Long-Term Capital Management

... Participating firms acquired 90% ownership of the equity in the fund – Original partners kept 10% control (~$400m) but this was mostly wiped out by debt ...

... Participating firms acquired 90% ownership of the equity in the fund – Original partners kept 10% control (~$400m) but this was mostly wiped out by debt ...

Wholesale at retail, or vice-versa

... But typical bond investors ignore convertibles, which are normally not rated, and equity investors would rather buy the shares. Sunglass Hut carries about $160 million of debt, of which only about $40 million ranks ahead of these debentures. More importantly, the company has almost $85 million in an ...

... But typical bond investors ignore convertibles, which are normally not rated, and equity investors would rather buy the shares. Sunglass Hut carries about $160 million of debt, of which only about $40 million ranks ahead of these debentures. More importantly, the company has almost $85 million in an ...

Q2.15: Cleantech and Renewable Energy

... Solar Fund and The Renewables Energy Infrastructure Group. The previous quarter yieldcos secured $379 million through a series of secondary offerings. Venture capital and private equity investment totalled $140 million in Q2.15, a 72% decrease on the $495 million invested in Q2.14. Investment was in ...

... Solar Fund and The Renewables Energy Infrastructure Group. The previous quarter yieldcos secured $379 million through a series of secondary offerings. Venture capital and private equity investment totalled $140 million in Q2.15, a 72% decrease on the $495 million invested in Q2.14. Investment was in ...

information

... IFC has provided an investment consisting of a senior loan The G20 established the Global Agriculture and Food Security Program (GAFSP) to fund public and private investment in agriculture in low-income countries. GAFSP’s private sector window, managed by IFC, a member of the World Bank Group, offer ...

... IFC has provided an investment consisting of a senior loan The G20 established the Global Agriculture and Food Security Program (GAFSP) to fund public and private investment in agriculture in low-income countries. GAFSP’s private sector window, managed by IFC, a member of the World Bank Group, offer ...

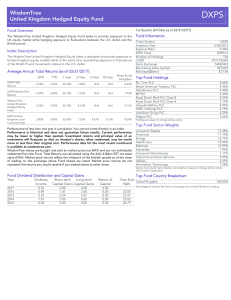

WisdomTree United Kingdom Hedged Equity Fund

... impact of events and developments in the United Kingdom that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and mor ...

... impact of events and developments in the United Kingdom that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest rate fluctuations, derivative investments which can be volatile and may be less liquid than other securities, and mor ...

View - Ferguson Wellman Capital Management

... a 15-year investment boom in China. Over those 15 years direct investment increased by 20 percent per year and this unsustainable pace has caused an imbalance in their GDP. Direct investment is now nearly 50 percent of China’s gross domestic product, while consumer spending is less than 40 percent. ...

... a 15-year investment boom in China. Over those 15 years direct investment increased by 20 percent per year and this unsustainable pace has caused an imbalance in their GDP. Direct investment is now nearly 50 percent of China’s gross domestic product, while consumer spending is less than 40 percent. ...

A Letter from the CEO - F.L.Putnam Investment Management Company

... U.S. economy is showing signs of improvement, the job market continues to grow stronger, and economic growth rates appear to be accelerating – not only in the United States, but around the world as well. If these trends continue, we expect higher corporate profitability and potentially higher stock ...

... U.S. economy is showing signs of improvement, the job market continues to grow stronger, and economic growth rates appear to be accelerating – not only in the United States, but around the world as well. If these trends continue, we expect higher corporate profitability and potentially higher stock ...

Competitive aspects of foreign markets appear attractive

... a little bit deeper. China is the biggest emerging market. They have two stock exchanges in China. One is the Shenzhen Stock Market and the other is the Shanghai Stock Market. The Shanghai Stock Market was one of the worst performers and the Shenzhen Stock Market was one of the best performers in As ...

... a little bit deeper. China is the biggest emerging market. They have two stock exchanges in China. One is the Shenzhen Stock Market and the other is the Shanghai Stock Market. The Shanghai Stock Market was one of the worst performers and the Shenzhen Stock Market was one of the best performers in As ...

Weekly Commentary 01-25-16

... central bank seeks to normalize policy. Instead, traders put the odds on just one rate rise this year.” A late-week rally in oil prices also helped push stock markets higher. The Financial Times reported crude oil hit a 12-year low midweek and then bounced more than 18 percent. While improving oil p ...

... central bank seeks to normalize policy. Instead, traders put the odds on just one rate rise this year.” A late-week rally in oil prices also helped push stock markets higher. The Financial Times reported crude oil hit a 12-year low midweek and then bounced more than 18 percent. While improving oil p ...

CPD Quiz - Association of Corporate Treasurers

... Of course all of the areas of responsibility are important, the real question is one of priorities. Reducing the cost of debt can increase profitability but, in practice, the value gains are relatively modest compared to those achievable from the optimising the WACC (which would normally include deb ...

... Of course all of the areas of responsibility are important, the real question is one of priorities. Reducing the cost of debt can increase profitability but, in practice, the value gains are relatively modest compared to those achievable from the optimising the WACC (which would normally include deb ...

flow of funds - WordPress.com

... • The most common method for a firm or an individual to raise funds in the financial markets is to issue a debt instrument, such as a bond. • The maturity of a debt instrument is the number of years (term) until that instrument’s expiration date. – A debt instrument is short-term if its maturity is ...

... • The most common method for a firm or an individual to raise funds in the financial markets is to issue a debt instrument, such as a bond. • The maturity of a debt instrument is the number of years (term) until that instrument’s expiration date. – A debt instrument is short-term if its maturity is ...

