Living Annuity 3.4MB

... the average return of large fund managers (BEFORE FEES) since inception (1 January 2008). 10X’s total fees are generally half the industry average** and so 10X saves most clients at least 1% pa (of the investment balance) in fees. We thus also show the average return of large fund managers reduced b ...

... the average return of large fund managers (BEFORE FEES) since inception (1 January 2008). 10X’s total fees are generally half the industry average** and so 10X saves most clients at least 1% pa (of the investment balance) in fees. We thus also show the average return of large fund managers reduced b ...

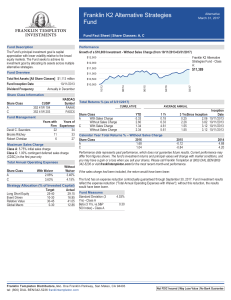

Franklin K2 Alternative Strategies Fund Fact Sheet

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

... The Fund may shift allocations among strategies at any time. Further, K2 may determine in its sole discretion to not allocate to one or more of the strategies and/or to add new strategies. Accordingly the above target allocations are presented for illustrative purposes only, and should not be viewed ...

Investor profile questionnaire - Sun Life of Canada

... the long term I have a better chance of higher returns. Nevertheless, I do worry when the stock market drops significantly. (10) I am very comfortable with volatility and seek more aggressive investments, knowing that in the short term this strategy may result in declines in value, but in the long t ...

... the long term I have a better chance of higher returns. Nevertheless, I do worry when the stock market drops significantly. (10) I am very comfortable with volatility and seek more aggressive investments, knowing that in the short term this strategy may result in declines in value, but in the long t ...

UNIVERSITY OF NORTH FLORIDA

... As reports continued to show a stable or strong economy, and as interest rates remained level, exposure to this sector was increased. Positions included Berkley (BER), American Express (AXP) and the sector ETF, ...

... As reports continued to show a stable or strong economy, and as interest rates remained level, exposure to this sector was increased. Positions included Berkley (BER), American Express (AXP) and the sector ETF, ...

Revolving doors, musical chairs and portfolio performance

... the change in senior portfolio manager can sometimes be material, even though on average the signal is less distinct. CEOs of fund management firms should not ignore this phenomenon, nor treat it as an exceptional occurrence. Their strategies must be resilient to the threat posed by staff turnover a ...

... the change in senior portfolio manager can sometimes be material, even though on average the signal is less distinct. CEOs of fund management firms should not ignore this phenomenon, nor treat it as an exceptional occurrence. Their strategies must be resilient to the threat posed by staff turnover a ...

Deloitte report identifies `red flags` for hedge fund managers and

... While the hedge fund industry is maturing, the risk management and valuation practices of many hedge funds can best be characterised as in their adolescence, according to a study by Deloitte Research and Deloitte & Touche USA's Investment Management Industry Group that warns hedge fund managers and ...

... While the hedge fund industry is maturing, the risk management and valuation practices of many hedge funds can best be characterised as in their adolescence, according to a study by Deloitte Research and Deloitte & Touche USA's Investment Management Industry Group that warns hedge fund managers and ...

Investment Management Policy

... Financial Institutions should have been in continuous operation for more than 5 years To reduce concentration risk and diversify investment portfolio, investment in any single institution should not exceed 2.5% of the total asset of the respective institution or 10% of the total investment of PK ...

... Financial Institutions should have been in continuous operation for more than 5 years To reduce concentration risk and diversify investment portfolio, investment in any single institution should not exceed 2.5% of the total asset of the respective institution or 10% of the total investment of PK ...

A New Strategy for Social Security Investment in Latin America

... shifting that sale to the Social Security personal retirement accounts frees up other saving for real investment in business equipment and structures. But if the availability of new saving in the PRAs encourages the government to increase its spending and to finance the resulting deficit by selling ...

... shifting that sale to the Social Security personal retirement accounts frees up other saving for real investment in business equipment and structures. But if the availability of new saving in the PRAs encourages the government to increase its spending and to finance the resulting deficit by selling ...

File: ch01, Chapter 1: The Nature of Investments

... portfolio of securities. Investment bankers assist with mergers and acquisitions, as well as arranging the sale of new securities to institutional investors. A security analyst, or investment analyst, may assist investment bankers or portfolio managers by providing a valuation of a company and its s ...

... portfolio of securities. Investment bankers assist with mergers and acquisitions, as well as arranging the sale of new securities to institutional investors. A security analyst, or investment analyst, may assist investment bankers or portfolio managers by providing a valuation of a company and its s ...

