpus should be tested 24 months from the date of its la ...

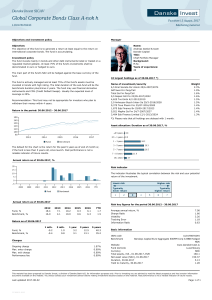

Global Corporate Bonds Class A-nok h

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

Merk Investments

... Since the Fund primarily invests in foreign currencies, changes in currency exchange rates will affect the value of what the Fund owns and the price of the Fund's shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of cu ...

... Since the Fund primarily invests in foreign currencies, changes in currency exchange rates will affect the value of what the Fund owns and the price of the Fund's shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of cu ...

here [PDF 930KB]

... as significantly undervalued in terms of purchasing power parity (PPP). PPP, measured via what is termed the real effective exchange rate, gives a measure of the purchasing power of one currency compared to another. The Big Mac index of real purchasing power, invented by The Economist magazine in 19 ...

... as significantly undervalued in terms of purchasing power parity (PPP). PPP, measured via what is termed the real effective exchange rate, gives a measure of the purchasing power of one currency compared to another. The Big Mac index of real purchasing power, invented by The Economist magazine in 19 ...

Quiznos Completes Restructuring of Debt and Strengthens Financial

... New Owners Affirm Commitment to Best‐In‐Class Products, Stores and Marketing ...

... New Owners Affirm Commitment to Best‐In‐Class Products, Stores and Marketing ...

item[`#file`]->filename - Open Michigan

... ROE = Net Income/Equity = (EBIT-int-tax)/equity Profitability ratio ROE = rate of growth in equity ROE is key to financial (and therefore operational and strategic) success • If the firm can grow equity, then – It qualifies to borrow (can raise debt funds) on good terms – It can purchase necessary a ...

... ROE = Net Income/Equity = (EBIT-int-tax)/equity Profitability ratio ROE = rate of growth in equity ROE is key to financial (and therefore operational and strategic) success • If the firm can grow equity, then – It qualifies to borrow (can raise debt funds) on good terms – It can purchase necessary a ...

A cost effective way to set up an investment fund

... the issuance of the information, and such opinions and estimates are also subject to change without notice. Neither this presentation, nor any of the information it contains, constitutes or will form the basis of a representation, contract or term of any contract. It is essential that before proceed ...

... the issuance of the information, and such opinions and estimates are also subject to change without notice. Neither this presentation, nor any of the information it contains, constitutes or will form the basis of a representation, contract or term of any contract. It is essential that before proceed ...

MT Crowdfunding Case Study 1.indd

... (think private security offerings). The characteristic that all of these platforms have in common is their desire to create new marketplaces to connect those seeking capital with those looking to invest or redeploy capital outside of the traditional capital markets. The industry is evolving and has ...

... (think private security offerings). The characteristic that all of these platforms have in common is their desire to create new marketplaces to connect those seeking capital with those looking to invest or redeploy capital outside of the traditional capital markets. The industry is evolving and has ...

Mackenzie Maximum Diversification Emerging Markets Index ETF

... performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. An index’s performance is not illustrative of an investable product’s performance. Indexes are ...

... performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. An index’s performance is not illustrative of an investable product’s performance. Indexes are ...

Cost of Capital

... nominal, after tax, operating cash flows) and discount with an appropriate discount rate • What is the appropriate discount rate? ...

... nominal, after tax, operating cash flows) and discount with an appropriate discount rate • What is the appropriate discount rate? ...

PDF

... change in net sales. In general, highly profitable slow-growing firms should generate the most cash, while less profitable fast-growing firms will need significant external financing. In addition, earnings before interest and taxes and net income grow at the same rate. It means that the degree of to ...

... change in net sales. In general, highly profitable slow-growing firms should generate the most cash, while less profitable fast-growing firms will need significant external financing. In addition, earnings before interest and taxes and net income grow at the same rate. It means that the degree of to ...

Title: Arial Narrow, size 28 on 1 or 2 lines

... The information contained within this document (‘information’) is believed to be reliable but BNP Paribas Securities Services does not warrant its completeness or accuracy. Opinions and estimates contained herein constitute BNP Paribas Securities Services’ judgment and are subject to change without ...

... The information contained within this document (‘information’) is believed to be reliable but BNP Paribas Securities Services does not warrant its completeness or accuracy. Opinions and estimates contained herein constitute BNP Paribas Securities Services’ judgment and are subject to change without ...

Large Cap Growth Fund FAQ - Westfield Capital Management

... within a disciplined investment process that is designed to enable its team of career analysts to impact portfolios. Westfield believes constant analysis and measurement of its investment process permits continual improvement to its approach to asset management. What are Fund’s investment objectives ...

... within a disciplined investment process that is designed to enable its team of career analysts to impact portfolios. Westfield believes constant analysis and measurement of its investment process permits continual improvement to its approach to asset management. What are Fund’s investment objectives ...

- FRASER (St.Louis Fed)

... series of the economy over time, but in each period there is uncertainty regarding future consumption. Future consumption is financed with income on equity holdings and income from holdings of a riskless asset. The riskless asset provides a stream of income that is certain, while the equity holdings ...

... series of the economy over time, but in each period there is uncertainty regarding future consumption. Future consumption is financed with income on equity holdings and income from holdings of a riskless asset. The riskless asset provides a stream of income that is certain, while the equity holdings ...

