Economic Planning

... 1. Monetarism - Increase the money supply at a rate equal to economic growth and let the free market operate. 2. Keynesianism - When demand is low, gov’t should pump more money into the economy by spending more than it collects in taxes. If demand is high, increase taxes. ...

... 1. Monetarism - Increase the money supply at a rate equal to economic growth and let the free market operate. 2. Keynesianism - When demand is low, gov’t should pump more money into the economy by spending more than it collects in taxes. If demand is high, increase taxes. ...

Unit 4 Homework Packet Due Friday 4/10 Read pages 306

... 3. What is the difference between Nominal GDP and Real GDP? Why is real GDP a better measure when trying to compare two different periods of time? ...

... 3. What is the difference between Nominal GDP and Real GDP? Why is real GDP a better measure when trying to compare two different periods of time? ...

Lecture29(Ch25)

... capital, or technology at the time of a recession • Exceptions are important and have huge effects, but not the typical recession – AIDS epidemic in Africa – Hurricane Mitch in central America ...

... capital, or technology at the time of a recession • Exceptions are important and have huge effects, but not the typical recession – AIDS epidemic in Africa – Hurricane Mitch in central America ...

PDF Download

... only for the medium run, but also for the short run, as questions about debt sustainability would undercut the near-term effectiveness of policy through adverse effects on financial markets, interest rates, and consumer spending. ...

... only for the medium run, but also for the short run, as questions about debt sustainability would undercut the near-term effectiveness of policy through adverse effects on financial markets, interest rates, and consumer spending. ...

doc conf

... a. Explain why the budget deficit function is downward sloping. b. If the government increases its level of purchases (G), what happens to the budget deficit at any level of real GDP? Show this in the diagram. c. If the government increases its level of net tax revenues (T), what happens to the defi ...

... a. Explain why the budget deficit function is downward sloping. b. If the government increases its level of purchases (G), what happens to the budget deficit at any level of real GDP? Show this in the diagram. c. If the government increases its level of net tax revenues (T), what happens to the defi ...

PDF Download

... much more targeted tax rebate could have provided a much more efficient use of funds. Also, while being temporary undercuts the income effect on consumption, it would increase the substitution effect. Thus, had the tax rebates been provided in a form that offered temporary price reductions, as for e ...

... much more targeted tax rebate could have provided a much more efficient use of funds. Also, while being temporary undercuts the income effect on consumption, it would increase the substitution effect. Thus, had the tax rebates been provided in a form that offered temporary price reductions, as for e ...

Neyra EN

... 2. Establishment of stabilization funds to reduce volatility associated with natural resource transfers. 3. Link the use of transfers to close gaps in the regions and municipalities. 4. Improving mechanisms for evaluating the use of transfers and strengthen accountability. 5. Avoid substitution effe ...

... 2. Establishment of stabilization funds to reduce volatility associated with natural resource transfers. 3. Link the use of transfers to close gaps in the regions and municipalities. 4. Improving mechanisms for evaluating the use of transfers and strengthen accountability. 5. Avoid substitution effe ...

Should U.S. Fiscal Policy Address Slow Growth or the Debt? A Nondilemma

... government purchases as equal to expenditure on these purchases. This means that bridges-to-nowhere or military expenditures aimed at an imaginary alien invasion are both desirable policies from the Keynesian perspective because they cause measured GDP to increase (one component of GDP is government ...

... government purchases as equal to expenditure on these purchases. This means that bridges-to-nowhere or military expenditures aimed at an imaginary alien invasion are both desirable policies from the Keynesian perspective because they cause measured GDP to increase (one component of GDP is government ...

Unit 6 Income Determination in a Simple Keynesian Macroeconomic

... have, the more goods we can import. This creates a problem for economic theory. Exports are autonomous in relation to income, and to make the analysis less complicated, we assume that imports are also autonomous. ...

... have, the more goods we can import. This creates a problem for economic theory. Exports are autonomous in relation to income, and to make the analysis less complicated, we assume that imports are also autonomous. ...

Unit 6 Income Determination in a Simple Keynesian Macroeconomic

... have, the more goods we can import. This creates a problem for economic theory. Exports are autonomous in relation to income, and to make the analysis less complicated, we assume that imports are also autonomous. ...

... have, the more goods we can import. This creates a problem for economic theory. Exports are autonomous in relation to income, and to make the analysis less complicated, we assume that imports are also autonomous. ...

Chapter 13

... _____________ have been cut and ________________ are at their lowest levels in 40 years to stimulate the economy. Tax cuts during increased spending increase the amount of the ______________ to record levels. ____________________ is creeping up ___________________ has remained steady except ...

... _____________ have been cut and ________________ are at their lowest levels in 40 years to stimulate the economy. Tax cuts during increased spending increase the amount of the ______________ to record levels. ____________________ is creeping up ___________________ has remained steady except ...

Chapter 18 Fiscal Policy

... rate. In this case, expansionary fiscal policy would start to push domestic interest rates up above the world level, which would put upward pressure on the domestic currency. To counter this pressure and maintain the exchange-rate peg, the central bank would be forced to expand the domestic money s ...

