Slide 1

... • Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of ...

... • Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. • Monetary policy is the process by which the government, central bank, or monetary authority of ...

ISMP_2013_L2_v4a_post

... stimulus. Economists in recent years have become skeptical about discretionary fiscal policy and have regarded monetary policy as a better tool for short-term stabilization. Our judgment, however, was that in a liquidity trap-type scenario of zero interest rates, a dysfunctional financial system, an ...

... stimulus. Economists in recent years have become skeptical about discretionary fiscal policy and have regarded monetary policy as a better tool for short-term stabilization. Our judgment, however, was that in a liquidity trap-type scenario of zero interest rates, a dysfunctional financial system, an ...

Robbins-aggregate_demand

... • Lower price levels increase purchasing power and increase expenditures Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will likely reduce your spending. The quantity purchased is reduced. • So…Price Level goes up, GDP demanded goes down. ...

... • Lower price levels increase purchasing power and increase expenditures Example: • If the balance in your bank was $50,000, but inflation erodes your purchasing power, you will likely reduce your spending. The quantity purchased is reduced. • So…Price Level goes up, GDP demanded goes down. ...

AS/AD Model

... • Should budget be set to balance at full employment? Keynes – No! Balance over the business cycle. Buchanan – Politicians will never do that! “Structural deficit” – what remains at full employment. ...

... • Should budget be set to balance at full employment? Keynes – No! Balance over the business cycle. Buchanan – Politicians will never do that! “Structural deficit” – what remains at full employment. ...

Quiz # 2 ECO403

... citizens within the United States. B. When a Japanese company earns profits in the United States, those profits are counted as part of Japanese GDP, but not as part of Japanese GNP. C. The wages paid to U.S. workers working in a Japanese factory in the United States are counted as part of U.S. GNP, ...

... citizens within the United States. B. When a Japanese company earns profits in the United States, those profits are counted as part of Japanese GDP, but not as part of Japanese GNP. C. The wages paid to U.S. workers working in a Japanese factory in the United States are counted as part of U.S. GNP, ...

lump-sum tax

... by a upward shift in the primary components of demand (see below for definitions). Printing money, say, to finance deficits in time of recession, does not by itself cause inflation unless people lose confidence in the purchasing power of money and try to spend it as fast as they receive it so that s ...

... by a upward shift in the primary components of demand (see below for definitions). Printing money, say, to finance deficits in time of recession, does not by itself cause inflation unless people lose confidence in the purchasing power of money and try to spend it as fast as they receive it so that s ...

Document

... Foreign Repercussions Leading industrial nation has additional responsibility for fate of other countries To calculate foreign trade multiplier effect of any policy, foreign repercussions must complete circuit and affect policy-originating country No country completely free to pursue independ ...

... Foreign Repercussions Leading industrial nation has additional responsibility for fate of other countries To calculate foreign trade multiplier effect of any policy, foreign repercussions must complete circuit and affect policy-originating country No country completely free to pursue independ ...

Consumer Spending by Type, 2002 (in billions)

... salaries + interest + rent + profit = National Income ...

... salaries + interest + rent + profit = National Income ...

Keynesian economics

... production, employment, and investment. Saving is the natural reaction to hard times; if a growing number of households start saving, the momentum for a recession can build The paradox of thrift, however, is probably irrelevant in an economy operating at full steam ...

... production, employment, and investment. Saving is the natural reaction to hard times; if a growing number of households start saving, the momentum for a recession can build The paradox of thrift, however, is probably irrelevant in an economy operating at full steam ...

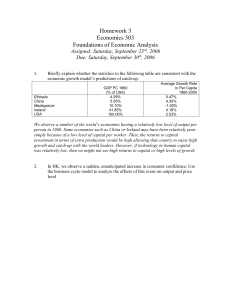

Answer Key 3

... person in 1960. Some economies such as China or Ireland may have been relatively poor simply because of a low level of capital per worker. Then, the returns to capital investment in terms of extra production would be high allowing that country to enjoy high growth and catch-up with the world leaders ...

... person in 1960. Some economies such as China or Ireland may have been relatively poor simply because of a low level of capital per worker. Then, the returns to capital investment in terms of extra production would be high allowing that country to enjoy high growth and catch-up with the world leaders ...

Assignment 4: Macroeconomic Stabilization Policies

... Consider two policies—a tax cut that will last for only one year, and a tax cut that is expected to be permanent. Which policy will stimulate greater spending by consumers? Which policy will have the greater impact on aggregate demand? Explain. ...

... Consider two policies—a tax cut that will last for only one year, and a tax cut that is expected to be permanent. Which policy will stimulate greater spending by consumers? Which policy will have the greater impact on aggregate demand? Explain. ...

No Slide Title

... • Most economists do not support a balanced budget amendment because: – Forecasting deficits requires an impossible degree of accuracy. – It is bad public policy to balance the budget in every year. The budget should be balanced over the business cycle. • Deficits in recession cushion the economy • ...

... • Most economists do not support a balanced budget amendment because: – Forecasting deficits requires an impossible degree of accuracy. – It is bad public policy to balance the budget in every year. The budget should be balanced over the business cycle. • Deficits in recession cushion the economy • ...

ECONOMIC ENVIRO NMENT MAY 2011 SOLUTIONS

... GDP does not include non-marketed output e.g. housework GDP does not include illegal businesses or some transactions for the informal sector GDP does not account for externalities – positive or negative GDP does not measure economic inequality ...

