Economic of Depression, Hyperinflation, and Deficits

... Frequently there are unsuccessful attempts at stabilization before the final success disagreement over who should bear the cost of ...

... Frequently there are unsuccessful attempts at stabilization before the final success disagreement over who should bear the cost of ...

Chapter 28

... demand conditions in the food and oil markets, it can be difficult to detect the long run trend in price levels when those prices are included. Therefore most statistical agencies also report a measure of 'core inflation', which removes the most volatile components (such as food and oil) from a broa ...

... demand conditions in the food and oil markets, it can be difficult to detect the long run trend in price levels when those prices are included. Therefore most statistical agencies also report a measure of 'core inflation', which removes the most volatile components (such as food and oil) from a broa ...

Slide 1

... according to the amount of trade carried out with each trading partners. For example, if the main trading partner is the UK then the action of the currency against pound is likely to be the most important movement. ...

... according to the amount of trade carried out with each trading partners. For example, if the main trading partner is the UK then the action of the currency against pound is likely to be the most important movement. ...

Discussion of External Constraints on Monetary Policy and the Financial Accelerator

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

Carmen Reinhart is Professor of the International Financial System

... This seems a distant memory after the steady decline in prices in Greece since 2013, alongside a debt crisis and collapse in output. The Swiss National Bank, for its part, has been battling with the deflationary effects of the franc’s dramatic appreciation over the past few years. The deflationary ...

... This seems a distant memory after the steady decline in prices in Greece since 2013, alongside a debt crisis and collapse in output. The Swiss National Bank, for its part, has been battling with the deflationary effects of the franc’s dramatic appreciation over the past few years. The deflationary ...

THE CENTRAL BANK AND INFLATION

... the two other possible causes of inflation, growth of the money stock and growth of velocity, it is rapid growth of the money stock that causes very rapid rates of inflation. In fact, as the money stock grows rapidly and speeds up inflation, this causes people to want to get rid of money very quick ...

... the two other possible causes of inflation, growth of the money stock and growth of velocity, it is rapid growth of the money stock that causes very rapid rates of inflation. In fact, as the money stock grows rapidly and speeds up inflation, this causes people to want to get rid of money very quick ...

Test 2

... price stability as the central bank’s primary goal—Mexico began installing a framework that has proven remarkably successful. Additional fiscal and financial system reforms of the 1990s and 2000s have eliminated macroeconomic policy as a source of instability. Mexico’s experience provides an instruc ...

... price stability as the central bank’s primary goal—Mexico began installing a framework that has proven remarkably successful. Additional fiscal and financial system reforms of the 1990s and 2000s have eliminated macroeconomic policy as a source of instability. Mexico’s experience provides an instruc ...

The Realities of Modern Hyperinflation

... in all episodes of hyperinflation that have occurred in market economies since the mid-1950s. Following Philip Cagan’s classic definition of hyperinflation, published in 1956, we define a hyperinflation episode as beginning in the month that the rise in prices exceeds 50 percent and as ending the mo ...

... in all episodes of hyperinflation that have occurred in market economies since the mid-1950s. Following Philip Cagan’s classic definition of hyperinflation, published in 1956, we define a hyperinflation episode as beginning in the month that the rise in prices exceeds 50 percent and as ending the mo ...

A) income. B) profits. C) as

... 25. In the case of an unanticipated inflation: A) creditors with an unindexed contract are hurt because they get less than they expected in real terms. B) creditors with an indexed contract gain because they get more than they contracted for in nominal terms. C) debtors with an unindexed contract d ...

... 25. In the case of an unanticipated inflation: A) creditors with an unindexed contract are hurt because they get less than they expected in real terms. B) creditors with an indexed contract gain because they get more than they contracted for in nominal terms. C) debtors with an unindexed contract d ...

MACROECONOMICS AND THE GLOBAL BUSINESS ENVIRONMENT

... Assumes banks don’t hold excess reserves Assumes loans make it back to bank as ...

... Assumes banks don’t hold excess reserves Assumes loans make it back to bank as ...

The Realities of Modern Hyperinflation

... in all episodes of hyperinflation that have occurred in market economies since the mid-1950s. Following Philip Cagan’s classic definition of hyperinflation, published in 1956, we define a hyperinflation episode as beginning in the month that the rise in prices exceeds 50 percent and as ending the mo ...

... in all episodes of hyperinflation that have occurred in market economies since the mid-1950s. Following Philip Cagan’s classic definition of hyperinflation, published in 1956, we define a hyperinflation episode as beginning in the month that the rise in prices exceeds 50 percent and as ending the mo ...

Goal 1: Compare two types of inflation Type 1: Demand

... Type 1: Demand-Pull Inflation-An increase in prices that is the result of a total demand for goods and services that is greater than the supply. -demand-pull inflation usually occurs when the economy is in the expansion part of the business cycle -happens with growing production, growing investments ...

... Type 1: Demand-Pull Inflation-An increase in prices that is the result of a total demand for goods and services that is greater than the supply. -demand-pull inflation usually occurs when the economy is in the expansion part of the business cycle -happens with growing production, growing investments ...

