... imports declined by 4.6% and export receipts increased by 16.8%. There was deflation (-1.3%) across ECCU, with price falls across all economies. ECCU growth is projected at 3.3% in 2016, with economic activity in the tourism, construction and agricultural sectors strengthening. The fiscal performanc ...

Principles of Economics

... ► At p2 in figure 13-3, producers will have produced a lower real output than the spending that consumers, businesses, and the government want to do. The price level would tend to rise leading business investment to increase, thereby ...

... ► At p2 in figure 13-3, producers will have produced a lower real output than the spending that consumers, businesses, and the government want to do. The price level would tend to rise leading business investment to increase, thereby ...

Principles of Economics

... ► At p2 in figure 13-3, producers will have produced a lower real output than the spending that consumers, businesses, and the government want to do. The price level would tend to rise leading business investment to increase, thereby ...

... ► At p2 in figure 13-3, producers will have produced a lower real output than the spending that consumers, businesses, and the government want to do. The price level would tend to rise leading business investment to increase, thereby ...

11. Macroeconomic and fiscal impacts

... reform; a higher level, and more efficient allocation, of savings and investment; and increased entrepreneurial activity. They also exclude the efficiency gains from lower system administration and compliance costs. The estimated increases would be expected to arise over an extended period, in part ...

... reform; a higher level, and more efficient allocation, of savings and investment; and increased entrepreneurial activity. They also exclude the efficiency gains from lower system administration and compliance costs. The estimated increases would be expected to arise over an extended period, in part ...

keynesian multiplier effects

... The Keynesian Government Spending Multiplier is 1/MPS. Let’s use the information we have already been given: The MPC is 90% and the MPS is 10%. We can plug the appropriate number into the Government Spending Multiplier and come up with a useful number. Govt. Spending Multiplier = 1/MPS = 1/10% = 1/. ...

... The Keynesian Government Spending Multiplier is 1/MPS. Let’s use the information we have already been given: The MPC is 90% and the MPS is 10%. We can plug the appropriate number into the Government Spending Multiplier and come up with a useful number. Govt. Spending Multiplier = 1/MPS = 1/10% = 1/. ...

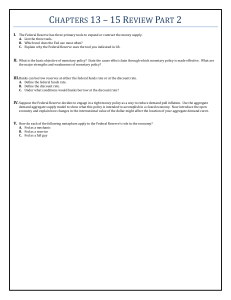

chapters 13 – 15 review part 2

... The unemployment rate is 6% and the CPI is increasing at a 9% rate. The federal government raises personal income taxes and cuts spending. The Federal Reserve sells bonds on the open market. What happens to GDPR, PL, unemployment, interest rates and Ig? Explain. ...

... The unemployment rate is 6% and the CPI is increasing at a 9% rate. The federal government raises personal income taxes and cuts spending. The Federal Reserve sells bonds on the open market. What happens to GDPR, PL, unemployment, interest rates and Ig? Explain. ...

Shifts in Aggregate Demand Page 1 of 2

... The first answer is an increase in autonomous spending. Autonomous means stuff that is by itself, unto itself, not caused by something else. If consumers decided that they just wanted to spend more money for the heck of it, or were feeling rich or confident about the future of the economy, then an i ...

... The first answer is an increase in autonomous spending. Autonomous means stuff that is by itself, unto itself, not caused by something else. If consumers decided that they just wanted to spend more money for the heck of it, or were feeling rich or confident about the future of the economy, then an i ...

Background_material_for_PM_Monti_s_talk

... tenders. Public administration’s supplies of goods and services must go through a central-purchasing agency Creation of limited liability companies made easier and cheaper All local public services submitted to open, public tenders; privatization of firms that derive more than 90% of sales from cont ...

... tenders. Public administration’s supplies of goods and services must go through a central-purchasing agency Creation of limited liability companies made easier and cheaper All local public services submitted to open, public tenders; privatization of firms that derive more than 90% of sales from cont ...

Theory of Capitalism

... monetary policy and to counteract fluctuations in investment spending. – Say’s Law – that supply creates its own demand – requires perfect information and perfectly flexible prices to restore full-employment. – Keynesian economics advocates policy activism-the discretionary use of monetary and fisca ...

... monetary policy and to counteract fluctuations in investment spending. – Say’s Law – that supply creates its own demand – requires perfect information and perfectly flexible prices to restore full-employment. – Keynesian economics advocates policy activism-the discretionary use of monetary and fisca ...

