Macroeconomics – Fiscal Policy

... used at a time when the economy is not in a recession, it can increase aggregate demand in a way that leads to inflation.* ...

... used at a time when the economy is not in a recession, it can increase aggregate demand in a way that leads to inflation.* ...

... between January and October, also down on the prior-year period (39.8%). The provincial reports also recorded slower food and beverage price inflation, thanks to the effects of the Precios Cuidados public price regulation scheme, which is focused chiefly on food items. Despite slack economic activit ...

AP Macroeconomics

... 9. Using the above graph, draw a SRPC and a LRPC if the expected inflation rate is 4 percent and the natural unemployment rate is 6 percent. Then explain the shortrun changes due to the following situations: a. Slower growth in AD causes a recession. ...

... 9. Using the above graph, draw a SRPC and a LRPC if the expected inflation rate is 4 percent and the natural unemployment rate is 6 percent. Then explain the shortrun changes due to the following situations: a. Slower growth in AD causes a recession. ...

CH17

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

... 7.By fixing the exchange rate, the central bank gives up its ability to A) adjust taxes. B) increase government spending. C) influence the economy through fiscal policy. D)influence the economy through monetary policy. 8.Fiscal Expansion under a fixed exchange has what effect(s) on the economy: A) t ...

Money and Banking - Elkhorn Public Schools

... • If velocity and output are fixed, any increase in the money supply will just drive up prices ...

... • If velocity and output are fixed, any increase in the money supply will just drive up prices ...

Presentation - Federal Reserve Bank of St. Louis

... constitutes a significant risk for U.S. monetary policy, much larger than the risks associated with the zero lower bound. If a bubble in a key asset market develops, history has shown that we have little ability to contain it. A gradual normalization would help to mitigate this risk while still prov ...

... constitutes a significant risk for U.S. monetary policy, much larger than the risks associated with the zero lower bound. If a bubble in a key asset market develops, history has shown that we have little ability to contain it. A gradual normalization would help to mitigate this risk while still prov ...

14.02 Principles of Macroeconomics Problem Set 4 Fall 2004

... 5. The Keynesian government is up for reelection soon, and so it wants to achieve the natural level of output. (We are still in the short run.) Propose two different policy options that would do the job. For each policy option, draw the IS-LM and the AS-AD diagrams, and show how the first translates ...

... 5. The Keynesian government is up for reelection soon, and so it wants to achieve the natural level of output. (We are still in the short run.) Propose two different policy options that would do the job. For each policy option, draw the IS-LM and the AS-AD diagrams, and show how the first translates ...

The liberalisation of the capital market

... accomplished through a printed decree. The desire to simplify public administration was among Struensee’s causes and can also be seen in this order. In addition, the release of the interest rate is found in the same decree as a ban on the export of grain ’to foreign cities.’ ...

... accomplished through a printed decree. The desire to simplify public administration was among Struensee’s causes and can also be seen in this order. In addition, the release of the interest rate is found in the same decree as a ban on the export of grain ’to foreign cities.’ ...

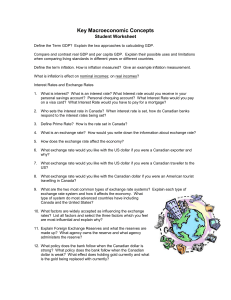

2-1-2 Key Macroeconomic Concepts - Student

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

... 7. What exchange rate would you like with the US dollar if you were a Canadian traveller to the US? 8. What exchange rate would you like with the Canadian dollar if you were an American tourist travelling in Canada? 9. What are the two most common types of exchange rate systems? Explain each type of ...

FedViews

... the past four years, the private sector has finally made up all the jobs lost during the recession. However, because the government is employing fewer workers now than at the start of the recession, total employment—private sector plus government workers—is still a half million jobs short of its pea ...

... the past four years, the private sector has finally made up all the jobs lost during the recession. However, because the government is employing fewer workers now than at the start of the recession, total employment—private sector plus government workers—is still a half million jobs short of its pea ...

1 - UCSB Economics

... In January, 1999 each national currency was redefined as a fixed number of euros. No physical euros yet, but euros are used for electronic transactions and accounting purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in eur ...

... In January, 1999 each national currency was redefined as a fixed number of euros. No physical euros yet, but euros are used for electronic transactions and accounting purposes: stock and bond trades denominated entirely in euros, all transactions between banks, bank customers can write checks in eur ...

Options for Organizing Small and Large Businesses

... Government uses monetary and fiscal policy to fight unemployment, increase spending, and reduce the duration and severity of economic recession. ...

... Government uses monetary and fiscal policy to fight unemployment, increase spending, and reduce the duration and severity of economic recession. ...

Review Questions Chapter 16

... 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, open market operations, and reserve requirements. What is the discount rate? What is the central bank? Define money supply and monetary policy. 3. Suppose the reserve requirement for ...

