Year 6 Money Matters - Manor Field Primary School

... Recognise household expenses and regular financial commitments. Begin to understand why money, such as tax or pension contributions, is deducted from earnings Understand that we may increase money through saving by gaining interest Begin to understand the principles of probability and insurance. ...

... Recognise household expenses and regular financial commitments. Begin to understand why money, such as tax or pension contributions, is deducted from earnings Understand that we may increase money through saving by gaining interest Begin to understand the principles of probability and insurance. ...

Public Eye - JP Morgan Asset Management

... unleveraged core properties trading at internal rates of return (IRRs) at just 6%, based on our current underwriting. This is a low and, for some investors, a psychological barrier that makes real estate feel more like bonds than equities. However, these IRRs are still at a historically wide spread ...

... unleveraged core properties trading at internal rates of return (IRRs) at just 6%, based on our current underwriting. This is a low and, for some investors, a psychological barrier that makes real estate feel more like bonds than equities. However, these IRRs are still at a historically wide spread ...

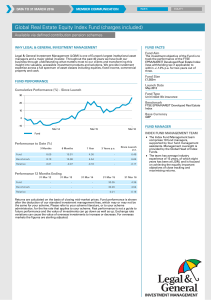

Global Real Estate Equity Index Fund

... Returns are calculated on the basis of closing mid-market prices. Fund performance is shown after the deduction of our standard investment management fees, which may or may not be the same for your scheme. Please refer to your scheme literature, or to your scheme administrator, for the fee rate that ...

... Returns are calculated on the basis of closing mid-market prices. Fund performance is shown after the deduction of our standard investment management fees, which may or may not be the same for your scheme. Please refer to your scheme literature, or to your scheme administrator, for the fee rate that ...

ECON 201: Introduction to Macroeconomics Professor Robert

... A) In both cases, individual behavior has large negative consequences for the whole of society. B) In both cases, seemingly bad behavior ends up harming everyone. C) In both cases, seemingly careless behavior leads to good times for all. D) In both cases, government intervention can only make matter ...

... A) In both cases, individual behavior has large negative consequences for the whole of society. B) In both cases, seemingly bad behavior ends up harming everyone. C) In both cases, seemingly careless behavior leads to good times for all. D) In both cases, government intervention can only make matter ...

Barbados_en.pdf

... The tourism sector continues to be the largest foreign-exchange earner for Barbados, and its poor performance since the economic crisis has hampered the return to sustained growth. After a 5.6% fall in tourism arrivals between 2012 and 2013, the downward trend continued with a further 1% drop year-o ...

... The tourism sector continues to be the largest foreign-exchange earner for Barbados, and its poor performance since the economic crisis has hampered the return to sustained growth. After a 5.6% fall in tourism arrivals between 2012 and 2013, the downward trend continued with a further 1% drop year-o ...

Polish Presentation

... Indicator of differences in GDP per capita among voivodeships (NUTS-2) below the average value for the EU-27 (in 2009 20.7 in Poland and 27.2 in EU-27); but growing while in the EU it declines. • Public investments rate in 2011 stood at a record high 5.8% of the GDP. The share of public sector’s i ...

... Indicator of differences in GDP per capita among voivodeships (NUTS-2) below the average value for the EU-27 (in 2009 20.7 in Poland and 27.2 in EU-27); but growing while in the EU it declines. • Public investments rate in 2011 stood at a record high 5.8% of the GDP. The share of public sector’s i ...

Handout #5 - Texas A&M University

... Annual level of gross private domestic investment. This is significant since it not only affects GDP but also indirectly affects the growth of the economy’s productive capacity and employment over the longer run. ...

... Annual level of gross private domestic investment. This is significant since it not only affects GDP but also indirectly affects the growth of the economy’s productive capacity and employment over the longer run. ...

financial focus - Pegasus Asset Management, Inc.

... Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or inves ...

... Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or inves ...

www.financialexecutives.org

... 30 Day T-bill rate drops to all time low of 5bp Treasury reserves $250 Billion of TARPs for investment in banks and other financial institutions ...

... 30 Day T-bill rate drops to all time low of 5bp Treasury reserves $250 Billion of TARPs for investment in banks and other financial institutions ...

Discretionary fiscal policy refers to: A. any change in government

... B. tax increases during recession and tax cuts during inflation. C. tax cuts during recession and tax increases during inflation. D. increases in government spending during recession and tax increases during inflation. Answer: D 5. The effect of a government surplus on the equilibrium level of GDP i ...

... B. tax increases during recession and tax cuts during inflation. C. tax cuts during recession and tax increases during inflation. D. increases in government spending during recession and tax increases during inflation. Answer: D 5. The effect of a government surplus on the equilibrium level of GDP i ...

PROBLEM SET 2 14.02 Macroeconomics March 6, 2006

... wealth. 3. Expanding government spending leaves less saving available for private investment, so investment necessarily decreases. This is known as the crowding-out effect of fiscal expansion. Ans: Uncertain. A fiscal expansion increases both output and the interest rate. Investment increases with ou ...