Week One Quiz

... A) currency plus non-interest bearing checking accounts. B) currency plus all checking accounts. C) currency plus all deposits at financial institutions. D) definitive money. Answer: B 10) A hyperinflation occurs when A) inflation persists for more than two years. B) inflation persists for more than ...

... A) currency plus non-interest bearing checking accounts. B) currency plus all checking accounts. C) currency plus all deposits at financial institutions. D) definitive money. Answer: B 10) A hyperinflation occurs when A) inflation persists for more than two years. B) inflation persists for more than ...

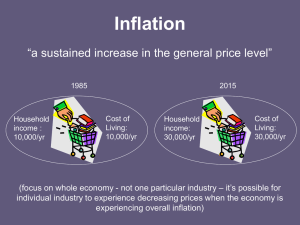

Inflation

... deemed the best rate for a stable economy (higher than that and inflation can have negative effects; lower than that can mean a stagnant economy) As prices rise, the value of money falls – the same money can’t buy as much as it used to. The Bank of England is charged with the responsibility of contr ...

... deemed the best rate for a stable economy (higher than that and inflation can have negative effects; lower than that can mean a stagnant economy) As prices rise, the value of money falls – the same money can’t buy as much as it used to. The Bank of England is charged with the responsibility of contr ...

Chapter 11 Money and the Economy

... Inflation refers to an increase in the general price level. One-shot inflation is a one-time increase in the price level. Continued inflation is continuous increases in the price level (CPI rises each year) ...

... Inflation refers to an increase in the general price level. One-shot inflation is a one-time increase in the price level. Continued inflation is continuous increases in the price level (CPI rises each year) ...

Stagflation is unique situation where there is high

... allowing too much money to enter the economy too quickly. ...

... allowing too much money to enter the economy too quickly. ...

13-Real

... • After four months the government launched the new currency real • The value of 1 real would not be allowed to cost more than one dollar (upper bar in the exchange rate) • Once the exchange rate reach close to 1 real = 1 dollar, the CB committed to sell dollars • All the contract that were set in r ...

... • After four months the government launched the new currency real • The value of 1 real would not be allowed to cost more than one dollar (upper bar in the exchange rate) • Once the exchange rate reach close to 1 real = 1 dollar, the CB committed to sell dollars • All the contract that were set in r ...

Focus Points July 2009

... allows monetarists to focus on rates of change – how fast the supply of new money is growing and how rapidly it is being used to accomplish transactions. To stabilize credit markets, many governments have created unprecedented amounts of new reserves, vastly in excess of the amount of money needed t ...

... allows monetarists to focus on rates of change – how fast the supply of new money is growing and how rapidly it is being used to accomplish transactions. To stabilize credit markets, many governments have created unprecedented amounts of new reserves, vastly in excess of the amount of money needed t ...

Problem of Inflation in India

... government • FM call it is as “Imported Inflation”%% • Increase in food prices, oil prices ,USA recession are some of the reasons behind inflation • CRR was increased from 7.5 to 8 % • Much more needed esp. supply side to control this situation ...

... government • FM call it is as “Imported Inflation”%% • Increase in food prices, oil prices ,USA recession are some of the reasons behind inflation • CRR was increased from 7.5 to 8 % • Much more needed esp. supply side to control this situation ...

Inflation and Deflation

... Inflation and Deflation Inflation is a complex indicator of economic developments. Along with its opposite, deflation, inflation expresses changes in the availability of currency and/or the amount of money needed within an economy. If there are too many dollars in the system, sales prices inflate t ...

... Inflation and Deflation Inflation is a complex indicator of economic developments. Along with its opposite, deflation, inflation expresses changes in the availability of currency and/or the amount of money needed within an economy. If there are too many dollars in the system, sales prices inflate t ...

In Times of inflation….

... • holders of real assets ( such as properties, jewellery ) gain because the values of these assets rise. • money debtors gain because the real value of the debt falls. ...

... • holders of real assets ( such as properties, jewellery ) gain because the values of these assets rise. • money debtors gain because the real value of the debt falls. ...

Hyperinflation

Certain figures in this article use scientific notation for readability.In economics, hyperinflation occurs when a country experiences very high and usually accelerating rates of inflation, rapidly eroding the real value of the local currency, and causing the population to minimize their holdings of the local money. The population normally switches to holding relatively stable foreign currencies. Under such conditions, the general price level within an economy increases rapidly as the official currency quickly loses real value. The value of economic items remains relatively more stable in terms of foreign currencies.Unlike low inflation, where the process of rising prices is protracted and not generally noticeable except by studying past market prices, hyperinflation sees a rapid and continuing increase in nominal prices and in the supply of money, and the nominal cost of goods. But typically the general price level rises even more rapidly than the money supply since people try to get rid of the devaluing money as quickly as possible. The real stock of money, that is the amount of circulating money divided by the price level, decreases.Hyperinflations are usually caused by large persistent government deficits financed primarily by money creation (rather than taxation or borrowing). As such, hyperinflation is often associated with wars, their aftermath, sociopolitical upheavals, or other crises that make it difficult for the government to tax the population. A sharp decrease in real tax revenue coupled with a strong need to maintain the status quo, together with an inability or unwillingness to borrow, can lead a country into hyperinflation.