Tactical ETF Market Growth Strategy

... SEI uses a goals-based approach to investing that combines both traditional finance and behavioral theory. The selection of investment styles for a particular portfolio is guided by the investor’s goals and other constraints or preferences (e.g., risk/return requirements or tax implications). From a ...

... SEI uses a goals-based approach to investing that combines both traditional finance and behavioral theory. The selection of investment styles for a particular portfolio is guided by the investor’s goals and other constraints or preferences (e.g., risk/return requirements or tax implications). From a ...

15 - Finance

... Its dollar expenses will increase by normal inflation at a 4% rate over last year. 5. Finance and administration expenses will need to expand to support the higher volume, but due to scale economies the expansion will be at a lower rate than the growth in sales. A target growth of 10% is planned for ...

... Its dollar expenses will increase by normal inflation at a 4% rate over last year. 5. Finance and administration expenses will need to expand to support the higher volume, but due to scale economies the expansion will be at a lower rate than the growth in sales. A target growth of 10% is planned for ...

Passive Global Equity (inc. UK) Fund

... We’ve based this information on our current understanding of law and practice. We make every effort to ensure that this information is helpful, accurate and correct, but it may change or may not apply to your personal circumstances. All funds carry some risk and you should consider these risks befor ...

... We’ve based this information on our current understanding of law and practice. We make every effort to ensure that this information is helpful, accurate and correct, but it may change or may not apply to your personal circumstances. All funds carry some risk and you should consider these risks befor ...

ICG: The Rise of Private Debt as an Institutional Asset Class

... the worst crisis since the Great Depression of 192932, the demand for fresh capital by mid-market companies has grown rapidly to fund their business growth as well as to raise fresh capital to refinance existing loans. In Europe alone, for example, the sums involved could be between €2.4trn and €2.8 ...

... the worst crisis since the Great Depression of 192932, the demand for fresh capital by mid-market companies has grown rapidly to fund their business growth as well as to raise fresh capital to refinance existing loans. In Europe alone, for example, the sums involved could be between €2.4trn and €2.8 ...

During August 2012, company produced and sold 3000 boxes of

... In the real world, capital markets are imperfect, so it is usual for companies to be restricted in the amount of finance available for capital investment. Companies therefore need to choose between competing investment proposals and select those with the best strategic fit and the most appropriate u ...

... In the real world, capital markets are imperfect, so it is usual for companies to be restricted in the amount of finance available for capital investment. Companies therefore need to choose between competing investment proposals and select those with the best strategic fit and the most appropriate u ...

INTRODUCING THE WOODFORD EQUITY INCOME FEEDER FUND

... IE00BD037V94 IE00BD037T72 IE00BD9F8T12 IE00BD037X19 IE00BD037W02 IE00BD038055 IE00BD037Z33 IE00BD037Y26 ...

... IE00BD037V94 IE00BD037T72 IE00BD9F8T12 IE00BD037X19 IE00BD037W02 IE00BD038055 IE00BD037Z33 IE00BD037Y26 ...

Joint-stock Company supporting the capitalization and

... The Guarantee guarantees investments in the Company’s share capital and ensures recovery of 80 per cent of the difference between (i) capital injected to the Company for any reason plus investment costs and (ii) the amount received by the relevant investor, for any reason, during each fiscal year, ...

... The Guarantee guarantees investments in the Company’s share capital and ensures recovery of 80 per cent of the difference between (i) capital injected to the Company for any reason plus investment costs and (ii) the amount received by the relevant investor, for any reason, during each fiscal year, ...

chapter 5

... stockholders' equity to finance operations. At some point in time, the company will have to repay this debt. The company will either have to repay this debt by (1) generating cash from operations, (2) selling assets, (3) borrowing additional cash, or (4) acquiring cash by issuing stock. From the sta ...

... stockholders' equity to finance operations. At some point in time, the company will have to repay this debt. The company will either have to repay this debt by (1) generating cash from operations, (2) selling assets, (3) borrowing additional cash, or (4) acquiring cash by issuing stock. From the sta ...

Corporate Finance

... bond rate at that time was 2.75%. Using an estimated equity risk premium of 5.76%, we estimated the cost of equity for Disney to be 8.52%: Cost of Equity = 2.75% + 1.0013(5.76%) = 8.52% Disney’s bond rating in May 2009 was A, and based on this rating, the estimated pretax cost of debt for Disney is ...

... bond rate at that time was 2.75%. Using an estimated equity risk premium of 5.76%, we estimated the cost of equity for Disney to be 8.52%: Cost of Equity = 2.75% + 1.0013(5.76%) = 8.52% Disney’s bond rating in May 2009 was A, and based on this rating, the estimated pretax cost of debt for Disney is ...

Capital Reduction

... “The company reduced capital by reducing the number of shares on August 3, 2010 in order to wipe out the deficit in retained earnings that was incurred during normal business undertakings. The company did not need capital reduction, but with the deficit in retained earnings, the company was not able ...

... “The company reduced capital by reducing the number of shares on August 3, 2010 in order to wipe out the deficit in retained earnings that was incurred during normal business undertakings. The company did not need capital reduction, but with the deficit in retained earnings, the company was not able ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.

![here [PDF 930KB]](http://s1.studyres.com/store/data/015583737_1-d7b211cd32cfe2b3ea9542c07b5cf992-300x300.png)

![item[`#file`]->filename - Open Michigan](http://s1.studyres.com/store/data/021191075_1-36ce23228fd8a88fa4a71cb51eef3709-300x300.png)