Untitled

... rates continue for years, the result is called creeping inflation. A rapid increase in price levels is called galloping inflation. If the rate exceeds 50 percent per month, it is called hyperinflation. Deflation, which is a decrease in general price levels, happens very rarely. 3. Name the two main ...

... rates continue for years, the result is called creeping inflation. A rapid increase in price levels is called galloping inflation. If the rate exceeds 50 percent per month, it is called hyperinflation. Deflation, which is a decrease in general price levels, happens very rarely. 3. Name the two main ...

The Greenspan Legacy of Hyperinflation

... created by inflation and hyper-inflation consumption falls but is more than offset by hoarding such that composite demand increases. But this demand that is fueled by a desire to diversify out of a depreciating currency depends on someone being willing to take the other side of the trade and to acce ...

... created by inflation and hyper-inflation consumption falls but is more than offset by hoarding such that composite demand increases. But this demand that is fueled by a desire to diversify out of a depreciating currency depends on someone being willing to take the other side of the trade and to acce ...

questions to the Lecture 5

... 13. What interest rate do we take into consideration in money demand function and why? 14. Explain the idea behind portfolio theories of money demand. 15. Explain the idea behind transaction theories of money demand. 16. Write down the definition (formula) of CPI. How is CPI computed in real life? 1 ...

... 13. What interest rate do we take into consideration in money demand function and why? 14. Explain the idea behind portfolio theories of money demand. 15. Explain the idea behind transaction theories of money demand. 16. Write down the definition (formula) of CPI. How is CPI computed in real life? 1 ...

Economic Fluctuations: Unemployment and Inflation

... that prices were rising at 11% annually. In 1980, we had output falling by .3% at the same time that the inflation rate was about thirteen 13.5%. The final possibility to consider is hyperinflation, an extraordinarily rapid increase in prices. Hyperinflation is very rare and when it happens it makes ...

... that prices were rising at 11% annually. In 1980, we had output falling by .3% at the same time that the inflation rate was about thirteen 13.5%. The final possibility to consider is hyperinflation, an extraordinarily rapid increase in prices. Hyperinflation is very rare and when it happens it makes ...

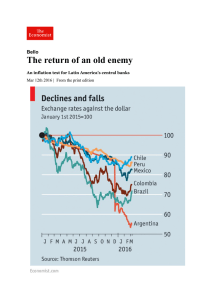

The return of an old enemy | The Economist

... Alejandro Werner of the IMF. The Fund’s research shows that before 1999, when several ...

... Alejandro Werner of the IMF. The Fund’s research shows that before 1999, when several ...

The Effects of Hyperinflationary Environments on

... annualized inflation rate of 50,000 percent (the highest inflation rate in world history for a peacetime economy) (Swanson, 2003). The primary cause of the high inflation rates was deficit spending. The three governments paid off debt by increasing the money supply without increasing production, whi ...

... annualized inflation rate of 50,000 percent (the highest inflation rate in world history for a peacetime economy) (Swanson, 2003). The primary cause of the high inflation rates was deficit spending. The three governments paid off debt by increasing the money supply without increasing production, whi ...

Module 33 - Types of Infl

... • Assumes adjustment is automatic and instantaneous • Holds true during periods of high inflation but not in times of slower inflation • So in countries with persistently high inflation, increase in M are quickly turned into changes in P (inflation) but in other countries, changes in M may actually ...

... • Assumes adjustment is automatic and instantaneous • Holds true during periods of high inflation but not in times of slower inflation • So in countries with persistently high inflation, increase in M are quickly turned into changes in P (inflation) but in other countries, changes in M may actually ...

Hyperinflation and state bankruptcies: an acute threat?

... Is the threat of hyperinflation and state bankruptcy acute? Hyperinflation is defined as an inflation rate of 50% per quarter. We do not anticipate such a development. The requisite demand pressures on the goods market are absent, as are political acceptance and monetary laxity. Though we expect inf ...

... Is the threat of hyperinflation and state bankruptcy acute? Hyperinflation is defined as an inflation rate of 50% per quarter. We do not anticipate such a development. The requisite demand pressures on the goods market are absent, as are political acceptance and monetary laxity. Though we expect inf ...

I) Inflation

... the general level of prices. The value of currency is constantly decreasing. Conversely, prices of all consumer goods are constantly increasing. ...

... the general level of prices. The value of currency is constantly decreasing. Conversely, prices of all consumer goods are constantly increasing. ...

what is management

... When Money Loses its Meaning When money decreases in value because of inflation, people tend to place less trust in it as a method of storing value, and look for alternative means of storing their wealth that would be more efficient. Hyperinflation—extremely high inflation that can range from 100% t ...

... When Money Loses its Meaning When money decreases in value because of inflation, people tend to place less trust in it as a method of storing value, and look for alternative means of storing their wealth that would be more efficient. Hyperinflation—extremely high inflation that can range from 100% t ...

Beginning Activity

... • Creeping inflation – 1 to 3% per year • Galloping inflation – 100 to 300% per year • Hyperinflation – 500% and up – Ex. Hungary’s currency inflation went up to 828 octillion to 1 because it printed money to pay its bills. – What currency rule does that violate? ...

... • Creeping inflation – 1 to 3% per year • Galloping inflation – 100 to 300% per year • Hyperinflation – 500% and up – Ex. Hungary’s currency inflation went up to 828 octillion to 1 because it printed money to pay its bills. – What currency rule does that violate? ...

Hyperinflation

Certain figures in this article use scientific notation for readability.In economics, hyperinflation occurs when a country experiences very high and usually accelerating rates of inflation, rapidly eroding the real value of the local currency, and causing the population to minimize their holdings of the local money. The population normally switches to holding relatively stable foreign currencies. Under such conditions, the general price level within an economy increases rapidly as the official currency quickly loses real value. The value of economic items remains relatively more stable in terms of foreign currencies.Unlike low inflation, where the process of rising prices is protracted and not generally noticeable except by studying past market prices, hyperinflation sees a rapid and continuing increase in nominal prices and in the supply of money, and the nominal cost of goods. But typically the general price level rises even more rapidly than the money supply since people try to get rid of the devaluing money as quickly as possible. The real stock of money, that is the amount of circulating money divided by the price level, decreases.Hyperinflations are usually caused by large persistent government deficits financed primarily by money creation (rather than taxation or borrowing). As such, hyperinflation is often associated with wars, their aftermath, sociopolitical upheavals, or other crises that make it difficult for the government to tax the population. A sharp decrease in real tax revenue coupled with a strong need to maintain the status quo, together with an inability or unwillingness to borrow, can lead a country into hyperinflation.