Why equity markets matter

... markets in the form of private placements or public offerings. Our report shows how equities can fund the growth of European businesses and create jobs. In addition, equity markets can make a much greater contribution to funding the growth of European businesses and creating jobs.1 We believe that e ...

... markets in the form of private placements or public offerings. Our report shows how equities can fund the growth of European businesses and create jobs. In addition, equity markets can make a much greater contribution to funding the growth of European businesses and creating jobs.1 We believe that e ...

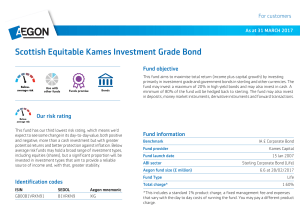

Scottish Equitable Kames Investment Grade Bond

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

... for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type of company. Some funds in this category may be more suitable f ...

Chapter 10: Input Demand: The Capital Market and the Investment

... • The ability to lend at the market rate of interest means that there is an opportunity cost associated with every investment project. • The evaluation process thus involves not only estimating future benefits, but also comparing the possible alternative uses of the funds required to undertake the p ...

... • The ability to lend at the market rate of interest means that there is an opportunity cost associated with every investment project. • The evaluation process thus involves not only estimating future benefits, but also comparing the possible alternative uses of the funds required to undertake the p ...

Factsheet-WisdomTree Germany Equity UCITS ETF - USD

... The WisdomTree Germany Hedged Equity Index is a dividend weighted index designed to provide exposure to German equity markets while at the same time neutralising exposure to fluctuations of the value of the Euro relative to US Dollar. The Index consists of dividend-paying companies incorporated in G ...

... The WisdomTree Germany Hedged Equity Index is a dividend weighted index designed to provide exposure to German equity markets while at the same time neutralising exposure to fluctuations of the value of the Euro relative to US Dollar. The Index consists of dividend-paying companies incorporated in G ...

Diversification – Too Much of a Good Thing is a Bad Thing

... often mimic an index fund. This is galling as the investment manager is charging a fee ostensibly to construct a unique portfolio and then ends up creating an index fund – at a cost far in excess of what a standard index fund fee is! Another related issue in the portfolio management sphere was broug ...

... often mimic an index fund. This is galling as the investment manager is charging a fee ostensibly to construct a unique portfolio and then ends up creating an index fund – at a cost far in excess of what a standard index fund fee is! Another related issue in the portfolio management sphere was broug ...

Wells Fargo Funds to merge certain funds

... prospectus/proxy statement—when available—in its entirety because it will contain important information about the acquiring funds, merging funds, transaction, fees, expenses, risk considerations, persons soliciting proxies in connection with the transaction, and the interests of these persons in the ...

... prospectus/proxy statement—when available—in its entirety because it will contain important information about the acquiring funds, merging funds, transaction, fees, expenses, risk considerations, persons soliciting proxies in connection with the transaction, and the interests of these persons in the ...

Present financial position and performance of the firm

... How large should the firm be? Many industries have been the subject of studies focusing on the economies of size. Firms often benefit from growth due to increases in efficiency as well as perhaps being able to buy in bulk and hence pay a lower price for inputs. Let’s examine the graph below and draw ...

... How large should the firm be? Many industries have been the subject of studies focusing on the economies of size. Firms often benefit from growth due to increases in efficiency as well as perhaps being able to buy in bulk and hence pay a lower price for inputs. Let’s examine the graph below and draw ...

(EPL) title for 2014-15 on 3 May 2015 with three games

... 4 May 2015. This move is expected to create one of the largest retail networks in the country. What is the total value of this all-stock transaction? – Rs. 750 crore Explanation: After this huge merger in Indian retail segment, the combined retail entity is expected to have a total turnover of Rs. 1 ...

... 4 May 2015. This move is expected to create one of the largest retail networks in the country. What is the total value of this all-stock transaction? – Rs. 750 crore Explanation: After this huge merger in Indian retail segment, the combined retail entity is expected to have a total turnover of Rs. 1 ...

print to PDF - Willis Owen

... From this example, we can see that both the funds pay out the same income but as Fund B has had more capital growth, the income yield is reduced. Although looking at the yield is important when considering an income fund, it is also important to consider the capital growth as both contribute to the ...

