Downlaod File

... Annual salary would be $120,000 minus the $36,000 would equal to $84,000. His current bank balance is $300,000. Therefore the sum of his savings for 20 years would equal to $1,980,000 ($300,000 + ($84,000*20 years) at the end of his career. Asset allocation is balancing risk and reward by diversifyi ...

... Annual salary would be $120,000 minus the $36,000 would equal to $84,000. His current bank balance is $300,000. Therefore the sum of his savings for 20 years would equal to $1,980,000 ($300,000 + ($84,000*20 years) at the end of his career. Asset allocation is balancing risk and reward by diversifyi ...

EIB GEEREF and REPIN ppt

... ~400 projects annually in more than 160 countries More than 25% of total EIB lending goes towards Climate Action In 2013 EUR 19bn (signed loans) in Climate Action Almost EUR 100bn of financing worldwide during 2008 ...

... ~400 projects annually in more than 160 countries More than 25% of total EIB lending goes towards Climate Action In 2013 EUR 19bn (signed loans) in Climate Action Almost EUR 100bn of financing worldwide during 2008 ...

Innovation in Climate Change: Financial Products and Services

... The information in this document is derived from sources HSBC believe to be reliable but which have not been independently verified. HSBC makes no guarantee of its accuracy and completeness, nor shall HSBC be liable for damages arising out of any person’s reliance upon this information. All charts a ...

... The information in this document is derived from sources HSBC believe to be reliable but which have not been independently verified. HSBC makes no guarantee of its accuracy and completeness, nor shall HSBC be liable for damages arising out of any person’s reliance upon this information. All charts a ...

Dynamic Global Value Fund Series G

... [‡] Risk rating measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfol ...

... [‡] Risk rating measures the degree of uncertainty that an investor can handle regarding fluctuations in the value of their portfolio. The amount of risk associated with any particular investment depends largely on your own personal circumstances including your time horizon, liquidity needs, portfol ...

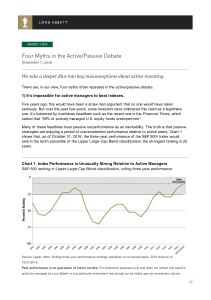

Four Myths in the Active/Passive Debate

... speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, b ...

... speaking, growth and value investments tend to react dif f erently during the economic cycle. Since value stocks are of ten cyclical in nature, they may benef it f rom the increased spending that usually occurs during an economic expansion. Growth stocks may also perf orm well during an expansion, b ...

Assets = Liabilities + Shareholders` Equity

... • Assets are equal to the sum of the company’s equity investment or capitalization, plus retained earnings, minus any current financial obligations or debt. • Assets are what a company uses to operate its business, while its liabilities and equity are two sources that support these assets. • Owner o ...

... • Assets are equal to the sum of the company’s equity investment or capitalization, plus retained earnings, minus any current financial obligations or debt. • Assets are what a company uses to operate its business, while its liabilities and equity are two sources that support these assets. • Owner o ...

BALANCE SHEET RESTRUCTURING AND INVESTMENT 1

... and equity was reduced. The increase in debt of the listed corporate sector in 1989/90 was half that of the previous year. It was negligible the following year, and firms actually reduced debt outstanding in 1991/92. Equity raisings, the other main source of external funds, were negligible through 1 ...

... and equity was reduced. The increase in debt of the listed corporate sector in 1989/90 was half that of the previous year. It was negligible the following year, and firms actually reduced debt outstanding in 1991/92. Equity raisings, the other main source of external funds, were negligible through 1 ...

AGENDA ITEM

... which have probably since been liquidated. The large US balance of payments current account deficit will probably now re-assert itself, which coupled with the desire by some countries to diversify some of their foreign exchange reserves from US dollars and the possible opening up of new short positi ...

... which have probably since been liquidated. The large US balance of payments current account deficit will probably now re-assert itself, which coupled with the desire by some countries to diversify some of their foreign exchange reserves from US dollars and the possible opening up of new short positi ...

Finding Value in the Environment Private equity firms are

... Bowen White, Research Associate, INSEAD Global Private Equity Initiative Private equity fund managers are well-known for their ability to generate value through active ownership of their portfolio company investments. From capital structure and strategy optimisation to streamlining operations and co ...

... Bowen White, Research Associate, INSEAD Global Private Equity Initiative Private equity fund managers are well-known for their ability to generate value through active ownership of their portfolio company investments. From capital structure and strategy optimisation to streamlining operations and co ...

Mini Case (p.45) A. Why is corporate finance important to all

... The global economic crisis can be broken into three parts just like anything: (1) beginning, (2) middle, and (3) end. First sub-prime standards were established in the mid-1990s allowing for less than credit worthy borrows to start purchasing homes. With lower fundamental loan standards in lending r ...

... The global economic crisis can be broken into three parts just like anything: (1) beginning, (2) middle, and (3) end. First sub-prime standards were established in the mid-1990s allowing for less than credit worthy borrows to start purchasing homes. With lower fundamental loan standards in lending r ...

