P Ravi IDECK PPP

... to the private entity – and usually includes financial investment obligations For a payment to the private entity – directly by users or by the public entity such that - a significant portion of project revenues and/ or the payments, are conditional on achieving pre-specified levels of performance ...

... to the private entity – and usually includes financial investment obligations For a payment to the private entity – directly by users or by the public entity such that - a significant portion of project revenues and/ or the payments, are conditional on achieving pre-specified levels of performance ...

Paradox of Wealth - Helm Investment Management

... column and elsewhere that the current S&P 500 index CAPE level of 24.8 is well above the measure’s long-term average of 16.4, indicating that equities in the U.S. are overpriced. Bernstein notes that there is a clear upward trend in the CAPE over the past 115 years (which is as long as we have relia ...

... column and elsewhere that the current S&P 500 index CAPE level of 24.8 is well above the measure’s long-term average of 16.4, indicating that equities in the U.S. are overpriced. Bernstein notes that there is a clear upward trend in the CAPE over the past 115 years (which is as long as we have relia ...

Are European banks a buy?

... A strong justification for a higher level of banking sector profitability is that all this new capital has to be somehow remunerated. That is, capital providers (shareholders) will require higher compensation to be paid for by bank customers in the form of higher costs of financial intermediation, a ...

... A strong justification for a higher level of banking sector profitability is that all this new capital has to be somehow remunerated. That is, capital providers (shareholders) will require higher compensation to be paid for by bank customers in the form of higher costs of financial intermediation, a ...

global equity fund

... before investing. Indicated rates of return include changes in share or unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Return ...

... before investing. Indicated rates of return include changes in share or unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. Return ...

Jonathan R. Baum Chairman and Chief Executive Officer

... wholly-owned subsidiary of the Company) since 1986 and as director of GAMCO Asset Management Inc. since 1991. Mr. Jamieson also serves as President and a director of Gabelli Securities, Inc. (a majority-owned subsidiary of the Company) and a director of GAMCO Asset Management (UK) Ltd. (a wholly-own ...

... wholly-owned subsidiary of the Company) since 1986 and as director of GAMCO Asset Management Inc. since 1991. Mr. Jamieson also serves as President and a director of Gabelli Securities, Inc. (a majority-owned subsidiary of the Company) and a director of GAMCO Asset Management (UK) Ltd. (a wholly-own ...

Lecture 4: Cost of capital and CAPM. First lecture

... • Slope of the CML is the market price of risk for efficient portfolios, or the equilibrium price of risk in the market (Risk premium per unit of risk) ...

... • Slope of the CML is the market price of risk for efficient portfolios, or the equilibrium price of risk in the market (Risk premium per unit of risk) ...

Document

... Cost of Debt In order to find what the company pays to its debt holders, we should find what the weighted average interest rate for their debt is (on the 10-K) We then weight the average interest rate they pay (by multiplying it by what percentage of their capital comes from debt capital) then mult ...

... Cost of Debt In order to find what the company pays to its debt holders, we should find what the weighted average interest rate for their debt is (on the 10-K) We then weight the average interest rate they pay (by multiplying it by what percentage of their capital comes from debt capital) then mult ...

India Capital Market Update

... FIIs can invest on behalf of their clients through subaccounts. For normal FIIs, limit for investment in equity is at least 70 per cent while the rest could be invested in debt up to a maximum limit of 30 per cent. 9040 brokers in cash segment and 1064 in derivative segment of the market. 122 invest ...

... FIIs can invest on behalf of their clients through subaccounts. For normal FIIs, limit for investment in equity is at least 70 per cent while the rest could be invested in debt up to a maximum limit of 30 per cent. 9040 brokers in cash segment and 1064 in derivative segment of the market. 122 invest ...

RISK FACTORS As is the case with any type of investment, hedge

... risks. Below is a summary of certain risks involved in hedge fund investing, but by no means should this list be considered exhaustive. Potential loss of investment No guarantee or representation is made that our investment programs will be successful. Past performance is not indicative of future re ...

... risks. Below is a summary of certain risks involved in hedge fund investing, but by no means should this list be considered exhaustive. Potential loss of investment No guarantee or representation is made that our investment programs will be successful. Past performance is not indicative of future re ...

LEVERAGE

... nothing in the nature of high-yield bonds strongly suggests that they will wind up on that short list. Some may question the fairness of my treating these realized risks on junk bonds as essentially exogenous shocks, like earthquakes or droughts. Surely, they would contend, the very rise of corporat ...

... nothing in the nature of high-yield bonds strongly suggests that they will wind up on that short list. Some may question the fairness of my treating these realized risks on junk bonds as essentially exogenous shocks, like earthquakes or droughts. Surely, they would contend, the very rise of corporat ...

BCM Named To Financial Times 300 Top RIA List

... 3 Years In A Row: Brookstone Capital Management Named to 2016 Financial Times 300 Top Registered Investment Advisers WHEATON, IL – June 20, 2016 – Brookstone Capital Management (BCM) is pleased to announce that it has been named to the Financial Times (FT) 300 Top Registered Investment Advisers for ...

... 3 Years In A Row: Brookstone Capital Management Named to 2016 Financial Times 300 Top Registered Investment Advisers WHEATON, IL – June 20, 2016 – Brookstone Capital Management (BCM) is pleased to announce that it has been named to the Financial Times (FT) 300 Top Registered Investment Advisers for ...

Euronav NV (Form: 6-K, Received: 01/05/2017 16:12:38)

... business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. The Company desires to take advantage of the safe harbor provis ...

... business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. The Company desires to take advantage of the safe harbor provis ...