MidCap Financial Launches Commercial Finance Company with

... on the Board. The Board will also include members of management and Moelis Capital Partners, with Mark K. Gormley, a Partner at Lee Equity, serving as Chairman. Tom Lee, President of Lee Equity Partners added, "MidCap is one of those businesses that can do well by doing good. The liquidity crisis in ...

... on the Board. The Board will also include members of management and Moelis Capital Partners, with Mark K. Gormley, a Partner at Lee Equity, serving as Chairman. Tom Lee, President of Lee Equity Partners added, "MidCap is one of those businesses that can do well by doing good. The liquidity crisis in ...

Overview of Craft3 Powerpoint with information on

... The skilled work of many hands over time triples positive impacts on local economies, the environment, and opportunity for the excluded. ...

... The skilled work of many hands over time triples positive impacts on local economies, the environment, and opportunity for the excluded. ...

march 23rd-27th, 2015 - Imber Wealth Advisors

... Recent volatility has led to some raised eyebrows and concern over the near-term direction of U.S. equity markets. It is our opinion that yesterday’s sell off was primarily an act of taking profit and rebalancing portfolios at quarter-end. Two of the hardest hit areas were technology at large and mo ...

... Recent volatility has led to some raised eyebrows and concern over the near-term direction of U.S. equity markets. It is our opinion that yesterday’s sell off was primarily an act of taking profit and rebalancing portfolios at quarter-end. Two of the hardest hit areas were technology at large and mo ...

File

... Today we announce the winners for hedge funds and alternatives. By The Editors | 22 April 2010 Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We concl ...

... Today we announce the winners for hedge funds and alternatives. By The Editors | 22 April 2010 Keywords: asianinvestor | awards | investment performance | hedge funds | hedge fund awards | alternatives AsianInvestor is pleased to announce the 2010 winners for institutional funds management. We concl ...

Equity Share Class Fact Sheet

... To achieve the stated objectives, the Investment Committee (IRC) may invest the Class in large-to-mid-capitalization common shares and equities with both low systematic risk and higher expected returns through capital appreciation, dividend income, or a combination of both. The IRC may also invest t ...

... To achieve the stated objectives, the Investment Committee (IRC) may invest the Class in large-to-mid-capitalization common shares and equities with both low systematic risk and higher expected returns through capital appreciation, dividend income, or a combination of both. The IRC may also invest t ...

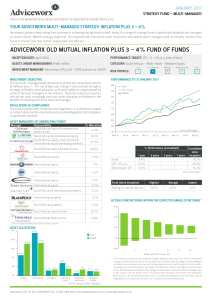

adviceworx old mutual inflation plus 3

... With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which has now moved to a rolling three-year ba ...

... With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which has now moved to a rolling three-year ba ...

Downlaod File

... Weighted Average Cost of Capital (WACC) is the average cost to a company of the funds it has invested in the assets of the company. This is composed of a possible combination of debt, preferred shares, common shares and retained earnings. All components of the cost of capital are determined at the c ...

... Weighted Average Cost of Capital (WACC) is the average cost to a company of the funds it has invested in the assets of the company. This is composed of a possible combination of debt, preferred shares, common shares and retained earnings. All components of the cost of capital are determined at the c ...

the stability of large external imbalances

... on its foreign investments than foreigners earn on their U.S. investments – that is, that the United States enjoys a positive returns differential with the rest of the world. It is further believed that such a situation contributes to overall economic stability, or what has been called a “relatively ...

... on its foreign investments than foreigners earn on their U.S. investments – that is, that the United States enjoys a positive returns differential with the rest of the world. It is further believed that such a situation contributes to overall economic stability, or what has been called a “relatively ...

Quarter letter - OregonLive.com

... the debt ceiling, segues into an unprecedented downgrade of U.S. Treasury debt, and concludes with worries about the fiscal soundness of numerous European countries and concerns about flagging growth in the global economy, it’s bound to be a challenging time for the markets. Indeed, the Dow Industri ...

... the debt ceiling, segues into an unprecedented downgrade of U.S. Treasury debt, and concludes with worries about the fiscal soundness of numerous European countries and concerns about flagging growth in the global economy, it’s bound to be a challenging time for the markets. Indeed, the Dow Industri ...

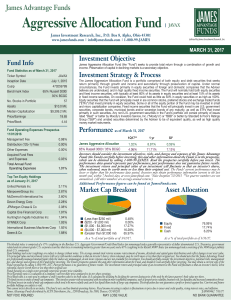

Aggressive Allocation Fund | JAVAX

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

... The blended index is comprised of a 35% weighting in the Barclays U.S. Aggregate Government/Credit Bond Index (an unmanaged index generally representative of dollar denominated U.S. Treasuries, government related and investment grade U.S. corporate securities that have a remaining maturity greater t ...

Portfolio Update

... floor more rapidly than in the seasonal sell-offs of recent years, buoyed by the tide of central bank liquidity, and the prospect of dovish replacements (Carney, Yellen?) to the incumbent Central Bankers. Valuation measures rose almost across the board during the quarter, but there are still opportu ...

... floor more rapidly than in the seasonal sell-offs of recent years, buoyed by the tide of central bank liquidity, and the prospect of dovish replacements (Carney, Yellen?) to the incumbent Central Bankers. Valuation measures rose almost across the board during the quarter, but there are still opportu ...

Job Description Job title Senior Investment Manager, Northern

... information, and taking action where necessary to ensure the best possible outcome of these investments for the fund; ...

... information, and taking action where necessary to ensure the best possible outcome of these investments for the fund; ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.