The Effect of Dividend Tax Relief on Investment Incentives

... which the company may deduct interest payments, to finance their activities. This may make corporate capital structures too rigid and too vulnerable to bankruptcy and financial distress. In addition, by distinguishing between dividends, taxed as ordinary income, and retained earnings and share repur ...

... which the company may deduct interest payments, to finance their activities. This may make corporate capital structures too rigid and too vulnerable to bankruptcy and financial distress. In addition, by distinguishing between dividends, taxed as ordinary income, and retained earnings and share repur ...

O Are We Investing Too Little?

... Compared to the straight-line pattern used previously, geometric patterns lead to faster depreciation for structures in their younger years and slower depreciation in their older years.4 That is, structures initially depreciate more quickly but then last much longer. So buildings and other structure ...

... Compared to the straight-line pattern used previously, geometric patterns lead to faster depreciation for structures in their younger years and slower depreciation in their older years.4 That is, structures initially depreciate more quickly but then last much longer. So buildings and other structure ...

The End of the Great Depression 1939-41

... as sources of the end of the Great Depression. Candidates for this list explaining the end, each with strong supporting voices in the literature, include monetary policy, military spending, and the economy’s natural mean-reverting and recuperative properties. Some of the prominent policymakers of th ...

... as sources of the end of the Great Depression. Candidates for this list explaining the end, each with strong supporting voices in the literature, include monetary policy, military spending, and the economy’s natural mean-reverting and recuperative properties. Some of the prominent policymakers of th ...

Mutual Fund Ratings: What is the Risk in Risk

... are perhaps more relevant for investors who are a bit jumpy and/or nearing retirement. Using the same method to simulate 10,000 hypothetical 5 year future holding periods, it turns out that the fund still underperforms the index 38% of the time. So there is still a 62% chance (almost 2:1 odds) that ...

... are perhaps more relevant for investors who are a bit jumpy and/or nearing retirement. Using the same method to simulate 10,000 hypothetical 5 year future holding periods, it turns out that the fund still underperforms the index 38% of the time. So there is still a 62% chance (almost 2:1 odds) that ...

Bank of England Staff Working Paper No.571

... demographic forces, higher inequality and to a lesser extent the glut of precautionary saving by emerging markets. Meanwhile, desired levels of investment have fallen as a result of the falling relative price of capital, lower public investment, and due to an increase in the spread between risk-free ...

... demographic forces, higher inequality and to a lesser extent the glut of precautionary saving by emerging markets. Meanwhile, desired levels of investment have fallen as a result of the falling relative price of capital, lower public investment, and due to an increase in the spread between risk-free ...

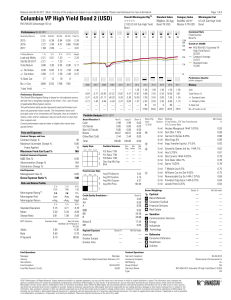

Columbia VP High Yield Bond 2 (USD)

... If adjusted for taxation, the performance quoted would be significantly reduced. For variable annuities, additional expenses will be taken into account, including M&E risk charges, fund-level expenses such as management fees and operating fees, contract-level administration fees, and charges such as ...

... If adjusted for taxation, the performance quoted would be significantly reduced. For variable annuities, additional expenses will be taken into account, including M&E risk charges, fund-level expenses such as management fees and operating fees, contract-level administration fees, and charges such as ...

Dividends and Interest Rate Sensitivity

... central banks have been reluctant to tighten monetary policy over this period. The current economic environment has increased the potential divergence of policy across the world’s economic regions. The European Union has been mired in the prevention of a Greece default, amid soft growth in the South ...

... central banks have been reluctant to tighten monetary policy over this period. The current economic environment has increased the potential divergence of policy across the world’s economic regions. The European Union has been mired in the prevention of a Greece default, amid soft growth in the South ...

GMAT逻辑总结 补充材料 Page 184 第77题 77. Suitable habitats for

... (D) insurance company profits would rise substantially if drivers were classified in terms of the actual number of miles they drive each year (E) drivers who have caused insurance companies to pay costly claims generally pay insurance rates that are equal to or lower than those paid by other drivers ...

... (D) insurance company profits would rise substantially if drivers were classified in terms of the actual number of miles they drive each year (E) drivers who have caused insurance companies to pay costly claims generally pay insurance rates that are equal to or lower than those paid by other drivers ...

The effect of the economic and financial crisis on government

... output. Thus, a fall in tax revenues need not necessarily be due to a change in fiscal policy. In 2010, the slower growth of total expenditure compared to total revenues and nominal GDP indicates a slight improvement in the public balance. ...

