Laddered Bond Portfolio Corporate Fixed Income

... D I S C LOS U R ES The Washington Crossing Advisors Laddered Bond Portfolio requires a $150,000 minimum investment. Strategies in the Stifel Score Program are proprietary products developed by Stifel. More information on the Score Program is included in the Stifel Consulting Services Disclosure Bro ...

... D I S C LOS U R ES The Washington Crossing Advisors Laddered Bond Portfolio requires a $150,000 minimum investment. Strategies in the Stifel Score Program are proprietary products developed by Stifel. More information on the Score Program is included in the Stifel Consulting Services Disclosure Bro ...

Modeling Portfolios that Contain Risky Assets I: Risk and

... A 1952 paper by Harry Markowitz had enormous influence on the theory and practice of portfolio management and financial engineering ever since. It presented his doctoral dissertation work at the Unversity of Chicago, for which he was awarded the Nobel Prize in Economics in 1990. It was the first wor ...

... A 1952 paper by Harry Markowitz had enormous influence on the theory and practice of portfolio management and financial engineering ever since. It presented his doctoral dissertation work at the Unversity of Chicago, for which he was awarded the Nobel Prize in Economics in 1990. It was the first wor ...

Lecture 7

... Suppose risk premium on the market is a function of its variance. The market : ERm – rf = As2m ERi = rf + [(ERm-rf)/s2m] s2i bi sim / s2m Rem. : Portfolio risk is covariance ERi = rf + bi[ERm – rf] or ERi –rf = bi[ERm – rf] ...

... Suppose risk premium on the market is a function of its variance. The market : ERm – rf = As2m ERi = rf + [(ERm-rf)/s2m] s2i bi sim / s2m Rem. : Portfolio risk is covariance ERi = rf + bi[ERm – rf] or ERi –rf = bi[ERm – rf] ...

STOCK Beta

... covariance. If the average covariance were zero, it would be possible to eliminate all risk by holding a sufficient number of securities. – Unfortunately common stocks move together, not independently. Thus most of the stocks that the investor can actually buy are tied together in a web of positive ...

... covariance. If the average covariance were zero, it would be possible to eliminate all risk by holding a sufficient number of securities. – Unfortunately common stocks move together, not independently. Thus most of the stocks that the investor can actually buy are tied together in a web of positive ...

Question and Problem Answers Chapter 5

... risk. In other words, all investments must earn at least this minimum return, otherwise investors will consume their income rather than investing it. Stocks with an "average" amount of systematic risk (â=1; the market risk) should provide a return equal to the average of all investments. Thus the SM ...

... risk. In other words, all investments must earn at least this minimum return, otherwise investors will consume their income rather than investing it. Stocks with an "average" amount of systematic risk (â=1; the market risk) should provide a return equal to the average of all investments. Thus the SM ...

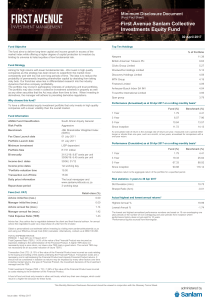

The benefits of growth with lower volatility

... extent of their exposure to risk; (2) have sufficient knowledge, experience and access to professional advisors to make their own legal, tax, accounting, and financial evaluation of the merits and risks of participating in an investment in the strategy; and (3) consider the suitability of investing ...

... extent of their exposure to risk; (2) have sufficient knowledge, experience and access to professional advisors to make their own legal, tax, accounting, and financial evaluation of the merits and risks of participating in an investment in the strategy; and (3) consider the suitability of investing ...

CHAPTER 5 Risk and Rates of Return - Course ON-LINE

... Although people will have different optimal portfolios, these will have the same combination of risky securities. Stated differently, the optimal combination of risky assets for an investor can be determined without any knowledge of the investor’s preferences toward risk and return. Let Wi be the we ...

... Although people will have different optimal portfolios, these will have the same combination of risky securities. Stated differently, the optimal combination of risky assets for an investor can be determined without any knowledge of the investor’s preferences toward risk and return. Let Wi be the we ...

Strategic Finanancial Management

... deemed to be “low” then it will rise to an accurate price given that the market is operating in strong-form efficiency which eliminated arbitrage opportunities such as the EBAY example above. Taking out all of Mary’s money and placing it into fixed income securities may be an option, but it still m ...

... deemed to be “low” then it will rise to an accurate price given that the market is operating in strong-form efficiency which eliminated arbitrage opportunities such as the EBAY example above. Taking out all of Mary’s money and placing it into fixed income securities may be an option, but it still m ...

Quarterly Newsletter - March 1999 : Pinney and Scofield : http://www

... management. We believe that diversification management is the safest and most reliable way to achieve a longterm acceptable rate of return on an investment portfolio. A diversified portfolio will be spread out among many asset classes. Our view is that the portfolio should be constructed with equal ...

... management. We believe that diversification management is the safest and most reliable way to achieve a longterm acceptable rate of return on an investment portfolio. A diversified portfolio will be spread out among many asset classes. Our view is that the portfolio should be constructed with equal ...

R i

... Assumptions for CAPM – All investors have the homogeneous expectations about the expected values, variances, and correlations of security returns – All investors attempt to construct efficient frontier portfolios, i.e., they are rational mean-variance optimizers (Investors are all very similar exce ...

... Assumptions for CAPM – All investors have the homogeneous expectations about the expected values, variances, and correlations of security returns – All investors attempt to construct efficient frontier portfolios, i.e., they are rational mean-variance optimizers (Investors are all very similar exce ...

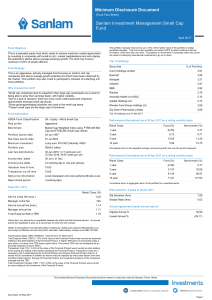

Sanlam Investment Management Small Cap Fund

... The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily a guide to future performances, and that the value of investments / units / unit tr ...

... The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily a guide to future performances, and that the value of investments / units / unit tr ...

Expected Return Standard Deviation

... Efficient Diversification with three risky assets Expected Return ...

... Efficient Diversification with three risky assets Expected Return ...