as macro key term glossary - School

... Comparative advantage refers to the relative advantage that one country or producer has over another. Countries can benefit from specializing in and exporting the product(s) for which it has the lowest opportunity cost of supply ...

... Comparative advantage refers to the relative advantage that one country or producer has over another. Countries can benefit from specializing in and exporting the product(s) for which it has the lowest opportunity cost of supply ...

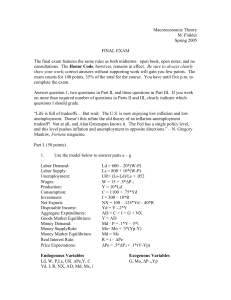

Endogenous Variables Exogenous Variables

... (vertical), or c) gradually upward sloping. For each curve, be sure to address the role played by in the labor market. ...

... (vertical), or c) gradually upward sloping. For each curve, be sure to address the role played by in the labor market. ...

Zero Is Not A Bound on Monetary Policy

... But monetary policy can operate on long-term interest rates, i.e., bond prices. ...

... But monetary policy can operate on long-term interest rates, i.e., bond prices. ...

Econ 302

... balance equal to zero is attained automatically by: a. exchange rate appreciation or depreciation sufficient to bring desired net exports equal to zero. b. domestic real interest rate changes will reverse the capital flow that finances the current account deficit, forcing the deficit back to zero. c ...

... balance equal to zero is attained automatically by: a. exchange rate appreciation or depreciation sufficient to bring desired net exports equal to zero. b. domestic real interest rate changes will reverse the capital flow that finances the current account deficit, forcing the deficit back to zero. c ...

Inflation targeting in the Armenian context

... the Armenian context King Banaian, David Kemme and Grigor Sargsyan AIPRG conference, 4/21/06 ...

... the Armenian context King Banaian, David Kemme and Grigor Sargsyan AIPRG conference, 4/21/06 ...

The Conduct of Monetary Policy Kevin M. Warsh

... monetary policy. But while the Fed is independent within government, it is not independent of government. The grant of authority to the Fed comes from Congress, to which the Fed is ultimately accountable. In my view, the Fed was granted significant powers by Congress, but those powers were not unlim ...

... monetary policy. But while the Fed is independent within government, it is not independent of government. The grant of authority to the Fed comes from Congress, to which the Fed is ultimately accountable. In my view, the Fed was granted significant powers by Congress, but those powers were not unlim ...

Honduras_en.pdf

... achieve higher tax revenues and greater control over public expenditure. On the income side, measures included a rise in the sales tax rate from 12% to 15%. These changes led to a 19.4% year-on-year increase in total central government revenue in the period between January and August, with indirect ...

... achieve higher tax revenues and greater control over public expenditure. On the income side, measures included a rise in the sales tax rate from 12% to 15%. These changes led to a 19.4% year-on-year increase in total central government revenue in the period between January and August, with indirect ...

Chapter 12

... People buying or selling internationally traded goods who are not themselves speculating. For example, if speculation drives the exchange rate below what it would otherwise have been, then purchasers of imports will be paying a higher price than they otherwise would. ...

... People buying or selling internationally traded goods who are not themselves speculating. For example, if speculation drives the exchange rate below what it would otherwise have been, then purchasers of imports will be paying a higher price than they otherwise would. ...

Chapter 3: Federal Reserve System

... charged to borrow reserves from the Fed) are a highly publicized but less important monetary policy tool. Increases (decreases) in the discount rate raise (lower) the cost of borrowing reserves from the Fed. In recent years, the primary credit rate has been set one percent above another key short-te ...

... charged to borrow reserves from the Fed) are a highly publicized but less important monetary policy tool. Increases (decreases) in the discount rate raise (lower) the cost of borrowing reserves from the Fed. In recent years, the primary credit rate has been set one percent above another key short-te ...

A State-Centered Approach to Monetary and Exchange

... • Low interest rates increase inflation because – Low unemployment, high capacity utilization increases costs of production – High demand for finished goods increases prices ...

... • Low interest rates increase inflation because – Low unemployment, high capacity utilization increases costs of production – High demand for finished goods increases prices ...

MPR Summary - October 2015

... trade will continue to play out over the projection horizon. The weaker profile for business investment suggests that, in the near term, growth in potential output is more likely to be in the lower part of the Bank’s range of estimates. Given this judgment about potential output, the Canadian econom ...

