Slide 1

... 1. Own country fiat money (not dollarize, peg, gold standard, etc.) 2. Chronic high inflation 3. Legal restrictions to boost demand for base money a) Currency controls, then trade controls (Hold M, not $) b) Banking, finance, interest rate controls (Hold M, not bank deposits, stocks) c) Anti- “hoard ...

... 1. Own country fiat money (not dollarize, peg, gold standard, etc.) 2. Chronic high inflation 3. Legal restrictions to boost demand for base money a) Currency controls, then trade controls (Hold M, not $) b) Banking, finance, interest rate controls (Hold M, not bank deposits, stocks) c) Anti- “hoard ...

Monetary Policy

... What economist is most associated with advocating fiscal policy tools as a way to end the Great Depression? ...

... What economist is most associated with advocating fiscal policy tools as a way to end the Great Depression? ...

Chapter 12

... have to be drawn to show the different combinations of interest rates and national income to achieve the equilibrium exchange rate. As the level of domestic economic activity increases, the demand for imports would also increase but it is unlikely that this would be accompanied by any increase in th ...

... have to be drawn to show the different combinations of interest rates and national income to achieve the equilibrium exchange rate. As the level of domestic economic activity increases, the demand for imports would also increase but it is unlikely that this would be accompanied by any increase in th ...

CLOUDY IN AMERICA, CLEARING IN CHINA

... political pressure to support U.S. bond prices if global demand declines. Fed action could keep long-term interest rates artificially low but would fail as investors flee the dollar. As of late 2009, the Fed was paying interest on more than US$ 1 trillion in excess reserves.That policy kept a lid on ...

... political pressure to support U.S. bond prices if global demand declines. Fed action could keep long-term interest rates artificially low but would fail as investors flee the dollar. As of late 2009, the Fed was paying interest on more than US$ 1 trillion in excess reserves.That policy kept a lid on ...

Slide 1

... - Probably best solution … if could figure out how to do it. - Problem: Hard to predict impact? world financial meltdown? ...

... - Probably best solution … if could figure out how to do it. - Problem: Hard to predict impact? world financial meltdown? ...

Investor `Extra` - Bank of Ireland Private Banking

... With the European Central Bank’s announcement of further sovereign bond purchases back in January, yet another developed economy central bank has now embarked on a fully fledged Quantitative Easing program. This again prompts investor questions around what exactly the objectives behind QE are and ho ...

... With the European Central Bank’s announcement of further sovereign bond purchases back in January, yet another developed economy central bank has now embarked on a fully fledged Quantitative Easing program. This again prompts investor questions around what exactly the objectives behind QE are and ho ...

Slide 1 - Federal Reserve Bank of Dallas

... • Is transmission of monetary policy through exchange rates becoming more potent? – Shocks to domestic demand have smaller impact on output in more open economies because of offsetting movements in the trade balance (Guerrieri, Gust and Lopez-Salido 2007) ...

... • Is transmission of monetary policy through exchange rates becoming more potent? – Shocks to domestic demand have smaller impact on output in more open economies because of offsetting movements in the trade balance (Guerrieri, Gust and Lopez-Salido 2007) ...

Great Depression

... • If we assume just V is constant or stable, • The equation of exchange (MV=PY) that if M increases, PY (nominal income )will increase. • If deflation is anticipated, when M falls, P will fall • If deflation is not anticipated Y will also fall – In this case money supply is not falling because of di ...

... • If we assume just V is constant or stable, • The equation of exchange (MV=PY) that if M increases, PY (nominal income )will increase. • If deflation is anticipated, when M falls, P will fall • If deflation is not anticipated Y will also fall – In this case money supply is not falling because of di ...

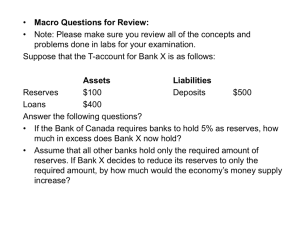

chapter 33 (18)

... Americans buy more imports from the UK. If supply is at S1, the exchange rate value of the pound rises from P2 to P0. A boom in the UK economy means an increase in its income, causing an increased demand for imports and an increase in the demand for the foreign currency to buy those imports, thus re ...

... Americans buy more imports from the UK. If supply is at S1, the exchange rate value of the pound rises from P2 to P0. A boom in the UK economy means an increase in its income, causing an increased demand for imports and an increase in the demand for the foreign currency to buy those imports, thus re ...

Economics Study Guide November 2011 exam

... tested on the final exam in December. Please focus your review these next two nights on 10, 12, and 16. Know the following terms: inside lag monetarism monetary policy outside lag money multiplier formula federal funds rate prime rate discount rate open market operations money creation The Federal R ...