... From this example, we can see that both the funds pay out the same income but as Fund B has had more capital growth, the income yield is reduced. Although looking at the yield is important when considering an income fund, it is also important to consider the capital growth as both contribute to the ...

Macquarie Group - The Energy Roundtable

... Large new “renewables” commitments in Ontario and Quebec – over 2,000 MW ...

... Large new “renewables” commitments in Ontario and Quebec – over 2,000 MW ...

Click to download DGHM ACV SEPTEMBER 2010

... The Hereford/Dalton Greiner Allcap Value Fund returned 9.48% during the month of September compared to an 8.00% return for the Russell 3000 Value Index. Year to date, the Hereford/Dalton Greiner Allcap Value Fund returned 7.71% compared to a 4.77% return for the Russell 3000 Value Index. The outperf ...

... The Hereford/Dalton Greiner Allcap Value Fund returned 9.48% during the month of September compared to an 8.00% return for the Russell 3000 Value Index. Year to date, the Hereford/Dalton Greiner Allcap Value Fund returned 7.71% compared to a 4.77% return for the Russell 3000 Value Index. The outperf ...

MBS Total Return Fund

... Investments in Mortgage-Backed Securities include additional risks that investors should be aware of such as credit risk, interest rate risk, prepayment risk, real estate market risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Fund may ...

... Investments in Mortgage-Backed Securities include additional risks that investors should be aware of such as credit risk, interest rate risk, prepayment risk, real estate market risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. The Fund may ...

responsible investment for institutional investors in hedge funds

... Investors with a RI mandate are looking for investment managers that systematically integrate ESG issues into their investment process, valuation calculations, and active ownership practices, and those who continually assess the impact of ESG issues on their portfolio’s risk and return. These invest ...

... Investors with a RI mandate are looking for investment managers that systematically integrate ESG issues into their investment process, valuation calculations, and active ownership practices, and those who continually assess the impact of ESG issues on their portfolio’s risk and return. These invest ...

Total liabilities and equity

... • Short-term investments decrease to zero—this is because we projected that Van Leer wouldn’t simultaneously borrow short-term and invest shortterm. • Short-term borrowing increases substantially. If this happens in subsequent years, the long-term debt policy (or dividend policy) may need to be revi ...

... • Short-term investments decrease to zero—this is because we projected that Van Leer wouldn’t simultaneously borrow short-term and invest shortterm. • Short-term borrowing increases substantially. If this happens in subsequent years, the long-term debt policy (or dividend policy) may need to be revi ...

CREF Social Choice

... Economic, political, social, or diplomatic developments can also negatively impact performance. High-Yield Securities: Investments in below-investment-grade debt securities and unrated securities of similar credit quality, commonly known as "junk bonds" or "high-yield securities," may be subject to ...

... Economic, political, social, or diplomatic developments can also negatively impact performance. High-Yield Securities: Investments in below-investment-grade debt securities and unrated securities of similar credit quality, commonly known as "junk bonds" or "high-yield securities," may be subject to ...

Cerberus Capital Management Acquires Chrysler Corporation

... leveraged buyout transactions initiate on the premise that private equity investors acquire and go private then regenerate or resurrect the ailing entity with for a future profit sale. To aide in its effort, Cerberus used the mortgage the entity assets so as to provide funding whatever acquisition p ...

... leveraged buyout transactions initiate on the premise that private equity investors acquire and go private then regenerate or resurrect the ailing entity with for a future profit sale. To aide in its effort, Cerberus used the mortgage the entity assets so as to provide funding whatever acquisition p ...

Private equity

In finance, private equity is an asset class consisting of equity securities and debt in operating companies that are not publicly traded on a stock exchange.A private equity investment will generally be made by a private equity firm, a venture capital firm or an angel investor. Each of these categories of investor has its own set of goals, preferences and investment strategies; however, all provide working capital to a target company to nurture expansion, new-product development, or restructuring of the company’s operations, management, or ownership.Bloomberg Businessweek has called private equity a rebranding of leveraged-buyout firms after the 1980s. Common investment strategies in private equity include: leveraged buyouts, venture capital, growth capital, distressed investments and mezzanine capital. In a typical leveraged-buyout transaction, a private-equity firm buys majority control of an existing or mature firm. This is distinct from a venture-capital or growth-capital investment, in which the investors (typically venture-capital firms or angel investors) invest in young, growing or emerging companies, and rarely obtain majority control.Private equity is also often grouped into a broader category called private capital, generally used to describe capital supporting any long-term, illiquid investment strategy.