UNIVERSITY OF NORTH FLORIDA

... OFG faced two major issues in Q4 as it entered the fixed income markets: the likelihood of a recession and the rare occurrence of an inverted yield curve, which was increasing in its depth of inversion. The recession issue has yet to be resolved, but it has triggered a belief that based on a weakeni ...

... OFG faced two major issues in Q4 as it entered the fixed income markets: the likelihood of a recession and the rare occurrence of an inverted yield curve, which was increasing in its depth of inversion. The recession issue has yet to be resolved, but it has triggered a belief that based on a weakeni ...

Axis Long Term Equity Fund - Growth

... Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Dat ...

... Disclaimer: CRISIL Research, a division of CRISIL Limited (CRISIL) has taken due care and caution in preparing this Report based on the information obtained by CRISIL from sources which it considers reliable (Data). However, CRISIL does not guarantee the accuracy, adequacy or completeness of the Dat ...

Investment Companies Entities Expert Panel

... Chris is a financial services partner since July 1, 2005 at PricewaterhouseCoopers LLP with experience serving investment management, capital markets and other financial services companies. As a member of the Firm's National Office Accounting Service Group, Chris is involved in technical consultatio ...

... Chris is a financial services partner since July 1, 2005 at PricewaterhouseCoopers LLP with experience serving investment management, capital markets and other financial services companies. As a member of the Firm's National Office Accounting Service Group, Chris is involved in technical consultatio ...

Investment and Savings

... sold for $100,000. How much is gross investment, depreciation, net investment? 2) Becky earned $50,000, paid $6k in taxes and consumed $43 k worth of goods. What is her Savings? Suppose she has $30,000 in her bank account, what is her wealth? 3) Jeremy purchases a bond that pays $600 in interest. If ...

... sold for $100,000. How much is gross investment, depreciation, net investment? 2) Becky earned $50,000, paid $6k in taxes and consumed $43 k worth of goods. What is her Savings? Suppose she has $30,000 in her bank account, what is her wealth? 3) Jeremy purchases a bond that pays $600 in interest. If ...

Associate Portfolio Manager Job Description (00291244).PDF

... Associate Portfolio Manager Athena Capital Advisors -- Lincoln, MA www.athenacapital.com Description Athena Capital Advisors is seeking an Entry to Mid-Level Associate Portfolio Manager to join its Portfolio Management Team. Athena provides investment advisory and management services to a limited gr ...

... Associate Portfolio Manager Athena Capital Advisors -- Lincoln, MA www.athenacapital.com Description Athena Capital Advisors is seeking an Entry to Mid-Level Associate Portfolio Manager to join its Portfolio Management Team. Athena provides investment advisory and management services to a limited gr ...

agenda for a new strategy of equity financing by the islamic

... in companies that are likely to do so is not the way to promote development. It translates its development objectives by promoting private sector development in countries where considerable work is required to fund, create and structure projects. Although operating in these countries is often less p ...

... in companies that are likely to do so is not the way to promote development. It translates its development objectives by promoting private sector development in countries where considerable work is required to fund, create and structure projects. Although operating in these countries is often less p ...

BVR8ppt

... estimating debt ratios: For most companies, using book values will yield a lower cost of capital than using market value weights. Since accounting returns are computed based upon book value, consistency requires the use of book value in computing cost of capital: While it may seem consistent to use ...

... estimating debt ratios: For most companies, using book values will yield a lower cost of capital than using market value weights. Since accounting returns are computed based upon book value, consistency requires the use of book value in computing cost of capital: While it may seem consistent to use ...

International Investment

... Asset pricing models do not argue that risk factors have geographically different E(R). In the US market, value and size explain the difference in E(R) across equity portfolio International value stocks and small stocks diversify US portfolio more than EAFE. ...

... Asset pricing models do not argue that risk factors have geographically different E(R). In the US market, value and size explain the difference in E(R) across equity portfolio International value stocks and small stocks diversify US portfolio more than EAFE. ...

