Cuba_en.pdf

... gradually towards the elimination of monetary duality. Monetary aggregates grew slightly above the nominal increase in GDP. In the first three quarters M1 recorded a nominal rise of 10%, while M2 was up by around 15% owing to the large increase in fixed-term deposits. Since financial equilibrium was ...

... gradually towards the elimination of monetary duality. Monetary aggregates grew slightly above the nominal increase in GDP. In the first three quarters M1 recorded a nominal rise of 10%, while M2 was up by around 15% owing to the large increase in fixed-term deposits. Since financial equilibrium was ...

The Brazilian Political Economy Today

... 2. The Brazilian economy during the Lula da Silva’s terms and the first ...

... 2. The Brazilian economy during the Lula da Silva’s terms and the first ...

Ass no. 3 2017

... Q#2 Explain Inflation and cost of inflation (Expected and unexpected). a. Differentiate Demand pull and cost push inflation with the help of graph which one you suggest for economy and why? b. Define Hyper inflation, stagflation? Q#3 a) What determines the position of the FE line? Give two examples ...

... Q#2 Explain Inflation and cost of inflation (Expected and unexpected). a. Differentiate Demand pull and cost push inflation with the help of graph which one you suggest for economy and why? b. Define Hyper inflation, stagflation? Q#3 a) What determines the position of the FE line? Give two examples ...

International Economics II: International Monetary & Finance Economics

... ** The instructor reserves the right to alter the course outline and course requirements at any time. Grading Policy: Grades are based on two mid-term exams (25% each), a final exam (25% and cumulative), and homework exercises (25%). Attendance Expectations: You are acquired to attend every class a ...

... ** The instructor reserves the right to alter the course outline and course requirements at any time. Grading Policy: Grades are based on two mid-term exams (25% each), a final exam (25% and cumulative), and homework exercises (25%). Attendance Expectations: You are acquired to attend every class a ...

Presentation to Lambda Alpha International and Arizona Bankers Association Phoenix, Arizona

... For the non-bankers out there: The FOMC has kept short-term interest rates near zero for the past five years. That’s the Federal Open Market Committee, the Fed’s monetary policy decision-making body. We did this in order to lower interest costs to consumers and businesses and thereby increase spendi ...

... For the non-bankers out there: The FOMC has kept short-term interest rates near zero for the past five years. That’s the Federal Open Market Committee, the Fed’s monetary policy decision-making body. We did this in order to lower interest costs to consumers and businesses and thereby increase spendi ...

Homework 5

... Retail firms that sell these consumer items may especially benefit from lower interest rates along with borrowers. Savers may not benefit especially since inflation will rise in the future. ...

... Retail firms that sell these consumer items may especially benefit from lower interest rates along with borrowers. Savers may not benefit especially since inflation will rise in the future. ...

Recession in Advanced Economies: A View from the United States

... Policy Responses Monetary easing unprecedented, appropriately. But it has largely run its course: – Policy interest rates ≈ 0. ...

... Policy Responses Monetary easing unprecedented, appropriately. But it has largely run its course: – Policy interest rates ≈ 0. ...

The Great Depression 1929

... • After the crash of October 1929, the Federal Reserve (NY Fed) provides open market purchases—flushes system with high-powered money. Nominal and expected interest rates fall. • Romer (1990) crash generates considerable uncertainty about future income. Thus consumer perishable purchases remain stab ...

... • After the crash of October 1929, the Federal Reserve (NY Fed) provides open market purchases—flushes system with high-powered money. Nominal and expected interest rates fall. • Romer (1990) crash generates considerable uncertainty about future income. Thus consumer perishable purchases remain stab ...

– 62 No: 2012 Release date: 25 December 2012

... the last quarter of the year. In fact, confidence indices and credit growth show a marked increase, supported by the accommodative liquidity policies implemented by the Central Bank since mid-year and the relative improvement in the risk appetite. Therefore, the contribution of domestic demand to ec ...

... the last quarter of the year. In fact, confidence indices and credit growth show a marked increase, supported by the accommodative liquidity policies implemented by the Central Bank since mid-year and the relative improvement in the risk appetite. Therefore, the contribution of domestic demand to ec ...

FRBSF L CONOMIC

... For the nonbankers out there: The FOMC has kept short-term interest rates near zero for the past five years. That’s the Federal Open Market Committee, the Fed’s monetary policy decisionmaking body. We did this in order to lower interest costs to consumers and businesses and thereby increase spending ...

... For the nonbankers out there: The FOMC has kept short-term interest rates near zero for the past five years. That’s the Federal Open Market Committee, the Fed’s monetary policy decisionmaking body. We did this in order to lower interest costs to consumers and businesses and thereby increase spending ...

Module 33 - Types of Infl

... • Assumes adjustment is automatic and instantaneous • Holds true during periods of high inflation but not in times of slower inflation • So in countries with persistently high inflation, increase in M are quickly turned into changes in P (inflation) but in other countries, changes in M may actually ...

... • Assumes adjustment is automatic and instantaneous • Holds true during periods of high inflation but not in times of slower inflation • So in countries with persistently high inflation, increase in M are quickly turned into changes in P (inflation) but in other countries, changes in M may actually ...

AP Economics - Arundel High School

... The Central Bank attempts to achieve economic stability by varying the quantity of money in circulation, the cost and availability of credit, and the composition of a country's national debt. The Central Bank has three instruments available to it in order to implement monetary policy: 1. Open market ...

