Consequences of Growth

... Review . . . What is the difference between economic growth and economic development? Is it possible to have one without the other? – Growth: increase in economies real level of output over time. Quantitative – GDP ect. – Development: The process to improve the lives of all people in a country. Thi ...

... Review . . . What is the difference between economic growth and economic development? Is it possible to have one without the other? – Growth: increase in economies real level of output over time. Quantitative – GDP ect. – Development: The process to improve the lives of all people in a country. Thi ...

Economics, by R. Glenn Hubbard and Anthony Patrick O`Brien

... IP covers nearly everything produced in the U.S. (20% of the economy) for manufacturing (82%), mining (8%), electric utilities (10%) and gas industries. Does not include output from agriculture, construction, transportation, communications, and service industries. Measures changes in the volume of g ...

... IP covers nearly everything produced in the U.S. (20% of the economy) for manufacturing (82%), mining (8%), electric utilities (10%) and gas industries. Does not include output from agriculture, construction, transportation, communications, and service industries. Measures changes in the volume of g ...

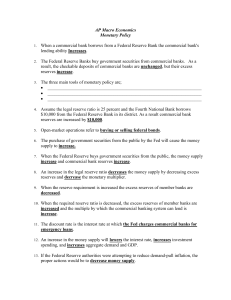

AP Macro Economics Monetary Policy When a commercial bank

... When the required reserve ratio is decreased, the excess reserves of member banks are increased and the multiple by which the commercial banking system can lend is increase. ...

... When the required reserve ratio is decreased, the excess reserves of member banks are increased and the multiple by which the commercial banking system can lend is increase. ...

PowerPoint Slides 1

... investment will eventually lead to more than a threefold increase (decrease) in income; note that it takes time for the multiplier to work. • The critical value in this computation is MPC. Thus, a quantitative estimate of MPC provides valuable information for policy purposes. Knowing MPC, one can pr ...

... investment will eventually lead to more than a threefold increase (decrease) in income; note that it takes time for the multiplier to work. • The critical value in this computation is MPC. Thus, a quantitative estimate of MPC provides valuable information for policy purposes. Knowing MPC, one can pr ...

Economic Policy

... b) Keynes explained that business cycle fluctuations result from imbalances between aggregate demand and productive capacity. (1) Aggregate demand is the income available to consumers, business, and government to be spent on goods and services. (2) The economy’s productive capacity is the total valu ...

... b) Keynes explained that business cycle fluctuations result from imbalances between aggregate demand and productive capacity. (1) Aggregate demand is the income available to consumers, business, and government to be spent on goods and services. (2) The economy’s productive capacity is the total valu ...

chapter 8 fiscal policy: coping with inflation and

... MPC/(1 MPC). When the government increases its spending and taxes by the same amount, both the income and tax multipliers are at work. The net effect is an increase in national income that equals the increase in spending and taxes. The balanced budget multiplier equals one. The government can create ...

... MPC/(1 MPC). When the government increases its spending and taxes by the same amount, both the income and tax multipliers are at work. The net effect is an increase in national income that equals the increase in spending and taxes. The balanced budget multiplier equals one. The government can create ...

chapter 23 fiscal policy: coping with inflation and

... MPC/(1 MPC). When the government increases its spending and taxes by the same amount, both the income and tax multipliers are at work. The net effect is an increase in national income that equals the increase in spending and taxes. The balanced budget multiplier equals one. The government can create ...

... MPC/(1 MPC). When the government increases its spending and taxes by the same amount, both the income and tax multipliers are at work. The net effect is an increase in national income that equals the increase in spending and taxes. The balanced budget multiplier equals one. The government can create ...

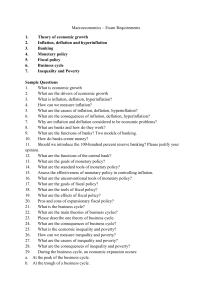

Macroeconomics – Exam Requirements 1. Theory of economic

... Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of the things you buy. b. Inflation that is higher than expected benefits borrowers, and inflation that is lower than expected benefits lenders. c. There are no costs or losses ...

... Whether you gain or lose during a period of inflation depends on whether your income rises faster or slower than the prices of the things you buy. b. Inflation that is higher than expected benefits borrowers, and inflation that is lower than expected benefits lenders. c. There are no costs or losses ...

View Presentation

... Labor market policies (subsidize training, provide job search assistance, subsidize part-time employment,...) ...

... Labor market policies (subsidize training, provide job search assistance, subsidize part-time employment,...) ...

Four Phases of the Business Cycle

... Depression Phase : Contraction or Downswing of economy. Recovery Phase : from depression to prosperity (lower turning Point). Peak—A high point at which the economy is at its strongest and most prosperous. Trough—The final stage in the business cycle; demand, production, and employment reach their l ...

