UP Congress Presentation

... • Low priority for environmental investments • Shelve planned investments in environmentally ...

... • Low priority for environmental investments • Shelve planned investments in environmentally ...

Chapter21

... b) The value of the simple multiplier is 1/(1 – MPC). In this economy, MPC = 0.75 and so the value of the simple multiplier is 1/(1 – 0.75) = 1/(0.25) = 4. c) If desired investment increases from 150 to 250, this is an increase in autonomous expenditure of 100. Given the multiplier of 4, the change ...

... b) The value of the simple multiplier is 1/(1 – MPC). In this economy, MPC = 0.75 and so the value of the simple multiplier is 1/(1 – 0.75) = 1/(0.25) = 4. c) If desired investment increases from 150 to 250, this is an increase in autonomous expenditure of 100. Given the multiplier of 4, the change ...

Chapter 13: Unemployment

... Government spending and taxing decisions are called fiscal policy and they have a significant impact on employment levels automatic stabilizers – changes in G & T that occur automatically with changes in the economy (e.g. employment, income and output) that stabilize the economy discretionary fi ...

... Government spending and taxing decisions are called fiscal policy and they have a significant impact on employment levels automatic stabilizers – changes in G & T that occur automatically with changes in the economy (e.g. employment, income and output) that stabilize the economy discretionary fi ...

Chap. 3 - The Goods Market

... The function C(YD) is called the consumption function. It is a behavioral function, that is, it captures the behavior of consumers. ...

... The function C(YD) is called the consumption function. It is a behavioral function, that is, it captures the behavior of consumers. ...

Fiscal Stimulus, Fiscal Inflation, or Fiscal Fallacies?

... spent by government is a $ drained out of the private sector which can’t create additional jobs, demand etc. ...

... spent by government is a $ drained out of the private sector which can’t create additional jobs, demand etc. ...

Quantitative Easing UK

... • Quantitative Easing stimulates Aggregate demand through increased spending as a result of more money circulating in the economy. • QE also lowers long term borrowing costs, and helps the economy reach the governments inflation target of 2.0%. ...

... • Quantitative Easing stimulates Aggregate demand through increased spending as a result of more money circulating in the economy. • QE also lowers long term borrowing costs, and helps the economy reach the governments inflation target of 2.0%. ...

PowerPoint CHAPTER 1 – Circular Flow & National

... produced undertaken (TP) =interest whatby isand households paidprofits out asto Rent, wages/salaries, Consists of consumer goods/services and capital (consumption) and firmsin(investment). income (TI) to FOP used production. households from firms. goods. TS = C + I ...

... produced undertaken (TP) =interest whatby isand households paidprofits out asto Rent, wages/salaries, Consists of consumer goods/services and capital (consumption) and firmsin(investment). income (TI) to FOP used production. households from firms. goods. TS = C + I ...

Take-Home Quiz

... TRUE/FALSE (0.5 POINTS EACH) 1. Fiat money is paper money that is backed by gold, silver or some other commodity. 2. When you voluntarily cook dinner for your family every Sunday night, the value of that service is included in gross domestic product (GDP). 3. Total household income will be equal to ...

... TRUE/FALSE (0.5 POINTS EACH) 1. Fiat money is paper money that is backed by gold, silver or some other commodity. 2. When you voluntarily cook dinner for your family every Sunday night, the value of that service is included in gross domestic product (GDP). 3. Total household income will be equal to ...

Fiscal Policy

... What fiscal policy is and why it is an important tool in managing economic fluctuations Which policies constitute an expansionary fiscal policy and which constitute a contractionary fiscal policy ...

... What fiscal policy is and why it is an important tool in managing economic fluctuations Which policies constitute an expansionary fiscal policy and which constitute a contractionary fiscal policy ...

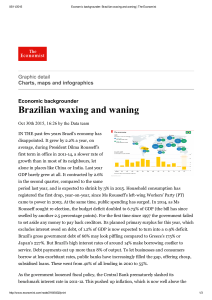

Brazilian waxing and waning

... swelled by another 2.5 percentage points). For the first time since 1997 the government failed to set aside any money to pay back creditors. Its planned primary surplus for this year, which excludes interest owed on debt, of 1.2% of GDP is now expected to turn into a 0.9% deficit. Brazil’s gross gov ...

... swelled by another 2.5 percentage points). For the first time since 1997 the government failed to set aside any money to pay back creditors. Its planned primary surplus for this year, which excludes interest owed on debt, of 1.2% of GDP is now expected to turn into a 0.9% deficit. Brazil’s gross gov ...

Big Government Causes Slow Growth

... to the dustbin of history. This isn't that surprising. Whether Pluto is a planet, or not, doesn't impact politicians, or their constituents. If it did, Pluto might still be categorized as a planet. Keynes thought a free market economy should be managed: in fact, needed to be managed. His ideas flour ...