... wealth. 3. Expanding government spending leaves less saving available for private investment, so investment necessarily decreases. This is known as the crowding-out effect of fiscal expansion. Ans: Uncertain. A fiscal expansion increases both output and the interest rate. Investment increases with ou ...

CHAPTER II - ECONOMIC REFORMS IN NUTSHELL

... general prosperity of the nation. This was because the goal of public sector is publicgood and not profits. Further, since, in the first few years of Independence, private capital was lacking, the Central government had to make large investment in heavy industry, fuel and infrastructure. There was a ...

... general prosperity of the nation. This was because the goal of public sector is publicgood and not profits. Further, since, in the first few years of Independence, private capital was lacking, the Central government had to make large investment in heavy industry, fuel and infrastructure. There was a ...

1. The tax multiplier associated with a $10B reduction in taxes is

... When the U.S. central bank, the Federal Reserve, increases the supply of money: a. U.S. interest rates fall which cause the U.S. dollar to depreciate against other currencies. b. U.S. interest rates rise which cause the U.S. dollar to depreciate against other currencies. c. U.S. interest rates fall ...

... When the U.S. central bank, the Federal Reserve, increases the supply of money: a. U.S. interest rates fall which cause the U.S. dollar to depreciate against other currencies. b. U.S. interest rates rise which cause the U.S. dollar to depreciate against other currencies. c. U.S. interest rates fall ...

Exponential Function

... 9. Personal Finance: Present Value - A rich uncle wants to make you a million. How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold z ...

... 9. Personal Finance: Present Value - A rich uncle wants to make you a million. How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold z ...

Operating Leases

... 1. The lease asset is not reported on the balance sheet - net operating asset turnover (NOAT) is higher. 2. The lease liability is not reported on the balance sheet - financial leverage is improved. 3. Without analytical adjustments (see later section on capitalization of operating leases), the port ...

... 1. The lease asset is not reported on the balance sheet - net operating asset turnover (NOAT) is higher. 2. The lease liability is not reported on the balance sheet - financial leverage is improved. 3. Without analytical adjustments (see later section on capitalization of operating leases), the port ...

here - First Trust

... Implications: Nothing in today’s report should shift the Federal Reserve away from raising short-term rates at least twice more this year and starting to trim its balance sheet. Although real GDP expanded at only a 0.7% annual rate in the first quarter, the soft headline was dragged down by slower i ...

... Implications: Nothing in today’s report should shift the Federal Reserve away from raising short-term rates at least twice more this year and starting to trim its balance sheet. Although real GDP expanded at only a 0.7% annual rate in the first quarter, the soft headline was dragged down by slower i ...

Document

... Changes in Exchange Rates Exchange rates (e) are a function of the supply and demand for currency. – An increase in the supply of a currency will decrease the exchange rate of a currency – A decrease in supply of a currency will increase the exchange rate of a currency – An increase in demand for a ...

... Changes in Exchange Rates Exchange rates (e) are a function of the supply and demand for currency. – An increase in the supply of a currency will decrease the exchange rate of a currency – A decrease in supply of a currency will increase the exchange rate of a currency – An increase in demand for a ...

Taiwan`s Current Economic Situation

... Therefore, it is quite difficult to balance our fiscal deficit by the issuance of debt. If the government does not adopt any reform measure, we may face fiscal difficulty in few years. ...

... Therefore, it is quite difficult to balance our fiscal deficit by the issuance of debt. If the government does not adopt any reform measure, we may face fiscal difficulty in few years. ...

1600547EE_Bahamas_en PDF - CEPAL

... individuals who expected to be hired by the resort have failed to secure employment. Inflation remained modest at 2.0% as the pass-through effects of lower fuel prices partly offset higher prices resulting from the introduction of value added tax (VAT) in 2015. The fiscal position improved in fiscal ...

... individuals who expected to be hired by the resort have failed to secure employment. Inflation remained modest at 2.0% as the pass-through effects of lower fuel prices partly offset higher prices resulting from the introduction of value added tax (VAT) in 2015. The fiscal position improved in fiscal ...

October 2, 2001 date last saved: 09/25/01 3:44 PM date last printed

... in the coming decades. Nonetheless, there are many questions about this process. The projected fiscal pressures are far in the future, and long-term projections are very unreliable; might not the whole problem evaporate if we just wait? For example, will increased costs in programs for the elderly b ...

... in the coming decades. Nonetheless, there are many questions about this process. The projected fiscal pressures are far in the future, and long-term projections are very unreliable; might not the whole problem evaporate if we just wait? For example, will increased costs in programs for the elderly b ...

macro quiz 6.tst

... C) balance its budget because that policy would create the maximum level of employment. D) improve the distribution of income. ...

... C) balance its budget because that policy would create the maximum level of employment. D) improve the distribution of income. ...

Business Cycle - The Bronx High School of Science

... people with rising incomes – depends on how rapidly your is rising government usually benefits because taxes collected rises ...

... people with rising incomes – depends on how rapidly your is rising government usually benefits because taxes collected rises ...