... rate. In this case, expansionary fiscal policy would start to push domestic interest rates up above the world level, which would put upward pressure on the domestic currency. To counter this pressure and maintain the exchange-rate peg, the central bank would be forced to expand the domestic money s ...

PDF, ca. 100 KB

... which have now reached a five-year high. The expectations for the next six months continue to be optimistic. The expansion of the world economy will continue to be lively in the forecast period but will flatten gradually. It will be particularly stimulated by corporate earnings that still remain fav ...

... which have now reached a five-year high. The expectations for the next six months continue to be optimistic. The expansion of the world economy will continue to be lively in the forecast period but will flatten gradually. It will be particularly stimulated by corporate earnings that still remain fav ...

Broad Social Goals of Economic Systems

... • Federal government conducts monetary policies (through Federal Reserve System in US). • Fiscal policies promote full employment (the 4-5 % unemployment rates in the US reflect frictional unemployment). ...

... • Federal government conducts monetary policies (through Federal Reserve System in US). • Fiscal policies promote full employment (the 4-5 % unemployment rates in the US reflect frictional unemployment). ...

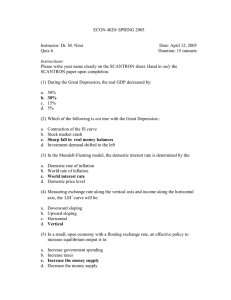

Date - N. Meltem Daysal

... A) is fixed and so does the IS analysis. B) depends on the interest rate and so does the IS analysis. C) is fixed, whereas the IS analysis assumes it depends on the interest rate. D) depends on the interest rate and so does the IS analysis. 12. An increase in the interest rate: A) reduces planned in ...

... A) is fixed and so does the IS analysis. B) depends on the interest rate and so does the IS analysis. C) is fixed, whereas the IS analysis assumes it depends on the interest rate. D) depends on the interest rate and so does the IS analysis. 12. An increase in the interest rate: A) reduces planned in ...

Financing Government - Kenston Local Schools

... • 1933 = 13.5 million unemployed • 1935: Over 18 million people rely on government relief programs • More than 5,000 banks closed In order to try to meet this catastrophe, deficit financing becamee a constant practice of fiscal policy Election of 1932: F.D.R won over Hoover because of his drastic go ...

... • 1933 = 13.5 million unemployed • 1935: Over 18 million people rely on government relief programs • More than 5,000 banks closed In order to try to meet this catastrophe, deficit financing becamee a constant practice of fiscal policy Election of 1932: F.D.R won over Hoover because of his drastic go ...

influence of monetary and fiscal policy on aggregate demand

... Panel (a) shows the money market. When the government increases its purchases of goods and services, the resulting increase in income raises the demand for money from MD1 to MD2, and this causes the equilibrium interest rate to rise from i1 to i2 . Panel (b) shows the affect on aggregate demand. The ...

... Panel (a) shows the money market. When the government increases its purchases of goods and services, the resulting increase in income raises the demand for money from MD1 to MD2, and this causes the equilibrium interest rate to rise from i1 to i2 . Panel (b) shows the affect on aggregate demand. The ...

Comments for Policy Session

... • There are no constraints on the supply side in US medicine as in most other countries. If you want to set up a MRI imaging center, go ahead, even if your metro area already has 3X the facilities of the typical European country ...

... • There are no constraints on the supply side in US medicine as in most other countries. If you want to set up a MRI imaging center, go ahead, even if your metro area already has 3X the facilities of the typical European country ...

Open Economy

... • Weak responsiveness of the demand for money to interest rate changes; thus, large changes in the interest rate are needed to readjust the money market. The larger is the change in the interest the stronger is the stimulus to I and C, and hence the effect on the IS curve, and the GDP. ...

... • Weak responsiveness of the demand for money to interest rate changes; thus, large changes in the interest rate are needed to readjust the money market. The larger is the change in the interest the stronger is the stimulus to I and C, and hence the effect on the IS curve, and the GDP. ...

MTBPS Presentation - Amazon Web Services

... Interest costs are the fastest growing area of spending over the MTEF and rise to 3.2% of GDP by 2012/13 To support fiscal sustainability, government will need to reduce borrowing and debt as the economy recovers If revenue does not recover sufficiently, tax rates will need to be adjusted and the ta ...

... Interest costs are the fastest growing area of spending over the MTEF and rise to 3.2% of GDP by 2012/13 To support fiscal sustainability, government will need to reduce borrowing and debt as the economy recovers If revenue does not recover sufficiently, tax rates will need to be adjusted and the ta ...

1. The Depressed State of the US Housing

... 2. Deficits are due to lower tax receipts and increased spending 3. Prediction are that deficits will remain high at 9-10% of GDP and debt will be close to 100% of GDP 4. Debt can be classified as gross public debt ($14.5 trillion) and publically owned public debt ($10 trillion). 5. Half of US debt ...

... 2. Deficits are due to lower tax receipts and increased spending 3. Prediction are that deficits will remain high at 9-10% of GDP and debt will be close to 100% of GDP 4. Debt can be classified as gross public debt ($14.5 trillion) and publically owned public debt ($10 trillion). 5. Half of US debt ...