Tab 1.1 - University of Maine System

... David Sultan, Executive Director, is a Client Advisor in the Endowments & Foundations Group. In his role, David leverages all of the resources of J.P. Morgan to deliver investment advice tailored to the needs of endowments, foundations, and hospitals. Previously, David was an Investment Specialist i ...

... David Sultan, Executive Director, is a Client Advisor in the Endowments & Foundations Group. In his role, David leverages all of the resources of J.P. Morgan to deliver investment advice tailored to the needs of endowments, foundations, and hospitals. Previously, David was an Investment Specialist i ...

perspectives on dynamic asset allocation

... The PSP building block relates to the diversification concept of the framework, which is theoretically constructed as a portfolio with the highest possible Sharpe ratio for the next short-term review period. In practice, however, the situation is more complex. For instance, it is not always clear if ...

... The PSP building block relates to the diversification concept of the framework, which is theoretically constructed as a portfolio with the highest possible Sharpe ratio for the next short-term review period. In practice, however, the situation is more complex. For instance, it is not always clear if ...

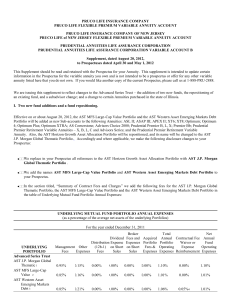

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... This supplement sets forth changes to the Prospectus, dated April 30, 2012 (the Prospectus), of Advanced Series Trust (the Trust). The Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your ...

... This supplement sets forth changes to the Prospectus, dated April 30, 2012 (the Prospectus), of Advanced Series Trust (the Trust). The Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your ...

Market Funds and Trust-Investment Law

... inflation that lay ahead, the authors said (at 17-18): For those accustomed to the twentieth-century trends, however, the most striking implication of the earlier price data is the relative stability of the value of money. . .. Indeed, if we exclude the French wars and their immediate aftermath we c ...

... inflation that lay ahead, the authors said (at 17-18): For those accustomed to the twentieth-century trends, however, the most striking implication of the earlier price data is the relative stability of the value of money. . .. Indeed, if we exclude the French wars and their immediate aftermath we c ...

Unconstrained Investing: Unleash Your Bonds

... models utilize the Barclays Aggregate Index as the de facto bond allocation. This suggests that the allocations in a portfolio should look somewhat like the benchmark. Once one omits the benchmark, allocations can be made based on the attractiveness of the investment rather than the issuance pattern ...

... models utilize the Barclays Aggregate Index as the de facto bond allocation. This suggests that the allocations in a portfolio should look somewhat like the benchmark. Once one omits the benchmark, allocations can be made based on the attractiveness of the investment rather than the issuance pattern ...

Investment Style and Process - Qualified Financial Services

... 1.Source: Franklin Templeton Investments (FTI), as of 06.30.12, unless otherwise noted. Assets under management (AUM) combines the U.S. and non-U.S. AUM of the investment management subsidiaries of the parent company, Franklin Resources, Inc. [NYSE: BEN], a global investment organisation operating a ...

... 1.Source: Franklin Templeton Investments (FTI), as of 06.30.12, unless otherwise noted. Assets under management (AUM) combines the U.S. and non-U.S. AUM of the investment management subsidiaries of the parent company, Franklin Resources, Inc. [NYSE: BEN], a global investment organisation operating a ...

Focus your aim - JP Morgan Asset Management

... portfolios are likely to interact with real-world participant usage shows improved risk/ reward characteristics and potentially stronger investment performance through a wide range of possible market environments. ...

... portfolios are likely to interact with real-world participant usage shows improved risk/ reward characteristics and potentially stronger investment performance through a wide range of possible market environments. ...

Higher Pensions and Less Risk: Innovation at Denmark`s ATP

... 1. If the risk tolerance level becomes too high, the portion of risky assets in the risk portfolio is reduced by one percentage point every fifth weekday after the desired risk tolerance level has been exceeded. If risky assets comprise more than 30% of the total risk portfolio, then risky assets ar ...

... 1. If the risk tolerance level becomes too high, the portion of risky assets in the risk portfolio is reduced by one percentage point every fifth weekday after the desired risk tolerance level has been exceeded. If risky assets comprise more than 30% of the total risk portfolio, then risky assets ar ...

Revisiting the Role of Insurance Company ALM

... Most publicly-traded life insurers classify the majority of their fixed income assets as available for sale under US Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) accounting regimes. This means that fixed income assets are held on the balance s ...

... Most publicly-traded life insurers classify the majority of their fixed income assets as available for sale under US Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) accounting regimes. This means that fixed income assets are held on the balance s ...

The Effect of Credit Risk on Stock Returns

... returns of assets to a mean-variance optimization model. The key concept of the mean-variance optimization model is to build a portfolio with the same or even higher expected return against a lower volatility by eliminating idiosyncratic risk as far as possible using the diversification strategy. As ...

... returns of assets to a mean-variance optimization model. The key concept of the mean-variance optimization model is to build a portfolio with the same or even higher expected return against a lower volatility by eliminating idiosyncratic risk as far as possible using the diversification strategy. As ...

Data Mining, Arbitraged Away, or Here to Stay?

... ball. We’d have to wait as much as 25 years to gain insights on the true return properties of the various smart betas available today. Robust backtests and theory are helpful for understanding the return properties of smart beta strategies, but they can’t completely mitigate the risks associated wit ...

... ball. We’d have to wait as much as 25 years to gain insights on the true return properties of the various smart betas available today. Robust backtests and theory are helpful for understanding the return properties of smart beta strategies, but they can’t completely mitigate the risks associated wit ...

Challenging traditional attitudes towards investment risk and

... of inheritance tax. The saver can draw from the assets at their marginal rate of tax and at the time of their choosing. The perception of poor value from annuities, the flexibility of how much is drawn and the benefits of leaving what is left in a pension pot to loved ones upon death all help explai ...

... of inheritance tax. The saver can draw from the assets at their marginal rate of tax and at the time of their choosing. The perception of poor value from annuities, the flexibility of how much is drawn and the benefits of leaving what is left in a pension pot to loved ones upon death all help explai ...

MACRO HEDGING OF INTEREST RATE RISK INTRODUCTION

... Building a portfolio requires aggregating the necessary information (data) of all assets and liabilities that share the same risk to be hedged. Although systems differ, there is general agreement that the hedging process involves identification of notional amounts and repricing dates. As the economi ...

... Building a portfolio requires aggregating the necessary information (data) of all assets and liabilities that share the same risk to be hedged. Although systems differ, there is general agreement that the hedging process involves identification of notional amounts and repricing dates. As the economi ...