December 2011 - Capital Markets Board of Turkey

... exchanges, academia and the central theme is exchanging views on current approaches and initiatives to financial market regulation namely for post financial crisis crucial topics such as regulation of credit rating agencies, OTC Derivatives, financial literacy, investor protection and systemic risk. ...

... exchanges, academia and the central theme is exchanging views on current approaches and initiatives to financial market regulation namely for post financial crisis crucial topics such as regulation of credit rating agencies, OTC Derivatives, financial literacy, investor protection and systemic risk. ...

- Miller Capital Management

... countries following the financial crisis and global recession. The MSCI Emerging Markets Index delivered pretty remarkable (and highly volatile) performance during the past decade. According to the MSCI fact sheet, annual returns have ranged from down 53.33 to up 78.51: Annual Returns (%) ...

... countries following the financial crisis and global recession. The MSCI Emerging Markets Index delivered pretty remarkable (and highly volatile) performance during the past decade. According to the MSCI fact sheet, annual returns have ranged from down 53.33 to up 78.51: Annual Returns (%) ...

Chapter 11 File

... Financial services companies now engage in 24-hourday trading – the international capital market never sleeps However, this also means that shocks that occur in one financial market spread around the globe very quickly ...

... Financial services companies now engage in 24-hourday trading – the international capital market never sleeps However, this also means that shocks that occur in one financial market spread around the globe very quickly ...

Alberta Investor Tax Credit - Calgary Chamber of Commerce

... sustainable enterprises. Enterprise Alberta is one body which provides public funding to such ventures. Yet, a sustainable ecosystem for small business investment in Alberta is not possible without greater private sector involvement. New businesses backed in large part by public venture capital tend ...

... sustainable enterprises. Enterprise Alberta is one body which provides public funding to such ventures. Yet, a sustainable ecosystem for small business investment in Alberta is not possible without greater private sector involvement. New businesses backed in large part by public venture capital tend ...

26-31 ISCA May - Focus (Cover story) V1.indd

... In addition to its information value, QR can also benefit the company and its existing shareholders by lowering the cost of raising equity capital. But it may also encourage myopic behaviour from managers, especially when the company’s shareholder base is dominated by impatient investors with short ...

... In addition to its information value, QR can also benefit the company and its existing shareholders by lowering the cost of raising equity capital. But it may also encourage myopic behaviour from managers, especially when the company’s shareholder base is dominated by impatient investors with short ...

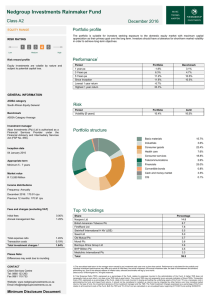

Fact sheets - Nedgroup Investments

... Nhlanhla Nene as the finance minister and consequently reduced the extent of the rand hedge position, we did not anticipate the extent of recovery that occurred during the balance of 2016. The rand ended the year 30% stronger versus the British pound and 18% versus the US dollar than it was in Janua ...

... Nhlanhla Nene as the finance minister and consequently reduced the extent of the rand hedge position, we did not anticipate the extent of recovery that occurred during the balance of 2016. The rand ended the year 30% stronger versus the British pound and 18% versus the US dollar than it was in Janua ...

OPIC Support for Innovative Financial Intermediaries in

... OPIC is the U.S. Governments Development Finance Institution and mobilizes private capital to help solve critical development challenges around the world while catalyzing revenues, jobs and growth opportunities both at home and abroad. One of the key ways OPIC supports this mission is by providing f ...

... OPIC is the U.S. Governments Development Finance Institution and mobilizes private capital to help solve critical development challenges around the world while catalyzing revenues, jobs and growth opportunities both at home and abroad. One of the key ways OPIC supports this mission is by providing f ...

deep value fund

... Mutual fund investing involves risk; principal loss is possible. The Carbon Beach Deep Value Fund invests in smaller companies, which involve additional risk such as limited liquidity and greater volatility. Event driven investments carry the risk that expected events or transactions may not occur a ...

... Mutual fund investing involves risk; principal loss is possible. The Carbon Beach Deep Value Fund invests in smaller companies, which involve additional risk such as limited liquidity and greater volatility. Event driven investments carry the risk that expected events or transactions may not occur a ...

Alleghany`s common stockholders` equity per share at year

... exceptionally profitable years for the specialty insurance market, but competitive forces began to take their toll in 2008 and 2009. We expect that market conditions will remain highly competitive in 2010, and perhaps 2011 as well. RSUI’s principal goal in such an environment is to provide superior ...

... exceptionally profitable years for the specialty insurance market, but competitive forces began to take their toll in 2008 and 2009. We expect that market conditions will remain highly competitive in 2010, and perhaps 2011 as well. RSUI’s principal goal in such an environment is to provide superior ...

April 2015 Factsheet - Electric and General Investment Fund

... the end of April the dollar slid in response to lacklustre GDP growth in the first quarter. In Europe, however, in spite of on-going concerns over Greece, there were further signs that the recovery is taking hold and coupled with the stronger euro, this resulted in a pleasing month for the Fund. Dur ...

... the end of April the dollar slid in response to lacklustre GDP growth in the first quarter. In Europe, however, in spite of on-going concerns over Greece, there were further signs that the recovery is taking hold and coupled with the stronger euro, this resulted in a pleasing month for the Fund. Dur ...

International Value Fund - Third Avenue Management

... 2. Investor Share Class Inception Date: December 31, 2009. 3. The Morgan Stanley Capital International All Country World ex USA Index is an unmanaged index of common stocks and includes securities representative of the market structure of over 50 developed and emerging market countries (other than t ...