... 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, open market operations, and reserve requirements. What is the discount rate? What is the central bank? Define money supply and monetary policy. 3. Suppose the reserve requirement for ...

Presentation

... Once the fiscal envelope is determined: Expenditure policy: composition of spending, efficiency and equity issues, scope for ...

... Once the fiscal envelope is determined: Expenditure policy: composition of spending, efficiency and equity issues, scope for ...

Of Prancing Horses and Un

... of the market – It speeds up income convergence at lower cost in current consumption – Rational expectations ensure stability – Competition empowers rational expectations ...

... of the market – It speeds up income convergence at lower cost in current consumption – Rational expectations ensure stability – Competition empowers rational expectations ...

FRBSF E L

... This concern is exemplified by downside risks from abroad. Economic conditions and policies from China to Europe to Brazil have contributed to a substantial increase in the dollar’s value. This has held back U.S. growth and inflation over the past year (see, for example, Amiti and Bodine-Smith 2015) ...

... This concern is exemplified by downside risks from abroad. Economic conditions and policies from China to Europe to Brazil have contributed to a substantial increase in the dollar’s value. This has held back U.S. growth and inflation over the past year (see, for example, Amiti and Bodine-Smith 2015) ...

The Hub of Central Bank Websites Develops Central Bank Search

... Given a deep recession • Restructure the supply side and recapitalise banks as quickly as possible. • Use monetary and fiscal policies to back in aggregate demand. • Both required because Hayek and Keynes both had a point. ...

... Given a deep recession • Restructure the supply side and recapitalise banks as quickly as possible. • Use monetary and fiscal policies to back in aggregate demand. • Both required because Hayek and Keynes both had a point. ...

Slide 1

... • Open market operations: use standard policy tool to pump up reserves and make sure traditional banks had the liquidity they needed. • Problem: It quickly became clear that a “non-bank” bank run was in progress drying up the commercial paper market and putting strains on the availability of credit. ...

... • Open market operations: use standard policy tool to pump up reserves and make sure traditional banks had the liquidity they needed. • Problem: It quickly became clear that a “non-bank” bank run was in progress drying up the commercial paper market and putting strains on the availability of credit. ...

ESCAP High-level Policy Dialogue

... Challenging for countries where commodity prices have stronger & longer‐lasting effects on inflation since food & energy account for a large share of CPI basket & where pass‐ through from global commodity prices is higher CBs typically accommodate first‐round effects as these price pressur ...

... Challenging for countries where commodity prices have stronger & longer‐lasting effects on inflation since food & energy account for a large share of CPI basket & where pass‐ through from global commodity prices is higher CBs typically accommodate first‐round effects as these price pressur ...

Guyana_en.pdf

... capital outlays. The budget deficit is anticipated to be 3.5% of GDP in 2011 but may be as high as 6% in 2012 due especially to the investment in the Amaila Falls hydroelectric project. In the first half of 2011, some US$ 32.2 million in debt relief was received through the Multilateral Debt Relief ...

... capital outlays. The budget deficit is anticipated to be 3.5% of GDP in 2011 but may be as high as 6% in 2012 due especially to the investment in the Amaila Falls hydroelectric project. In the first half of 2011, some US$ 32.2 million in debt relief was received through the Multilateral Debt Relief ...

here - Lakes Area Tea Party

... Simply by virtue of the fact that the following sectors are commonly the first recipients of the new purchasing power, expansionary monetary policy will cause them to become artificially larger and more profitable than otherwise: 1) Finance ...

... Simply by virtue of the fact that the following sectors are commonly the first recipients of the new purchasing power, expansionary monetary policy will cause them to become artificially larger and more profitable than otherwise: 1) Finance ...

presentation

... – Develop a formal theoretical framework and derive a variety of empirical implications. – Link the theory to the test in a direct way (We follow the spirit of empirical implications of theoretical models (EITM)). – The significance of this linkage would help identify stylized international patterns ...

... – Develop a formal theoretical framework and derive a variety of empirical implications. – Link the theory to the test in a direct way (We follow the spirit of empirical implications of theoretical models (EITM)). – The significance of this linkage would help identify stylized international patterns ...

Supply-Side Policy - McGraw Hill Higher Education

... – Increase government outlays. – Widen budget deficits. ...

... – Increase government outlays. – Widen budget deficits. ...

problem set 5 - Shepherd Webpages

... Briefly explain. Label the new equilibrium A’ after you mark it in the graph on the right side above. Repeat the analysis in a and b assuming that Y falls even further to Y2. Label this point A” and plot it in the graph on the right side above. What does the plot of points in the right-hand graph ab ...

... Briefly explain. Label the new equilibrium A’ after you mark it in the graph on the right side above. Repeat the analysis in a and b assuming that Y falls even further to Y2. Label this point A” and plot it in the graph on the right side above. What does the plot of points in the right-hand graph ab ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.