CVP Analysis

... shares of Rs. 100 each. The management plans to raise another Rs. 30 lakhs to finance a major expansion through the following means: i) Entirely through Equity Shares ii) Rs. 15 lakhs in equity shares of Rs. 100 each & balance in 8% debentures iii)Rs. 10 lakhs in equity shares of Rs. 100 each & bala ...

... shares of Rs. 100 each. The management plans to raise another Rs. 30 lakhs to finance a major expansion through the following means: i) Entirely through Equity Shares ii) Rs. 15 lakhs in equity shares of Rs. 100 each & balance in 8% debentures iii)Rs. 10 lakhs in equity shares of Rs. 100 each & bala ...

Welcome! Property: open for inspection

... months) late. A new track was established in 1980 with termite proof sleepers. In 2004, the track was extended from Alice Springs to Darwin. ...

... months) late. A new track was established in 1980 with termite proof sleepers. In 2004, the track was extended from Alice Springs to Darwin. ...

Some Basics of Venture Capital

... • Often with a tech industry background, in position to judge high-risk investments • Usually a small investment (< $1M) in a very earlystage company (demo, 2-3 employees) • Motivation: – Dramatic return on investment via exit or liquidity event: • Initial Public Offering (IPO) of company • Subseque ...

... • Often with a tech industry background, in position to judge high-risk investments • Usually a small investment (< $1M) in a very earlystage company (demo, 2-3 employees) • Motivation: – Dramatic return on investment via exit or liquidity event: • Initial Public Offering (IPO) of company • Subseque ...

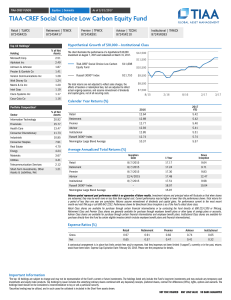

TIAA-CREF Social Choice Low Carbon Equity Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investmen ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investmen ...

Introduction to Hansa Investment Funds What is risk?

... Political risk – risk, that the value of the investment can decrease because of the changes political and/or regulatory environment – Political risk can realize through increased taxes, capital controls, currency devaluation, revolution etc – Scale: credit rating ...

... Political risk – risk, that the value of the investment can decrease because of the changes political and/or regulatory environment – Political risk can realize through increased taxes, capital controls, currency devaluation, revolution etc – Scale: credit rating ...

For investors who prefer a simple and accessible approach to

... Each underlying fund may engage in active and frequent trading, resulting in higher portfolio turnover and transaction costs. As a non-diversified fund, it is permitted to invest a higher percentage of its assets in any one issuer than a diversified fund, which may magnify the fund’s losses from eve ...

... Each underlying fund may engage in active and frequent trading, resulting in higher portfolio turnover and transaction costs. As a non-diversified fund, it is permitted to invest a higher percentage of its assets in any one issuer than a diversified fund, which may magnify the fund’s losses from eve ...

chapter 9 - U of L Class Index

... A major problem with comparing a firm to its industry is that you may not feel comfortable with the measure of central tendency for the industry. Specifically, you may feel that the average value is not a very useful measure because of the wide dispersion of values for the individual firms within th ...

... A major problem with comparing a firm to its industry is that you may not feel comfortable with the measure of central tendency for the industry. Specifically, you may feel that the average value is not a very useful measure because of the wide dispersion of values for the individual firms within th ...

Global Absolute Return Strategies Fund

... Investing in derivatives carries the risk of reduced liquidity, substantial loss and increased volatility in adverse market conditions, such as a failure amongst market participants. The use of derivatives will result in the fund being leveraged (where economic exposure and thus the potential for lo ...

... Investing in derivatives carries the risk of reduced liquidity, substantial loss and increased volatility in adverse market conditions, such as a failure amongst market participants. The use of derivatives will result in the fund being leveraged (where economic exposure and thus the potential for lo ...

