Policy Instrument - Porterville College Home

... The Federal Reserve System (“the Fed”) serves as the central bank for the United States. A central bank typically has the following functions: It is the banks’ bank: it accepts deposits from and makes loans to commercial banks. It acts as banker for the federal government. It controls the ...

... The Federal Reserve System (“the Fed”) serves as the central bank for the United States. A central bank typically has the following functions: It is the banks’ bank: it accepts deposits from and makes loans to commercial banks. It acts as banker for the federal government. It controls the ...

chap016Answers

... multiple changes in checkable deposits (and therefore money) in the economy? When the Fed buys government securities from a commercial bank, for example, it increases the reserves of that bank. Assuming these new reserves are excess reserves, the bank can then loan them out, creating new money. As t ...

... multiple changes in checkable deposits (and therefore money) in the economy? When the Fed buys government securities from a commercial bank, for example, it increases the reserves of that bank. Assuming these new reserves are excess reserves, the bank can then loan them out, creating new money. As t ...

Et - Economics

... We sidestep the critical issue of credibility and analyze policy when the central bank can not commit to a policy (no credibility). This is a reasonable place to start: No major central bank makes any type of binding commitment over the future course of its monetary policy. ...

... We sidestep the critical issue of credibility and analyze policy when the central bank can not commit to a policy (no credibility). This is a reasonable place to start: No major central bank makes any type of binding commitment over the future course of its monetary policy. ...

Chapter 10 Slides

... a stable function of a few well defined variables. Based on this simple functional relationship then, steady money supply growth should yield steady nominal output growth. If the money supply growth does not exceed that rate consistent with full employment, inflation will approach zero, and prices ( ...

... a stable function of a few well defined variables. Based on this simple functional relationship then, steady money supply growth should yield steady nominal output growth. If the money supply growth does not exceed that rate consistent with full employment, inflation will approach zero, and prices ( ...

Ecuador

... economies would follow from lower transaction costs, assured stability of prices in dollar terms and possibly lower interest rates. ...

... economies would follow from lower transaction costs, assured stability of prices in dollar terms and possibly lower interest rates. ...

krugman ir macro module 38(74).indd

... Ask students why the Federal Reserve would take action to reduce interest rates. Most students at this point will be able to recognize that lower interest rates will stimulate spending and output. Ask students if lower interest rates will necessarily increase spending and output. This question is mo ...

... Ask students why the Federal Reserve would take action to reduce interest rates. Most students at this point will be able to recognize that lower interest rates will stimulate spending and output. Ask students if lower interest rates will necessarily increase spending and output. This question is mo ...

Final Exam Study Questions

... An inflation shock is: the level of inflation consistent with output in a recessionary gap. the level of inflation consistent with output in an expansionary gap. a sudden change in the normal behavior of inflation, unrelated to the nation's output gap. a change in the inflation rate generated by exc ...

... An inflation shock is: the level of inflation consistent with output in a recessionary gap. the level of inflation consistent with output in an expansionary gap. a sudden change in the normal behavior of inflation, unrelated to the nation's output gap. a change in the inflation rate generated by exc ...

Intermediate Macroeconomics - College Of Business and

... Economists differ over correct model Models have developed historically to take account of novel facts and new historical situations Great Depression (1930s) Great Inflation (1970s) ...

... Economists differ over correct model Models have developed historically to take account of novel facts and new historical situations Great Depression (1930s) Great Inflation (1970s) ...

Deflation, Globalization and the New Paradigm of Monetary

... because of important non-linearities Losses to those who are worse off may lead to greater reduction in aggregate demand than the offsetting increases ...

... because of important non-linearities Losses to those who are worse off may lead to greater reduction in aggregate demand than the offsetting increases ...

Presentation to the Arizona Council on Economic Education, Tempe, AZ

... the crosscurrents we’re navigating: On one hand, the U.S. economy continues to grow and is closing in on full employment. On the other, in large part due to developments abroad, inflation has remained lower than we’d like. In any event, we should fully celebrate that the economic expansion is enter ...

... the crosscurrents we’re navigating: On one hand, the U.S. economy continues to grow and is closing in on full employment. On the other, in large part due to developments abroad, inflation has remained lower than we’d like. In any event, we should fully celebrate that the economic expansion is enter ...

Homework 3

... bank increases the reserve ratio while maintaining a fixed money level of reserves. If there is a given level of reserves and the reserve to deposit ratio rises, what effect will this have on the money supply. Draw a graph of the money market to show the impact of a rising reserve ratio. The increas ...

... bank increases the reserve ratio while maintaining a fixed money level of reserves. If there is a given level of reserves and the reserve to deposit ratio rises, what effect will this have on the money supply. Draw a graph of the money market to show the impact of a rising reserve ratio. The increas ...

Slide 1

... Ensure price and exchange rate stability • Intensify competition in the financial system to reduce high interest rate spread and ensure competitive rates • Strengthen the foreign exchange market Deepen the capital markets • Implement schemes to increase long-term savings/funds • Encourage the fu ...