... The Central Bank attempts to achieve economic stability by varying the quantity of money in circulation, the cost and availability of credit, and the composition of a country's national debt. The Central Bank has three instruments available to it in order to implement monetary policy: 1. Open market ...

Analyzing Curriculum Reform

... – To increase the money supply, the Fed instructs the Open Market Desk at the New York Fed to buy bonds to try and hit the target rate. – To decrease the money supply, the Fed instructs the Open Market Desk at the New York Fed to sell bonds. ...

... – To increase the money supply, the Fed instructs the Open Market Desk at the New York Fed to buy bonds to try and hit the target rate. – To decrease the money supply, the Fed instructs the Open Market Desk at the New York Fed to sell bonds. ...

ISLM_2010_post_000 - Department of Economics

... stimulus. Economists in recent years have become skeptical about discretionary fiscal policy and have regarded monetary policy as a better tool for short-term stabilization. Our judgment, however, was that in a liquidity trap-type scenario of zero interest rates, a dysfunctional financial system, an ...

... stimulus. Economists in recent years have become skeptical about discretionary fiscal policy and have regarded monetary policy as a better tool for short-term stabilization. Our judgment, however, was that in a liquidity trap-type scenario of zero interest rates, a dysfunctional financial system, an ...

Chapter 08 - Canvas (canvas.park.edu)

... capital markets • measured by consumer price index (CPI), the average price changes in a basket of consumer goods ...

... capital markets • measured by consumer price index (CPI), the average price changes in a basket of consumer goods ...

Answer Key Section 5 and 6 practice test

... A) left; decrease X B) left; increase C) right; increase D) right; decrease 17. Decreased interest rates will shift the aggregate demand curve to the _____ and _____ output demanded. A) left; decrease B) left; increase C) right; increase X D) right; decrease 18. If the marginal propensity to consume ...

... A) left; decrease X B) left; increase C) right; increase D) right; decrease 17. Decreased interest rates will shift the aggregate demand curve to the _____ and _____ output demanded. A) left; decrease B) left; increase C) right; increase X D) right; decrease 18. If the marginal propensity to consume ...

Top of Form Name Question 1 Assuming that both the price level

... d) ...demand policies cannot move the actual unemployment rate permanently away from its equilibrium level. ...

... d) ...demand policies cannot move the actual unemployment rate permanently away from its equilibrium level. ...

State Bank of Pakistan’s Monetary Policy Statement June 2013 – SUMMARY

... growth and the need to encourage private investment as the key drivers of its decision to cut rates. Effectively sidestepping the two challenges highlighted in SBP’s previous report(1) external account pressure and (2) fiscal financing – the Central Board of Directors of SBP has changed the policy d ...

... growth and the need to encourage private investment as the key drivers of its decision to cut rates. Effectively sidestepping the two challenges highlighted in SBP’s previous report(1) external account pressure and (2) fiscal financing – the Central Board of Directors of SBP has changed the policy d ...

Lecture 2: New Keynesian Model in Continuous Time

... • Simple framework to think about relationship between ...

... • Simple framework to think about relationship between ...

This PDF is a selection from a published volume from... Economic Research Volume Title: NBER International Seminar on Macroeconomics 2008

... consumption if the home bias is reduced from 0.85 to 0.65. Moreover, the main source of the gains is the markup shocks. Let us now turn to the second part of the paper. The idea is nice: In order to account for regime changes and structural breaks, let us use financial market–based expectations to a ...

... consumption if the home bias is reduced from 0.85 to 0.65. Moreover, the main source of the gains is the markup shocks. Let us now turn to the second part of the paper. The idea is nice: In order to account for regime changes and structural breaks, let us use financial market–based expectations to a ...

Econ 371 Spring 2006 Answer Key for Problem Set 5 (Chapter 17-18)

... 5. The optimal external balance is acheived when current account is balanced. ANSWER: False REASON: Current account does not need to be zero to maintain external balance. It can be a small number of deficits or surplus. 6. The optimal internal balance is full employment. ANSWER: True REASON: The goa ...

... 5. The optimal external balance is acheived when current account is balanced. ANSWER: False REASON: Current account does not need to be zero to maintain external balance. It can be a small number of deficits or surplus. 6. The optimal internal balance is full employment. ANSWER: True REASON: The goa ...

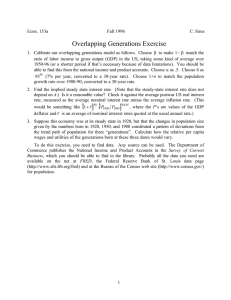

ogex.pdf

... depend on A.) Is it a reasonable value? Check it against the average postwar US real interest rate, measured as the average nominal interest rate minus the average inflation rate. (This ...

... depend on A.) Is it a reasonable value? Check it against the average postwar US real interest rate, measured as the average nominal interest rate minus the average inflation rate. (This ...

Nearly seven years have passed since the last reces-

... prick a suspected bubble could send the economy into a recession, thereby forgoing the benefits of the boom that might otherwise continue. In light of the severe economic fall-out from recent bubble episodes, this Economic Letter examines the potential role of monetary policy in responding to asset ...

... prick a suspected bubble could send the economy into a recession, thereby forgoing the benefits of the boom that might otherwise continue. In light of the severe economic fall-out from recent bubble episodes, this Economic Letter examines the potential role of monetary policy in responding to asset ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.