... Depression Phase : Contraction or Downswing of economy. Recovery Phase : from depression to prosperity (lower turning Point). Peak—A high point at which the economy is at its strongest and most prosperous. Trough—The final stage in the business cycle; demand, production, and employment reach their l ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... their research on “Implicit Taxes on Work from Social Security and Medicare.” They show how there is a substantial implicit tax on work from Social Security for many workers who are nearing retirement age due to several features of the benefit formula that result in additional work translating into ...

... their research on “Implicit Taxes on Work from Social Security and Medicare.” They show how there is a substantial implicit tax on work from Social Security for many workers who are nearing retirement age due to several features of the benefit formula that result in additional work translating into ...

1. Which of the following is included in U.S. GDP? I. The market

... 2 3 0 | Cracking the AP Economics Macro & Micro Exams ...

... 2 3 0 | Cracking the AP Economics Macro & Micro Exams ...

Chapter 25 Monetary and fiscal policy in a closed economy

... throughout time Put together these two goals suggest that we assume that individuals try to maintain the highest, smooth consumption path ...

... throughout time Put together these two goals suggest that we assume that individuals try to maintain the highest, smooth consumption path ...

16 - 嘉義大學

... In a country with a working-age population of 200 million, 130 million workers are employed and 10 million are unemployed. The unemployment rate is (a) 5.0 percent. (b) 7.1 percent. (c) 7.7 percent. (d) 65.0 percent. Who of the following is a discouraged worker? (a) Cara, who lost her job because of ...

... In a country with a working-age population of 200 million, 130 million workers are employed and 10 million are unemployed. The unemployment rate is (a) 5.0 percent. (b) 7.1 percent. (c) 7.7 percent. (d) 65.0 percent. Who of the following is a discouraged worker? (a) Cara, who lost her job because of ...

A-level Economics Question paper Unit 02 - The National

... In the US, between 2007 and 2011, real Gross Domestic Product (GDP) rose by 1% but the number of people in work fell by 4%. By contrast, over the same period of time, real GDP in the UK fell by 2.4% while employment rose by 0.3%. The UK economy has been creating jobs despite the slowest economic rec ...

... In the US, between 2007 and 2011, real Gross Domestic Product (GDP) rose by 1% but the number of people in work fell by 4%. By contrast, over the same period of time, real GDP in the UK fell by 2.4% while employment rose by 0.3%. The UK economy has been creating jobs despite the slowest economic rec ...

Document

... anticipated that the government’s tax revenues would fall short of its spending every year for the rest of the 2010s. • Orszag also viewed that the only way to bring revenues and spending back into closer balance was to raise federal tax ...

... anticipated that the government’s tax revenues would fall short of its spending every year for the rest of the 2010s. • Orszag also viewed that the only way to bring revenues and spending back into closer balance was to raise federal tax ...

Effect of Lower interest rates:

... • Aims to stimulate borrowing by banks and consumers... • Stimulate economy with increased economic activity... ...

... • Aims to stimulate borrowing by banks and consumers... • Stimulate economy with increased economic activity... ...

Econ 302 _______Name

... the person is a net borrower. the person is neither a saver nor a borrower (like Polonius). ...

... the person is a net borrower. the person is neither a saver nor a borrower (like Polonius). ...

High-level Regional Policy Dialogue on

... "Asia-Pacific economies after the global financial crisis: Lessons learnt, challenges for building resilience, and issues for global reform" ...

... "Asia-Pacific economies after the global financial crisis: Lessons learnt, challenges for building resilience, and issues for global reform" ...

Chapter 16: Fiscal Policy - the School of Economics and Finance

... government does—from paying the salaries of FBI agents, to operating the national parks, to supporting scientific research—which makes up 9.4 percent of the budget. In addition to purchases, there are three other categories of federal government expenditures: interest on the national debt, grants to ...

... government does—from paying the salaries of FBI agents, to operating the national parks, to supporting scientific research—which makes up 9.4 percent of the budget. In addition to purchases, there are three other categories of federal government expenditures: interest on the national debt, grants to ...

Tony Travers` presentation

... • Scotland, Wales: tax devolution • Minority government might be able to do a deal relating to fiscal devolution • London needs convincing governance for potential fiscal/public expenditure devolution ...

... • Scotland, Wales: tax devolution • Minority government might be able to do a deal relating to fiscal devolution • London needs convincing governance for potential fiscal/public expenditure devolution ...

Plenty Enough: The Fundamentals of the Economic Boom: New

... but not the lowest — trade barriers in the world. The competition this creates guarantees that consumers have the greatest range of choices and that manufacturers have the greatest incentive to remain efficient. And for the foreigners who provide the critical financing for U.S. investments, free tra ...

... but not the lowest — trade barriers in the world. The competition this creates guarantees that consumers have the greatest range of choices and that manufacturers have the greatest incentive to remain efficient. And for the foreigners who provide the critical financing for U.S. investments, free tra ...