Aggregate Demand - Spring Branch ISD

... * Domestic resource availability- increases in supply of domestic resources will lower resource prices, reduce per-unit production costs, and shift aggregate supply curve to the right A. Land- expansion will increase supply, vice versa B. labor- increase in labor reduces price of labor, shifting lab ...

... * Domestic resource availability- increases in supply of domestic resources will lower resource prices, reduce per-unit production costs, and shift aggregate supply curve to the right A. Land- expansion will increase supply, vice versa B. labor- increase in labor reduces price of labor, shifting lab ...

Transmission of Policy Actions to Agriculture

... There are numerous channels through which changes in monetary and fiscal policies can be transmitted to the farm business sector. ...

... There are numerous channels through which changes in monetary and fiscal policies can be transmitted to the farm business sector. ...

Exam #2 Review Questions (Answers) ECNS

... 5.) Determine whether each of the following statements is true or false, and explain why. For each statement, discuss the impact of monetary and fiscal policy in that special case. a.) If investment does not depend on the interest rate, the LM curve is horizontal. False. The IS cure represents the ...

... 5.) Determine whether each of the following statements is true or false, and explain why. For each statement, discuss the impact of monetary and fiscal policy in that special case. a.) If investment does not depend on the interest rate, the LM curve is horizontal. False. The IS cure represents the ...

Glossary, Fiscal Monitor, April 2015

... debtor to the creditor. This includes debt liabilities in the form of special drawing rights, currency, and deposits; debt securities; loans; insurance, pension, and standardized guarantee programs; and other accounts payable. (See the IMF’s 2001 Government Finance Statistics Manual and Public Secto ...

... debtor to the creditor. This includes debt liabilities in the form of special drawing rights, currency, and deposits; debt securities; loans; insurance, pension, and standardized guarantee programs; and other accounts payable. (See the IMF’s 2001 Government Finance Statistics Manual and Public Secto ...

CEP US Election Analysis No. 1

... al, 2011); and because the relatively closed US economy was severely depressed (fiscal policy is more potent in recessions).4 There remain sceptics (for example, Barro and Redlick, 2011), including those who advance the notion of expansionary fiscal contractions (for example, Alesina and Ardagna, 20 ...

... al, 2011); and because the relatively closed US economy was severely depressed (fiscal policy is more potent in recessions).4 There remain sceptics (for example, Barro and Redlick, 2011), including those who advance the notion of expansionary fiscal contractions (for example, Alesina and Ardagna, 20 ...

PDF Download

... throughout the economy. Another is to manage the reversal of the expansionary macroeconomic policies pursued since the early 1990s which resulted in the level of government debt that is 150 percent of GDP as well as in a massive increase in the stock of base money. ...

... throughout the economy. Another is to manage the reversal of the expansionary macroeconomic policies pursued since the early 1990s which resulted in the level of government debt that is 150 percent of GDP as well as in a massive increase in the stock of base money. ...

FIGURE 30-5 Stabilization Policy with a Flat AS Curve

... – The small magnitude of the likely effects – The large effects on aggregate demand – The problems in timing • The supply effects will take a long time to occur • The demand effects will take only a short time ...

... – The small magnitude of the likely effects – The large effects on aggregate demand – The problems in timing • The supply effects will take a long time to occur • The demand effects will take only a short time ...

Barbados_en.pdf

... following an 11% reduction in indirect taxes, due to the economic slowdown. At the same time, current and capital expenditure increased by 10% and 2.8% respectively, over the previous year, as the government implemented fiscal stimulus measures in response to the global economic crisis. The increase ...

... following an 11% reduction in indirect taxes, due to the economic slowdown. At the same time, current and capital expenditure increased by 10% and 2.8% respectively, over the previous year, as the government implemented fiscal stimulus measures in response to the global economic crisis. The increase ...

EXAM Please use the following notation in your answers.

... (a) (5 points) Define what you understand by the term ‘Keynesian Multiplier’. Answer. The Keynesian Multiplier is defined as ”the effect on demand of any exogenous increase in spending, such as an increase in government outlays is a multiple of that increaseuntil potential is reached. Thus, a govern ...

... (a) (5 points) Define what you understand by the term ‘Keynesian Multiplier’. Answer. The Keynesian Multiplier is defined as ”the effect on demand of any exogenous increase in spending, such as an increase in government outlays is a multiple of that increaseuntil potential is reached. Thus, a govern ...