... output. Thus, a fall in tax revenues need not necessarily be due to a change in fiscal policy. In 2010, the slower growth of total expenditure compared to total revenues and nominal GDP indicates a slight improvement in the public balance. ...

Strategies to Control Defined Contribution Plan Fees

... sharing with a wrap fee, (2) revenue sharing with a fixed per participant fee, and (3) a fixed per participant fee with a wrap fee. In a revenue sharing with a wrap fee model, an additional wrap charge is applied to the funds in the plan by dividing the revenue shortfall by the total plan assets. Fo ...

... sharing with a wrap fee, (2) revenue sharing with a fixed per participant fee, and (3) a fixed per participant fee with a wrap fee. In a revenue sharing with a wrap fee model, an additional wrap charge is applied to the funds in the plan by dividing the revenue shortfall by the total plan assets. Fo ...

Planning for Retirement Terrance K Martin Jr.* and Michael Finke

... Consumption and savings decisions made in the earlier stages of the life-cycle can have a disproportionately large impact on retirement preparedness. These saving decisions have had an even greater impact on U.S. household welfare over the last two decades as the responsibility for funding retiremen ...

... Consumption and savings decisions made in the earlier stages of the life-cycle can have a disproportionately large impact on retirement preparedness. These saving decisions have had an even greater impact on U.S. household welfare over the last two decades as the responsibility for funding retiremen ...

NBER WORKING PAPER SERIES TOWARDS A THEORY OF CURRENT ACCOUNTS Jaume Ventura

... about 33 percent in Japan. The latter is an outlier and most countries have an average saving rate somewhere between 18 and 25 percent. The differences in short run or year-to-year saving rates are even larger. In most countries the lowest saving rate is below 14 percent while the largest exceeds 26 ...

... about 33 percent in Japan. The latter is an outlier and most countries have an average saving rate somewhere between 18 and 25 percent. The differences in short run or year-to-year saving rates are even larger. In most countries the lowest saving rate is below 14 percent while the largest exceeds 26 ...

The thirty-minute guide to Private Equity

... they still own portfolio companies which have millions of people in employment. UNI Global Union is concerned about what the deteriorating financial environment means to the debt laden companies. The protection of workers interests during this credit crisis is a serious concern and not one likely to ...

... they still own portfolio companies which have millions of people in employment. UNI Global Union is concerned about what the deteriorating financial environment means to the debt laden companies. The protection of workers interests during this credit crisis is a serious concern and not one likely to ...

Macroeconomic Effects from Government Purchases and Taxes

... of nominal outlays in most cases over the next 3–5 years, and expressed these changes as present values by using US Treasury yields. As an example, she found that during the second quarter of 1940, planned nominal defense spending rose by $3 billion for 1941 and around $10 billion for each of 1942, ...

... of nominal outlays in most cases over the next 3–5 years, and expressed these changes as present values by using US Treasury yields. As an example, she found that during the second quarter of 1940, planned nominal defense spending rose by $3 billion for 1941 and around $10 billion for each of 1942, ...

Time-varying risk premia and the cost of capital

... Consistent with this implication, we find that variables which forecast excess stock market returns are also long-horizon predictors of aggregate investment growth. In particular, we find that an empirical proxy for the log consumption-aggregate wealth ratio (developed in Lettau and Ludvigson, 2001a) ...

... Consistent with this implication, we find that variables which forecast excess stock market returns are also long-horizon predictors of aggregate investment growth. In particular, we find that an empirical proxy for the log consumption-aggregate wealth ratio (developed in Lettau and Ludvigson, 2001a) ...

Growth Expectations, Dividend Yields, and Future Stock Returns

... Pruitt (2013) in which the single market return predicting factor is extracted from the cross section of portfolio-level valuation ratios. Extracting the forecasting factor from the cross section of stock yields delivers even better performance. The out-of-sample R2 s are 2.71% and 19.49%, respectiv ...

... Pruitt (2013) in which the single market return predicting factor is extracted from the cross section of portfolio-level valuation ratios. Extracting the forecasting factor from the cross section of stock yields delivers even better performance. The out-of-sample R2 s are 2.71% and 19.49%, respectiv ...

expenditure plans and real gdp

... • The Basic Idea of the Multiplier – The initial increase in investment brings an even bigger increase in aggregate expenditure because it encourages an increase in consumption expenditure. – The multiplier determines the amount of the increase in aggregate expenditure that results from an increase ...