... Ensure price and exchange rate stability • Intensify competition in the financial system to reduce high interest rate spread and ensure competitive rates • Strengthen the foreign exchange market Deepen the capital markets • Implement schemes to increase long-term savings/funds • Encourage the fu ...

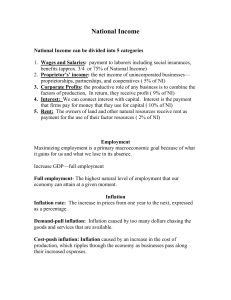

National Income

... Maximizing employment is a primary macroeconomic goal because of what it gains for us and what we lose in its absence. Increase GDP—full employment Full employment- The highest natural level of employment that our economy can attain at a given moment. Inflation Inflation rate: The increase in prices ...

... Maximizing employment is a primary macroeconomic goal because of what it gains for us and what we lose in its absence. Increase GDP—full employment Full employment- The highest natural level of employment that our economy can attain at a given moment. Inflation Inflation rate: The increase in prices ...

This PDF is a selection from a published volume from

... they find that a simple wage-inflation rule for monetary policy is considerably better than the best inflation-targeting rule, and only slightly worse quantitatively than the optimal rule. The paper is notable in embodying a broad consensus in macroeconomics on how to model monetary policy and busin ...

... they find that a simple wage-inflation rule for monetary policy is considerably better than the best inflation-targeting rule, and only slightly worse quantitatively than the optimal rule. The paper is notable in embodying a broad consensus in macroeconomics on how to model monetary policy and busin ...

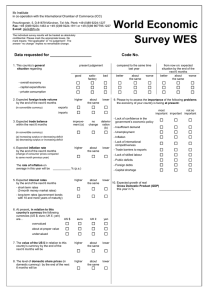

WES Questionnaire (PDF, 25 KB)

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

... (a) increasing surplus or decreasing deficit (b) decreasing surplus or increasing deficit ...

Chapter 3: The IS

... drops to r1 at point B. • At r1, there is excess demand in the output market. The economy ...

... drops to r1 at point B. • At r1, there is excess demand in the output market. The economy ...

Document

... minimizing the time spent in exchanging goods and services. Facilitates specialization and division of labor. A good medium of exchange ...

... minimizing the time spent in exchanging goods and services. Facilitates specialization and division of labor. A good medium of exchange ...

Economic 157b - Yale University

... – poor institutions (gold standard and fragile banking system) – poor international coordination (legacy of WW I) – inadequate understanding of macroeconomics (before Keynes’s theory) – inept policy response (cling to gold standard, no fiscal response) – bad dynamics (panic, high risk premia, deflat ...

... – poor institutions (gold standard and fragile banking system) – poor international coordination (legacy of WW I) – inadequate understanding of macroeconomics (before Keynes’s theory) – inept policy response (cling to gold standard, no fiscal response) – bad dynamics (panic, high risk premia, deflat ...

Economics 202

... This course uses market analysis (supply and demand at the national level) to develop an understanding of the working of the macroeconomy. The macroeconomic system is analyzed by studying five aggregated markets: the output market, the labor market, the financial (credit) market, the foreign exchang ...

... This course uses market analysis (supply and demand at the national level) to develop an understanding of the working of the macroeconomy. The macroeconomic system is analyzed by studying five aggregated markets: the output market, the labor market, the financial (credit) market, the foreign exchang ...

1 MACROECONOMIC RISKS IN THE INDIAN ECONOMY Dun and

... Control of Inflation 9. The current inflation rate of 12 per cent, based on the wholesale price index, is clearly unacceptable to the Indian polity. The major risk here is wonky analysis which results in inappropriate policies. It is often argued that the present inflation is a supply side problem, ...

... Control of Inflation 9. The current inflation rate of 12 per cent, based on the wholesale price index, is clearly unacceptable to the Indian polity. The major risk here is wonky analysis which results in inappropriate policies. It is often argued that the present inflation is a supply side problem, ...

Krugman`s Chapter 31 PPT

... 2. According to the liquidity preference model of the interest rate, the interest rate is determined in the money market by the money demand curve and the money supply curve. The Federal Reserve can change the interest rate in the short run by shifting the money supply curve. In practice, the Fed us ...

... 2. According to the liquidity preference model of the interest rate, the interest rate is determined in the money market by the money demand curve and the money supply curve. The Federal Reserve can change the interest rate in the short run by shifting the money supply curve. In practice, the Fed us ...

The Global Financial Crisis: A Re

... Stable inflation maintains stable activity • Even if policymakers cared about activity, the best they could do was to maintain stable inflation. There was also consensus that inflation should be very low (most central banks targeted 2% inflation). ...

... Stable inflation maintains stable activity • Even if policymakers cared about activity, the best they could do was to maintain stable inflation. There was also consensus that inflation should be very low (most central banks targeted 2% inflation). ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.