... GDP does not include non-marketed output e.g. housework GDP does not include illegal businesses or some transactions for the informal sector GDP does not account for externalities – positive or negative GDP does not measure economic inequality ...

loanable funds market

... Not a valid argument. Whenever the SR equilibrium is not at LR full-employment level of output as a result of some type of decline in AD, any discretionary monetary or fiscal policy put in place to close an inflationary gap will return the economy back to prerecession level price level and output. ...

... Not a valid argument. Whenever the SR equilibrium is not at LR full-employment level of output as a result of some type of decline in AD, any discretionary monetary or fiscal policy put in place to close an inflationary gap will return the economy back to prerecession level price level and output. ...

Have we hit a soft spot?

... consumption. I still expect a supply response in the form of alternative fuels for transportation to reduce US consumption of crude and products, but it will take a while. ...

... consumption. I still expect a supply response in the form of alternative fuels for transportation to reduce US consumption of crude and products, but it will take a while. ...

The Mother of All Sequesters: Fiscal Policy in the 1940s

... that trickled into the economy in the form of higher inflation. In a moment, we will turn our attention to the fiscal stimulus that results from extraordinary deficit spending. Driven in large part by the build up to World War II, such policy rapidly accelerated a recovery that had already begun. Fi ...

... that trickled into the economy in the form of higher inflation. In a moment, we will turn our attention to the fiscal stimulus that results from extraordinary deficit spending. Driven in large part by the build up to World War II, such policy rapidly accelerated a recovery that had already begun. Fi ...

The Federal Government

... extremes of the business cycle • Keynesian economics- the govt should intervene in the economy b/c instability is inherent; fiscal takes longer to implement and take effect which means the economy could be over-corrected ...

... extremes of the business cycle • Keynesian economics- the govt should intervene in the economy b/c instability is inherent; fiscal takes longer to implement and take effect which means the economy could be over-corrected ...

Fiscal Policy - McEachern High School

... and spending decisions. The student will describe the difference between the national debt and government deficits. The student will explain how changes in fiscal policy can impact an individual’s spending and savings ...

... and spending decisions. The student will describe the difference between the national debt and government deficits. The student will explain how changes in fiscal policy can impact an individual’s spending and savings ...

OUR MADCAP CONGRESS

... students how to watch television • $160,000 to study if you can hex an opponent by drawing an X on his chest • $100,000 to study how to avoid falling spacecraft • $500,000 to build a replica of the Great Pyramid in Indiana • Funds to study why people are polite at bowling alleys but rude on tennis c ...

... students how to watch television • $160,000 to study if you can hex an opponent by drawing an X on his chest • $100,000 to study how to avoid falling spacecraft • $500,000 to build a replica of the Great Pyramid in Indiana • Funds to study why people are polite at bowling alleys but rude on tennis c ...

The Simple Keynesian Model and Its Application

... equilibrium level of income? We’ve already calculated the government-spending multiplier: 1/(1-b) = 5. The increase in the equilibrium level of income, then, is 5 times 30, or 150. That is ÄY = 1/(1-b)ÄG. The government’s extra spending of 30 raises equilibrium income from 1050 to 1200. 9. How much ...

... equilibrium level of income? We’ve already calculated the government-spending multiplier: 1/(1-b) = 5. The increase in the equilibrium level of income, then, is 5 times 30, or 150. That is ÄY = 1/(1-b)ÄG. The government’s extra spending of 30 raises equilibrium income from 1050 to 1200. 9. How much ...

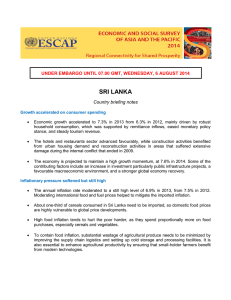

SRI LANKA UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014

... Despite the recent improvement, the current account shortfall remains large. This is reflected in a notable national savings-investment gap. Low domestic savings are partly linked to a lack of public savings, as evident in persistent fiscal deficits. Enhancing private and public savings would help s ...

... Despite the recent improvement, the current account shortfall remains large. This is reflected in a notable national savings-investment gap. Low domestic savings are partly linked to a lack of public savings, as evident in persistent fiscal deficits. Enhancing private and public savings would help s ...

Document

... Inventory investment is the value of the change in total inventories held in the economy during a given period. Unplanned inventory investment occurs when actual sales are more or less than businesses expected, leading to unplanned changes in inventories. Actual investment spending is the sum of pla ...

... Inventory investment is the value of the change in total inventories held in the economy during a given period. Unplanned inventory investment occurs when actual sales are more or less than businesses expected, leading to unplanned changes in inventories. Actual investment spending is the sum of pla ...

Last day to sign up for AP Exam

... • Ex: A senator promises more welfare and public works programs when there is already an inflationary gap. ...

... • Ex: A senator promises more welfare and public works programs when there is already an inflationary gap. ...

KAZAKHSTAN UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014

... UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014 ...

... UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014 ...

Macroeconomic Theory

... For fiscal policy to be potent, the LM must be relatively flat; thus, h – the sensitivity of money holding to interest rates - should be high. Stated more comprehensively, the fiscal policy multiplier Y/G should be greater than the monetary policy multiplier Y/M. From the results of model 3 this ...

... For fiscal policy to be potent, the LM must be relatively flat; thus, h – the sensitivity of money holding to interest rates - should be high. Stated more comprehensively, the fiscal policy multiplier Y/G should be greater than the monetary policy multiplier Y/M. From the results of model 3 this ...