sitarail

... only on the first five years of the concession. They have ignored long term needs that have proven to be much larger than anticipated as both Governments and private operators, at the concession bidding stage, have downplayed the decrepit state of rail infrastructure. Investments needs (2008/2020) ( ...

... only on the first five years of the concession. They have ignored long term needs that have proven to be much larger than anticipated as both Governments and private operators, at the concession bidding stage, have downplayed the decrepit state of rail infrastructure. Investments needs (2008/2020) ( ...

Lecture 1 - OpenDocs Home - Institute of Development Studies

... generate social and environmental impact alongside a financial return.’ (GIIN, 2012) ...

... generate social and environmental impact alongside a financial return.’ (GIIN, 2012) ...

“...one of the more evocative of the soft commodities and a hugely

... there are no longer slabs where the rate suddenly increased. For any buyers over £1 million, moving has become very expensive: on a £6 million purchase the stamp duty costs for a first home will be about £633,750. You can’t borrow this so it is a straight hit on capital. It’s a significant hit too – ...

... there are no longer slabs where the rate suddenly increased. For any buyers over £1 million, moving has become very expensive: on a £6 million purchase the stamp duty costs for a first home will be about £633,750. You can’t borrow this so it is a straight hit on capital. It’s a significant hit too – ...

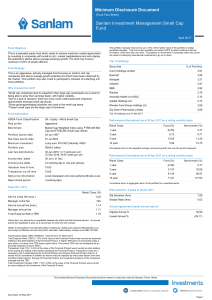

Sanlam Investment Management Small Cap Fund

... This is an aggressively managed, high-risk portfolio that aims to deliver capital growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified acr ...

... This is an aggressively managed, high-risk portfolio that aims to deliver capital growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified acr ...

1 May 2017 ASX: MVW – VANECK VECTORS AUSTRALIAN

... Fees and costs have always been a hot topic when it comes to investing and it’s getting hotter as we approach 1 October 2017. This is the date ASIC’s regulatory guidance on fees and costs disclosures (RG 97) comes into full effect. Many fund managers are worried about the changes as it will require ...

... Fees and costs have always been a hot topic when it comes to investing and it’s getting hotter as we approach 1 October 2017. This is the date ASIC’s regulatory guidance on fees and costs disclosures (RG 97) comes into full effect. Many fund managers are worried about the changes as it will require ...

Download PDF

... Investors who can successfully navigate potential obstacles will benefit from strong market supply-anddemand fundamentals. A dearth of modern building stock will ensure success as countries such as Poland, the Czech Republic, Hungary and Croatia, among many others, integrate into or prepare to join ...

... Investors who can successfully navigate potential obstacles will benefit from strong market supply-anddemand fundamentals. A dearth of modern building stock will ensure success as countries such as Poland, the Czech Republic, Hungary and Croatia, among many others, integrate into or prepare to join ...

Infrastructure Investment Trust

... The communique, after defining the infrastructure investment types, imposes the company, To have at least 100.000.000 YTL capital (50.000.000 Euros) initially, To be established within the registered capital model, The initial capital requirement lowered down to 5.000.000 YTL if a public autho ...

... The communique, after defining the infrastructure investment types, imposes the company, To have at least 100.000.000 YTL capital (50.000.000 Euros) initially, To be established within the registered capital model, The initial capital requirement lowered down to 5.000.000 YTL if a public autho ...

LionGlobal Asia Bond Fund

... insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, ...

... insured by LGI or any of its affiliates and are subject to investment risks including the possible loss of the principal amount invested. The performance of the Fund is not guaranteed and the value of units in the Fund and the income accruing to the units, if any, may rise or fall. Past performance, ...

Market Volatility: a Friend of Active Management?

... or mean-revert, creating opportunities for active managers. When yield spreads decline, benchmark performance has usually suffered in a similar decline and active managers have outperformed the benchmark. In other words, higher yields make for more attractive opportunities for active investors as th ...

... or mean-revert, creating opportunities for active managers. When yield spreads decline, benchmark performance has usually suffered in a similar decline and active managers have outperformed the benchmark. In other words, higher yields make for more attractive opportunities for active investors as th ...

Cost of Capital for a Project

... If the firm uses debt, the equity beta is higher than the asset beta (since debt is first in line, levered equity is riskier than the firm’s underlying assets): ...

... If the firm uses debt, the equity beta is higher than the asset beta (since debt is first in line, levered equity is riskier than the firm’s underlying assets): ...

Financial Markets and the Financing Choice of Firms

... practice, however, the existence of significant flotation costs implies fluctuation of the debtequity ratios around their target level, over time. Clearly any empirical work needs to identify this target level and how it might change due to exogenous shocks. However, since the target level is unobs ...

... practice, however, the existence of significant flotation costs implies fluctuation of the debtequity ratios around their target level, over time. Clearly any empirical work needs to identify this target level and how it might change due to exogenous shocks. However, since the target level is unobs ...

THE MINORITY RECAPITALIZATION

... term interests among the shareholders, a Minority Recap can offer a market clearing valuation for those shareholders seeking liquidity and provide the remaining shareholders with the ability to increase their equity positions through the use of less dilutive debt or debt-like securities. In order to ...

... term interests among the shareholders, a Minority Recap can offer a market clearing valuation for those shareholders seeking liquidity and provide the remaining shareholders with the ability to increase their equity positions through the use of less dilutive debt or debt-like securities. In order to ...