... 2. Investor Share Class Inception Date: December 31, 2009. 3. The Morgan Stanley Capital International All Country World ex USA Index is an unmanaged index of common stocks and includes securities representative of the market structure of over 50 developed and emerging market countries (other than t ...

March 2015 AULIEN S.C.A., Sicav

... kicking the debt can further down the road will not permit any sustainable and sound economical recovery. Europe needs to reduce its unnecessary large social wealth fare. Japan is struggling to escape from its low growth and deflationary environment. Finally, the “soft landing” of the Chinese econom ...

... kicking the debt can further down the road will not permit any sustainable and sound economical recovery. Europe needs to reduce its unnecessary large social wealth fare. Japan is struggling to escape from its low growth and deflationary environment. Finally, the “soft landing” of the Chinese econom ...

Lecture 2

... Public private partnerships is not new Federal government has equity in 400 companies Governments are often involved in firms, through the provision of loans, grants for r and d But equity is something altogether different ...

... Public private partnerships is not new Federal government has equity in 400 companies Governments are often involved in firms, through the provision of loans, grants for r and d But equity is something altogether different ...

Industry Comparison by GDP and Percentage of the

... • A type of share allowing corporations to transfer exploration and development expenses to investors. • Investors can use these expenses as deductions against their personal income tax. • Eligible corporations are those involved in the exploration, production, and processing of certain ...

... • A type of share allowing corporations to transfer exploration and development expenses to investors. • Investors can use these expenses as deductions against their personal income tax. • Eligible corporations are those involved in the exploration, production, and processing of certain ...

HSBC GIF BRIC Freestyle Equity Fund

... There are risks involved with this type of investment. Please refer to the Prospectus for general risk factors, and to the Simplified Prospectus for specific risk factors. It is important to remember that your investment is not guaranteed and you may not get back the amount you originally invested. ...

... There are risks involved with this type of investment. Please refer to the Prospectus for general risk factors, and to the Simplified Prospectus for specific risk factors. It is important to remember that your investment is not guaranteed and you may not get back the amount you originally invested. ...

Chapter 22 File

... Variations of the two with variable-rate savings Investments set up as hedges against potential claims of policyholders ...

... Variations of the two with variable-rate savings Investments set up as hedges against potential claims of policyholders ...

A free market bailout alternative? Philipp Bagus, Juan Ramón Rallo

... in refinancing the short-term debts oblige mismatching institutions to liquidate longterm assets at prices that are inferior to those registered on the balance sheet.6 This deteriorates the capital of the company even more. At the same time the increase in default risk complicated the access to cred ...

... in refinancing the short-term debts oblige mismatching institutions to liquidate longterm assets at prices that are inferior to those registered on the balance sheet.6 This deteriorates the capital of the company even more. At the same time the increase in default risk complicated the access to cred ...

Dia 1

... Euro and Nordic currency infrastructure has eroded fundamentals Mid/Long term catch-up dynamics still in place South-East Europe & Turkey still attractive Russia has a significant implied X-factor at present time ...

... Euro and Nordic currency infrastructure has eroded fundamentals Mid/Long term catch-up dynamics still in place South-East Europe & Turkey still attractive Russia has a significant implied X-factor at present time ...

View item 6c as RTF 564 KB

... The London Co-investment Fund was launched in December 2014. The fund is expected to invest in more than 150 early stage businesses and accelerate the creation of at least 2,600 new jobs in London’s early stage Science, Digital and Technology businesses over three years to March 2018. The LCIF has m ...

... The London Co-investment Fund was launched in December 2014. The fund is expected to invest in more than 150 early stage businesses and accelerate the creation of at least 2,600 new jobs in London’s early stage Science, Digital and Technology businesses over three years to March 2018. The LCIF has m ...

Dubai SME Template

... “organizations” who bring business angels in contact with quality deal flow National federations and associations Umbrella Organizations at national or regional level for the networks, enabling exchange of good practice and supporting professional standards (e.g., EBAN) ...

... “organizations” who bring business angels in contact with quality deal flow National federations and associations Umbrella Organizations at national or regional level for the networks, enabling exchange of good practice and supporting professional standards (e.g., EBAN) ...

I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second

... The GIC believes that the second stage of economic recovery usually means rising rates and stocks. As the US economy recovers, focus on “stock pickers;” managers with proven records of generating alpha and making "active" bets. ...

... The GIC believes that the second stage of economic recovery usually means rising rates and stocks. As the US economy recovers, focus on “stock pickers;” managers with proven records of generating alpha and making "active" bets. ...

Public Private Partnerships in South Africa

... Road, rail, airports, ports, electricity, telecoms, water expanding Strong financial markets, competitive commerce and industry Inter-governmental system. 3 spheres: national, provincial, local Over 200 days of sunshine a year! ...

... Road, rail, airports, ports, electricity, telecoms, water expanding Strong financial markets, competitive commerce and industry Inter-governmental system. 3 spheres: national, provincial, local Over 200 days of sunshine a year! ...

Long-Term Investment Asset-Class Based Capital

... 2% difference between long-term and short-term equity premium. Whatever your choice of equity premium is, it should be about 2% lower for long-term projects than for short-term projects. You can’t believe in an 8% equity premium with respect to long-term bonds and an 8% equity premium with respect t ...

... 2% difference between long-term and short-term equity premium. Whatever your choice of equity premium is, it should be about 2% lower for long-term projects than for short-term projects. You can’t believe in an 8% equity premium with respect to long-term bonds and an 8% equity premium with respect t ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.