Portfolio choice with jumps: A closed-form solution

... when jumps are included, the determination of an optimal portfolio has not been amenable to a closed-form solution, and this is a long-standing open problem in continuous-time finance. As a result, with n assets, one must solve numerically an n-dimensional nonlinear equation. This is difficult, if n ...

... when jumps are included, the determination of an optimal portfolio has not been amenable to a closed-form solution, and this is a long-standing open problem in continuous-time finance. As a result, with n assets, one must solve numerically an n-dimensional nonlinear equation. This is difficult, if n ...

View/Open

... The first case involved allowing for different lease rates. Johnson argued that there must be some risk-free alternative, thus the farmer should be able to lease his/her land. The second case involved looking at long-run diversification problem. Or in other words, the amount of land ownership can va ...

... The first case involved allowing for different lease rates. Johnson argued that there must be some risk-free alternative, thus the farmer should be able to lease his/her land. The second case involved looking at long-run diversification problem. Or in other words, the amount of land ownership can va ...

Our Investment Process - Horbury Financial Services

... customers risk profiles. They are professional and experienced in doing this and are well respected within their field. ...

... customers risk profiles. They are professional and experienced in doing this and are well respected within their field. ...

Ch22e-EquityPortfoli..

... (or programming techniques) • This is the application for which Markowitz optimization is most frequently used in practice • Suffers from the same problems as mentioned in Ch. 8 on Markowitz optimization, such as: – Relies on historical correlations, which may change over time, leading to failure to ...

... (or programming techniques) • This is the application for which Markowitz optimization is most frequently used in practice • Suffers from the same problems as mentioned in Ch. 8 on Markowitz optimization, such as: – Relies on historical correlations, which may change over time, leading to failure to ...

Behavioral Portfolio Theory

... mean-variance investors, integrate their portfolios into a single mental account; they do so by considering covariance. In contrast, BPT-MA investors segregate their portfolios into mental accounts and overlook covariance among mental ac? counts. Note that BPT-MA differs from both Markowitz's mean-v ...

... mean-variance investors, integrate their portfolios into a single mental account; they do so by considering covariance. In contrast, BPT-MA investors segregate their portfolios into mental accounts and overlook covariance among mental ac? counts. Note that BPT-MA differs from both Markowitz's mean-v ...

Multi-stock portfolio optimization under prospect theory

... the prospect value can indeed explode for large portfolios. This issue of ill-posedness is a shortcoming of prospect theory and it has sometimes been overlooked in the literature. Here prospect theory sets wrong incentives, as the trade-off between gains and losses is not present. The agent strives ...

... the prospect value can indeed explode for large portfolios. This issue of ill-posedness is a shortcoming of prospect theory and it has sometimes been overlooked in the literature. Here prospect theory sets wrong incentives, as the trade-off between gains and losses is not present. The agent strives ...

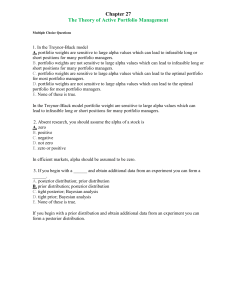

Chapter 27 The Theory of Active Portfolio Management

... D. indexing is always optimal. E. the objective of security analysis is to form an active portfolio of a limited number of mispriced securities; the cost of less than full diversification comes from the nonsystematic risk of the mispriced stock; and the optimal weight of a mispriced security in the ...

... D. indexing is always optimal. E. the objective of security analysis is to form an active portfolio of a limited number of mispriced securities; the cost of less than full diversification comes from the nonsystematic risk of the mispriced stock; and the optimal weight of a mispriced security in the ...

Chapter 5

... (rounded slightly) VaR$ = $500,000 x -.4557 = -$227,850 What does this number mean? ...

... (rounded slightly) VaR$ = $500,000 x -.4557 = -$227,850 What does this number mean? ...

Will my portfolio give me an inflation plus return?

... case focused on technology stocks and the emergence of the internet. The tech bubble and bust foreshadowed more than just another boom-bust event. It marked the end of the era of disinflation and heralded more difficult economic and investment times ahead. As this realisation has progressively dawne ...

... case focused on technology stocks and the emergence of the internet. The tech bubble and bust foreshadowed more than just another boom-bust event. It marked the end of the era of disinflation and heralded more difficult economic and investment times ahead. As this realisation has progressively dawne ...

投影片 1

... Determining best linear fits • A famous application in Finance of determining the best linear fit is determining the β of a stock. • CAPM assumes that the return of a stock s in a given time period is rs = a + βrm + ε, rs = return on stock s in the time period rm = return on market in the time peri ...

... Determining best linear fits • A famous application in Finance of determining the best linear fit is determining the β of a stock. • CAPM assumes that the return of a stock s in a given time period is rs = a + βrm + ε, rs = return on stock s in the time period rm = return on market in the time peri ...

the case for real return investing

... as a result of any reliance on this information. The PDS for the Perpetual Diversified Real Return Fund, issued by PIML, should be considered before deciding whether to acquire or hold units in the fund. The PDS can be obtained by calling 1800 011 022 or visiting our website www.perpetual.com.au. No ...

... as a result of any reliance on this information. The PDS for the Perpetual Diversified Real Return Fund, issued by PIML, should be considered before deciding whether to acquire or hold units in the fund. The PDS can be obtained by calling 1800 011 022 or visiting our website www.perpetual.com.au. No ...

Portfolio Funding Profile

... For Due Diligence purposes only. Not for distribution to the public in any form. ...

... For Due Diligence purposes only. Not for distribution to the public in any form. ...

Managed portfolio service

... with Rathbones taking no responsibility for the suitability of the investment. ...

... with Rathbones taking no responsibility for the suitability of the investment. ...

Illusions of Precision, Completeness and Control

... for more details), but Sharpe Ratios are useless in a fat tail/high peak world and, in fact, can drive plan sponsors to create portfolios that seek to pick up proverbial nickels while standing in front of a silently approaching steamroller; greater complexity often makes plans more susceptible to su ...

... for more details), but Sharpe Ratios are useless in a fat tail/high peak world and, in fact, can drive plan sponsors to create portfolios that seek to pick up proverbial nickels while standing in front of a silently approaching steamroller; greater complexity often makes plans more susceptible to su ...