Solutions to Chapter 9

... 23. Sassafras is not a risky investment to a diversified investor. Its return is better when the economy enters a recession. Therefore, the company risk offsets the risk of the rest of the portfolio. It is a portfolio stabilizer despite the fact that there is a 90 percent chance of loss. (Compare Sa ...

... 23. Sassafras is not a risky investment to a diversified investor. Its return is better when the economy enters a recession. Therefore, the company risk offsets the risk of the rest of the portfolio. It is a portfolio stabilizer despite the fact that there is a 90 percent chance of loss. (Compare Sa ...

Investing in Bond Funds

... number of investors. In contrast, hedge funds are not subject to the strict regulations that apply to mutual funds. Hedge funds are not required to register with the SEC, they are not legally required to publicly disclose performance and fee information, and their fees tend to be much larger than th ...

... number of investors. In contrast, hedge funds are not subject to the strict regulations that apply to mutual funds. Hedge funds are not required to register with the SEC, they are not legally required to publicly disclose performance and fee information, and their fees tend to be much larger than th ...

Equity Diversification:

... that might mean that he realizes a lower return than anticipated — thus preventing him from meeting investment goals and objectives. In another case, it might mean that his return is less than the rate of inflation — purchasing power risk — meaning that his money won't go as far as when it was inves ...

... that might mean that he realizes a lower return than anticipated — thus preventing him from meeting investment goals and objectives. In another case, it might mean that his return is less than the rate of inflation — purchasing power risk — meaning that his money won't go as far as when it was inves ...

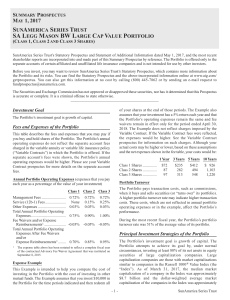

SAST - SA Legg Mason BW Large Cap Value

... will be met or that the net return on an investment in the Portfolio will exceed what could have been obtained through other investment or savings vehicles. Shares of the Portfolio are not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance ...

... will be met or that the net return on an investment in the Portfolio will exceed what could have been obtained through other investment or savings vehicles. Shares of the Portfolio are not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance ...

Sanlam Investment Management Value Fund Class A1

... therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equities. There may be some capital volatility in the short term, although higher returns may be ex ...

... therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include offshore equities. There may be some capital volatility in the short term, although higher returns may be ex ...

The GreaT DebaTe: Income vs . ToTal reTurn

... portfolios with similar expected return, the income investor will choose the one with higher yield.6 Today, to access an acceptable level of income may require moving beyond portfolios that contain only traditional common stocks and bonds. There are a range of other securities that provide a large f ...

... portfolios with similar expected return, the income investor will choose the one with higher yield.6 Today, to access an acceptable level of income may require moving beyond portfolios that contain only traditional common stocks and bonds. There are a range of other securities that provide a large f ...

Strategy Overview Schroder International Equity Alpha Summary

... investors. Our aim is to apply our specialist asset management skills in serving the needs of our clients worldwide and in delivering value to our shareholders. With one of the largest networks of offices of any dedicated asset management company and over 420 portfolio managers and analysts covering ...

... investors. Our aim is to apply our specialist asset management skills in serving the needs of our clients worldwide and in delivering value to our shareholders. With one of the largest networks of offices of any dedicated asset management company and over 420 portfolio managers and analysts covering ...

OCBSFFund1qtr2014 copy

... charges. A schedule of fees and charges and maximum commissions is available from the management company on request. Commission and incentives may be paid and if so, would be included in the overall costs. CIS are traded at ruling prices and forward pricing is used. CIS can engage in borrowing and s ...

... charges. A schedule of fees and charges and maximum commissions is available from the management company on request. Commission and incentives may be paid and if so, would be included in the overall costs. CIS are traded at ruling prices and forward pricing is used. CIS can engage in borrowing and s ...

FM11 Ch 04 Mini

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...