Equities and Indexes

... Tracking market returns Benchmarking fund manager performance Bases for derivatives, e.g., index options ...

... Tracking market returns Benchmarking fund manager performance Bases for derivatives, e.g., index options ...

Your global investment challenges answered

... Through O'Connor, you have access to a global, relative value-focused, single-manager hedge fund platform. It is dedicated to providing investors with absolute and riskadjusted returns, differentiated from those available from long-only investments in traditional asset classes. Fixed income You can ...

... Through O'Connor, you have access to a global, relative value-focused, single-manager hedge fund platform. It is dedicated to providing investors with absolute and riskadjusted returns, differentiated from those available from long-only investments in traditional asset classes. Fixed income You can ...

New Issue of Securities (Chapter 6 of Listing Requirements): Fund

... 2011, 22 September 2011 and 4 October 2011 in respect of the Proposed Private Placement. Further to the above, KIBB, on behalf of the Board, is pleased to announce that Bursa Malaysia Securities Berhad (“Bursa Securities”) had vide its letter dated 7 October 2011 (“Approval Letter”) approved the lis ...

... 2011, 22 September 2011 and 4 October 2011 in respect of the Proposed Private Placement. Further to the above, KIBB, on behalf of the Board, is pleased to announce that Bursa Malaysia Securities Berhad (“Bursa Securities”) had vide its letter dated 7 October 2011 (“Approval Letter”) approved the lis ...

Chairman`s Letter 2005 - Plymouth Rock Assurance

... good showing. The three insurance management companies, which are only expected to earn about half as much per unit of premium volume, earned a net income of $23.2 million, or 3.2% of managed premiums and very close to the appropriate target. The holding companies added $2.9 million to the gains. Th ...

... good showing. The three insurance management companies, which are only expected to earn about half as much per unit of premium volume, earned a net income of $23.2 million, or 3.2% of managed premiums and very close to the appropriate target. The holding companies added $2.9 million to the gains. Th ...

Edward Meigs and Sean Slein Discuss Investing in High Yield

... risk we’re taking. For anything that we buy, we generally expect the credit to stay the same or to improve, and we expect the issuer to be generating a fair level of free cash flow in order to service its debt. We think of ourselves as risk rotators—we believe that rotating risk in each phase of the ...

... risk we’re taking. For anything that we buy, we generally expect the credit to stay the same or to improve, and we expect the issuer to be generating a fair level of free cash flow in order to service its debt. We think of ourselves as risk rotators—we believe that rotating risk in each phase of the ...

Investments Lecture Notes

... Purchased to yield interest, dividends, or increases in fair value. They are not ...

... Purchased to yield interest, dividends, or increases in fair value. They are not ...

Columbia Marsico International Opportunities Fund

... Index soared 18.53% in local currency terms during the quarter, but rose only 5.20% after translating the return into U.S. dollar terms. Long-term interest rates fell modestly in both the United States and abroad during the period, and oil prices roughly stabilized at approximately half of mid-2014 ...

... Index soared 18.53% in local currency terms during the quarter, but rose only 5.20% after translating the return into U.S. dollar terms. Long-term interest rates fell modestly in both the United States and abroad during the period, and oil prices roughly stabilized at approximately half of mid-2014 ...

KSE crossed all time high owing to 12 year low inflation figure

... The company Spectrum Securities (Private) Limited was acquired from M/S Mazhar Hussain Securities (Private) Limited. Mazhar Hussain Securities (Private) Limited was constituted in December 19, 2000. Later, Spectrum Securities took over Mazhar Hussain Securities on October 27, 2014 and registered in ...

... The company Spectrum Securities (Private) Limited was acquired from M/S Mazhar Hussain Securities (Private) Limited. Mazhar Hussain Securities (Private) Limited was constituted in December 19, 2000. Later, Spectrum Securities took over Mazhar Hussain Securities on October 27, 2014 and registered in ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.