... tested on the final exam in December. Please focus your review these next two nights on 10, 12, and 16. Know the following terms: inside lag monetarism monetary policy outside lag money multiplier formula federal funds rate prime rate discount rate open market operations money creation The Federal R ...

FedViews

... The eventual reversal of the cyclical factors affecting investment and saving in financial markets should lead to some normalization of long-term interest rates. However, the structural factors are not expected to change rapidly. Hence, there is likely to be a new normal for long-term real rates, wh ...

... The eventual reversal of the cyclical factors affecting investment and saving in financial markets should lead to some normalization of long-term interest rates. However, the structural factors are not expected to change rapidly. Hence, there is likely to be a new normal for long-term real rates, wh ...

Presentation to the Los Angeles Chapter, National Association of Business... Omni Hotel, Los Angeles

... b. And, with a lower inflation rate, it wouldn’t take a very big standard error of the forecast to come up with a small, but still worrisome, possibility of deflation going forward. B. Now, you’re used to hearing central bankers like me cheer when we think inflation is trending lower. 1. I guess tha ...

... b. And, with a lower inflation rate, it wouldn’t take a very big standard error of the forecast to come up with a small, but still worrisome, possibility of deflation going forward. B. Now, you’re used to hearing central bankers like me cheer when we think inflation is trending lower. 1. I guess tha ...

Chapter 14

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 ...

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 ...

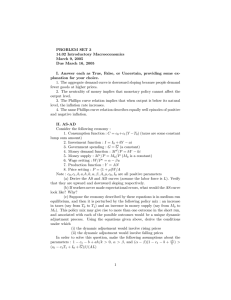

PROBLEM SET 3 14.02 Introductory Macroeconomics March 9, 2005 Due March 16, 2005

... (a) Derive the AS and AD curves (assume the labor force is L). Verify that they are upward and downward sloping respectively. (b) If workers never made expectational errors, what would the AS curve look like? Why? (c) Suppose the economy described by these equations is in medium run equilibrium, and ...

... (a) Derive the AS and AD curves (assume the labor force is L). Verify that they are upward and downward sloping respectively. (b) If workers never made expectational errors, what would the AS curve look like? Why? (c) Suppose the economy described by these equations is in medium run equilibrium, and ...

Uruguay_en.pdf

... the monetary policy assessment horizon was extended to 24 months. On 1 July 2013, the interest rate was replaced by indicative growth targets for the money supply, using the M1 monetary aggregate, as the central bank’s monetary policy benchmark instrument. In addition, reserve requirements were intr ...

... the monetary policy assessment horizon was extended to 24 months. On 1 July 2013, the interest rate was replaced by indicative growth targets for the money supply, using the M1 monetary aggregate, as the central bank’s monetary policy benchmark instrument. In addition, reserve requirements were intr ...

Heading for the exit: Is this the end of cheap...

... • The deployment of unconventional monetary policy instruments since 2009 has disproportionately benefited emerging markets. This was because yields on traditionally safe assets like government bonds in advanced economies were pushed to record lows, forcing investors to look elsewhere for return. As ...

... • The deployment of unconventional monetary policy instruments since 2009 has disproportionately benefited emerging markets. This was because yields on traditionally safe assets like government bonds in advanced economies were pushed to record lows, forcing investors to look elsewhere for return. As ...

Interest Rates - Cloudfront.net

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 ...

... Fed buys bonds, lowers reserve ratio, lowers the discount rate, or increases reserve auctions Excess reserves increase Federal funds rate falls Money supply rises Interest rate falls Investment spending increases Aggregate demand increases Real GDP rises LO4 ...

Introduction to Macroeconomics

... – Given the U.S. labor force of approximately 150 million people, a one percentage point increase in the unemployment rate implies that an additional 1.5 million workers are unemployed. ...

... – Given the U.S. labor force of approximately 150 million people, a one percentage point increase in the unemployment rate implies that an additional 1.5 million workers are unemployed. ...

Interest Rates - McGraw Hill Higher Education

... Fed sells bonds, increases reserve ratio, increases the discount rate, or decreases reserve auctions Excess reserves decrease ...

... Fed sells bonds, increases reserve ratio, increases the discount rate, or decreases reserve auctions Excess reserves decrease ...

Monetary Policy & Oil Crisis

... • In effect, the economy tended to overheat, which showed up first in imports and a trade deficit • Poor investor sentiment (an exogenous recession) were not issues – the BOJ "caused" all the recessions ...

... • In effect, the economy tended to overheat, which showed up first in imports and a trade deficit • Poor investor sentiment (an exogenous recession) were not issues – the BOJ "caused" all the recessions ...

Macro Ch 16 - 19e - use this one

... • The price paid for the use of money • Many different interest rates • Speak as if only one interest rate • Determined by the money supply and money demand ...

... • The price paid for the use of money • Many different interest rates • Speak as if only one interest rate • Determined by the money supply and money demand ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.