... trade will continue to play out over the projection horizon. The weaker profile for business investment suggests that, in the near term, growth in potential output is more likely to be in the lower part of the Bank’s range of estimates. Given this judgment about potential output, the Canadian econom ...

Presentation to the Australian Business Economists

... both the second and third quarters. And forecasts for the rest of the year have been shaded upward into the one to two percent range. In addition, deflation seems to be lessening. ...

... both the second and third quarters. And forecasts for the rest of the year have been shaded upward into the one to two percent range. In addition, deflation seems to be lessening. ...

The Australian economy: 2014 outlook

... impressive achievement. Nonetheless, the pace of economic growth has slowed as the mining investment boom plateaued and conditions in the non-mining sector remain soft. Australian economic growth fell to a two-year low of 2.3%/year in the September quarter of 2013. This outcome was disappointing for ...

... impressive achievement. Nonetheless, the pace of economic growth has slowed as the mining investment boom plateaued and conditions in the non-mining sector remain soft. Australian economic growth fell to a two-year low of 2.3%/year in the September quarter of 2013. This outcome was disappointing for ...

Monetary Policies

... amount of money in the economy V= velocity, average number of times each dollar changes hands during the year PG = weighted average price level of goods and services in the economy Q= quantity of goods and services sold l ...

... amount of money in the economy V= velocity, average number of times each dollar changes hands during the year PG = weighted average price level of goods and services in the economy Q= quantity of goods and services sold l ...

The Eurozone crisis strikes back Global economy watch – April 2013

... approach to assessing the Eurozone’s economic environment. Our analysis highlights that investor perceptions of credit risk, as measured by government bond yields, evolved markedly over the last year (see Figure 3 below). In particular, investors’ attitudes towards investing in Ireland and Portugal ...

... approach to assessing the Eurozone’s economic environment. Our analysis highlights that investor perceptions of credit risk, as measured by government bond yields, evolved markedly over the last year (see Figure 3 below). In particular, investors’ attitudes towards investing in Ireland and Portugal ...

Impacts of QE Policy, Fiscal Cliff, and Euro Zone Crisis

... monetary policy used by central banks to stimulate the national economy. A central bank implements quantitative easing by buying financial assets from commercial banks and other private institutions with newly created money in order to inject a pre-determined quantity of money into the economy. ...

... monetary policy used by central banks to stimulate the national economy. A central bank implements quantitative easing by buying financial assets from commercial banks and other private institutions with newly created money in order to inject a pre-determined quantity of money into the economy. ...

Slide 1

... the future the economy (about income, output and prices that affect their decision to work and invest) than others. These perceptions about the future affect all types of economic activities. How do these expectations affect macroeconomic behaviour? It is obvious from what we see in the markets. Pro ...

... the future the economy (about income, output and prices that affect their decision to work and invest) than others. These perceptions about the future affect all types of economic activities. How do these expectations affect macroeconomic behaviour? It is obvious from what we see in the markets. Pro ...

The importance of inflation expectations

... Box 1: The importance of inflation expectations The credibility of central banks acting within an inflation targeting framework is extremely important, since it allows the sustainable anchoring of economic agents’ expectations. As a direct consequence, their decisions and behaviour will rely to an i ...

... Box 1: The importance of inflation expectations The credibility of central banks acting within an inflation targeting framework is extremely important, since it allows the sustainable anchoring of economic agents’ expectations. As a direct consequence, their decisions and behaviour will rely to an i ...

Prezentace aplikace PowerPoint

... • communists overstated its economic results. • avoid taxing (the black economy accounted something between 10 – 20% of the GDP). • the statistical office was not prepared • official inflation was probably overstated ...

... • communists overstated its economic results. • avoid taxing (the black economy accounted something between 10 – 20% of the GDP). • the statistical office was not prepared • official inflation was probably overstated ...

Sections 5 & 6 - Vocab Review

... _____a claim on a tangible object that gives the owner the right to dispose of the object at he or she wishes. _____investment in several different assets with unrelated, or independent, risks, so that the possible losses are independent events. _____an approach to the business cycle that returns to ...

... _____a claim on a tangible object that gives the owner the right to dispose of the object at he or she wishes. _____investment in several different assets with unrelated, or independent, risks, so that the possible losses are independent events. _____an approach to the business cycle that returns to ...

Document

... High Interest rates therefore increased cost of capital for businesses thus driving their return into negative territory ...

... High Interest rates therefore increased cost of capital for businesses thus driving their return into negative territory ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.