... to the dustbin of history. This isn't that surprising. Whether Pluto is a planet, or not, doesn't impact politicians, or their constituents. If it did, Pluto might still be categorized as a planet. Keynes thought a free market economy should be managed: in fact, needed to be managed. His ideas flour ...

The Policy Debate: Keynesians versus Monetarists

... The case against monetary policy: (1) MS also depends on other factors (banking system) which can be unpredictable. (2) Lower interest rates may be less effective if business or consumer confidence is low. (3) Increasing MS will ultimately lead to higher inflation. (4) Federal reserve officials are ...

... The case against monetary policy: (1) MS also depends on other factors (banking system) which can be unpredictable. (2) Lower interest rates may be less effective if business or consumer confidence is low. (3) Increasing MS will ultimately lead to higher inflation. (4) Federal reserve officials are ...

Economic Policy

... Gross domestic product (GDP)- proportion in relation to debt about the same as 1964 Strategy: get rid of the annual deficit to make progress on the overall debt By raising taxes (political liberals) By cutting spending (political conservatives) ...

... Gross domestic product (GDP)- proportion in relation to debt about the same as 1964 Strategy: get rid of the annual deficit to make progress on the overall debt By raising taxes (political liberals) By cutting spending (political conservatives) ...

PowerPoint Template

... measures may not be clearly thought through. Ideally, fiscal policy support for domestic demand should be implemented in a timely way, phased out as soon as self-sustaining growth has been restored, and reversed when the economy is on its way to overheating. The phasing out of a fiscal stimulus wo ...

... measures may not be clearly thought through. Ideally, fiscal policy support for domestic demand should be implemented in a timely way, phased out as soon as self-sustaining growth has been restored, and reversed when the economy is on its way to overheating. The phasing out of a fiscal stimulus wo ...

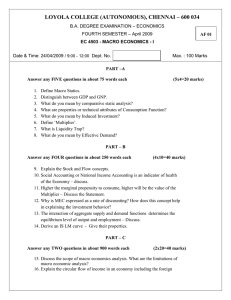

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 9. Explain the Stock and Flow concepts. 10. Social Accounting or National Income Accounting is an indicator of health of the Economy – discuss. 11. Higher the marginal propensity to consume, higher will be the value of the Multiplier – Discuss the Statement. 12. Why is MEC expressed as a rate of dis ...

... 9. Explain the Stock and Flow concepts. 10. Social Accounting or National Income Accounting is an indicator of health of the Economy – discuss. 11. Higher the marginal propensity to consume, higher will be the value of the Multiplier – Discuss the Statement. 12. Why is MEC expressed as a rate of dis ...

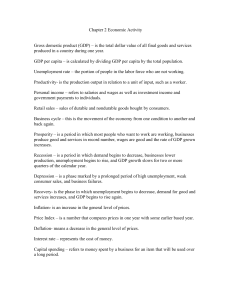

Chapter 2 Vocabulary

... services increases, and GDP begins to rise again. Inflation- is an increase in the general level of prices. Price Index – is a number that compares prices in one year with some earlier based year. Deflation- means a decrease in the general level of prices. Interest rate – represents the cost of mone ...

... services increases, and GDP begins to rise again. Inflation- is an increase in the general level of prices. Price Index – is a number that compares prices in one year with some earlier based year. Deflation- means a decrease in the general level of prices. Interest rate – represents the cost of mone ...

Financial Crisis 2008

... states (Cuba, Iran, Libya, North Korea, Sudan and Syria) whose spending amounts to around $13 billion, maximum. (Tabulated data does not include four of the six, as the data only lists nations that have spent over 1 billion in the year, so their budget is assumed to be $1 billion each) US spending i ...

... states (Cuba, Iran, Libya, North Korea, Sudan and Syria) whose spending amounts to around $13 billion, maximum. (Tabulated data does not include four of the six, as the data only lists nations that have spent over 1 billion in the year, so their budget is assumed to be $1 billion each) US spending i ...

THE IS-LM MODEL First developed 1937 by JR Hicks, as a way

... I = I(Y, i) positive impact of Y, negative of i. Expenditure Z = C(Y-T) + I(Y, i) + G So 45-degree diag for given i is: Z ...

... I = I(Y, i) positive impact of Y, negative of i. Expenditure Z = C(Y-T) + I(Y, i) + G So 45-degree diag for given i is: Z ...

economists and economic theories

... MS at 3-5% every year If the money supply increases a little every year, it balances out the increase in prices every year. Economy will remain stable. ...

... MS at 3-5% every year If the money supply increases a little every year, it balances out the increase in prices every year. Economy will remain stable. ...

Y - The University of Chicago Booth School of Business

... Benefits of the infrastructure born by everyone. ...

... Benefits of the infrastructure born by everyone. ...