One Hat Too Many? Investment Desegregation in Private Equity

... Apollo Management, Kohlberg Kravis Roberts & Co., The Carlyle Group, and other buyout firms have recently launched new funds that specialize in such alternative investment strategies. These new investments undoubtedly make financial sense for the fund managers, as they likely expand the manager’s ex ...

... Apollo Management, Kohlberg Kravis Roberts & Co., The Carlyle Group, and other buyout firms have recently launched new funds that specialize in such alternative investment strategies. These new investments undoubtedly make financial sense for the fund managers, as they likely expand the manager’s ex ...

The Need for New Public Private Partnerships (2006)

... of energy sources); Enhanced reliability of supply (through purchases from neighbors if there are domestic shortfalls); Sharing shortages? Lower combined peak demand; Use of cheaper energy sources in another country. There is no cash flow from the first 3 benefits No private interest in fina ...

... of energy sources); Enhanced reliability of supply (through purchases from neighbors if there are domestic shortfalls); Sharing shortages? Lower combined peak demand; Use of cheaper energy sources in another country. There is no cash flow from the first 3 benefits No private interest in fina ...

Chapter 3 Accounting and Finance - McGraw-Hill

... markets exist, the market value of a company does not depend on its capital structure ◦ In other words, managers cannot increase firm value by changing the mix of securities used to finance the company ...

... markets exist, the market value of a company does not depend on its capital structure ◦ In other words, managers cannot increase firm value by changing the mix of securities used to finance the company ...

Credit Market Liquidity

... credit market wheel since they are used by a wide variety of investor types (ranging from institutional money managers to money market funds) to facilitate transactions over a short window of time. Repo activity has also fallen as a result of increased regulations placed on large financial institut ...

... credit market wheel since they are used by a wide variety of investor types (ranging from institutional money managers to money market funds) to facilitate transactions over a short window of time. Repo activity has also fallen as a result of increased regulations placed on large financial institut ...

ANNEXURE 2: FINANCIAL RATIOS It is important for business

... ROE can be calculated indirectly as: ROE = (Net Income/Total Assets) (Total Assets/Equity) ROE also can be calculated using the following method: ROE = (Net Income/Sales) (Sales/Total Assets) (Total Assets/Equity) This states that ROE is determined by multiplication of three levers: ...

... ROE can be calculated indirectly as: ROE = (Net Income/Total Assets) (Total Assets/Equity) ROE also can be calculated using the following method: ROE = (Net Income/Sales) (Sales/Total Assets) (Total Assets/Equity) This states that ROE is determined by multiplication of three levers: ...

product differentiation

... Firms with high operating risk, tend to adopt less financial risk financing (equity financing dominant) alternatives, to avoid high interest payment. Firms with low operating risk, tend to adopt more financial risk financing (debt financing dominant) alternatives, to increase ROE. ...

... Firms with high operating risk, tend to adopt less financial risk financing (equity financing dominant) alternatives, to avoid high interest payment. Firms with low operating risk, tend to adopt more financial risk financing (debt financing dominant) alternatives, to increase ROE. ...

here

... estimates, and subject to change. 1 Includes all assets managed by PGIM, the principal asset management business of Prudential Financial, Inc. Assets include public and private fixed income, public equity (both fundamental and quantitative), and real estate. Effective December 31, 2012, Prudential I ...

... estimates, and subject to change. 1 Includes all assets managed by PGIM, the principal asset management business of Prudential Financial, Inc. Assets include public and private fixed income, public equity (both fundamental and quantitative), and real estate. Effective December 31, 2012, Prudential I ...

About - Nasdaq

... NASDAQ Stock Market‚ has been at the forefront of innovation, using technology to bring millions of investors together with the world’s leading companies. Today, NASDAQ‚ (OTCBB: NDAQ) is the world’s largest electronic stock market, listing approximately 3,600 of the world’s most innovative companies ...

... NASDAQ Stock Market‚ has been at the forefront of innovation, using technology to bring millions of investors together with the world’s leading companies. Today, NASDAQ‚ (OTCBB: NDAQ) is the world’s largest electronic stock market, listing approximately 3,600 of the world’s most innovative companies ...

powerpoint on pensions and inter

... Action of Climate Change and Pensions • The overweighting of the UK stock market towards fossil fuel companies means that UK pension funds are at particular risk of any sudden reassessment of the viability of high-carbon energy sources, according to a leading analyst. • According to the most likely ...

... Action of Climate Change and Pensions • The overweighting of the UK stock market towards fossil fuel companies means that UK pension funds are at particular risk of any sudden reassessment of the viability of high-carbon energy sources, according to a leading analyst. • According to the most likely ...

Trade Capacity Building in Sub-Saharan Africa: Impact and

... It subjects countries to the discipline of the international market Fear of capital flow reversal is often a stimulus to more responsible economic policies ...

... It subjects countries to the discipline of the international market Fear of capital flow reversal is often a stimulus to more responsible economic policies ...

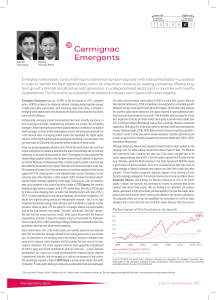

Quarterly report

... the country’s public-sector banks lack the capital required to grant additional loans, they have only scant prospects for growth. That inevitably sets the stage for a longterm expansion of the as yet small market share going to private-sector banks (just 32% in 2016 according to Bloomberg), making t ...

... the country’s public-sector banks lack the capital required to grant additional loans, they have only scant prospects for growth. That inevitably sets the stage for a longterm expansion of the as yet small market share going to private-sector banks (just 32% in 2016 according to Bloomberg), making t ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.