Bankruptcy and Miller Channels

... PV of stocks without the gamble = 0 PV of bonds with the gamble = $30 / 1.5 = $20 PV of stocks with the gamble = $70 / 1.5 = $47 ...

... PV of stocks without the gamble = 0 PV of bonds with the gamble = $30 / 1.5 = $20 PV of stocks with the gamble = $70 / 1.5 = $47 ...

Farm Credit System

... 2009 Farmers Cooperative Conference Credit Markets Update November 9, 2009 ...

... 2009 Farmers Cooperative Conference Credit Markets Update November 9, 2009 ...

Download attachment

... compatible with the Muslim religion. The funds started springing up by the dozen. Last year 14 were launched, and six more were started in the first quarter of this year, according to the Kuwaiti-American consultancy Failaka International Inc. "A lot of people until very recently used to think it wa ...

... compatible with the Muslim religion. The funds started springing up by the dozen. Last year 14 were launched, and six more were started in the first quarter of this year, according to the Kuwaiti-American consultancy Failaka International Inc. "A lot of people until very recently used to think it wa ...

New Star Asia raises 325m - Investment International

... This brings the total amount raised for New Star International guaranteed hedge funds since September 2001 to more than $343 million, a record amount for guaranteed single manager hedge funds. This Fund is designed to provide investors with absolute performance over a six-year investment period and ...

... This brings the total amount raised for New Star International guaranteed hedge funds since September 2001 to more than $343 million, a record amount for guaranteed single manager hedge funds. This Fund is designed to provide investors with absolute performance over a six-year investment period and ...

Document

... In the US, on average, 60-80% of the investment expenditures is financed with internal funds. In other countries reliance on internal funds is generally lower but still 40-60%. New sales of debt strongly prevail over new equity issues Large variations between types of firms and industries (e.g. for ...

... In the US, on average, 60-80% of the investment expenditures is financed with internal funds. In other countries reliance on internal funds is generally lower but still 40-60%. New sales of debt strongly prevail over new equity issues Large variations between types of firms and industries (e.g. for ...

No such thing as a free lunch, even with private REITs

... “The market decides what [a public REIT] is worth on a minute-by-minute basis,” says David Kaufman, president of Westcourt Capital Corp., a consulting firm specializing in alternative investments. “Private REITs are less volatile.” The unit price of a private REIT doesn’t move in tandem with equity ...

... “The market decides what [a public REIT] is worth on a minute-by-minute basis,” says David Kaufman, president of Westcourt Capital Corp., a consulting firm specializing in alternative investments. “Private REITs are less volatile.” The unit price of a private REIT doesn’t move in tandem with equity ...

Product Profile

... perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative, or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these i ...

... perform as expected. The main risk with derivatives is that some types can amplify a gain or loss, potentially earning or losing substantially more money than the actual cost of the derivative, or that the counterparty may fail to honor its contract terms, causing a loss for the Fund. Use of these i ...

Investment Insight - December 2016

... probability of outperforming higher-cost actively managed funds. ...

... probability of outperforming higher-cost actively managed funds. ...

Activity 2:

... Slovakia is one of the following states of the Czechoslovak republic and was for more than 40 years negatively affected by the communist system, which has deeply destroyed the economic and social system. The country became a NATO and an EU member state last year but is still in a middle of the trans ...

... Slovakia is one of the following states of the Czechoslovak republic and was for more than 40 years negatively affected by the communist system, which has deeply destroyed the economic and social system. The country became a NATO and an EU member state last year but is still in a middle of the trans ...

Epoch Global Equity Shareholder Yield Fund Institutional Class

... implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS. TD Asset Management may not update any FLS. ...

... implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS. TD Asset Management may not update any FLS. ...

Scoring Just Down the Road from Wall Street

... diligence process is complete, and expectations and accountability are firmly in place, GPs begin working with entrepreneurs to map out the company’s workforce needs and identifying strategies for finding the talent they need to grow, but were previously unable to afford. Even EDM firms that are rea ...

... diligence process is complete, and expectations and accountability are firmly in place, GPs begin working with entrepreneurs to map out the company’s workforce needs and identifying strategies for finding the talent they need to grow, but were previously unable to afford. Even EDM firms that are rea ...

Document

... sellers such that all market participants are pricetakers • The primary market (for all issuance) should have a large number of participants • Valuations in the secondary market should be transparent and liquid enough to allow easy exit • The bid-ask spreads in the secondary markets should be narrow ...

... sellers such that all market participants are pricetakers • The primary market (for all issuance) should have a large number of participants • Valuations in the secondary market should be transparent and liquid enough to allow easy exit • The bid-ask spreads in the secondary markets should be narrow ...

PDF - Marquette Associates

... – delivered returns in the mid to high teens. Fixed income markets were again positive, with credit, high yield, and bank loans proving to be the best sectors. Real Estate continued its trend ...

... – delivered returns in the mid to high teens. Fixed income markets were again positive, with credit, high yield, and bank loans proving to be the best sectors. Real Estate continued its trend ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.