... • The Basic Idea of the Multiplier – The initial increase in investment brings an even bigger increase in aggregate expenditure because it encourages an increase in consumption expenditure. – The multiplier determines the amount of the increase in aggregate expenditure that results from an increase ...

What Drives the German Current Account? And How Does it Affect

... Several hypotheses about the causes of Germany's external surplus have been debated in the policy and academic literature. Those causes have mostly been discussed separately, although in reality these drivers can operate jointly. Our estimated model allows us to recover the shocks that drive the Ger ...

... Several hypotheses about the causes of Germany's external surplus have been debated in the policy and academic literature. Those causes have mostly been discussed separately, although in reality these drivers can operate jointly. Our estimated model allows us to recover the shocks that drive the Ger ...

Title of the Text Crauder

... The minimum payment is 5% of the balance. Suppose we have a balance of $400 on the card. We decide to stop charging and to pay it off by making the minimum payment each month. Calculate the new balance after we have made our first minimum payment, and then calculate the minimum payment due for the n ...

... The minimum payment is 5% of the balance. Suppose we have a balance of $400 on the card. We decide to stop charging and to pay it off by making the minimum payment each month. Calculate the new balance after we have made our first minimum payment, and then calculate the minimum payment due for the n ...

Structural Unemployment in Japan - Pacific Economic Cooperation

... Employment adjustment speed was slow, because of high fixed costs due to long-term employment and accumulated firm-specific skills though intensive OJT. Discouraged-worker effect among women contributed to reduce labor supply during recessions. Smooth transition from school to work was ensured throu ...

... Employment adjustment speed was slow, because of high fixed costs due to long-term employment and accumulated firm-specific skills though intensive OJT. Discouraged-worker effect among women contributed to reduce labor supply during recessions. Smooth transition from school to work was ensured throu ...

The Macroeconomic Effects of Public Investment: Evidence from

... Six years after the global financial crisis, the recovery in many advanced economies remains tepid. There are now worries that demand will remain persistently weak—a possibility that has been described as “secular stagnation” (Summers 2013; Teulings and Baldwin 2014). One response that is being cons ...

... Six years after the global financial crisis, the recovery in many advanced economies remains tepid. There are now worries that demand will remain persistently weak—a possibility that has been described as “secular stagnation” (Summers 2013; Teulings and Baldwin 2014). One response that is being cons ...

Aalborg Universitet The Danish Welfare Commission Gjerding, Allan Næs

... are distributed across families according to the age of the mother in the family, based on a demographic prognosis of age-dependent fertility. The size of the representative family changes during time according to probabilities of child birth and death, and according to patterns for children growing ...

... are distributed across families according to the age of the mother in the family, based on a demographic prognosis of age-dependent fertility. The size of the representative family changes during time according to probabilities of child birth and death, and according to patterns for children growing ...

Introduntion - Hakan Berument`sHomepage

... and net trade balance by employing Uhlig’s (2005) methodology using quarterly data from 1987:Q1 to 2008:Q3 for Turkey. To the best of our knowledge, this is the first study that attempts to understand how the monetary policy affects each component of aggregate demand using Uhlig’s (2005) sign restri ...

... and net trade balance by employing Uhlig’s (2005) methodology using quarterly data from 1987:Q1 to 2008:Q3 for Turkey. To the best of our knowledge, this is the first study that attempts to understand how the monetary policy affects each component of aggregate demand using Uhlig’s (2005) sign restri ...

FREE Sample Here

... lowered interest charges and consequently increased net income and EPS. If we had to increase assets, then we would have had to finance this increase by adding either debt or equity, which would have lowered ROE and EPS, other things held constant. Finally, note that we could have asked some concept ...

... lowered interest charges and consequently increased net income and EPS. If we had to increase assets, then we would have had to finance this increase by adding either debt or equity, which would have lowered ROE and EPS, other things held constant. Finally, note that we could have asked some concept ...

Study on the Relationship Between Concentration Ratio of

... deteriorating terms of trade. A. A. Reddy [3] presents a literature review on Agricultural productivity growth, Research indicates that significant income gains are possible through crop diversification from paddy to pulses, oilseeds and HVCs in upland rain fed areas. These studies have demonstrated ...

... deteriorating terms of trade. A. A. Reddy [3] presents a literature review on Agricultural productivity growth, Research indicates that significant income gains are possible through crop diversification from paddy to pulses, oilseeds and HVCs in upland rain fed areas. These studies have demonstrated ...