A REVIEW OF THE CAPITAL STRUCTURE THEORIES Popescu

... understanding of mean reversion, the role of profits, the role of retained earnings, and path dependence. As a result, the trade-off class of models now appears to be much more promising than it did even just a few years ago. 4. The Pecking Order Theory The pecking order theory does not take an opti ...

... understanding of mean reversion, the role of profits, the role of retained earnings, and path dependence. As a result, the trade-off class of models now appears to be much more promising than it did even just a few years ago. 4. The Pecking Order Theory The pecking order theory does not take an opti ...

Capital Structure

... Leverage increases the risk and return to stockholders rs = r0 + (B / SL) (r0 - rB) rB is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity ...

... Leverage increases the risk and return to stockholders rs = r0 + (B / SL) (r0 - rB) rB is the interest rate (cost of debt) rs is the return on (levered) equity (cost of equity) r0 is the return on unlevered equity (cost of capital) B is the value of debt SL is the value of levered equity ...

OPIC`s Role in Impact Investment

... A recent example of OPIC’s support for impact invest involves Root Capital, a nonprofit organization active in more than 30 countries. OPIC provides financing to Root Capital, which then delivers affordable credit to rural grassroots businesses including cooperatives of farmers. Without Root Cap ...

... A recent example of OPIC’s support for impact invest involves Root Capital, a nonprofit organization active in more than 30 countries. OPIC provides financing to Root Capital, which then delivers affordable credit to rural grassroots businesses including cooperatives of farmers. Without Root Cap ...

Financial Developments and Macroeconomic Stability

... value of debt in the business sector drastically drops during a recession. This suggests that recessions are periods in which firms must restructure their financial position. If firms cannot compensate the debt reduction with new equity, it must cut investments and this generates sharper recessions. ...

... value of debt in the business sector drastically drops during a recession. This suggests that recessions are periods in which firms must restructure their financial position. If firms cannot compensate the debt reduction with new equity, it must cut investments and this generates sharper recessions. ...

Investment Guidelines - Cloudsplitter Foundation

... combination of current income plus the net impact of price changes. Income return is defined as the actual dividends and interest earned. The objective is to generate a return, after inflation, that will at least equal the Foundation’s granting requirements plus the costs of administering these fund ...

... combination of current income plus the net impact of price changes. Income return is defined as the actual dividends and interest earned. The objective is to generate a return, after inflation, that will at least equal the Foundation’s granting requirements plus the costs of administering these fund ...

MEMC Electronic Materials Inc. (WFR)

... Strategy: “Continuous improvement of technology, market share, and profits.” ...

... Strategy: “Continuous improvement of technology, market share, and profits.” ...

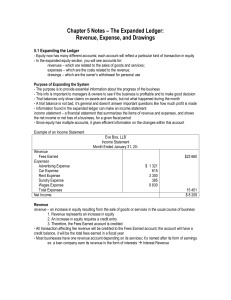

Chapter 5 Notes – The Expanded Ledger:

... - Expenses doesn’t always have to be on the account title if it is obvious that it was an expanse account - Not all expenditures are for expenses; long lasting buys such as a building is debited in assets Net Income or Net Loss - Its from the revenue and expense account that a business can tell if h ...

... - Expenses doesn’t always have to be on the account title if it is obvious that it was an expanse account - Not all expenditures are for expenses; long lasting buys such as a building is debited in assets Net Income or Net Loss - Its from the revenue and expense account that a business can tell if h ...

The problem with profits Big firms in the United States have never

... technology, America’s two most profitable industries. And new regulations do not just fence big banks in: they keep rivals out. Having limited working capital and fewer resources, small companies struggle with all the forms, lobbying and red tape. This is one reason why the rate of small-company cre ...

... technology, America’s two most profitable industries. And new regulations do not just fence big banks in: they keep rivals out. Having limited working capital and fewer resources, small companies struggle with all the forms, lobbying and red tape. This is one reason why the rate of small-company cre ...

Threadneedle UK Select Fund

... acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed ...

... acted upon prior to publication and is made available here incidentally. Any opinions expressed are made as at the date of publication but are subject to change without notice. Information obtained from external sources is believed to be reliable but its accuracy or completeness cannot be guaranteed ...

June - sibstc

... Factoring was used as an informal mode of financing to the Merchants in England prior to 1400. Originally the financiers (factors) took physical possession of the goods and against the same provided cash advances to the producer/supplier. Later on, the concept was extended to finance the credit exte ...

... Factoring was used as an informal mode of financing to the Merchants in England prior to 1400. Originally the financiers (factors) took physical possession of the goods and against the same provided cash advances to the producer/supplier. Later on, the concept was extended to finance the credit exte ...

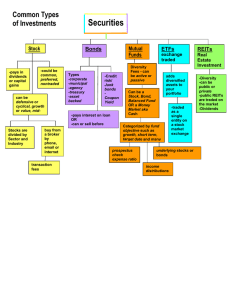

Securities

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

... composition of the index that the ETF tracks. But like a stock, an ETF is listed on an exchange and trades throughout the day, so that an order you place to buy or sell is executed at the current trading price. Very similar to Mutual Funds with these exceptions – ...

To propose the issuance plan of private placement for

... proposed to authorize the Company’s Board to determine the specific parties for private placement. C. The necessity of private placement: (a) The reasons for not taking a public offering: Considering the capital market status, effectiveness, feasibility and costs to raise capital, and the no-trading ...

... proposed to authorize the Company’s Board to determine the specific parties for private placement. C. The necessity of private placement: (a) The reasons for not taking a public offering: Considering the capital market status, effectiveness, feasibility and costs to raise capital, and the no-trading ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.